With only 1 in 10 people in the U.S. thinking their lives are the same as they were before the COVID-19 pandemic, about one-half of Americans believe that remote work, virtual community events, and telehealth should continue “once the pandemic ends.”

As of mid-May 2022, most people in the U.S. have resumed activities like socializing with friends and neighbors in person, going to restaurants and bars, traveling, meeting with older relatives face-to-face, and returning to exercising in gyms.

But a return-to-nearly-normal isn’t a universal phenomenon across all people in America: Hispanic and Black adults are more likely to be concerned about exposure to the coronavirus, less likely to be socializing with friends and neighbors. And Black and Hispanic people are also more likely than Whites to see wearing face masks in public indoor spaces as essential – at a rate of 78% for Black people and 62% for Hispanic people compared with 44% of White people, as quantified in Americans’ Readiness to Emerge from the Pandemic and How Their Daily Lives Have Changed, a poll report from The Associated Press and the NORC Center for Public Affairs Research.

AP-NORC polled 1,001 U.S. adults in May 2022 for the study.

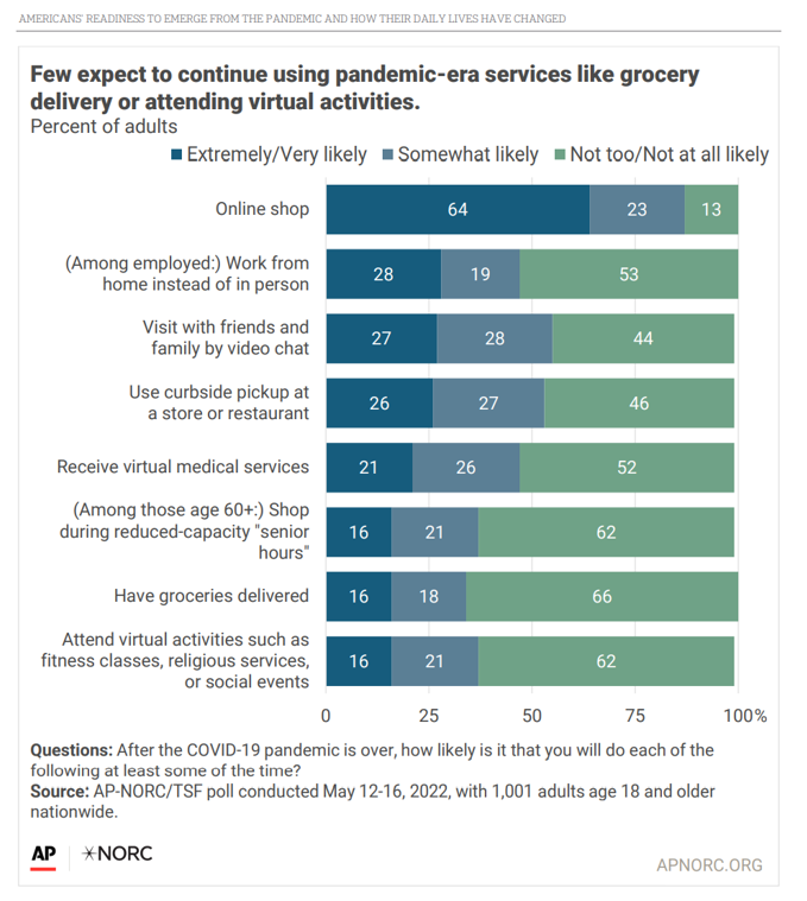

While most people in the U.S. took advantage of digital and virtual services during the pandemic, AP-NORC discovered that fewer Americans would likely use many of these “after the COVID-19 pandemic is over,” in the words of the survey question.

The virtual/digital services people would more likely use post-pandemic would be online shopping, by far the most popular service that would persist beyond COVID, followed by video chatting with friends and family, using curbside pickup at stores and restaurants, working from home, and receiving virtual medical services — i.e., telehealth.

At the low end of utilization would be attending virtual classes or religious services, having groceries delivered, or shopping during “senior hours” (among people ages 80+) — still likely to be used by about one in three U.S. adults, AP-NORC gauged.

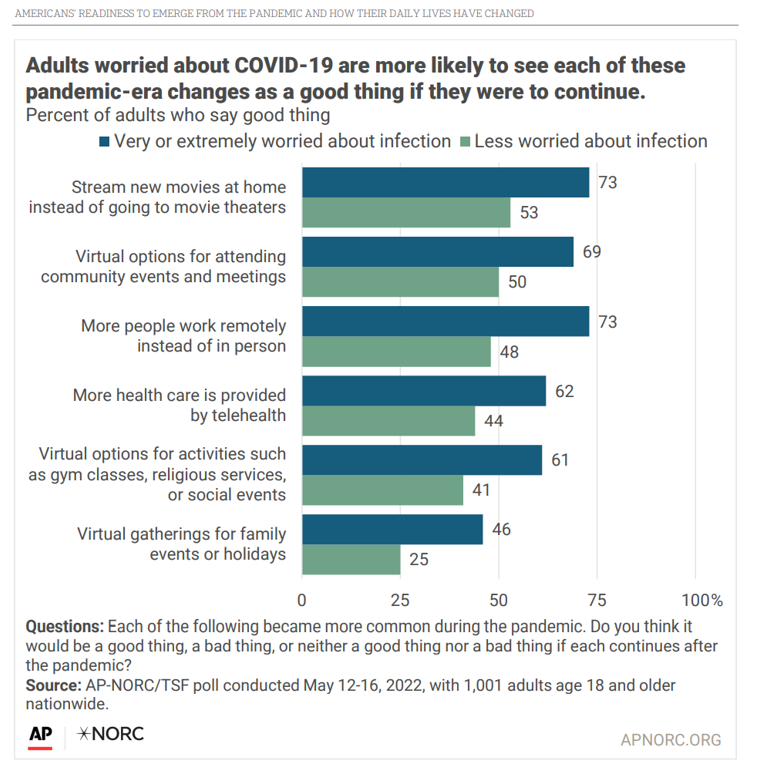

Concerns about the coronavirus infection continue to decline, with 23% of U.S. adults very or extremely worried about the infection and 31% “somewhat” worried. That leaves roughly one-half of people in the U.S. not worried about COVID-19.

You can see in the third chart that people more worried about the pandemic are more likely to see digital and virtual services and life-flows as good things to continue beyond the COVID era. In particular, options to stream entertainment at home versus going in-person to the cinema, attending virtual meetings and events (like PTA or town halls), and working remotely are the top 3 “good things” the COVID-worried would likely continue doing virtually post-COVID-19.

For medical care, 62% of those still worried about the coronavirus in May 2022 believed that services delivered through telehealth would be a good thing to continue beyond the pandemic era.

An important population segment to consider for this statistic is the cohort age 50 and older: they would be less likely to report that they would continue to use telehealth after the pandemic ends, AP-NORC found.

Health Populi’s Hot Points: Millions of people who were not digital natives or deep adopters of ecommerce and online social networking have undergone personal digital transformation in many ways by and through the pandemic. But that transformation does not mean people want to live all-digital, all-the-time, many keen in the summer of 2022 to return to working in offices, traveling, going to movie theatres in person (thank you Minions, Thor, and Lt. Pete “Maverick” Mitchell, et. al.), and attending July 4th parades, barbeques, and fireworks displays.

The point is that hybrid-life and omnichannel touchpoints are now learned life-flows and consumer behaviors in peoples’ daily lives, translating quite individually for each person.

This is certainly the evolving scenario for health care. Several signposts in the health/care ecosystem over the past few weeks point to the home’s and community’s continued evolution as our personal health hub:

Example 1: CVS Health withdrew its corporate membership in the National Association of Chain Drug Stores (NACDS), the U.S. member group convening retail pharmacy companies (such as Rite-Aid and Walgreens, among others). CVS storefronts represented about one-fourth of NACDS’s store count. With this decision, CVS continues to pivot away from the historical core pharmacy business, toward its ongoing vertical integration and service portfolio expansion for health and health care, beyond the pill. The news showed up on POLITICO Influence, noting greater FTC scrutiny of the PBM business — scrutiny which NACDS has supported. CVS Caremark operates the largest PBM in the market, so the plot thickens there.

Example 2: President Biden signed an Executive Order protecting health citizens’ access to reproductive health care services. The U.S. Supreme Court’s overturning of the Roe vs. Wade decision shifted women’s reproductive services focus to each state. The maxim that health care-is-local plays out here given the state-level focus, compelling women to assess their health care options across a range of necessary services based on their ZIP code. The Executive Order seeks to enhance and empower women in ways that it has the power to address, making the privacy of a woman’s home the (intended) haven for personal choice (as a short-term hack for the current situation and challenge people will be facing short of Congress’s passing a national law). The growing telehealth/Rx channels of Nurx, Hims and Hers, Ro, GoodRx, among others, could channel medications and virtual services to women in the privacy of their homes, a health care access pathway we will be closely watching.

Example 3: The FTC held a Merger Guidelines Listening Forum on June 21, bringing together diverse voices to brainstorm the topic of the “grocery store” and its evolving, expanding definition. “We have to fully update our definition of the grocery market to include all non-traditional grocers, whether they offer what we perceive as a full shop or not,” Mark Gross, Chairman of the board of several regional grocery chains and former CEO of Supervalu, commented at the meeting. “We need to understand the economic dominance of these non-traditional grocers and how they assert that power…it’s Walmart, it’s Target, it’s Amazon, it’s Costco, it’s Sam’s, it’s Aldi, it’s Dollar General…of the top 15 grocery sellers, only five are traditional supermarkets,” Gross explained.

Why this is important for home-as-health-hub: grocery stores and Big Box retailers have been trusted, important community touchpoints during the pandemic for serving health citizens’ basic needs for food and nutrition, along with pharmacy and health care services — from vaccinations to filling prescriptions and, increasingly, pharmacists and nutritionists playing growing roles in peoples’ primary care.

Most of those Big Retail companies Marc Gross called out in his statement to the FTC play roles in everyday peoples’ health — accessibly, conveniently, and providing value to health consumers navigating increasingly thrifty household economics.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for