Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll.

![]() Underpinning that household budget concern are gas and health care costs.

Underpinning that household budget concern are gas and health care costs.

Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans).

Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats.

The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with climate change, for just 6% of people in the U.S. The pandemic’s range across political party was 9% for Democrats and zero percent — none – among Republicans, as shown in the first graph.

![]() The cost of filling up a car’s gas tank ranked first among U.S. householder’s worries of household budget items among 71% of U.S. adults. About 3 in 5 people worry about unexpected medical bills, followed by one-half concerned about their home’s utility bills and grocery store spending.

The cost of filling up a car’s gas tank ranked first among U.S. householder’s worries of household budget items among 71% of U.S. adults. About 3 in 5 people worry about unexpected medical bills, followed by one-half concerned about their home’s utility bills and grocery store spending.

Other worrisome health care cost items follow down the line, including:

- 45% of U.S. adults concerned about long term care services for themselves

- Monthly health insurance deductibles, among 44% of people

- Prescription drug costs, for 43% of U.S. adults

- Monthly health insurance premium, among 36% of people.

Forty-three percent of Americans were worried about their rent or mortgage spending in the March 2022 Poll.

![]() Check out the third chart, which breaks down the budget cost concerns by household income. Note that most people in the highest income category, over $90,000 per annum, are feeling the worry about gas and transportation costs.

Check out the third chart, which breaks down the budget cost concerns by household income. Note that most people in the highest income category, over $90,000 per annum, are feeling the worry about gas and transportation costs.

Two in three people earning under $90,000 a year are worried about unexpected medical bills, and one-half concerned about prescription drug costs, the monthly health insurance deductible, and long-term care.

The cost of food — a key determinant of health — is also a worry for 50% of people earning $40,000 to $90,000 annually, and for 62% of people earning under $40,000 per year.

One-half of people in the U.S. have postponed some form of medical care in the past year due to costs. This self-rationing behavior hit dental services most, delayed by 35% of U.S. adults, followed by vision care for 25%, a doctor’s office visit among 24%, mental health services among 18%, and 14% of people avoiding hospital services.

The issue of health care costs, and in particular out-of-pocket costs for prescription drugs, continues to be a priority for most U.S. voters across political party. For example, allowing the Federal government to negotiate with drug companies to get a lower price on prescription drugs for people with Medicare is favored by 96% of Democrats, 87% of Independents, and 84% of Republicans. Limiting drug companies’ price increases each year to a max of the rate of general price inflation also garners at least 90% of Americans’ favor across all three party IDs.

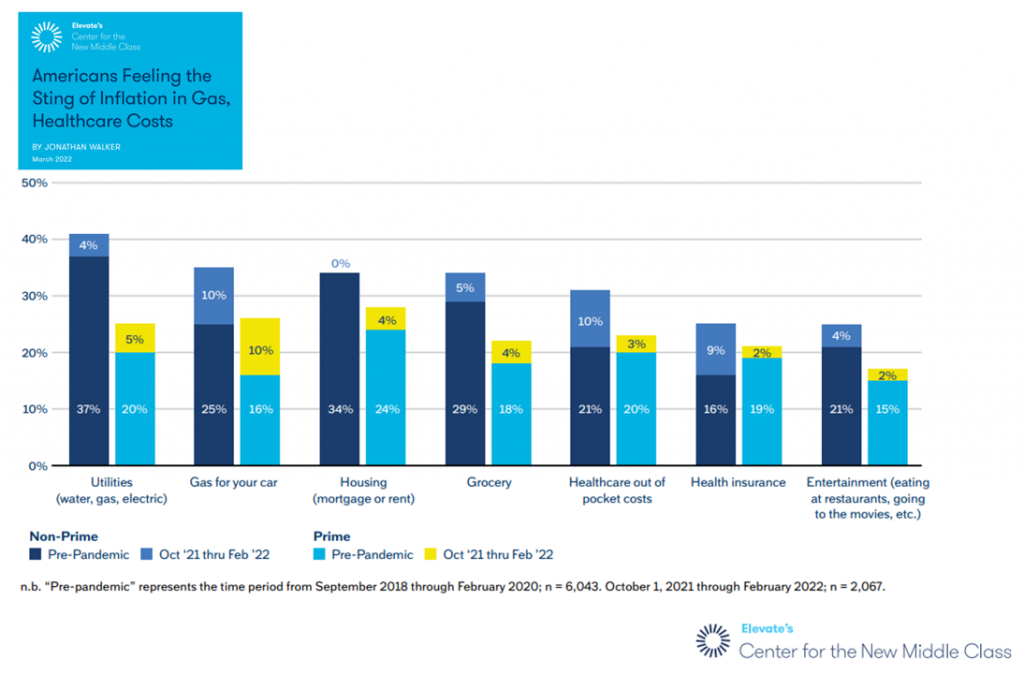

Health Populi’s Hot Points: Confirming the KFF findings, the Elevate Center for the New Middle Class published a report last week citing Americans feeling the “sting” of inflation for gas and healthcare costs.

Health Populi’s Hot Points: Confirming the KFF findings, the Elevate Center for the New Middle Class published a report last week citing Americans feeling the “sting” of inflation for gas and healthcare costs.

In this study, that “sting” tracks U.S. consumers’ feelings about various household costs strain on the family budgets — causing “a lot of strain,” “a little strain,” or “no strain” on month-to-month finances.

The blue-and-yellow bar chart from the report echoes the KFF observations, detailing that sting by household budget line items including utilities, gas for automobiles, housing, grocery, and health care for both out-of-pocket costs separate from health insurance.

This report compares U.S. consumers in “Prime” versus “Non-Prime” households. Prime credit scores are FICO numbers above 700, with access to all credit instruments; Non-Prime scores fall below 700, limiting consumers’ access to credit.

As the chart illustrates, people with Non-Prime scores felt greater strain pre- and post-pandemic than consumers with Prime credit ratings.

As the chart illustrates, people with Non-Prime scores felt greater strain pre- and post-pandemic than consumers with Prime credit ratings.

Elevate defines the new middle class as,

“a growing group of productive credit-constrained Americans generally described as subprime or non-prime, having credit scores below 700 and little or no savings….this group of 160 million Americans are generally limited to expensive forms of credit or no credit at all and have few options to meet their immediate financial needs.”

Most surprising to Elevate was the ten-percentage point growth in the number of non-prime households feeling “a lot of strain” due to healthcare costs for both insurance and out-of-pocket spending. As the chart shows, this accelerated in the third quarter of 2021 when the overall U.S. economy improved.

Last month, the trifecta of credit agencies — Equifax, Experian, and TransUnion — announced intentions to carve out a substantial amount of Americans’ medical debt from credit scoring beginning in July 2022.

“Non-prime households have felt the brunt of the pandemic and inflation….It is unclear how much more the new middle class can be squeezed without a significant impact across the economy,”

the report concludes.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for