Over one in three U.S. consumers use a health app or wearable technology device to track some aspect of their health.

“The public’s use of health apps and wearables has increased in recent years but digital health still has room to grow,” a new poll from Morning Consult asserts, published today.

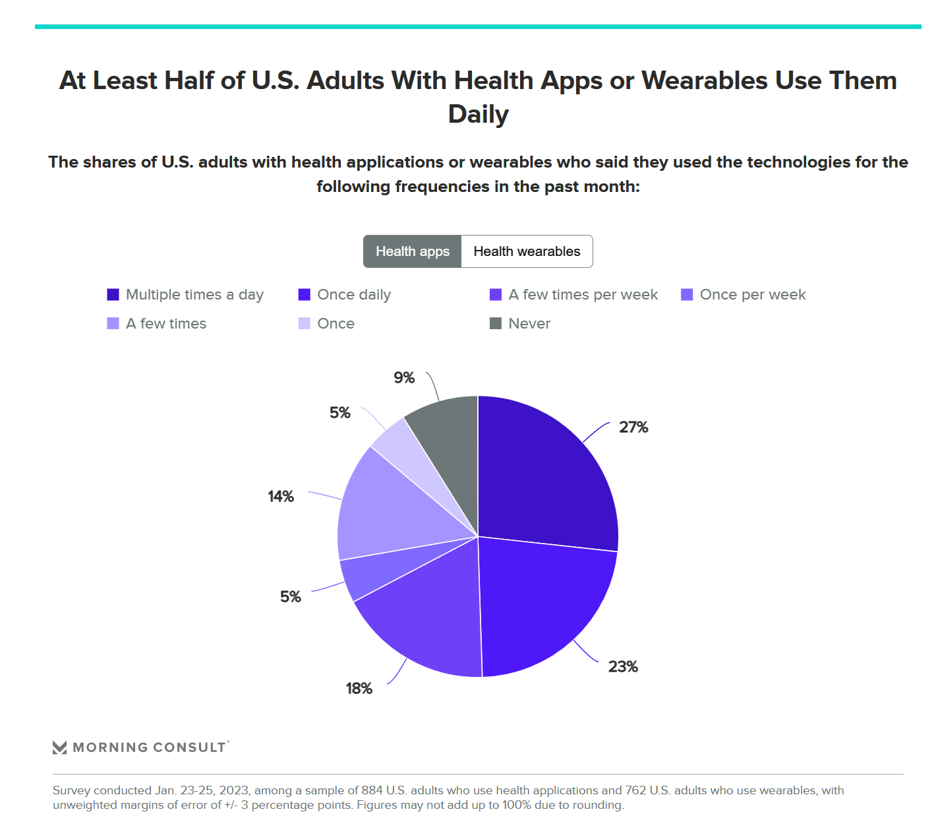

Among digital health tech users, most check into them at least once every day in the past month. One in four use these tech’s multiple times a day, the first pie chart illustrates. Eighteen percent of people use their digital health tech’s a few times a week.

Among those people who do not yet use health apps or wearable tech for health, cost is the top reason they haven’t adopted digital health tools, Morning Consult found.

Why do people own and use health wearables? Primarily, to be encouraged to achieve their fitness goals (31%), followed by being interested in tracking their personal health data (24%). In a distant third place is encouragement in losing or controlling weight (13%).

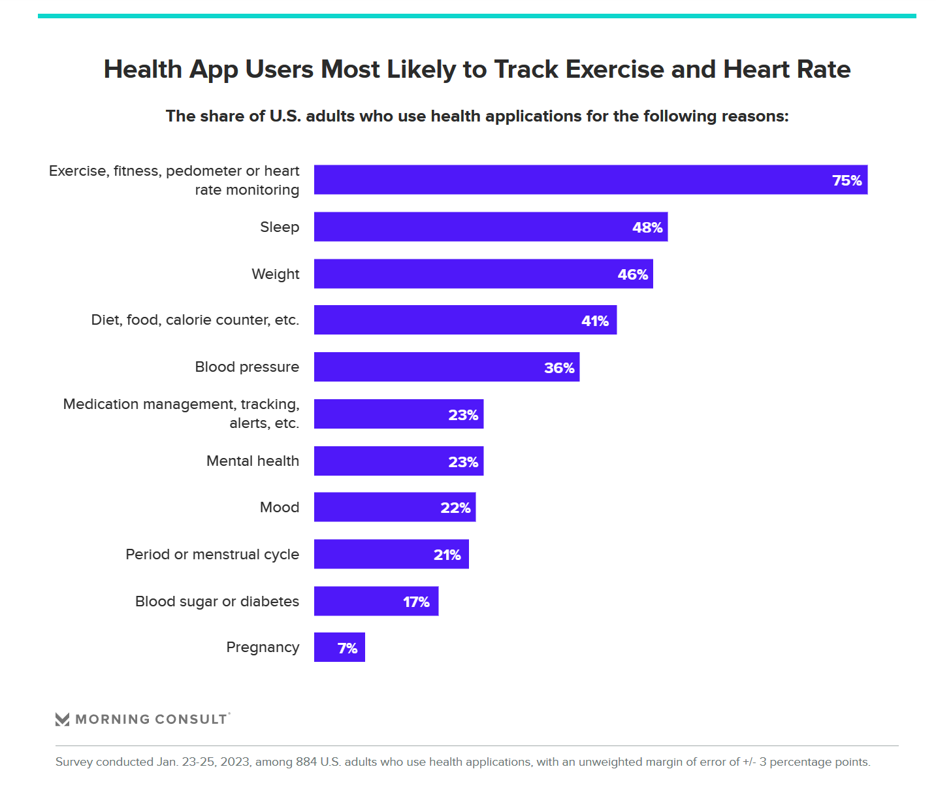

Those fitness goals are reflected in this next chart which quantifies the share of people using health applications by clinical reason: first, being exercise, fitness, activity tracking, or heart rate monitoring (not blood pressure, but heart rate).

Then it’s sleep and weight health consumers are most keen to track (for about one-half of those using health apps and tech’s), and then diet/food/counting calories (41%), and in fifth place, tracking blood pressure (for 36% of digital health tech users).

Nearly 1 in 4 consumers use digital health to track medications , mental health and mood.

Health Populi’s Hot Points: We’ve traditionally expected health apps to come out of “digital health” companies, the likes of which we’ve seen exhibit annually at CES, the big consumer electronics show. Once upon a time in digital health, it was Fitbit, Nike, Garmin, and Apple who were populating the app stores with health tracking apps.

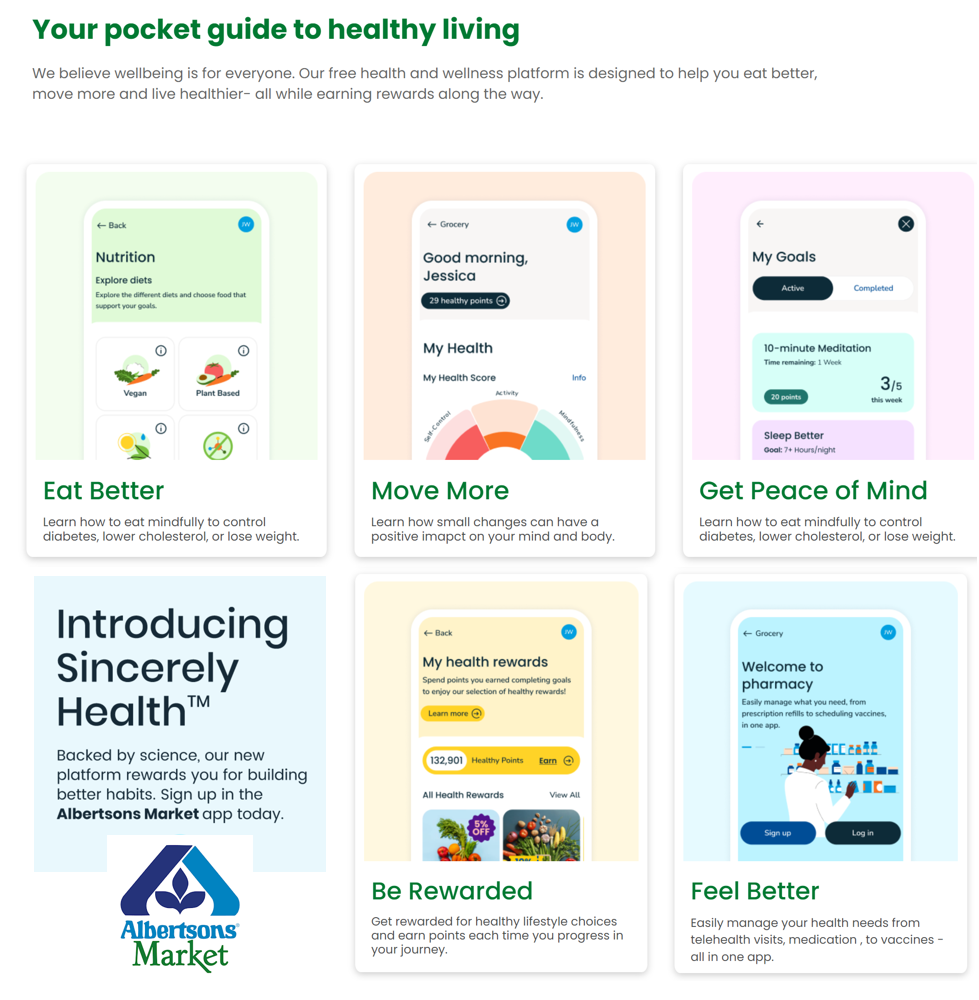

Today, we’re downloading health-oriented apps from new touchpoints playing growing roles in consumers’ self-care and health tracking: like grocery stores and retail pharmacies on the pure consumer side, and from Abbott (which launched the Lingo app for metabolic health at CES 2022) and other FDA-regulated companies on the more clinical side of patients’ work-flows.

Here in today’s Hot Points, I’m featuring Albertson’s recently-released Sincerely app, which marries healthy behaviors with good food and financial incentives.

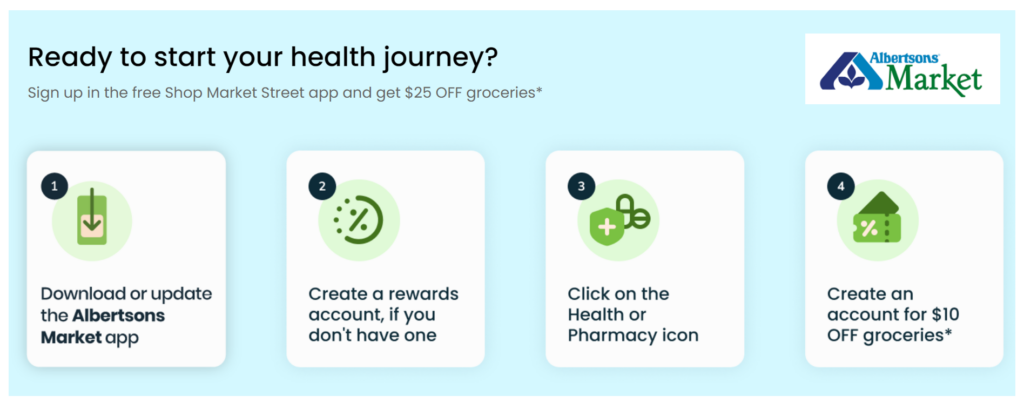

The second graphic titled “ready to start your health journey” kicks off the downloading of the app and creating an account, and ends with a $10 off grocery coupon.

As many consumers told Morning Consult, “price” and cost of apps are top-of-mind when it comes to opting-in to their adoption and continued use. Our groceries stores have become key touchpoints for our health and well-being in a larger retail health/self-care ecosystem that underpins our homes as our health hubs.

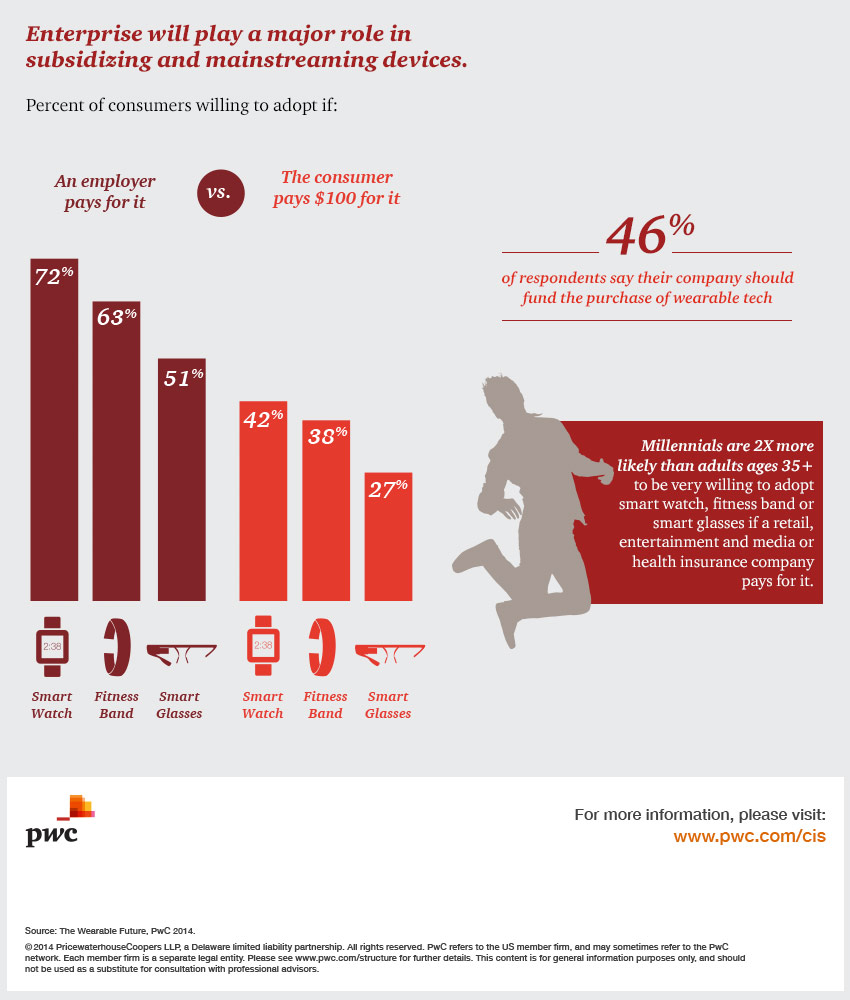

This has been a consistent health consumer sentiment for a long time: here’s how I covered PwC’s study on The Wearable Future back in 2014.

Note the chart at the left from PwC’s study, showing that consumers would be much more likely to use wearable tech if their employer paid for it whether a smart watch, fitness band, or smart glasses.

The Morning Consult poll gives us some insights into this, nearly ten years later, through the observation of Scott Whitaker, chief executive of the medical device industry group AdvaMed, who is quoted in the study press release.

For context, Morning Consult notes that, “One way to help increase adoption is for public and private payers to open up coverage for devices that can cost hundreds, if not thousands, of dollars. Another factor for device coverage is paying for data processing systems and artificial intelligence services that some products use, in addition to paying for the device itself.”

Scott Whitaker of AdvaMed then notes that while Medicare has “opened up a bit over the past several years to cover more apps and wearables,” the payor is still “stuck in the ‘60s” in fee-for-service — not able to be reimbursed for digital health devices and apps.

Whitaker told Morning Consult, “I’m not sure that as a payer, Medicare fully understands the value of wearables and other forms of technology to lower cost and improve health care outcomes for those in the Medicare program.”

As employers increasingly pay attention to worker wellness and population health, the enterprise-coverage vision that PwC began to quantify in 2014 is (finally) gaining traction. I’m looking forward to discussing this at the upcoming Virgin Pulse Thrive Summit in April 2023.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a