I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra:

“”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,”

coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law.

This feels especially apt right “now” as we enter 2022, Year 3 of the COVID-19 pandemic, with people mentally stressed, anxious, and shrugging off the Omicron variant – while taking on more DIY life-flows, self-care and desire for (more) control.

This year-end/New Year 2022 post on the Health Populi blog will weave together many of the key findings from these consumer health/care reports that are most resonating with me and the work I’m doing…

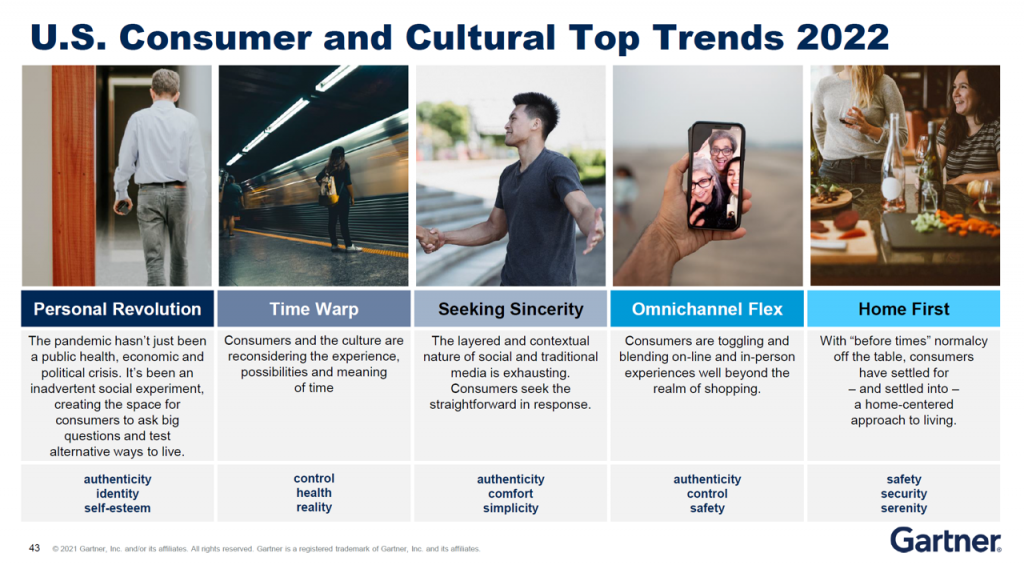

We start at a macro bird’s-eye view with Gartner’s top US consumer and cultural trends for 2022. While this research describes consumers generally, the takeaways have everything to do with health and well-being. Top trends include people seeking responsibility (up 4 points), justice (up 3), authenticity (up 2), loyalty (up 1), and equality (even over the year). Between 2017 to 2021, there was also significant movement in a few other areas: identity and self-esteem (up 11 points from 2017), as well as control and reality (up 7 points between 2017 to 2021).

We start at a macro bird’s-eye view with Gartner’s top US consumer and cultural trends for 2022. While this research describes consumers generally, the takeaways have everything to do with health and well-being. Top trends include people seeking responsibility (up 4 points), justice (up 3), authenticity (up 2), loyalty (up 1), and equality (even over the year). Between 2017 to 2021, there was also significant movement in a few other areas: identity and self-esteem (up 11 points from 2017), as well as control and reality (up 7 points between 2017 to 2021).

Weaving these trends together for consumers’ health, we can point to:

- Personal revolution – looking for authenticity, identity, and self-esteem

- Time warp – reaching for control, health, reality

- The search for sincerity – authenticity, comfort, and simplicity

- Omnichannel flex – authenticity, control, safety; and,

- Home first – the search for safety, security, and serenity.

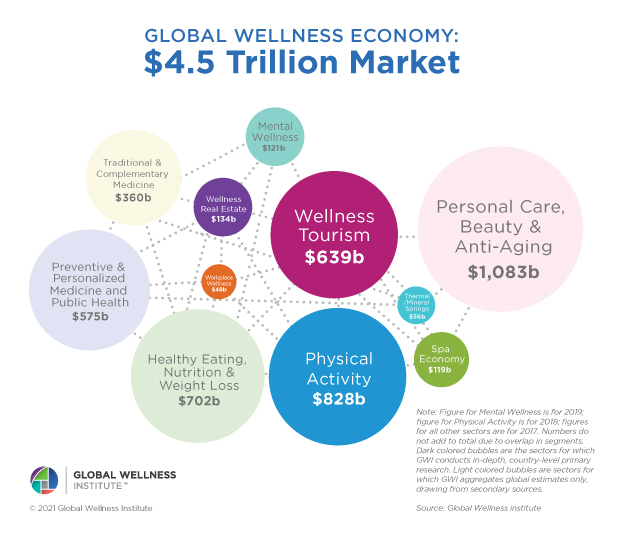

We turn now to the Global Wellness Institute’s latest forecast on the world market for wellness, which GWI expects will hit $7 trillion in 2025. This big number is comprised by personal care and beauty (which had various shifts within the category in the pandemic – less color cosmetics and more skin health and hygiene, for example), healthy eating for nutrition and weight loss, physical activity, and wellness tourism, among other categories.

We turn now to the Global Wellness Institute’s latest forecast on the world market for wellness, which GWI expects will hit $7 trillion in 2025. This big number is comprised by personal care and beauty (which had various shifts within the category in the pandemic – less color cosmetics and more skin health and hygiene, for example), healthy eating for nutrition and weight loss, physical activity, and wellness tourism, among other categories.

A big shift in the pandemic was consumers’ growing use of ecommerce for retail and appreciation for digital shopping platforms – which are re-shaping consumers’ expectations for health/care, as well.

Press Ganey, the health care experience advisors, published their report on health consumers noting that digital drives health care choices. Patients-as-health-consumers are increasingly searching for online provider reviews, and Press Ganey looks at the resulting “referral leakage” that falls out of not-so-great-reviews: there is such “leakage” if the reviews are under 4 stars, the firm found. With more health care shopping via websites, Press Ganey wants us to know that consumers on average read 5.5 reviews before deciding, and people use three different websites in their health care research. These sources are more likely to be search engines than insurance sites, hospital sites, or pharma sites. Specifically, Google attracts 78% of health consumers’ provider shopping searches, versus hospital/clinic sites consulted by 36%, WebMD for 27%, HealthGrades by 22%, and Facebook capturing under 20% of health care shoppers’ research source.

In their Road to Next report, Deloitte observes that the consumerization of health is advancing rapidly (again, we revert to Amara’s Law – short-term over-estimates, long-term under-estimating the pace of change). Deloitte calls out health consumers’ “craving” for empowerment and transparency, evidenced by the popularity of wearables and employee benefits that reward healthy behaviors. Deloitte also notes the growing use of telehealth and online appointment scheduling the enable easier access to services. To effectively personalize health care, Deloitte expects that health care providers will partner with technology companies to assess large pools of patient data (e.g., machine learning, AI) and should be mindful about data privacy and ownership vis-à-vis transparency and patient control of personal data.

Underpinning consumerization is patients-as-payors’ financial burden of medical costs – which Deloitte recognizes at the top of the report.

We segue then to a view from Kaiser Family Foundation’s Health Tracking Poll focusing on the cost of health care and prescription drugs.

We segue then to a view from Kaiser Family Foundation’s Health Tracking Poll focusing on the cost of health care and prescription drugs.

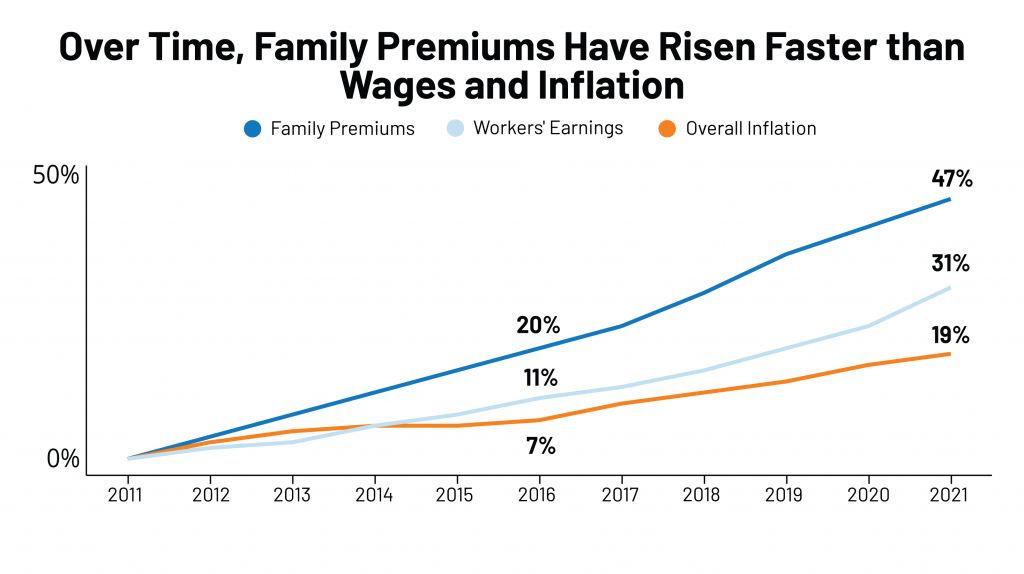

Americans remain concerned about the cost of prescription drugs and health care spending overall. KFF’s 2021 Employee Health Benefits report, published in November, calculated that the cost for a health plan for a U.S. family would reach $22,221, with employees bearing about 28% of that to share the cost of coverage – separate from out-of-pocket costs for co-payments, coinsurance, and other expenses driving consumers’ household medical spending up to a major kitchen table category in the family budget.

Note that family insurance premiums have steadily risen at a higher rate than wages or inflation over the ten years tracked in the chart.

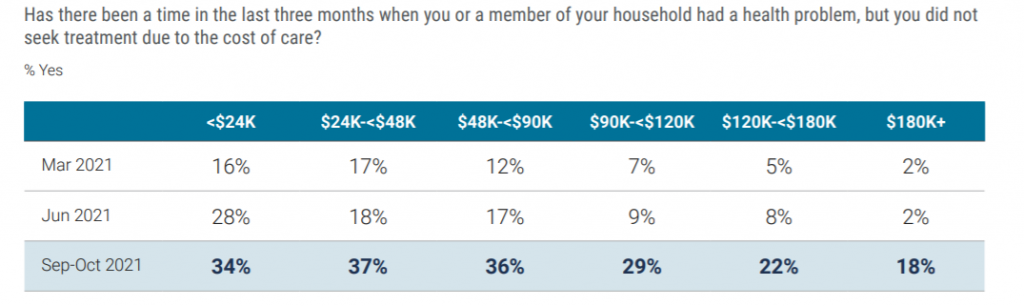

There has been a big spike among U.S. adults skipping medical treatment due to cost, noted by West Health and Gallup in their largest consumer health study conducted since the pandemic began, the Healthcare in America report published this week. Nearly 30% of Americans had skipped getting health care due to cost.

There has been a big spike among U.S. adults skipping medical treatment due to cost, noted by West Health and Gallup in their largest consumer health study conducted since the pandemic began, the Healthcare in America report published this week. Nearly 30% of Americans had skipped getting health care due to cost.

See that self-rationing health care is phenomenon for U.S. health consumers across incomes: while more acutely impacting people with incomes under $90,000, even one-in-five people earning over $120,000 a year skipped medical treatment due to cost in the three months prior to October 2021.

Americans increasingly understand that health care costs are a top line-item in their household budgets. And in the era of the pandemic, “COVID teaches us you cannot separate economics from epidemiology,” a Financial Times op-ed noted last week.

Americans increasingly understand that health care costs are a top line-item in their household budgets. And in the era of the pandemic, “COVID teaches us you cannot separate economics from epidemiology,” a Financial Times op-ed noted last week.

We’ve seen more financial and money-focused media bringing health care cost stories under their mastheads. So have investment banks, ratings agencies, and large financial services companies, as the pandemic has cast every industry’s eyes to public health and health spending.

One of those financial services companies is UBS, whose Morning Comment struck me with this observation from Paul Donovan’s newsletter:

We are at the stage where people who are not virologists are talking about the virus, and people who are not economists are talking about the economic impact of the virus. US Federal Reserve Chair Powell suggested that virus mutations may upset the US economy. The economic impact is driven by fear, and by the policy response,

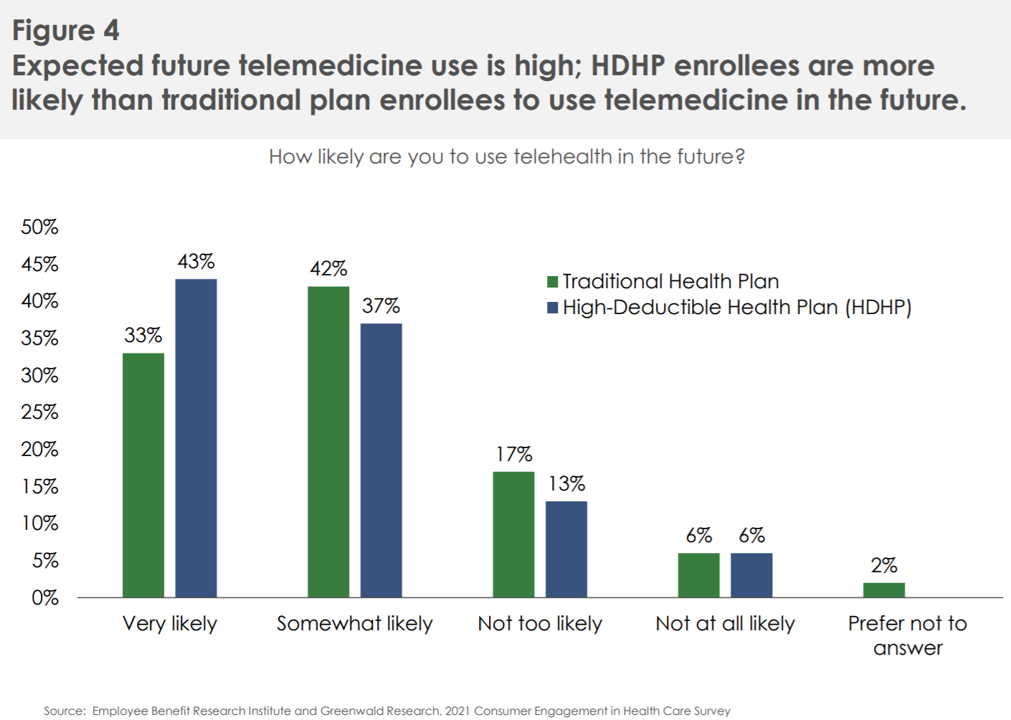

That point is not lost on EBRI, the Employee Benefits Research Institute, which is our go-to looking at workplace benefit package trends. In EBRI’s 17th annual consumer engagement survey, those workers enrolled in high-deductible health plans tended to be more cost-conscious, also taking up telehealth more than traditional health plan members. Those bearing more financial risk are seeking in-network services, easy access, drug coverage, lower out-of-pocket costs, and simpler-to-use plans.

That point is not lost on EBRI, the Employee Benefits Research Institute, which is our go-to looking at workplace benefit package trends. In EBRI’s 17th annual consumer engagement survey, those workers enrolled in high-deductible health plans tended to be more cost-conscious, also taking up telehealth more than traditional health plan members. Those bearing more financial risk are seeking in-network services, easy access, drug coverage, lower out-of-pocket costs, and simpler-to-use plans.

Financial stress is integral to overall health and well-being based on consumers’ own definition of “health.” The latest Morgan Stanley at Work report on the state of workplace financial benefits found that over the past year (during Year 2 of COVID-19 in the U.S.), nearly all employees have faced financial issues in their personal life – including challenges in reducing debt and savings. These forced 3 in 5 workers to reduce contributions to savings accounts, especially among Millennials.

Financial stressors were a kind of toxic side effect of the pandemic, observed by the spring of 2020 just weeks into the public health crisis. A new article in Nature details the mental health concerns exacerbated during the COVID-19 pandemic, which included economic problems faced by many families.

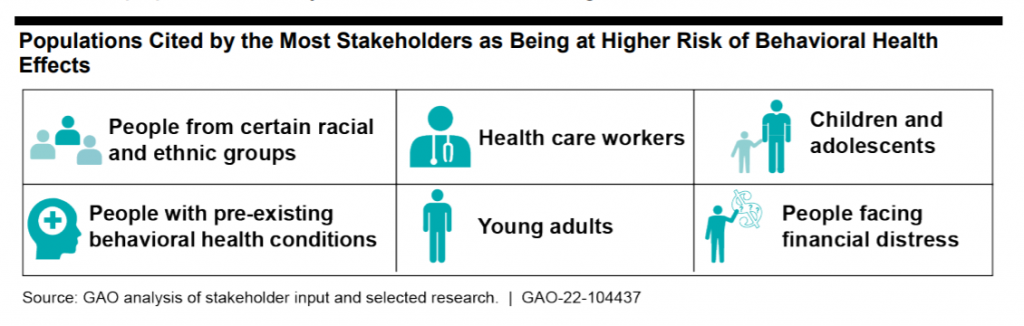

The U.S. Government Accountability Office (GAO) just looked at behavioral health and COVID-19, identifying higher-risk populations and how Federal relief funding is trying to address these health citizens. ”The effects of the COVID-19 pandemic and related economic crisis – such as increased social isolation, stress, and unemployment – have intensified concerns about the number of people in the U.S. affected by behavioral health conditions: mental health and substance use disorders,” GAO highlighted.

The U.S. Government Accountability Office (GAO) just looked at behavioral health and COVID-19, identifying higher-risk populations and how Federal relief funding is trying to address these health citizens. ”The effects of the COVID-19 pandemic and related economic crisis – such as increased social isolation, stress, and unemployment – have intensified concerns about the number of people in the U.S. affected by behavioral health conditions: mental health and substance use disorders,” GAO highlighted.

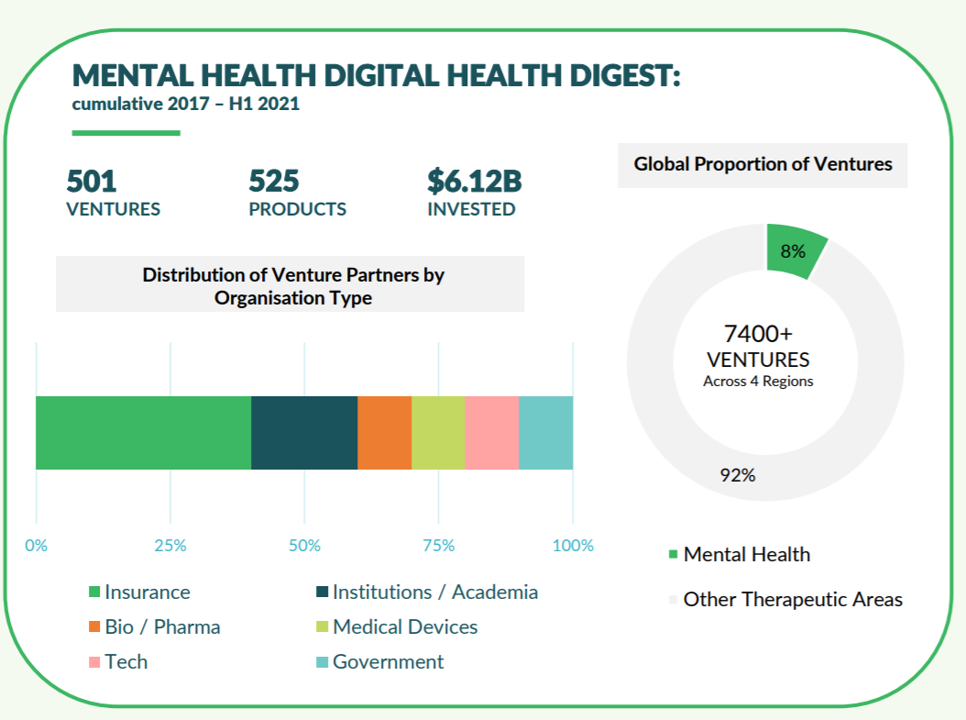

The growing recognition of mental health as the epidemic inside and outside of the pandemic has promoted major digital health investments into platforms and digital therapeutics to address this long under-served market. In just the past several weeks, we’ve seen:

The growing recognition of mental health as the epidemic inside and outside of the pandemic has promoted major digital health investments into platforms and digital therapeutics to address this long under-served market. In just the past several weeks, we’ve seen:

- Pear Therapeutics go public on NASDAQ via SPAC (trading symbol: PEAR)

- Independence Blue Cross (IBX) announce an alliance with Quartet Health to integrate physical and mental health via digital platforms

- Cerebral garner$300 million to “democratize mental health,” in a deal led by Softbank,

among many other developments in the digital mental health space.

Galen Growth identified in its latest report on digital health ecosystem trends at least 500 active private digital mental health ventures globally, nearly all mobile applications.

Employers covering health insurance have renewed interest in their workers’ mental health, a focus for re-imagining 2022 workplace benefit plans. The Employer Health Innovation Roundtable (EHIR)’s report on trends found that most employers expanding mental health services are adding at least one additional digital program to their benefits portfolio.

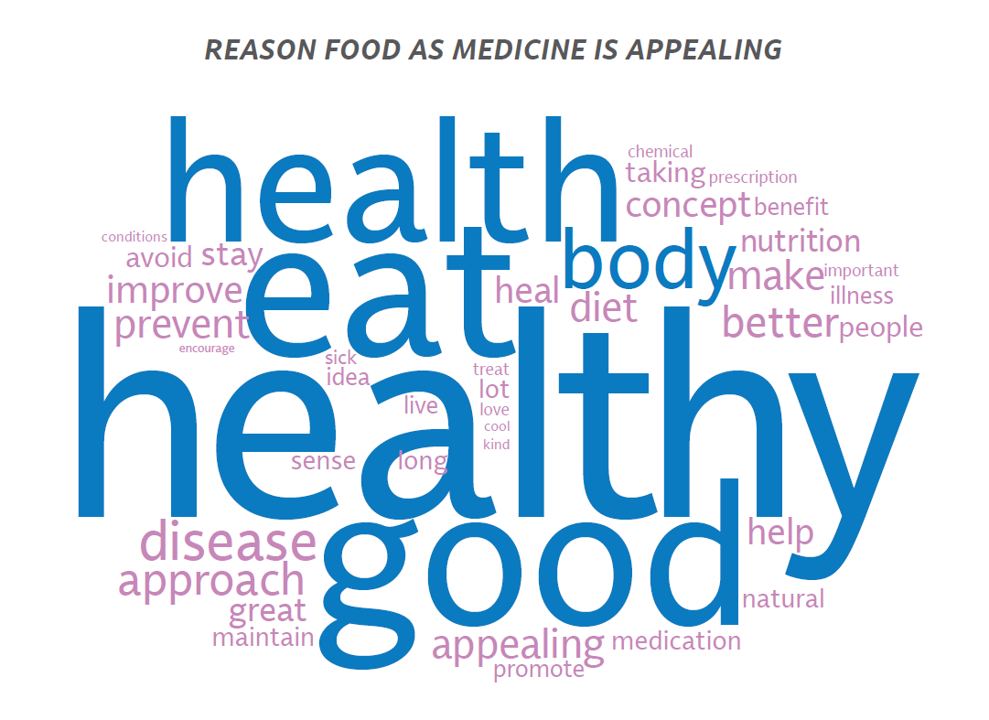

In addition to financial and mental health issues, consumers have also been dealing with food and nutrition challenges during the pandemic. In 2022, most people are looking for more control over their health and food-as-medicine is gaining traction in peoples’ kitchens.

During the pandemic, grocery stores were essential channels for food, of course, but also as health destinations – for a pharmacy channel, for over-the-counter drugs to manage everyday medical complaints, and for food-as-medicine. FMI’s latest look into grocery stores as a place to source food that bolsters health to prevent disease and manage chronic conditions. Specifically, consumers are seeking support for gut health, nutritional deficiencies, inflammation and allergies, diabetes and heart disease, and to manage food borne illness risks.

During the pandemic, grocery stores were essential channels for food, of course, but also as health destinations – for a pharmacy channel, for over-the-counter drugs to manage everyday medical complaints, and for food-as-medicine. FMI’s latest look into grocery stores as a place to source food that bolsters health to prevent disease and manage chronic conditions. Specifically, consumers are seeking support for gut health, nutritional deficiencies, inflammation and allergies, diabetes and heart disease, and to manage food borne illness risks.

Consumers are looking to leverage food to promote health and well-being, especially seeing fruits for heart health and dietary fiber, dairy for bone health and protein, and whole grains for heart health and diabetes management, FMI noted. Consumers can expect grocers to expand retail food-health programs in the forms of food “prescriptions,” incentive/loyalty, medically tailored nutrition, and personalized nutrition education in 2022.

Building on the Food Industry Association’s findings, the Tetra Pak Index 2021 predicted that consumers want more control over their health and believe they should do more to look after themselves physically, paying more attention to ingredients in what they eat. Tetra Pak identified the opportunity that consumers seek to build “a better me,” pointing out consumers’ Google Trends data spiking for searches on immunity-boosting foods, nutrition for building energy and mental acuity, and to improve mood.

Focusing on food-as-medicine is more likely a luxury for people who can afford to do so out of their own family budget versus those health citizens who lack sufficient funds and access to do so. COVID-19 exacerbated food insecurity as another side-effect of the public health crisis. A new McKinsey report on how health care payers can expand nutrition support to bolster health in communities talks about the food-as-health-determinant challenge, highlighting the opportunity for health plans and health care providers to integrate nutrition into primary care and other medical work-flows that channel nutrition to patients needing support.

In early December, FarmBoxRx was the first online grocer to be approved to deliver food to SNAP/EBT recipients as payment from Medicare and Medicaid. FarmboxRx works with providers and insurers in the U.S. enabling enrollees in Medicare and Medicaid to order fresh produce online. In addition to general fruit and veg boxes, consumers can specify more personalized selections such as anti-inflammatory, diabetic, Asian or Hispanic cuisine, or healthy snacking shipments.

This approach is built on a digital platform, which is key to scaling access to healthy shopping and, more generally, providing a digital front-door for consumers to access for medical care and social support.

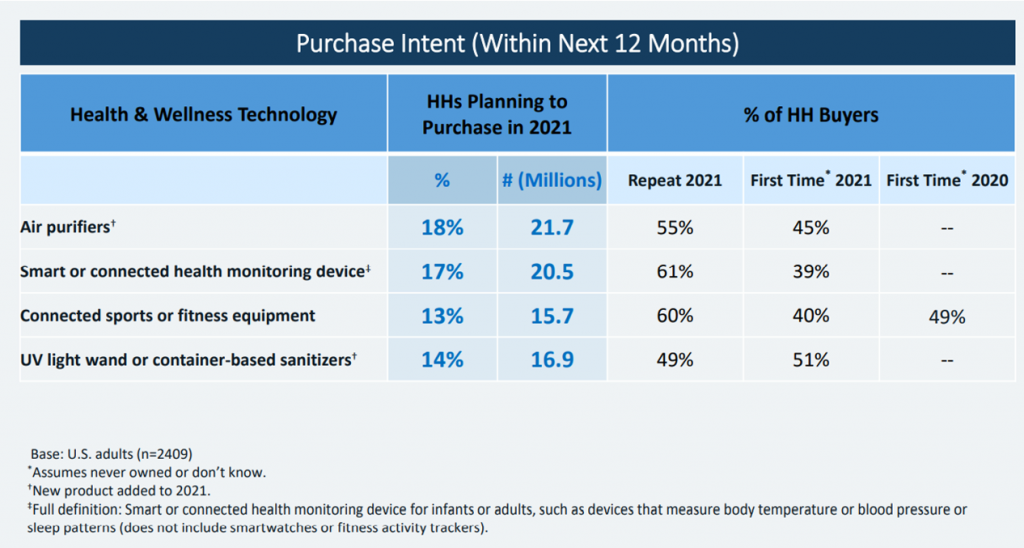

In the pandemic, consumers’ adoption of wearable tech and health monitoring tools used at-home grew, the Consumer Technology Association told us in CTA’s mid-year 2021 forecast.

I reported out this trend in my 2020 book Health Citizenship, which looked at U.S. health consumers’ behavior changes in the first six months of the COVID-19 pandemic. The over-arching theme here was the home as health hub, and the latest Omicron variant reinforces consumers’ life-flows in the long tail of the pandemic for adapting houses’ kitchens, bathrooms, airflows, and sleep styles in bedrooms.

CTA provided us an update on consumers’ electronics desires in their latest report on holiday shopping expectations and gifting plans for 2021. Here, wearable tech features high on consumers’ lists of holiday gift wants as well as their gifting intentions for others. In the 2021 holiday forecast, CTA also detailed the trend that health and safety products were coming into consumers’ focus with COVID-19 elevating interest in these product areas: specifically, 29% of people were interested in smart or connected health monitoring devices, such as those used to measure body temperature, sleep patterns or blood pressure, and 24% were keen to purchase smart cleaning solutions, such as UV light sanitizers. Air quality, too, will be demanded more in 2022 as the pandemic bolstered lasting changes in peoples’ self-care at home.

CTA provided us an update on consumers’ electronics desires in their latest report on holiday shopping expectations and gifting plans for 2021. Here, wearable tech features high on consumers’ lists of holiday gift wants as well as their gifting intentions for others. In the 2021 holiday forecast, CTA also detailed the trend that health and safety products were coming into consumers’ focus with COVID-19 elevating interest in these product areas: specifically, 29% of people were interested in smart or connected health monitoring devices, such as those used to measure body temperature, sleep patterns or blood pressure, and 24% were keen to purchase smart cleaning solutions, such as UV light sanitizers. Air quality, too, will be demanded more in 2022 as the pandemic bolstered lasting changes in peoples’ self-care at home.

Home health is of interest across consumers demographics: AARP expects people over 50 to use smartphones to keep New Year’s resolutions – for all aspects of health – such as fitness, finance, and stress.

This gets to “connected wellbeing,” a trend noted by Wunderman Thompson – from prescription gaming to VR pharmacies and digital therapeutics. Even 66% of Boomers reported they switched on digitally to unwind, the firm observed.

We conclude this huge trend-weave calling out that every company is a health company now – especially underpinned by technology to bolster access, scaling, and data analytics. Many tech companies are working to improve public health and individuals’ health equity. For example, Microsoft announced plans to collaborate with Scripps on maternal health outcomes through the PowerMom consortium, and Google is working with the World Health Organization on digital health apps, particularly in low to middle-income countries.

I am writing this post from my second home in Brussels, having been spending more time working across the health/care ecosystem in Europe, I can report out my observation that stakeholders here are more frequently speaking with me about #ESG, Environmental, Social, and Governance goals that are part of the larger Sustainable Development Goals and climate change initiatives.

I am writing this post from my second home in Brussels, having been spending more time working across the health/care ecosystem in Europe, I can report out my observation that stakeholders here are more frequently speaking with me about #ESG, Environmental, Social, and Governance goals that are part of the larger Sustainable Development Goals and climate change initiatives.

The recent COP26 meeting on climate change resulted in a convergence of health care stakeholders committing to address climate change and ESG, signed by 50 countries focused on building climate-resilient health systems.

“The COVID-19 pandemic has made evident how interconnected our governing systems are as the world experiences the consequences of a major shock to health systems in high-income countries and low-income and middle-income countries….COVID-19 like climate change is amplifying existing systemic vulnerability and inequalities….It is necessary to reframe the approach to health governance to recognize the mutual interdependencies of countries and communities’ and to reconfigure decision-making to put equity, justice, and local voices at the heart of crisis response,”

The Lancet asserted in its post-COP26 comment.

The concluding sentence here extends to re-building health care in the U.S. in 2022 – to bolster equity, justice, and empowering patient/consumer voices in the process. We come full circle to the initial trends I discussed here from Gartner – that health citizens are looking for responsibility, justice, authenticity, loyalty, and equality in their lives in the New Year.

These values extend to health and well-being in 2022….and beyond.

I wish you well for wonderful, joyful, healthy holidays – and appreciate your collegiality, support, and collaboration over the past challenging year. Hoping for more of these in 2022! Love and peace — JSK

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a