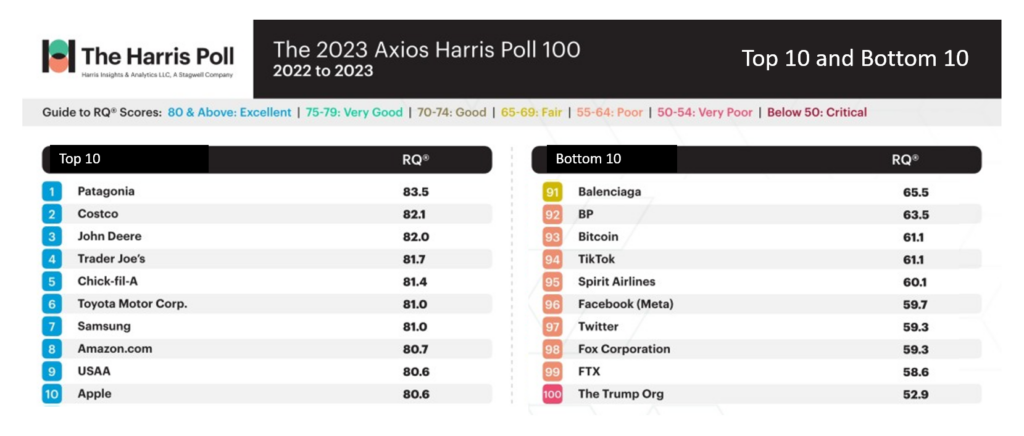

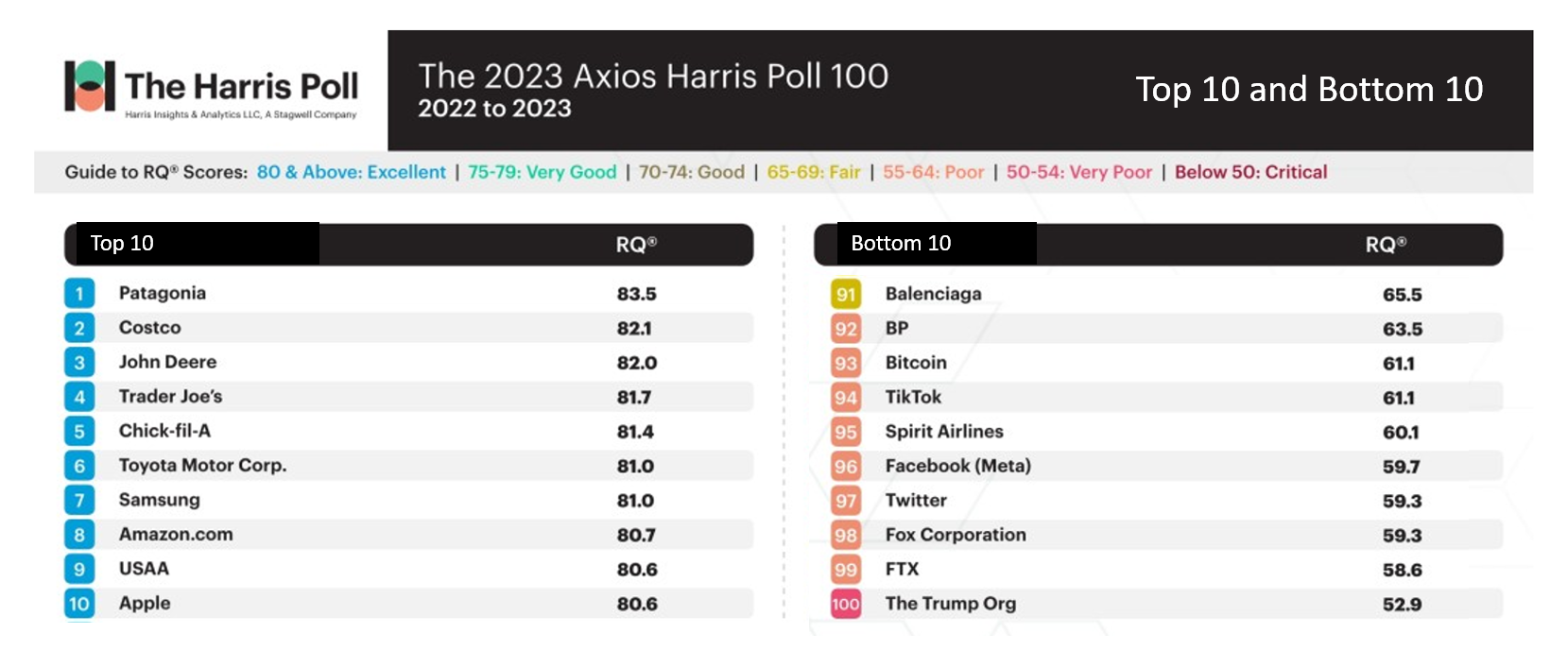

Patagonia, Costco, John Deere, and Trader Joe’s are loved; Twitter, Fox Corp., FTX and The Trump Organization?

Not so much.

Welcome to 2023 Axios Harris Poll 100 list of companies U.S. consumers rate from excellent in terms of reputation to very poor and, one in particular, “critical.” Exploring the list, we can find insights into consumers’ preferred touchpoints for health, health care, and well-being curated in their daily lives.

In this, today’s, Health Populi blog, I consider The 2023 Axios Harris Poll 100 reputation rankings in light of what we learned from the Morning Consult Most Trusted Brands 2023 study I discussed earlier this week here in Health Populi. Together, these two market research reports paint a very current picture of how U.S. consumers are living daily life in terms of the companies they trust, value, and ultimately spend hard-earned dollars with.

The two studies measure slightly different things, but they work together to give us insights into the current mind-set of consumers and the companies and brands with which they choose to align. The Morning Consult research focuses in on trust with brands, and the Axios-Harris Poll looks at consumers’ views on companies overall in terms of their “reputational quotients.” While the methodologies vary, the studies complement each other well especially through my lens over the evolving health/care and retail health ecosystem. The Axios/Harris Poll research was conducted in March 2023, and the Morning Consult study fielded roughly the same time (March 3-April 3, 2023).

In the 2023 Axios Harris Poll 100, a few themes emerged in 2023 when comparing the 2022 findings.

Consumers’ love for and appreciation of technology which was high at the start of the pandemic has eroded.

There’s been a “tarnishing of the technology titans” as the study results called out, marked by two key stories: the fall of cryptocurrency (that’s the company FTX you see in 99th place in the table), and Elon Musk’s acquisition of Twitter, which the Axios/Harris Poll analysts termed “Musk madness.”

“Americans have grown wary and weary of big ideas and powerful moguls who they feel have overpromised and underdelivered,” an Axios/Harris Poll summary observed. This year, Twitter fell to #97 of 100 companies assessed in the study, ranking low on factors such as character and trust. Musk’s Tesla auto company fell from 11th place in 2022 to 62nd place in 2023.

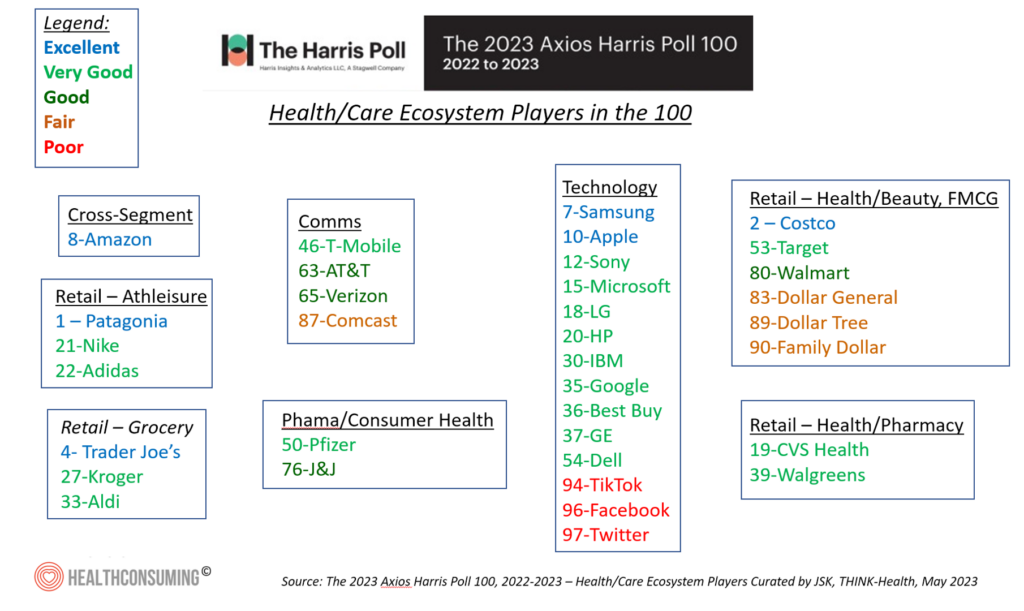

I reviewed the full list of 100 companies by reputation quotient, and identified some of the more obvious touchpoints for our broad health/care ecosystem and retail health landscape. You can see the breakout here based on my work with clients serving the broad consumer-facing health market. Companies in blue garnered “excellent” RQs, followed by the apple green tone symbolizing “very good” designations in the eyes of U.S. consumers.

Given that legend definition, your eyes will migrate to technology which most of the major consumer-facing electronics brands received “very good” reputation grades — with Samsung and Apple at the top of the tech roster in the top ten achieving “excellence” — with Patagonia (#1), Costco (#2), Trader Joe’s (#4), and other companies I’ve left out of the mix.

Amazon ranked #8 in the top 100, and I’ve carved out a singular N of 1 designation for the company as a “cross-segment” player across the health/care ecosystem. Some consumers will consider them a tech and e-commerce player primarily; others in terms of a pharmacy or primary care provider; and still others might consider Whole Foods part of their retail grocery channel, competing with Kroger, Aldi, and the “excellent” Trader Joe’s.

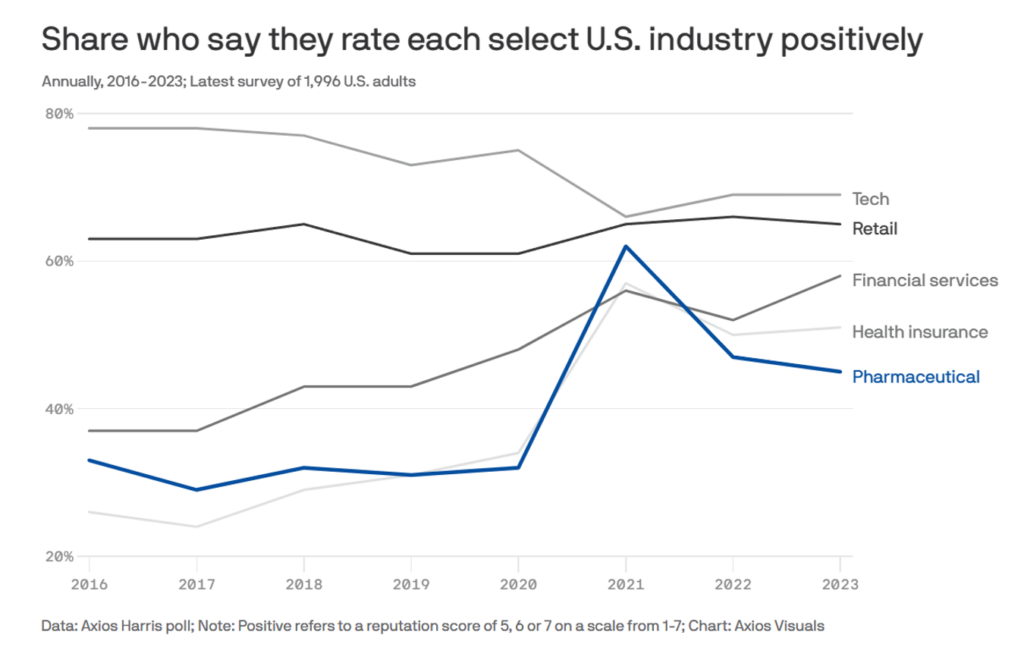

The Axios/Harris Poll did some detailed analysis on two health care categories relative to tech, retail, and financial services: health insurance and pharmaceuticals.

It’s important to call out CVS Health which ranked 19 (very good) in the 100 list, and Walgreens which fell a bit below CVS Health at #39. At the margin, these two retail health companies RQ’s had a small difference of 78.7 minus 76.9, or 2.8 RQ points difference. Walgreens fell between Capital One and Pepsico and Netflix, so in quite good company in terms of consumer brand equity and CX experience.

U.S. consumers are moving “from defensive health to proactive health” in the estimation of John Gerzema, CEO of The Harris Poll. He noted that more patients-as-consumers are looking for greater convenience and access in health care, asserting that, “the natural benefactors of that are the retail physicians.”

The line chart from the Axios-Harris Poll 100 for 2023 tells us that tech, while relatively eroded at the margin in reputation quotient, still ranks above retail (just slightly), financial services, health insurance, and pharma among these five sectors. Pharma peaked in reputation quotient in 2021, in the height of vaccination love and appreciation, which buoyed in particular Pfizer in this study. This year, Pfizer’s ranking fell to 50th, still considered “very good” in the mix and the top-ranked pharma of only 2 in this study.

The other pharma/life science company in the 100, Johnson & Johnson, landed at #76 in the “good” band of reputation between Uber and Disney [sidebar: Disney was especially “hit by polarizing political drama” in the words of Axios/Harris Poll, declining in reputation quotient since 2017.

Note that Band-Aid® was the #1 brand I talked about in yesterday’s blog on the Morning Consult study. Band-Aid® has long been a powerful consumer health love-brand for J&J (on the unregulated consumer side of the business, differentiated from pharma). Most consumers in 2023 do not yet realize that J&J spun off its consumer health division, now called Kenvue, which began trading on the New York Stock Exchange on May 4.

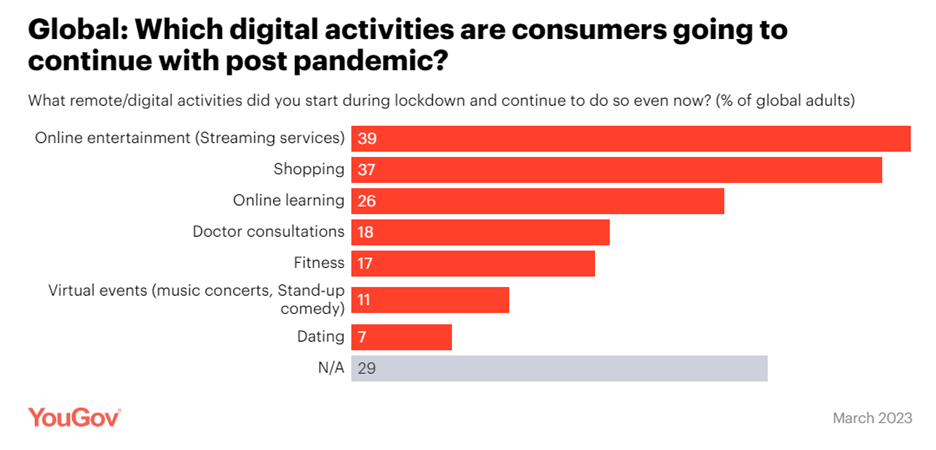

Health Populi’s Hot Points: The latest YouGov poll into post-pandemic consumer behaviors explored what remote and digital activities folks, globally, adopted in lockdown that they are continuing to engage with as of March 2023.

The orange bar chart illustrates that a plurality of newly-adopting online entertainment streamers are still doing so (for 39%), along with shopping online (37%), learning online (36%), and meeting up with doctors virtually for 18% of consumers.

Now consider Amazon, ranked #8 in the Axios-Harris Poll 100 top organizations for reputation: in my graphic shown above, I carved Amazon off from other retail and industry sector categories because of their cross-segment roles in health/care. Consumers look at Amazon for a variety of applications and channels and platforms — with Prime for the online entertainment, and also for shipping and shopping. Many patients source their mail order drugs accessing Pill Pack and Amazon Pharmacy. Some patients and members of employer sponsored health plans are taking advantage of Amazon’s health care services, which the company intends to grow through its acquisition of One Medical and other assets. Still other consumers see Whole Foods as their grocery store, food-as-medicine touchpoint which did a good job in supply foodstuffs during the challenging supply chain era in the pandemic.

Trust is a key factor and enabler for consumers’ health engagement. The research culled from both Morning Consult and Axios/The Harris Poll can help guide us to more understanding of peoples’ perceptions of the growing touchpoints for health we find in our local communities, and sourced from and to our homes-as-health-hubs. Continue to watch Amazon, and the Big Tech Titans and Retailers alike, as they also compete for more primary care share, and to doctors and hospitals in communities who may choose to partner and collaborate with the tech and retailing experts, many of whom enjoy trusted relationships and brand-love with consumers.

Thank you FeedSpot for

Thank you FeedSpot for