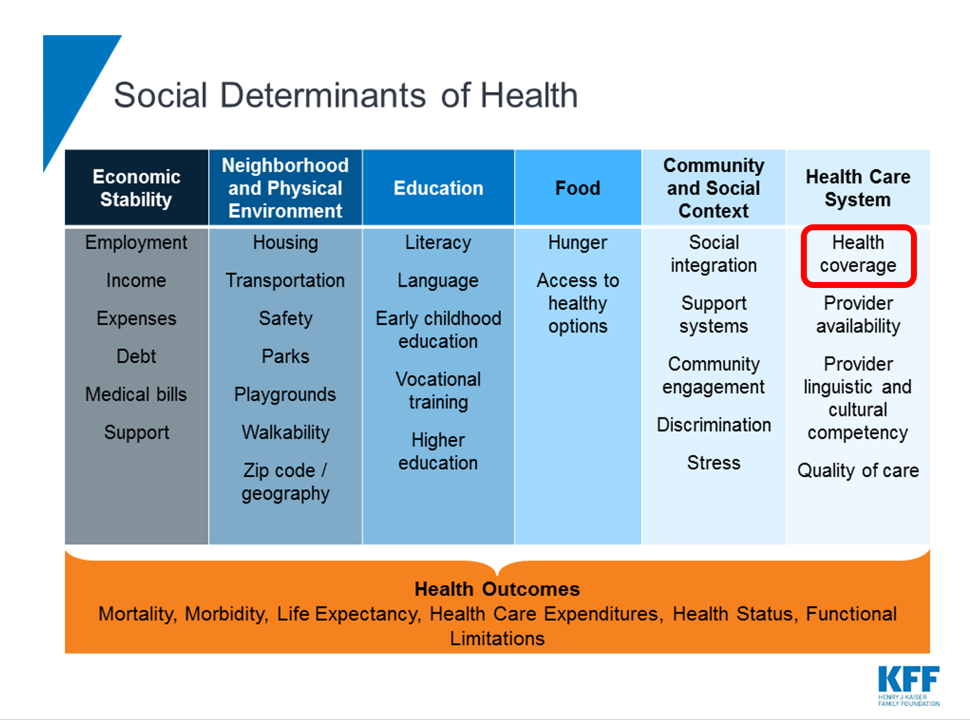

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care).

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care).

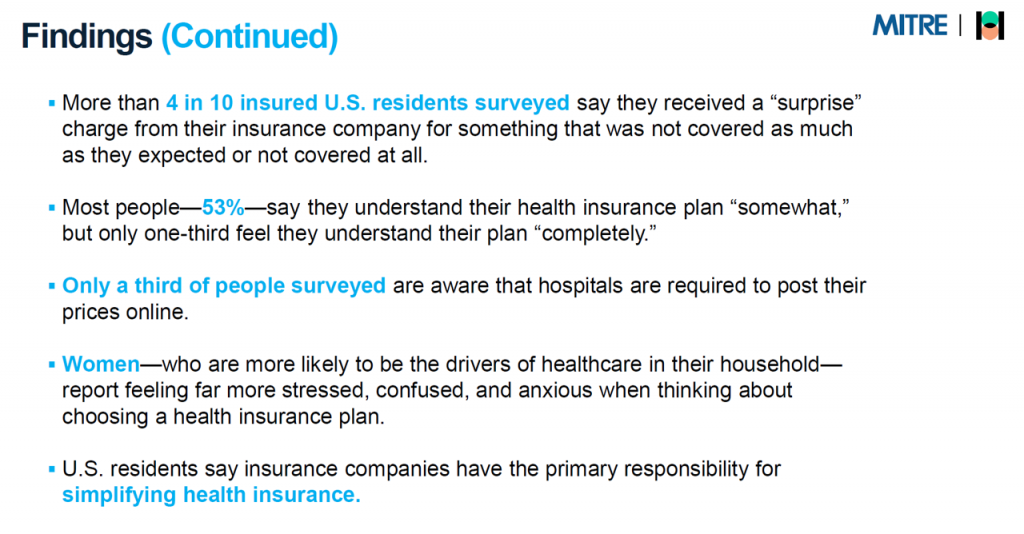

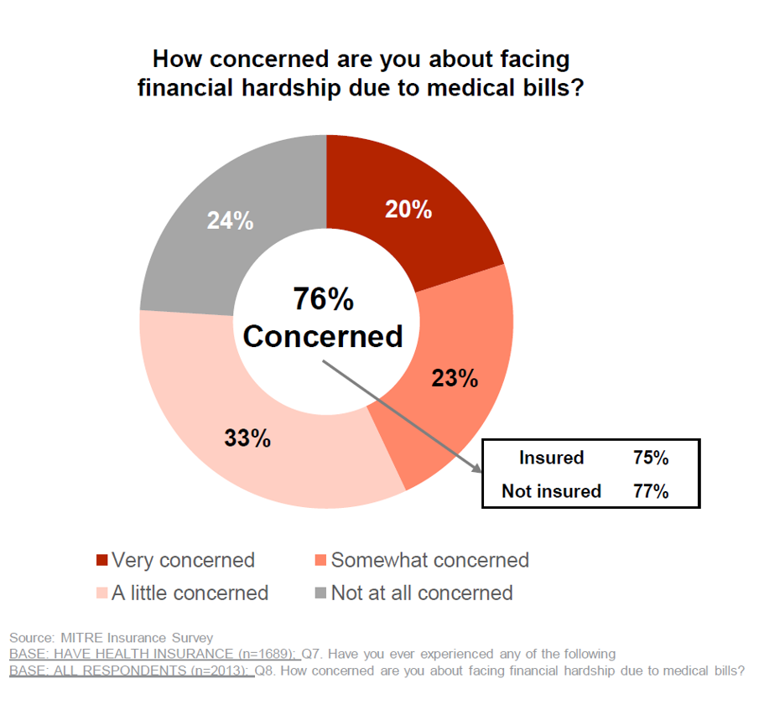

But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today.

“Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of MITRE judged from the study,

“Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of MITRE judged from the study,

Only one-half of covered health citizens say they understand their health plan only “somewhat.”

Who is responsible for addressing health insurance plan literacy?

Rob Jekielek, managing director of The Harris Poll, says, “There is a consumer education gap to fill when it comes to health insurance….as older generations (Gen X and Boomers) are twice as likely, versus younger generations (Gen Z and Millennials), to say that the primary responsibility of making insurance plans easier to understand is with insurance companies.”

Younger people point to the government’s and provider’s responsibility for informing and educating them on health insurance coverage, along with health plans.

Few Americans realize that health care providers are required to post their prices online.

At the same time, 28% of insured people in the U.S. “never” check their coverage before using their health insurance.

Even when they are aware of health care prices available online, one-third still do not research that information. The surveyed health-covered consumers said their biggest frustration with health insurance was trying to figure out what was covered, along with identifying what providers were in their network and finding “someone” to answer their coverage questions.

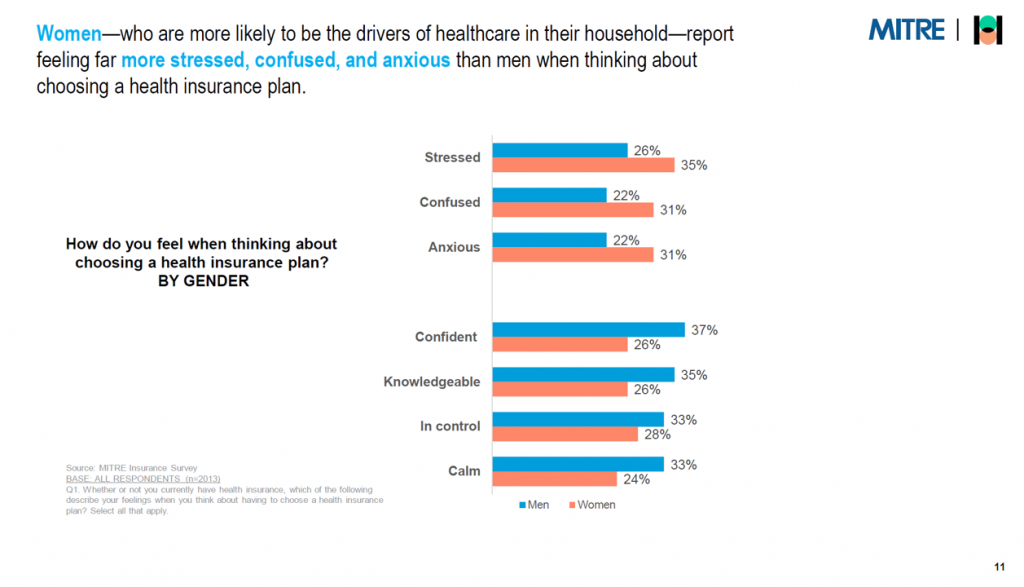

When looking at gender and health insurance literacy, women are more likely than men to be more stressed, more confused, and more anxious about choosing a health insurance plan, shown in the bar chart from the MITRE-Harris study.

When looking at gender and health insurance literacy, women are more likely than men to be more stressed, more confused, and more anxious about choosing a health insurance plan, shown in the bar chart from the MITRE-Harris study.

More men, on the other hand, feel confident, knowledgeable, in control, and calm about choosing a health plan.

The survey drew on online 1,689 U.S. adults with health insurance, 18 years of age and older, and was fielded between 24 and 28 June 2021.

Health Populi’s Hot Points: We started this post noting that having insurance coverage is one pillar of being able to achieve health and well-being in America, a key social determinant as shown in the first table from Kaiser Family Foundation.

Health Populi’s Hot Points: We started this post noting that having insurance coverage is one pillar of being able to achieve health and well-being in America, a key social determinant as shown in the first table from Kaiser Family Foundation.

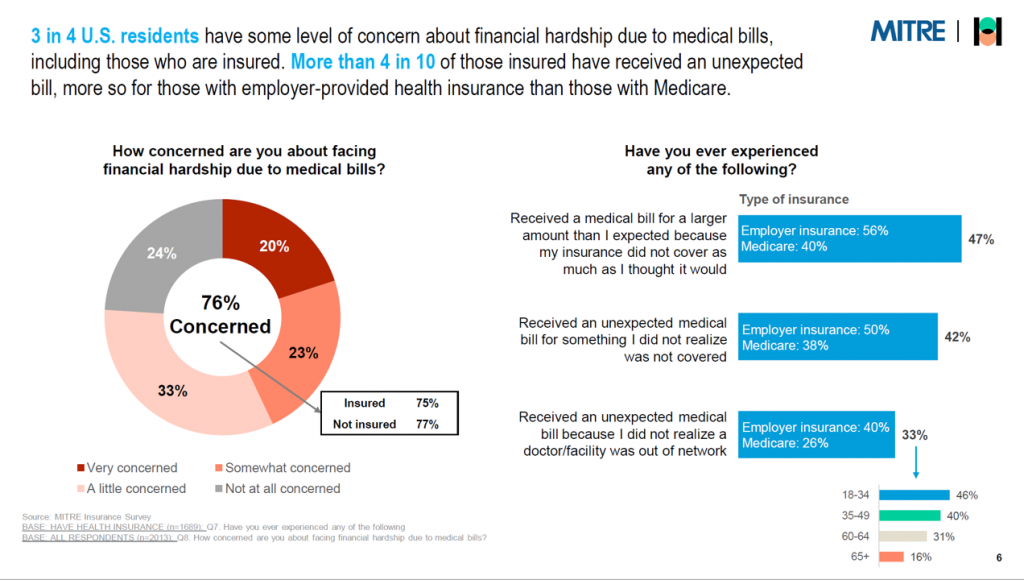

In the MITRE-Harris study, people with health insurance nonetheless felt financial stress even though they were covered by a health plan.

Both employees accessing employer-sponsored health care via the private sector and commercial insurance, as well as health citizens covered by public sector plans Medicare and Medicaid had concerns about medical bills.

Note that 3 in 5 of insured people had received an unexpected (or “surprise”) medical bill — more frequently among people covered by employer-sponsored health plans.

Even with regulations requiring providers to post prices online, consumers still have not universally adopted “shopping” behaviors in the hoped-for scenario of building health care consumerism in the U.S. Furthermore, surprise medical bills continue to confront patients-as-consumers, which erodes trust and loyalty between that person and her health plan and provider.

I recently read a report from Cedar on “empathetic dunning,” subtitled, “using compassionate communication to help patients avoid collections.”

After working with an FBI hostage negotiator, the company incorporated empathetic language into emails to patients, softening collections communications that might engender fear or a sense of threat.

Their bottom-line: “Simply put, a thoughtful and nuanced consumer-centric billing experience results in stronger relationships, more revenue and a positive experience for all. A little kindness goes a long way indeed.”

This is the current state of play for health citizens and health care payments in America, circa 2022.

Thank you FeedSpot for

Thank you FeedSpot for