Ever since Clayton Christensen explained the concept of disruptive innovation in 1995, health care became one of the poster children emblematic of an industry ripe for disruption.

Nearly 30 years later, disrupting health care continues to be a theme which, in 2023, seems open for those slow-moving tectonic driving forces to finally re-form and re-imagine health care delivery.

So in today’s Health Populi we turn to a new report, Health Care Disruption 2023 Outlook, part of AHA’s “The Buzz” market scan initiative. The American Hospital Association is taking disruption seriously right here, right now, as the U.S. hospital sector is facing major challenges on all fronts: staffing (especially nursing and more broadly, clinician burnout), supply chain, financial stressors, demographics, and cross-industry politics vis-à-vis pharma and health insurance.

The report explores the healthcare market moves for seven major players in retail and tech including Amazon, Apple, CVS Health, Google, UnitedHealth Group (exploring both Optum and UnitedHealthcare), Walgreens Boots Alliance, and Walmart.

The top-line theme of the report is that, “The $260 billion primary care market is dominated by traditional providers in a fee-for-service arrangement, but that is changing rapidly,” the report begins. “By 2030, nontraditional players could own as much as 30% of the primary care market.”

The report then provides one-page analyses addressing each of the seven companies profiled, describing their respective approaches to the health care ecosystem. In brief, in alphabetical order….

Amazon has been investing to expand primary care (virtual and in-person), diagnostics and therapeutics, pharmacy, disease management, and leveraging AWS for data-driven tools and analytics.

Apple won’t be one of the contestants in the retail health/primary care battle royale (as I discussed here in Health Populi over the week of 25th July 2022), but instead will focus on using platforms of Apple Watch and the iPhone to partner across the health care ecosystem and support people through healthy living and chronic disease management.

CVS Health continues its vertical integration with Aetna, primary care (again, virtual and in-person), home care, and retail health via the pharmacy storefront and omnichannel platforms.

Google (Alphabet) will be all about tech-driven health care, leveraging AI for more personalized health care which will also support research and development. In addition, like Amazon’s AWS, Google will be partnering via the Google Cloud with health care providers, pharma, and other innovators to accelerate health care transformation and innovation.

UnitedHealth Group has many moving parts between Optum and UnitedHealthcare, expanding services from primary care and mental/behavioral health to care coordination and virtual care. Optum’s merger with Change Healthcare expands the organization’s data and analytics capabilities, too. And the company has acquired thousands of physician practices, with now more than 70,000 employed or aligned doctors in over 2,200 sites as of 2023 — more physicians than Kaiser or even the VA have on their staff.

Walgreens has grown its primary care footprint through the VillageMD connection, now owning 2/3 of the company and expanding PCP practices to over 25 U.S. markets by 2025 and planning for 1,000 by 2027. Like CVS Health, Walgreens is also expanding home care services and post-acute care, and specialty pharma to complement pharmacy operations.

Walmart has long committed to health care, leveraging pharmacy as a “front door to primary care,” AHA describes. The largest retailer in the U.S. is expanding virtual care and telehealth, and building long-term partnerships across the health care ecosystem — including one with UnitedHealth Group over a ten-year agreement.

Together, the AHA sees these seven companies potentially capable of developing and offering innovative care models that could “significantly alter” the health care landscape, enable the shift to value-based care models, and grow alternative care sites and channels of care.

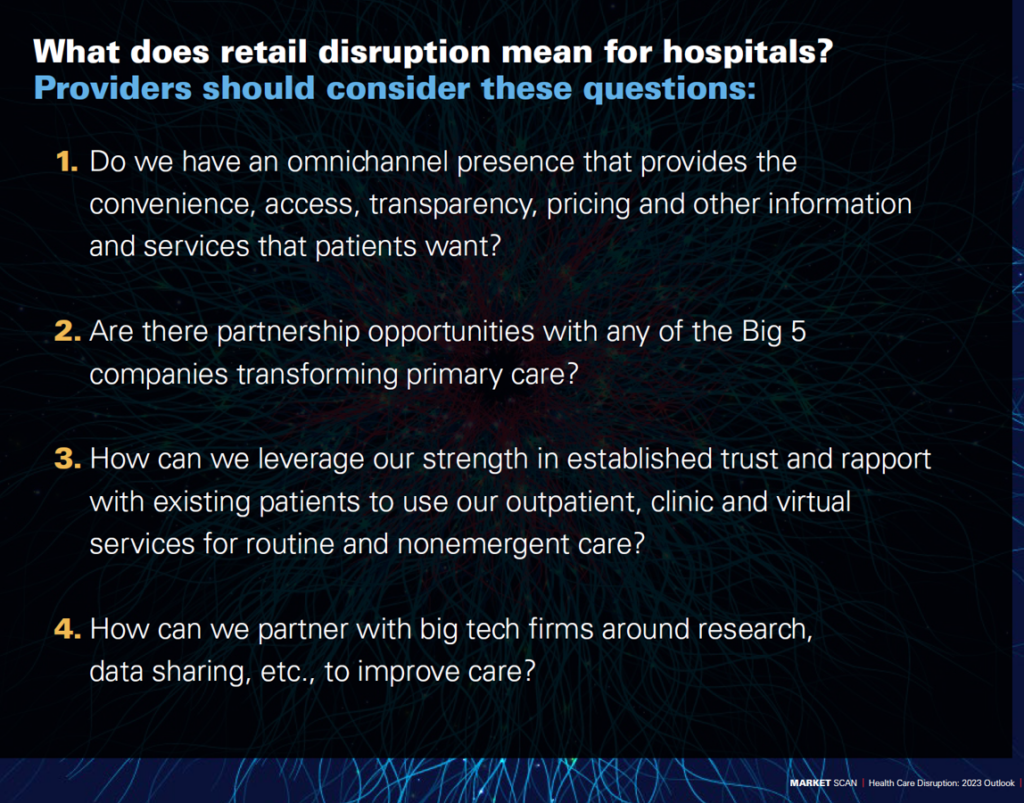

Health Populi’s Hot Points: In concluding the report, AHA poses four questions providers should consider in light of the seven health care disruptors’ moves:

- Is there an omnichannel presence that supports consumers’ demands for access, convenience, pricing and transparency?

- Is there an opportunity to partner with one of the primary care transformers?

- Can the provider leverage the earned trust and relationships with existing patients to grow consumer-facing services?

- Can the provider partner with tech firms on data and research projects to improve care?

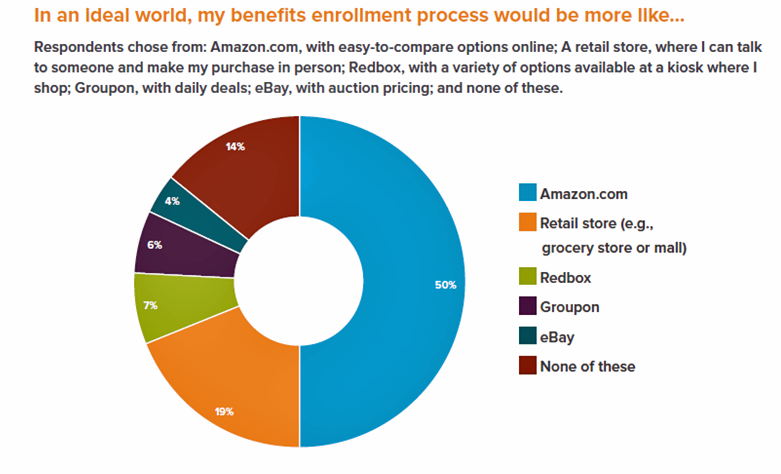

What underpins and inspires the seven “new” entrants to disrupt health care is consumer expectations. In 2016, I called out that most patients-as-health-consumers looked at Amazon as a model for health care experience to emulate well before Amazon acquired PillPack or invested in the industry as a major corporate vertical market strategy.

Now that patients feel increasingly like health care payors — facing high-deductibles and out-of-pocket costs — all health care looks/feels like retail. And as such, the seven companies featured in AHA’s disruptors report illustrate the kinds of benefits these kinds of companies can bring to bear to health consumers’ experiences.

Beyond the seven in this report, don’t count out Microsoft, Salesforce and Samsung on the technology sector side, and retailers Dollar General, Target, and grocery stores like Kroger out of the mix of disruptors-for-better-patient-experience.

Thank you FeedSpot for

Thank you FeedSpot for