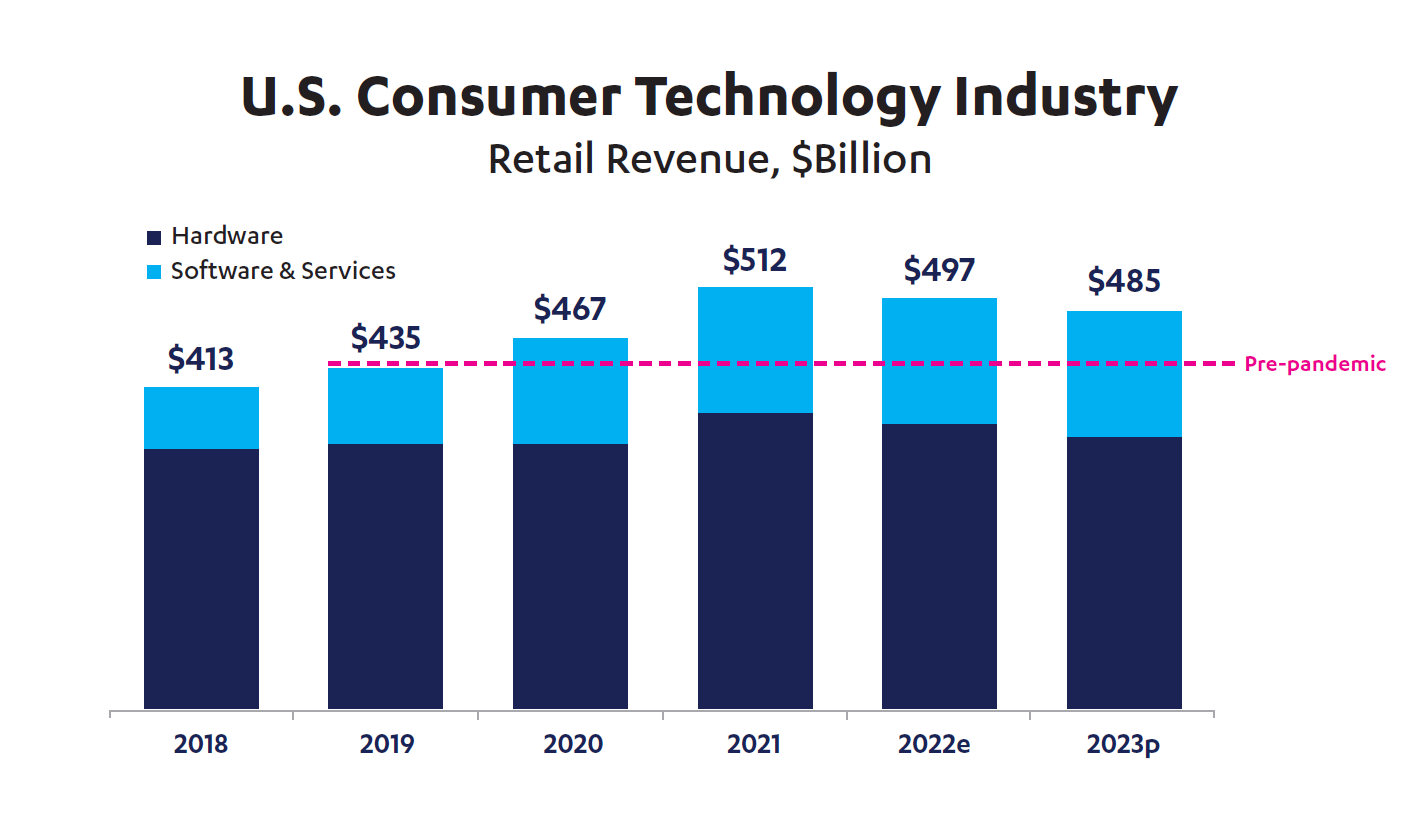

While CTA forecasts a sobering consumer technology revenue picture for 2023, one of the few bright spots is health and fitness technology services, expected to increase by 9 percent in 2023.

For the forecast, CTA looked at various spending categories, including gaming, automotive and transportation tech, video and audio streaming, consumer electronics (like big-screen TVs), and fitness and health devices.

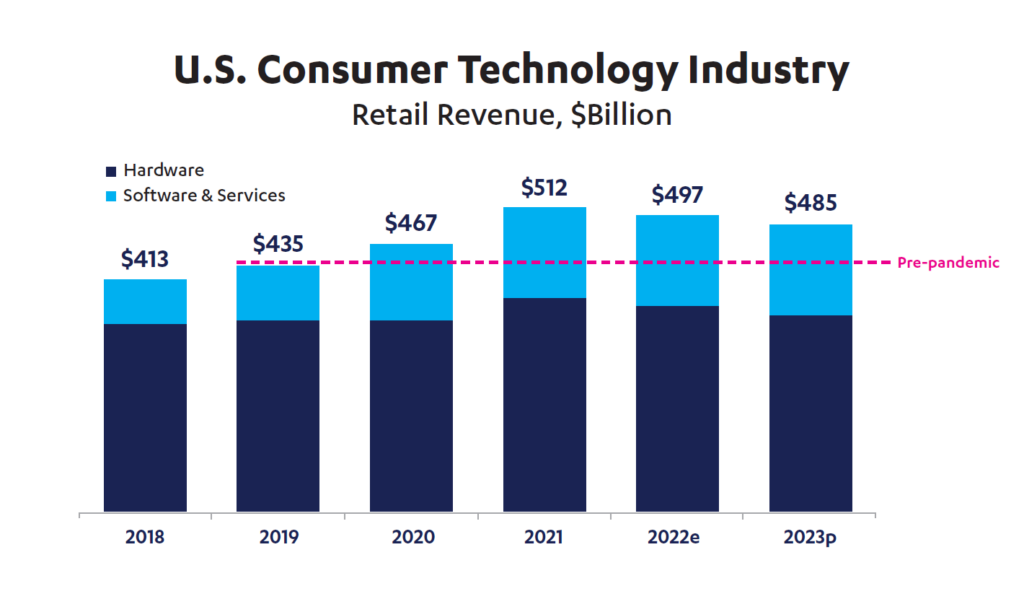

The chart illustrates that consumers’ spending on software and services is expected to hold steady in 2023, still above pre-pandemic levels.

On 3 January, in the annual #CES update of Technology Trends to Watch, Steve Koenig, CTA’s VP of Research, reviewed the major themes with media and industry analyst folks (of which Health Populi is one).

In 2023, Steve advised us to keep our eyes on six key trends:

- Enterprise tech

- Metaverse and Web 3.0 (which is “closer than we think,” Steve advised)

- Transportation and mobility

- Health technology

- Sustainability, and,

- Gaming and services.

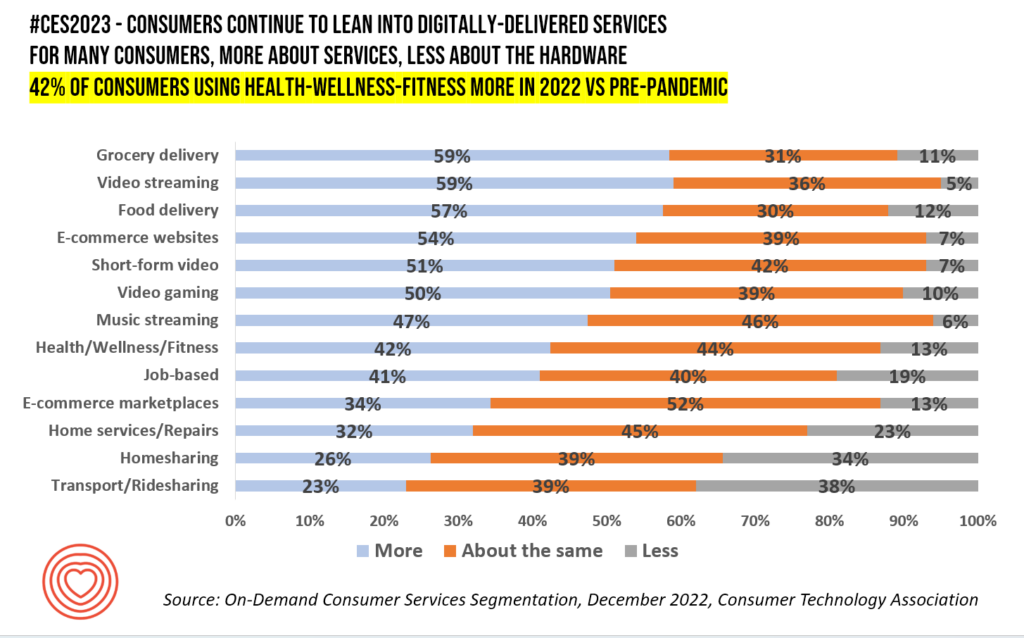

Health and drivers of wellbeing cross these six trends, and the plethora of services quantified in the on-demand segmentation revealed in the first chart.

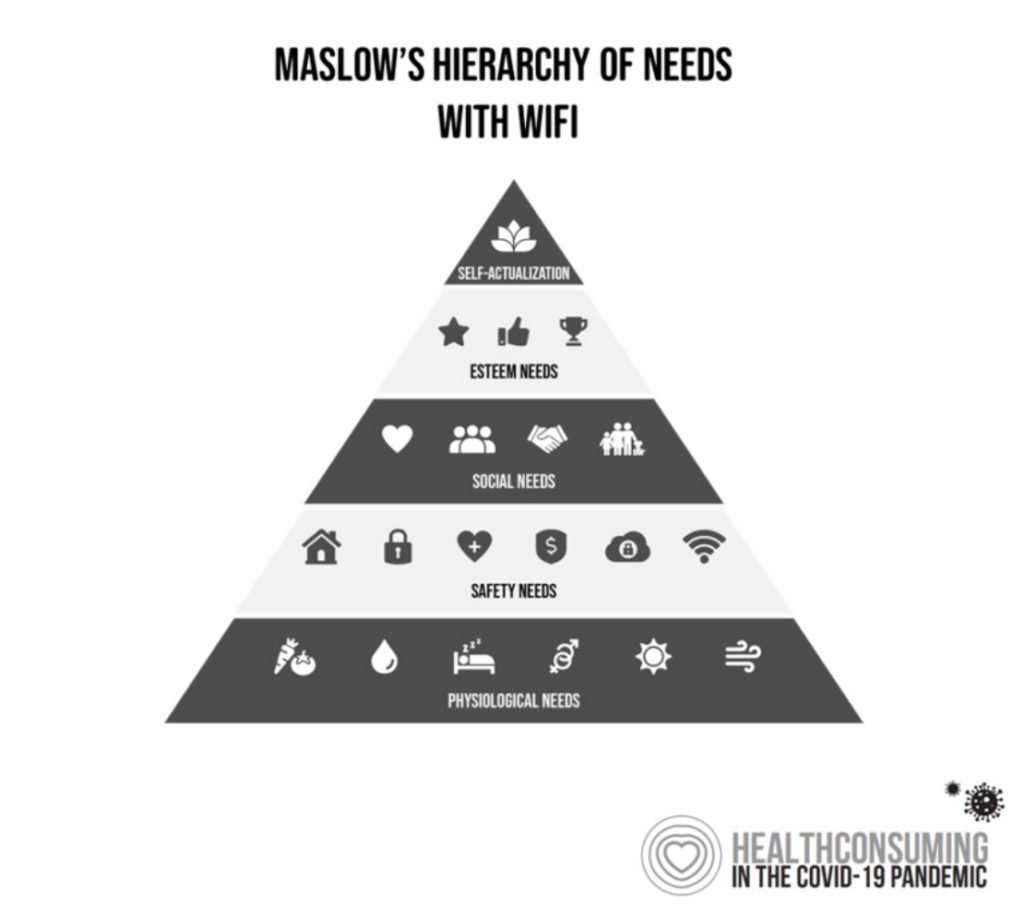

Consider our basic human needs, organized in my take on Maslow’s Hierarchy (with Wi-Fi).

Take the most popular on-demand service in CTA’s research, grocery delivery. This was a literal life-saver for many people living at/working from/learning from/cooking at home during the pandemic, during and after lockdown phases, depending on where you lived and what your risk-tolerance was for being out-and-about.

Sourcing food is at the base of our basic needs, and it appears that peoples’ demand for grocery delivery services is a changed behavior for over one-half of U.S. consumers post-pandemic. Food delivery follows this pattern as well for those folks who don’t want to scratch-cook.

Next think about e-commerce: so many health consumers and patients depended on delivery of prescription drugs, over-the-counter medicines, supplements, and durable medical supplies to self-care at home. More consumers purchased digital health apps and home monitoring technology, as well, especially from Amazon and Best Buy which persisted in health-tech commerce and weathered economic challenges to-date.

Finally cast your eyes to the health/wellness/fitness line item in the chart: 4 in 10 consumers were using on-demand health services (read: telehealth, virtual care, tele-therapy) more after the pandemic.

Steve identified three segments of the new “home health hub” (a concept I detailed in my 2020 book, Health Citizenship):

- Telehealth, including remote monitoring as well as “access to doctors,” in his words

- Digital therapeutics, “new ways to manage health conditions;” and,

- Fitness tech. covering connected exercise and sports equipment building out the home gym experience.

As examples at #CES2023, Steve talked about Essence Group’s Care@Home remote patient monitoring solution (which includes fall detection, a key application for safe aging at home), Abbott’s Proclaim Plus connected health device for spinal cord stimulation, and SK’s Zero Glasses for tracking neurological health (e.g., seizures), the latter two 2023 CES innovation honorees and Care@Home honored by CES in 2022.

Three “new frontiers” in health-tech innovation were also covered — including on-demand networks (a la virtual care and online pharmacies), mental well-being (for stress relief, anxiety management, and depression monitoring), and virtual reality (VR, ranging from fitness to prescribed, evidence-based therapeutic treatments to address, say, pain and PTSD).

Speaking of VR…Steve concluded the trends summary with a discussion on gaming and services, calling out a relatively bullish projection on consumer spending for services versus hardware. And what segments fall within that software and service category? Fitness and digital therapeutics, holding firm in consumers’ spending for 2023.

Read more on what we’re seeing at #CES2023 here.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for