“Big Tech has the capability to disrupt healthcare, though the complexity of healthcare ecosystems is not making it easy for these companies,” according to Big Tech & Digital Health, a detailed update from HealthXL published last week.

The pace of activity among Big Tech companies partnering with, investing in, and acquiring health technology and provider organizations has been dizzying, accelerating in and beyond the pandemic. This report profiles the current state and prospects for so-called “Big Tech” companies in the broad health/care ecosystem.

For context, “Big Tech” in this report covers activity among eight companies between January 2019 and March 22, including: Alphabet (Google), Amazon, Apple, IBM, Meta (Facebook), Microsoft, Oracle, Samsung and these organizations’ subsidiaries.

Why Big Tech and why now? “Healthcare is an $11+ trillion market that is haunted by disorganization and difficulties in resource allocation,” HealthXL asserts; Big Tech companies have the skills, in theory, to address the various “haunting” challenges of fragmented, un-interoperable health systems.

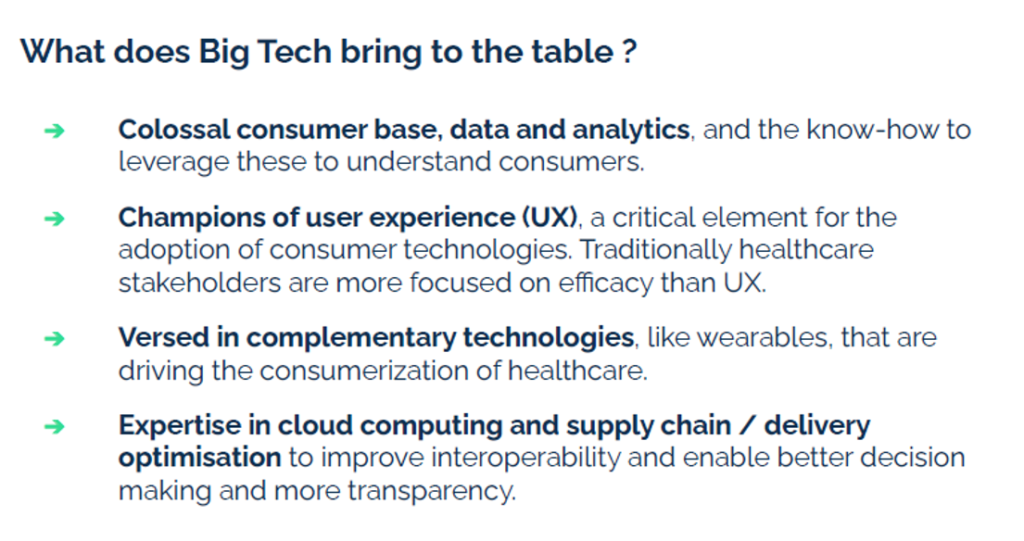

The four areas Big Tech brings to this party are the companies huge consumer base of data and analytic capabilities; savvy user experience (UX) skills; understanding of complementary and platform technologies like wearable tech and consumer-facing sensor technologies; and, mastery of cloud computing that can enable interoperability.

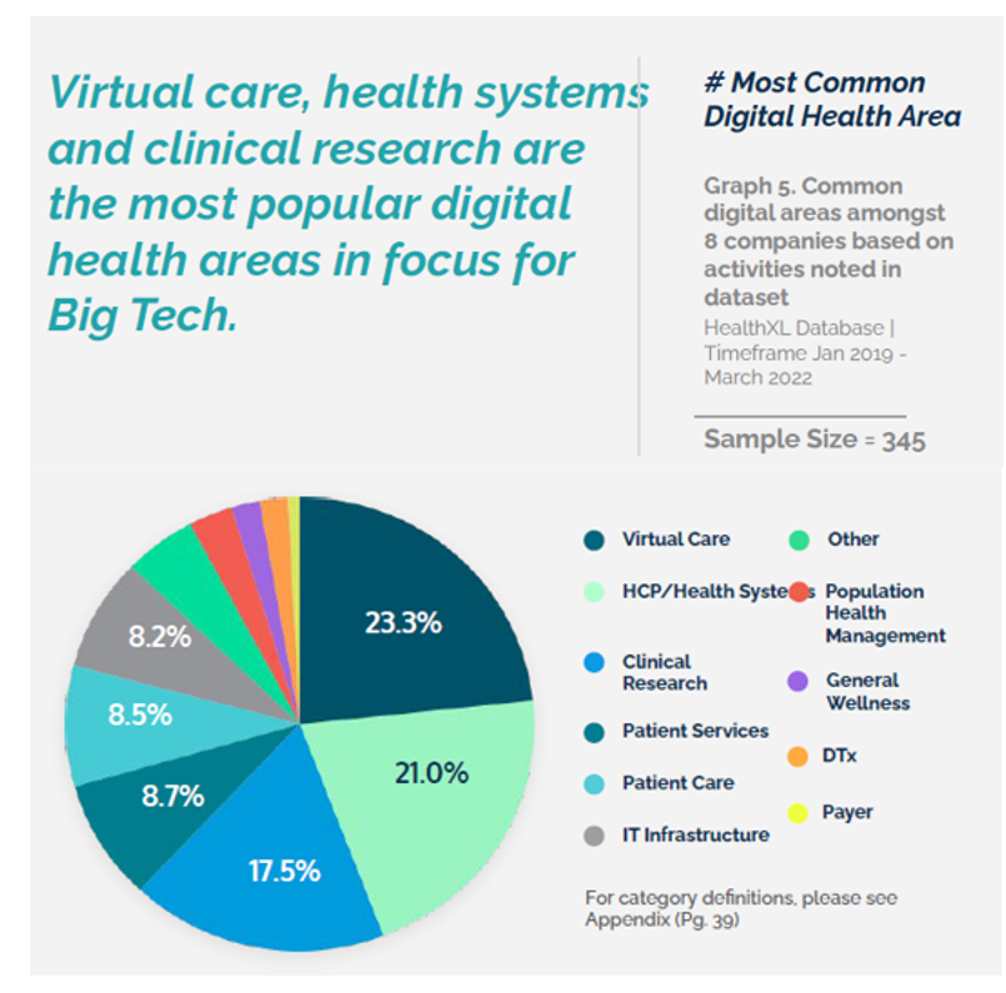

The most common areas in which Big Tech cos are focused cover virtual care, health systems and health care providers, and clinical research; together, these three segments comprise nearly two-thirds of activities by the eight major tech companies analyzed in the report in the period January 2019 to March 2022–covering the year before COVID-19 emerged as a global pandemic through the end of the first quarter of 2022 as the Omicron variant became the dominant form of the coronavirus in Europe and the US.

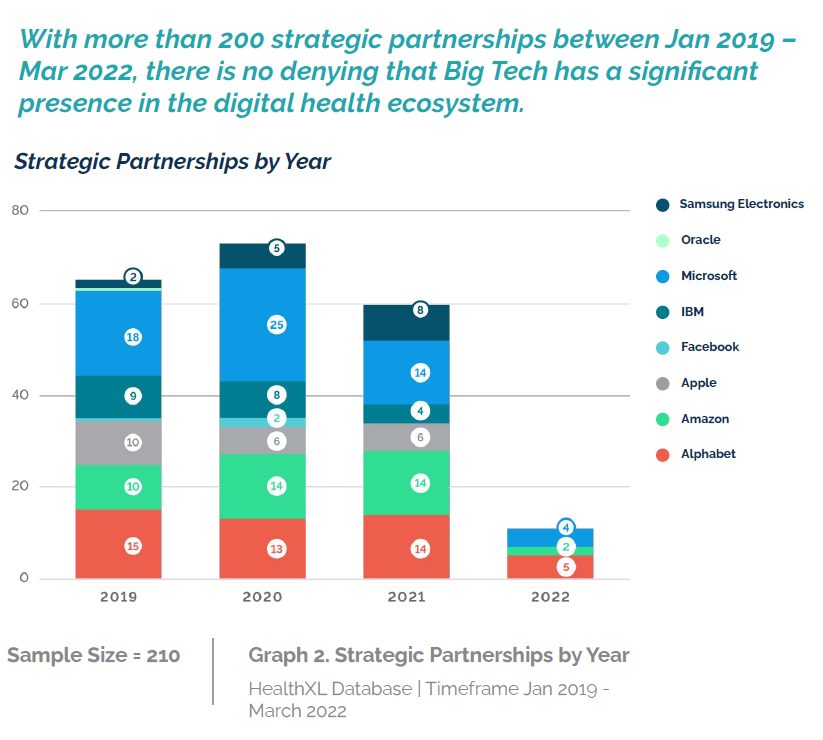

The most common deal type these activities took were, first and foremost, strategic partnerships (for 78% of the 268 arrangements assessed) followed by investments (for 19% of the deals), and only 2.6% which were acquisitions.

Note that these are the quantity of deals, not the scale/amount of the investment made in the programs.

The bar chart illustrates data for the eight Big Tech companies’ strategy partnerships, numbering 210 in total in the study period.

Here are some of the key details that will give you a more granular idea of who’s-doing-what in digital health by company:

- Alphabet has been active across all sectors with deepest activity in virtual care, health systems/HCPs, and clinical research, along with Google Cloud

- Amazon has had a huge focus on cloud infrastructure followed by virtual care, and active in patient-facing services as well (with HealthXL detailing the One Medical acquisition, PillPack in pharmacy, other pharmacy work through AWS cloud, and Health Navigator. Also watch for Amazon to leverage Alexa/voice for aging well at home

- Apple’s work on health via the Apple watch is its target, with activities in virtual care, clinical research, and patient services. Here’s where a “colossal” (HealthXL’s adjective) consumer user base can be leveraged for data analytics in big population cohorts

- Microsoft has had a strong focus on health systems and providers especially via clinical decision support, EHR, data analytics, and voice (think: Nuance)

- Samsung has worked most intensively in virtual care and wearable tech in health along with digital imaging and telemedicine

- IBM has been active in AI through strategic partnerships with providers and payors, and,

- Oracle’s acquisition of Cerner will look to go beyond the legacy EHR business to enable decentralized clinical trials (a fast-growing area in retail health as well watching CVS Health, Walgreens, and Walmart, for example).

All well and sound good…but where HealthXL lands is that, “Big Tech’s bold ambitions make for flashy headlines,” with the tech giants facing difficult headwinds trying to disrupt and re-organized the highly-regulated healthcare industry.

Nonetheless, some very visible “big-ticket failures,” in the words of Health XL, are teaching Big Tech to “learn, iterate, and succeed.”

Health Populi’s Hot Points: Among the many hurdles beyond the regulatory intensifying headwinds that make healthcare a risky space for Big Tech are challenges of user privacy and the use of consumers’ personal health information, direct-to-consumer business models that aren’t yielding consumer stickiness for paying out-of-pocket, and obstacles in acquiring and re-structuring patient data that remains locked or “stuck” in siloes where the data stewards have entrenched interests (that is, not so incentivized to share….yet).

Companies that used to be considered “new entrants” in health care have woven themselves into the fabric of health care, especially as data is becoming more liquid and privacy laws evolve. Watch the privacy conversation evolve through local to global lenses, from Governor Whitmer of the State of Michigan to the EU’s Margrethe Vestager, the lead on the European Commission overseeing digital and competition policy. Both women are now closely looking at data privacy and private sector-power.

To the latter point, regulation (both in the US, the EU, and in dialogues globally) will scrutinize antitrust and combinations of organizations that could prevent fair pricing and/or monopoly effects on other aspects of health care, and these regulatory forces must be calculated into companies’ plans (and profit expectations) to add more time and challenge into assumptions.

Nonetheless, even with regulation and privacy law moving targets, and business models evolving, we’ll see many other tech cos in addition to the eight mega-firms studied in the HealthXL research, growing health care in their workflows and portfolios, For example, Salesforce is emerging as a major tech player in health care, which was a major theme during last week’s annual Dreamforce conference.

Complementing the Big Tech side of this discussion is Big Retail — where I’ve mentioned CVS Health, Walgreens, and Walmart above the digital fold in this post. Other retailers, too, have the consumer UX chops and data analytics savvy to bring to the health/care transformation table. Continue to watch this space, ever-evolving for years to come.

And don’t assume more “big-ticket failures” will dissuade the Big Techs and others from committing resources to health care. Around the world, we need more transformation, imagination, and consumer-delightful design that many of these companies, and allied once in consumer goods and finance, will bring to bear.

Thank you FeedSpot for

Thank you FeedSpot for