As we enter the week’s brainstorms and deal-making prospects this week at the annual JP Morgan meet-up for healthcare, I’m kicking off Health Populi’s posts this week by diving into two major reports published in sync with this meeting that’s so pivotal and important for the digital health community: the Silicon Valley Bank (SVB) 2022 Annual Report on Healthcare Investments and Exits and the 2022 Global State of Digital Health Report from FINN Partners and Galen Growth

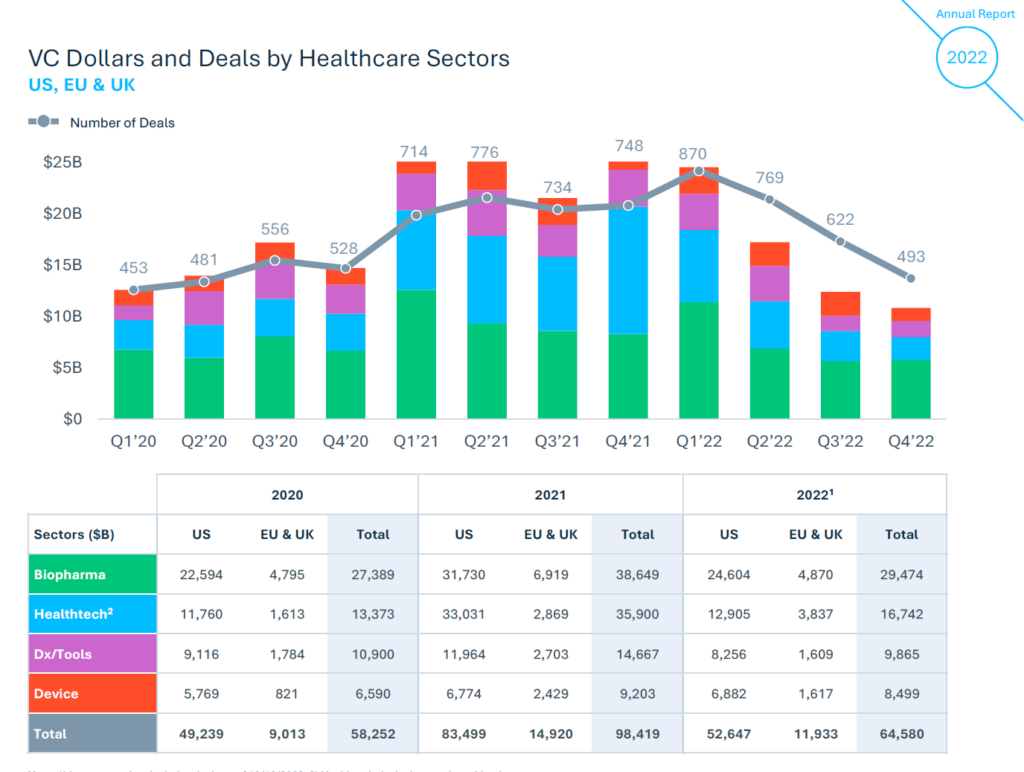

SVB notes that venture funding in healthcare fell in terms of both deals and dollars each quarter of 2022 after hitting records in 2021. Yet even with that downturn, 2-022 was the 2nd largest funding year ever, SVB quantified, with significant shifts by healthcare segment. The report looks into:

- Biopharma (declining but valuations “unaffected by public market turmoil”)

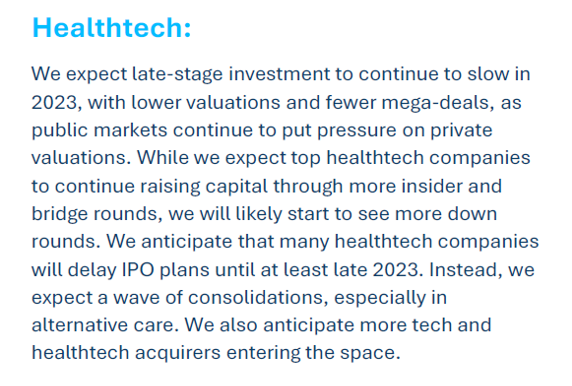

- Healthtech (shifting toward early-stage investment with mental health and primary care dominating the category)

- Dx/Tools, where early-stage investment set records in 2022 notwithstanding declines for some of the sub-categories (R&D tools investments especially), and

- Devices, the only one of the four sectors to match, relatively, record investments in 2021.

The bar chart illustrates SVB’s data for the four healthcare sectors by region and years 2020, 2021 and 2022. We can clearly see the lower bars throughout four quarters of 2020 quite similar to those in the latter 3 quarters of 2022 with the bullish funding for healthcare in 2021 and the first quarter of 2022.

By region, in the table below the bar chart, see that the US funding level for healthcare in 2022 was nearly five-fold that in the EU and UK. The smallest difference in funding levels was in the healthtech category, where EU + UK dollars differed by 3X versus the biggest delta seen in biopharma and Dx/Tools.

SVB also points out that investors are shifting their focus to address provider efficiencies and virtual care models, identifying notable 2022 deals such as TEMPUS, Commune, and Aledade on the provider side, and Lyra, Ro, Doctolib, on the alternative care side of funding. (See my post on Doctolib in Italy here from 15th December 2022).

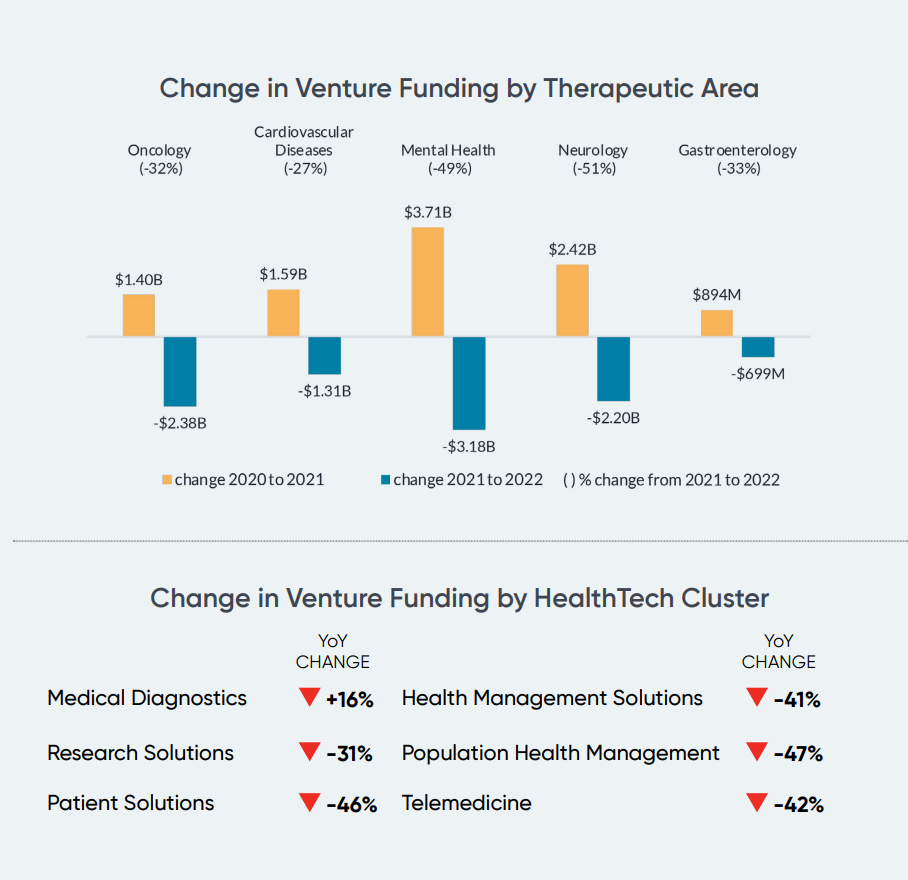

This third graphic (two charts in one) on changes in venture funding comes from the FINN + Galen Growth research.

First, check out the top portion on funding by therapeutic area: note the blue bars all show declining funding across five therapeutic areas between 2021 and 2022 following go-go growth from 2020 to 2021. Specifically, oncology was down 32%, cardiovascular declining by 27%, mental health falling 49%, neurology by 51%, and gastroenterology by 33%.

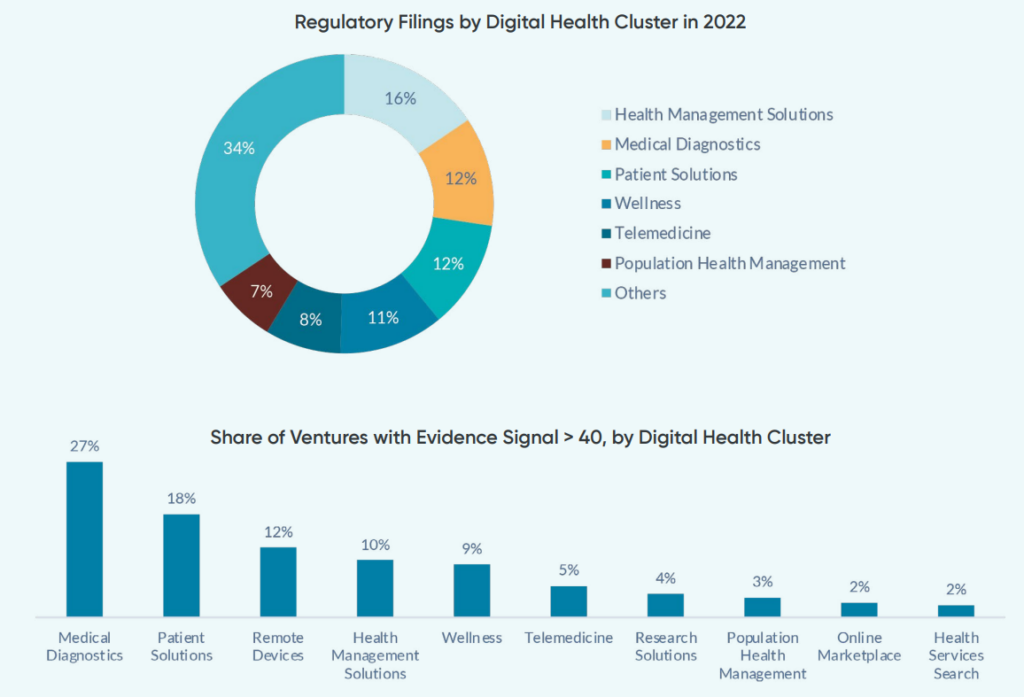

We learned from a recent report via GSR Ventures that gathering supporting clinical evidence for digital health innovation will be key to funding in 2023 and future years. The FINN + Galen Growth analysis quantifies regulatory filings by digital health clusters and evidence “signals” for each area. In the bar chart, we see that medical diagnostics, patient solutions, and remote device ventures had the strongest evidence signals compared with other digital health clusters — noting that telemedicine and population health, two major areas of digital health activity, yielded relatively low evidence signals in this assessment.

Health Populi’s Hot Points: “After an extraordinary two-year pandemic funding spree, there are apparent shifts in how investors place their economic bets,” the FINN + Galen Growth report observes.

In light of the global economy and the lessons we must all learn from the pandemic and relatively poor ROI on the digital health investments made in that “funding spree,” the FINN/Galen Growth tea leaves read the next investment factors for 2023 will be more tightly focused on the innovation’s development stage, the specific therapeutic category served, the health care providers’ demand for digital transformation, and “where” the innovators are located.

With these factors in mind, stay tuned for my post to be published tomorrow, on 10 January 2023, which will dive into CES 2023’s theme of Human Security For All (HS4A). Clearly, health, medical care, and drivers of health underpin HS4A which then begs the question: how will #JPM2023 and the upcoming HIMSS2023, SXSW2023, VIVE2023, the ATA2023, and other health-tech conferences address gaps in health equity, healthcare access. and health justice for all health citizens?

That’s my 2023 work-theme for the New Year.

Thank you FeedSpot for

Thank you FeedSpot for