In another factor to add into the retail health landscape, Dollar General (DG) the 80-year old retailer known for selling low-priced fast-moving consumer goods in peoples’ neighborhoods appointed a healthcare advisory panel this week. DG has been exploring its health-and-wellness offerings and has enlisted four physicians to advise the company’s strategy. One of the advisors, Dr. Von Nguyen, is the Clinical Lead of Public and Population Health at Google….tying back to yesterday’s post on Tech Giants in Healthcare.

Just about one year ago, DG appointed the company’s first Chief Medical Officer, which I covered here in Health Populi in a post titled, “Dollar General, the Latest Retail Health Destination?”

Well beyond our individual genetic codes, our health is made where we live, work, play, pray, learn, and shop….also well beyond hospitals and doctors’ offices in-between appointments, and often paid-for out-of-pocket quite separate from peoples’ health insurance plans.

All this week in Health Populi, I’ve covered various aspects of the Retail Health Battle Royale — the shake-up of the legacy healthcare industry that is evolving into a health/care ecosystem shaped by growing consumer demands for more experiences the way people deal with retail in omni-channel, digitally-enabled ways.

We’ve looked into the Amazon/One Medical combination, Apple’s paper on its future health vision, and the activities of the 16 largest Tech Giants in healthcare.

These three topics all occurred in the past couple of weeks. We can point to other events, too, continuing to re-shape consumer-facing healthcare, including the companies whose logos I’ve assembled for you here, All of these will impact health consumers’ access to and understanding of various health care services and products, across peoples’ healthcare journeys. Consider…

- MedWand was granted FDA 510(k) clearance for the company’s telemedicine innovative (and clinically-validated) vitals and remote examination tools which enable doctors and patients to meet up virtually for check0ups that can capture blood pressure, blood glucose spirometry, and weight data along with temperature, blood oxygen levels, pulse, electrocardiograms and other data.

- Zocdoc launched a data ecosystem enabled through application programming interfaces to streamline care coordination and referrals between primary care providers and specialists, aiming to provide consumers with a better experience and more convenient care access.

- For the second year in a row, H-E-B received J.D. Power’s top customer satisfactoin rank in the brick-and-mortar supermarket pharmacy category, noted for the grocer’s high Net Promoter Score for customer loyalty.

- AmerisourceBergen started up a platform to streamline bringing physicians and patients together for channeling digital therapeutics.

- GSK spun off Haleon to be a freestanding consumer health company, “to deliver better everyday health with humanity” the press release coined.

- U.S. News & World Report named Mayo Clinic the #1 health system in the U.S. for the 7th consecutive year.

- Hy-Vee grocery pharmacy announced test-to-treat services for consumers shown positive for COVID-19 with the therapy Paxlovid to be delivered across the store’s eight-state footprint.

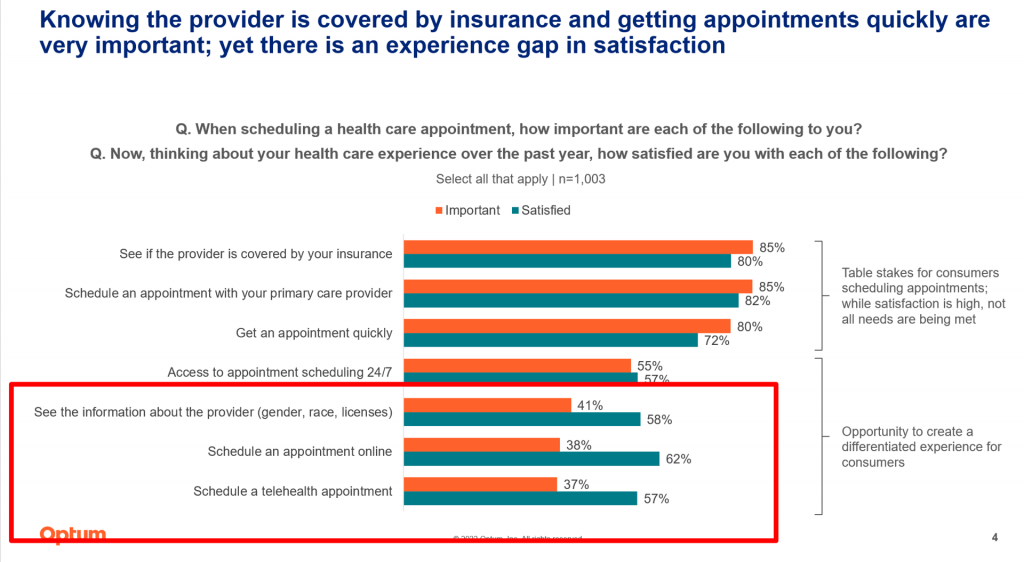

- Results of a survey from Optum, Qualtrics, and DocASAP quantified consumers’ demands for digital on-ramps to health care.

The Optum study found a gap between patients’ expectations for accessing information and easy scheduling and what folks have experienced. The red-boxed items here identify the three largest chasms between experience vs. expectations: for information about providers (say, their ethnicity, gender, and licenses), and abilities to schedule an appointment online or a telehealth encounter.

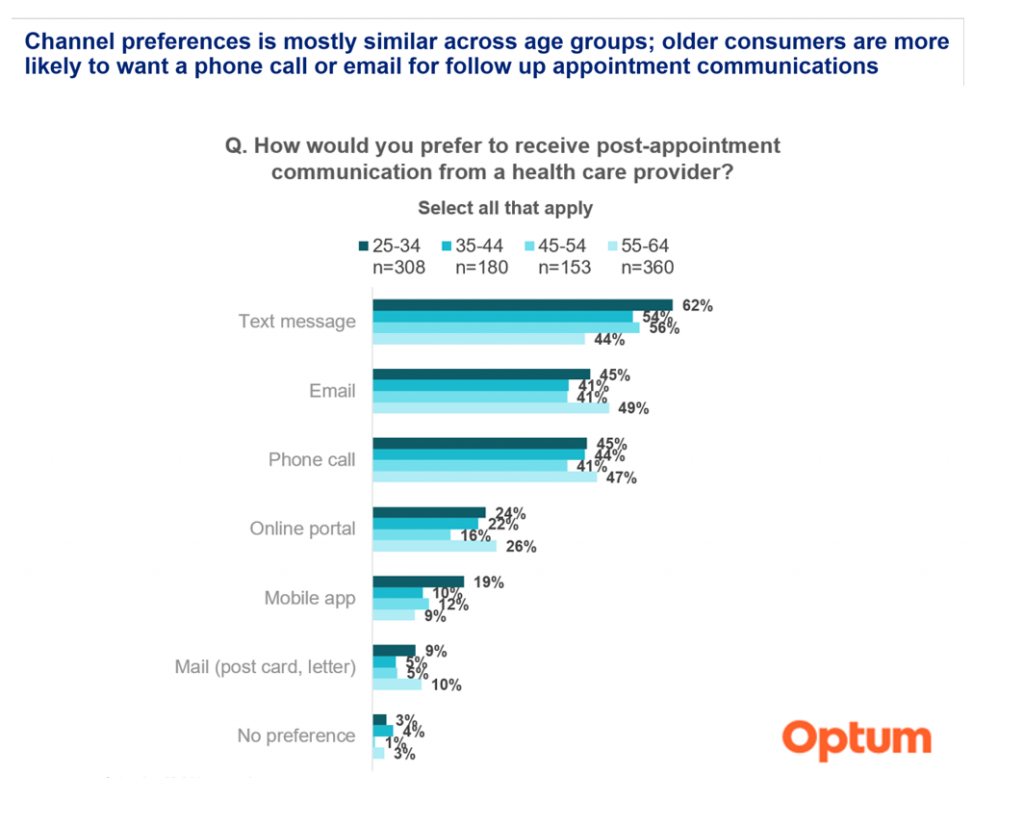

Here’s another lens on the Optum health consumer data. I’ll ask you to look at the top line gauging consumers’ interest in receiving text messages from health care providers after appointments.

We can see that 44% of people ages 55-64 would prefer text messaging, only a few percentage points fewer than preferences for emails or phone calls.

So even older work-age patients are seeking the convenient communication channel of text in 2022.

Interestingly, roughly 1 in 2 people across all ages would like to receive a plain old phone call post-appointment from a health care providers.

It seems the digital divide between generations, for provider communications, has shrunk.

We come full-circle from Monday’s Health Populi post discussing the concepts behind HealthConsuming and how, pre-pandemic, patients-as-consumers and healthcare payors were already Amazon-Primed for their care. People have come to expect technology-enabled services across their health care journeys, from scheduling appointments and identifying providers (e.g., via ZocDoc), through to post-appointment messaging, all the way to receiving evidence-based digital therapeutics (think: AmerisourceBergen) and signing up for clinical trials (in which consumer-facing CVS Health and Walgreens have begun to participate).

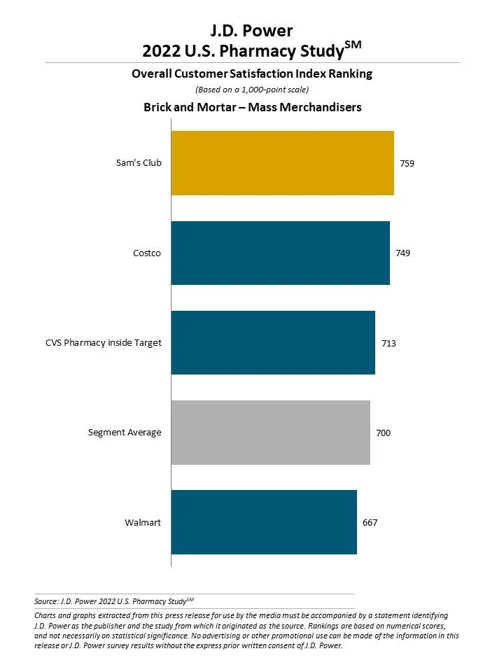

Heath Populi’s Hot Points: The J.D. Power 2022 U.S. Pharmacy Study has the headline, “Innovations at retail pharmacies accelerate as digital competition, health and wellness offerings grow.”

In fact, this is the headline we could use beyond retail pharmacies as we consider the broader landscape of retail health: consumer-facing healthcare that people as patients, caregivers, and health citizens will vet and choose to “consume” and pay for — via high-deductible health plans, health savings accounts, or sheer out-of-pocket and -wallet spending based on value and values.

J.D. Power’s study yielded four customer satisfaction pharmacy channel report cards: for brick-and-mortar chain drug stores (where Good Neighbor Pharmacy led the pack for the 6th year in a row), brick-and-mortar supermarket pharmacies (discussed above, led by H-E-B followed by Wegmans and Publix, the three well above other grocery chain drugstores), mail order (led by Kaiser Permanente Pharmacy, and brick-and-mortar mass merchandisers.

I have chosen the chart here to highlight the mass merchandisers, headed by Sam’s Club and then Costco in 2nd place.

In the current inflationary period in America, Costco has been getting some attention focused on its hot dog-and-soda combo sold at its in-store food court. The 1/4 pound all-beef dog and drink (with refill!) are priced at $1.50 — the same price since it was first offered in 1985.

If the company were to price the bundled mini meal based on 2022 CPI-food inflation, the combo would cost Costco shoppers $4.13.

This story has been featured in many media channels recently, capturing our hearts and financial heads right now. The Wall Street Journal called it “the combo that defies inflation.”

Of course, Costco is a value-focused shopper’s favored destination. I discussed Costco’s approach to the pharmacy last month in Health Populi, asking the question, “What if Costco designed the prescription drug sales model?”

It turns out that if Medicare Part D paid for the 184 most common generic medications for enrollees based on Costco’s cash-prices for the same products, the U.S. government would have saved $2.6 billion in 2018.

Costco isn’t only beloved for the $1.50 hot dog deal as well as its pharmacy, but for other consumer experiences as well…like value-priced gas.

With food, gas ‘n healthcare on consumers’ minds these days, Costco and dozens of other retail channels are capturing various items in health consumers household budgets for products and services — like Hy-Vee’s new test-to-treat program for COVID-19 and Paxlovid, just one example of care delivered closer to home or at-home.

We’re in the chaos-then-creation period of the New Retail Health, with lots of pieces being built, increasingly with clinical evidence and UX-baked design principles. The crucial pivot will be when an organization (a Tech Giant? a Health System or Health Insurer? a Vertically-Integrated retail health provider?) brings those pieces together with the eye firmly fixed to the Quadruple Aim — so that patients and providers, both, can flourish in the work- and life-flows, outcomes will be optimized, and health care costs conserved.

Chris Bischoff, Managing Director with investor General Catalyst, quoted in this digital health investment update from Oliver Wyman published today, says it more elegantly than I may have:

“Clearly, digital health, in its first wave, may have created a plethora of balkanized point solutions, and they need to become unified in some sort of platform….“I’m excited about the move of digital health from some of these more episodic or less acute conditions to really tackling the hard problems in healthcare.”

We’re not there yet, but the vision is in motion…

If you missed any of the Days 1-4 of The Retail Health Battle Royale posts, here are links to the previous four days of insights…

Day 4 – Tech Giants in Healthcare

Day 3 – Apple Wants To Be Your Intelligent Health Guardian

Day 2 – The Amazon/One Medical Combination

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a