As consumers learn to appreciate and patronize retail touchpoints, entertainment, and financial management via omnichannel platforms, patients and health citizens are seeking more enchanting service levels for their health care.

The latest view on patient preferences from Kaufman Hall is out in the firm’s annual 2022 State of the Healthcare Consumer Report.

Every year, this go-to report divines how U.S. patients continue to morph into health/care consumers. This year’s top-line is that peoples’ expectations of health care service providers exceed what those providers, health plans, and suppliers (like pharma) are serving up — as people see more personalized journeys and relationships to build their health and well-being along the way.

The perception of people on healthcare is that their relationships with the system are “tragically disconnected,” as coined by Grant Davies, CEO of Solis Mammography who was interviewed for the report.

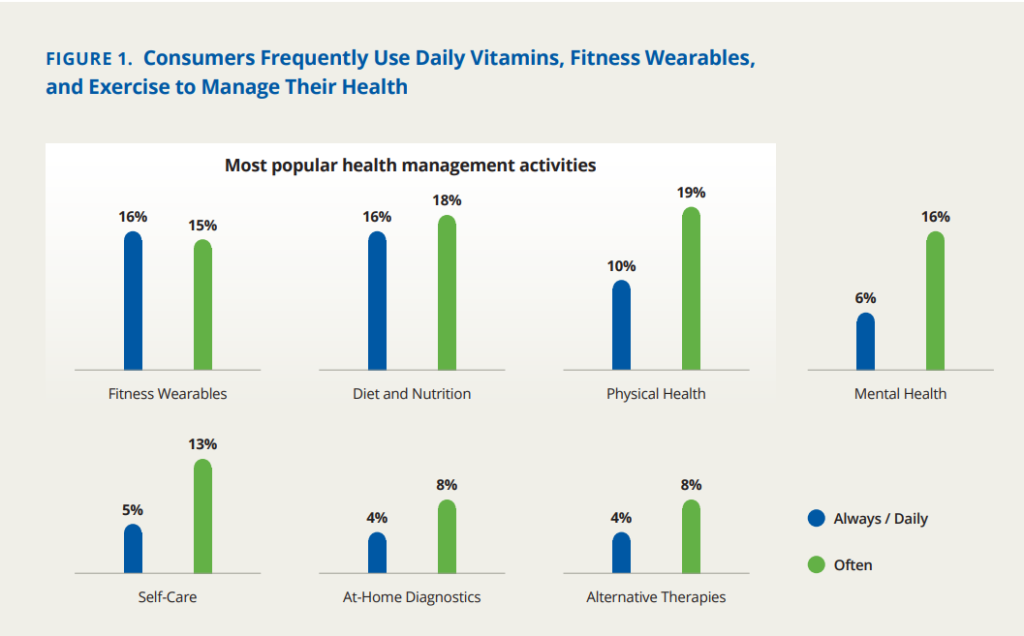

The most common activities people are doing to help manage their health include attending to diet and nutrition, physical health, using fitness wearables, and two most-fast growing areas: addressing mental health and self-care priorities.

KaufmanHall, which have been monitoring hospitals’ and physicians’ financial health since the start of the COVID-19 pandemic, always have an eye on fiscal issues: in this consumer study, the survey assessed consumers’ approaches to financing the seven personal health management activities polled and shown in the second bar chart.

The highest percentage of people paying out-of-pocket for one of these activities is for fitness wearables, where 55% of U.S. consumers pay for themselves. For 23% of fitness wearable users, insurances covers 100% of the cost, and 12% of peoples’ insurance companies cover part of the cost.

Payment for physical health (say, the gym) is covered totally by insurance for 38% of consumers, with roughly the same proportion of people paying for fitness totally out-of-pocket. Similarly, diet and nutrition is covered in-full for 41% of consumers whose health plans pay for this, and 36% paying out-of-pocket. Mental health services are totally covered by plans for one-third of consumers, and another one-third of people pay out-of-pocket for therapy.

While patients-as-consumers seek personalization and streamlined service levels for health care, many people are losing access to choice with narrower options for care providers. KaufmanHall learned that the higher a patient’s acuity (level or severity of illness/condition), the higher their expectations for service, from the consumer experience (at low acuity) to streamlined communication and price transparency (for mid-acuity patients) and finally to a full understanding of out-of-pocket costs (desired by high-acuity patients, often facing high-costs for specialty drugs or long stays in hospitals).

KaufmanHall offers six tactics to “put the pieces together” for health consumers’ delight:

- Develop and refine insights about patients and consumers in the market

- Embed consumers’ views in the C-suite and on Boards

- Integrate consumer insights into strategic planning and decision making

- Segment by lines of business and develop plans for value-creation

- Embed consumer principles in pricing, access, and patient experience processes, and,

- Tailor marketing based on specific consumer insights and lines of business.

“Integrating the voice of the consumer throughout a healthcare organization is not an overnight proposition,” the report concludes. But, “by developing the consumer insights and steadily elevating the consumer voice…, healthcare organizations can….build respectful, sustainable relationships with the individuals they serve.”

Health Populi’s Hot Points: Imagine opening your Instacart app and finding a “prescription” order for your physician’s-curated food basket from your favorite grocery store.

That’s the news coming out of Instacart, which this week launched Instacart Health to focus on supporting consumers’ healthy living goals.

As I discussed this week in my post on President Biden’s White House Conference on Hunger, Nutrition and Health, there is a mainstream embrace of food-as-medicine in the U.S. (and many other parts of the world) where consumers are more mindful to their grocery shopping opportunities that bolster health, well-being, and chronic condition management.

Among Instacart’s strategics for I-Health is to scale the product Care Carts, which enables health care providers’ and caregivers’ ability to order groceries on behalf of another person. Healthcare providers can order groceries for a patient’s meal plan upon hospital discharge or to manage a chronic condition at home. Friends or family members can order groceries on behalf of people ailing at home. Instacart has already been collaborating with organizations using Care Carts in their service offerings, such as Medically Home, a hospital-at-home provider, and WellCare of Kentucky (the state’s Medicaid program) working with Good Measures’ digital nutrition program.

Instacart Health adds to the convenient, accessible, relevant and enchanting kinds of services and products consumers can add into their daily life-flows that converge with their normal everyday lives. Grocery stores have evolved into trusted health/care destinations during the pandemic and, aside from the current financial stress of food prices challenging family budgets, grocery stores will remain one of consumer’s key health touch points in the community, closer to home and — n the case of Instacart Health — traveling to the home and kitchen.

As KaufmanHall’s 2022 report notes, consumers are growing their self-care muscles and diet and nutrition are part of peoples’ growing competencies and interests. Health plans and providers taking on financial risk will be keen to “prescribe” nutritious food and items from the grocery store that enable their patients to stay well at home and thrive. Pharma companies could see this as a complementary digital “therapeutic” to help patients undergoing aggressive therapies that attack cancer, HIV, renal failure, and other diseases where patients are at-risk of losing weight (cachexia, or wasting).

This is but one example of a personalized, inclusive service that can speak to patients-as-consumers and improve health outcomes, support patients’ caregivers, and boost clinicians’ success with value-based payments.

Thank you FeedSpot for

Thank you FeedSpot for