If you made your living in commercial real estate — and especially, working with hospitals’ and health systems’ office space — would the concept of telehealth be freaking you out right now?

If you heed the words of JLL’s 2022 Patient Consumer Survey, you’d chill (at least a bit). The tagline on this paper is, “Convenience and choice drive patient decisions as new digital options take hold.”

If you heed the words of JLL’s 2022 Patient Consumer Survey, you’d chill (at least a bit). The tagline on this paper is, “Convenience and choice drive patient decisions as new digital options take hold.”

I was particularly keen to dig into this study based on its sponsoring organization: JLL is a real estate services company serving over a dozen vertical markets — including health care, life sciences, senior housing, and retail, among other industry sectors.

Through their lens on real estate, JLL wove three themes from the consumer poll:

- Location and convenience matter most to patients, and health care providers can leverage patient preferences to inform site selection especially for scarce facility types

- Telehealth and virtual care are here to stay, opening new on-ramps for greater access, system expansion, and pressure on the supply of medical real estate

- The quality of care and facilities influence patient choice, and systems can improve patient access by modernizing key facilities.

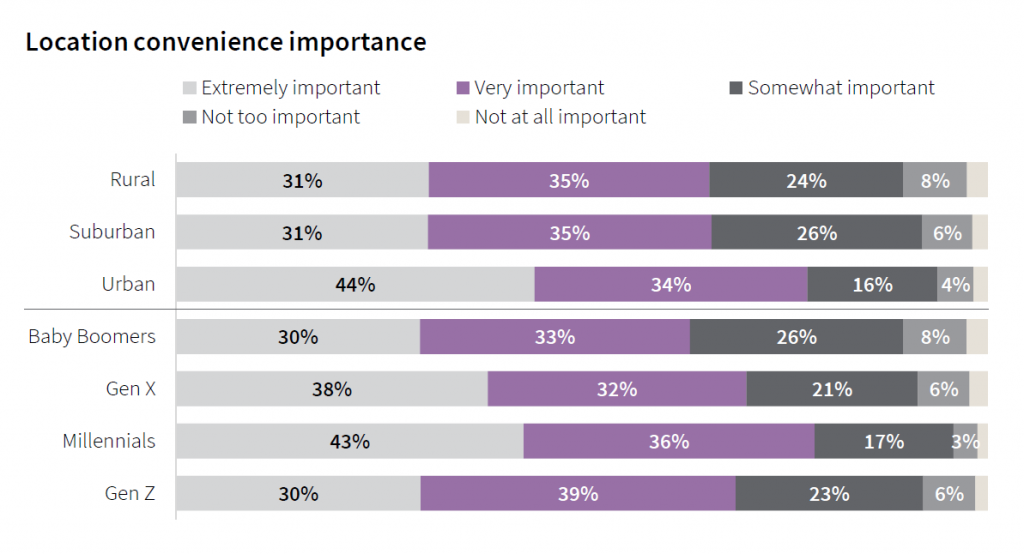

Intriguingly, “convenience” of health care location is as important to Baby Boomers as it is to younger Gen Z health consumers.

One factor defining convenience is travel time to a facility: 40% of patients with in-person doctor’s appointments traveled less than 15 minutes to receive care, and 43% spent between 15 and 30 minutes getting to the doctor’s office. More suburban dwellers travelled less than 15 minutes to the doctor’s office compared with people living in rural and urban areas. More patients spent longer times traveling to face-to-face encounters for behavioral health, surgery center care, hospitals and specialty physicians’ offices.

One factor defining convenience is travel time to a facility: 40% of patients with in-person doctor’s appointments traveled less than 15 minutes to receive care, and 43% spent between 15 and 30 minutes getting to the doctor’s office. More suburban dwellers travelled less than 15 minutes to the doctor’s office compared with people living in rural and urban areas. More patients spent longer times traveling to face-to-face encounters for behavioral health, surgery center care, hospitals and specialty physicians’ offices.

JLL points out that surgery centers are performing more complex procedures today, and complexity will continue to grow surgicenters’ procedure lists over the next decade — moving more complex care closer to peoples’ homes.

Of course, it’s of major interest to JLL how and whether telehealth and virtual care could replace demand for brick-and-mortar office space. The firm asserts that, and I quote from the report, “telehealth is not replacing the physical office by any means.”

The study found that one in three telehealth visits resulted in a face-to-face physical office visit. As such, JLL sees telehealth as an avenue to increase patient access and drive more overall health care visits — augmenting the physical office, not replacing it.

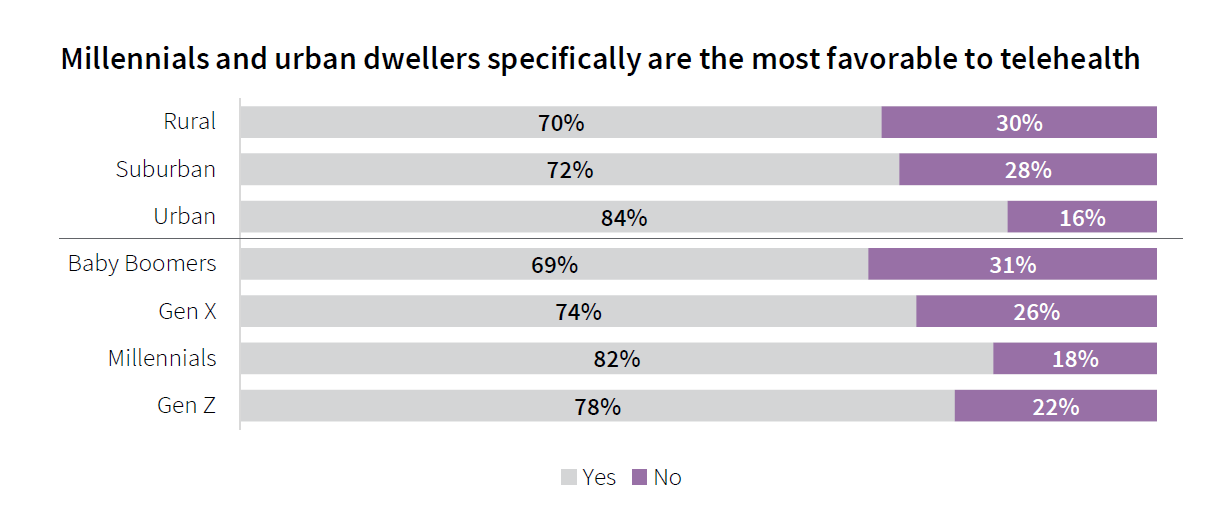

Between July 1, 2921, and January 2022, 50% of consumers in this survey had had a telehealth appointment, led by urban community dwellers and Millennials. And, 3 in 4 patients who had a telehealth visit since July 1 said they would prefer telehealth visits in the future, JLL learned. This includes 69% of Boomers.

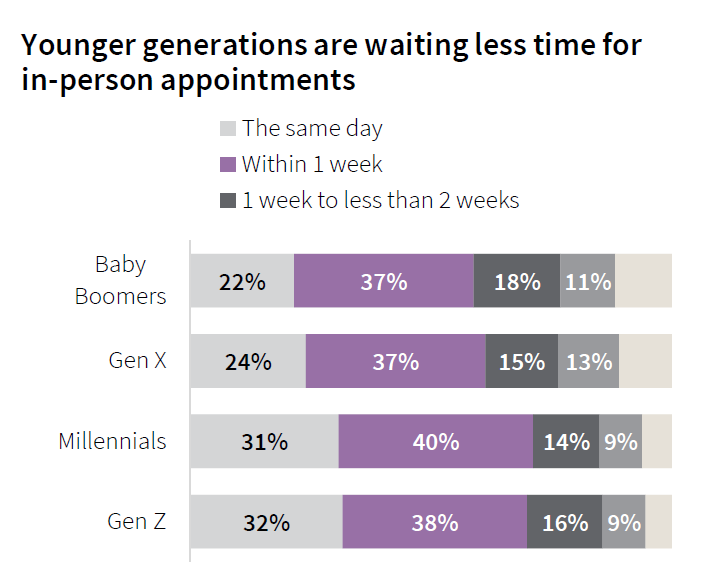

Ironically, Boomers had to wait longer for in-person appointments than patients in Gen Z or Millennial generations. The Advisory Board has called this out, noting that Boomers are the “most tolerant” of wait times for lower-acuity conditions compared to Gen Z consumers who are more “Amazon Primed” (that’s my parlance for less tolerant of waiting).

Ironically, Boomers had to wait longer for in-person appointments than patients in Gen Z or Millennial generations. The Advisory Board has called this out, noting that Boomers are the “most tolerant” of wait times for lower-acuity conditions compared to Gen Z consumers who are more “Amazon Primed” (that’s my parlance for less tolerant of waiting).

For those of you focused on serving Medicare or older patients, there are some important findings in the JLL study to add into your scenario planning assumptions.

For example, Boomers would be less likely than younger patients to take a telehealth appointment if it was available sooner than an in-person visit — signaling, JLL says, that older people may have stronger ties to medical providers than younger patients.

More Boomers also rated the quality of their in-person doctor’s appointment more highly than people in younger age cohorts.

Boomers also rate physical facility environments more highly than younger patients do — prompting JLL to infer that Boomers might be the least critical consumers relative to physical healthcare buildings. Boomers index higher relative to the factors of cleanliness, safety, staffing, ease in parking, and convenient/accessible locations compared with younger patients.

JLL surveyed 4,060 U.S. adults in the first half of January 2022 for this study.

Health Populi’s Hot Points: As a real estate firm, JLL is well aware of the impact of consumers’ growing omni-channel demands for all aspects of personal transactions, from banking to food shopping, auto purchases to filling prescription medicines. That the company devoted financial resources to invest in a consumer/patient survey on telehealth says a lot about the changing nature of health care delivery and the expanding retail health ecosystem that can deliver care almost anywhere there is broadband connectivity, and a licensed clinician and patient at either end of that connection.

One conclusion that could be drawn from this study is that telehealth is cost-additive, not cost-saving. Krista Drobac, who leads the Alliance for Connected Care, was quoted in Modern Healthcare noting that the JLL survey, “failed to specify the types of services leading to in-person referrals and whether telehealth helped patients avoid emergency or urgent care,” the journal said.

“This kind of patient self-reported data makes the leap to over-utilization way too simplistic,” Drobac told Modern Healthcare. “It’s also important to compare these visits to regular, in-person evaluation and management visits. Those often lead to follow-up care, so we may not be seeing any difference between in-person and telehealth for follow up to specialists, etc.,” she added.

This week, the U.S. House Appropriations Committee unveiled an omnibus spending package that included telehealth service extensions to cover Medicare enrollees for 151 days after the end of the COVID-19 public health emergency. This is essentially a five-month extension for telehealth in the U.S. The provisions include expanding the originating site to include any site at which the patient is located — including the patient’s home.

This week, the U.S. House Appropriations Committee unveiled an omnibus spending package that included telehealth service extensions to cover Medicare enrollees for 151 days after the end of the COVID-19 public health emergency. This is essentially a five-month extension for telehealth in the U.S. The provisions include expanding the originating site to include any site at which the patient is located — including the patient’s home.

In addition, the bill would expand eligible practitioners to provide telehealth such as occupational therapists, physical therapists, speech language pathologists and audiologists; FQHC’s and rural health clinics to provide virtual care; delaying the 6-month in-person requirement for mental health services delivered via telehealth until 152 days after the COVID emergency; and extending coverage and payment for audio-only telehealth services, which have been found to be especially welcomed by older (Medicare-enrolled) patients, among other provisions.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for