In 2023, U.S. consumers’ purchases of technology in their households will contract this year.

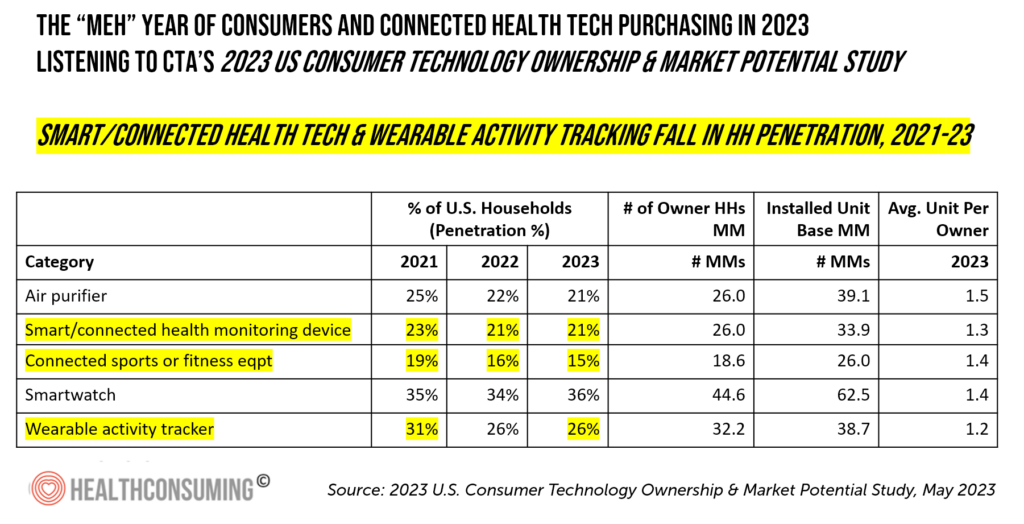

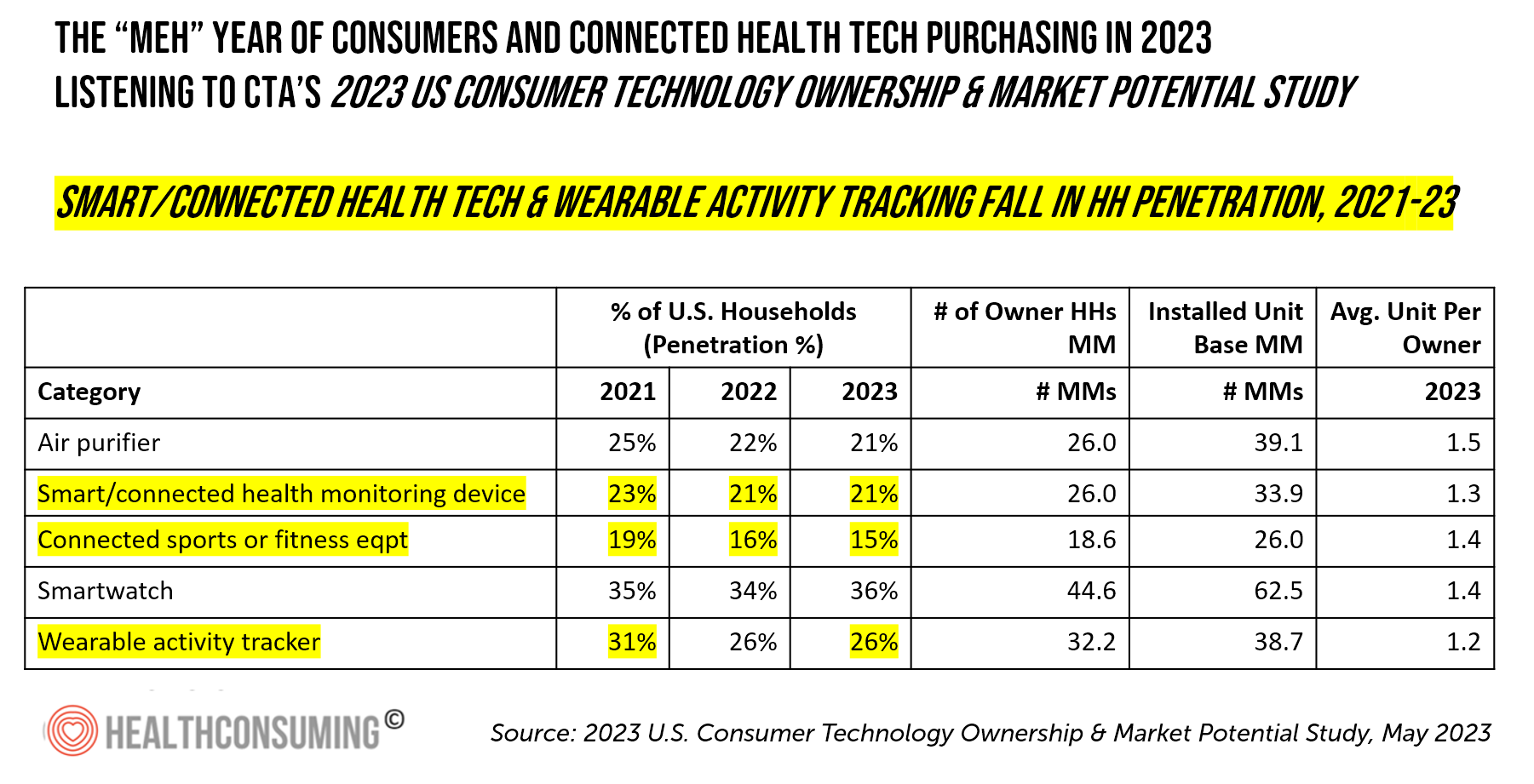

Consumer-facing health-tech categories won’t be spared, we learn in the 2023 U.S. Consumer Technology Ownership & Market Potential Study, an annual update from the Consumer Technology Association (CTA).

On the upside, smartwatch market penetration held steady in 2023, as this favorite form of wearable technology is “providing consumers a personalized digital health and fitness dashboard at their fingertips.” Many of these new smartwatch purchases will be cellular-enabled, blurring the space between smartphones and watches.

One in five households intends to purchase a smartwatch in the next 12 months (to April 2024), with 36% of U.S. households owning at least one smartwatch. The average household smartwatch ownership is 1.4 units per U.S. HH.

Note that this year, there are more U.S. homes with smartphones than televisions — 121.5 million versus 107.9 million, respectively.

In my read of the research, I’ll focus here on two categories CTA studied that direct related to healthcare:

- Health and wellness technologies, which in this study covers air purifiers, smart or connected health monitoring devices (such as those that measure body temperature/thermometers, blood pressure, blood glucose, or sleep patterns, for example); and, connected sports or fitness equipment (think: Peloton or Tonal); and,

- Wearable tech, covering smartwatches, wearable activity fitness trackers, VR headsets and AR glasses or headset.

In the table here, I’ve extracted five segments that I cover from the report for my own client work, and will call out especially the declining household Combining these penetration rates for smart/connected health devices, connected sports/fitness, and wearable activity tracking devices, in the context of the smartwatch market growth and consumer demand begs the question: how much are consumers substituting their smartwatch advancing feature sets for health and well-being for dedicated activity tracking with fewer functions? Consider the expanded functionality on the recently-announced Apple watchOS 10, for example.

This is indeed part of our scenario planning this year….as more health care ecosystem stakeholders are incorporating digital health tools into patients’ self-care and evolving programs in digital therapeutics and community-based clinical trials.

CTA surveyed 2,615 I.S. adults 18 and over in April 2023 for this study, exploring 10 technology product categories covering 80+ products.

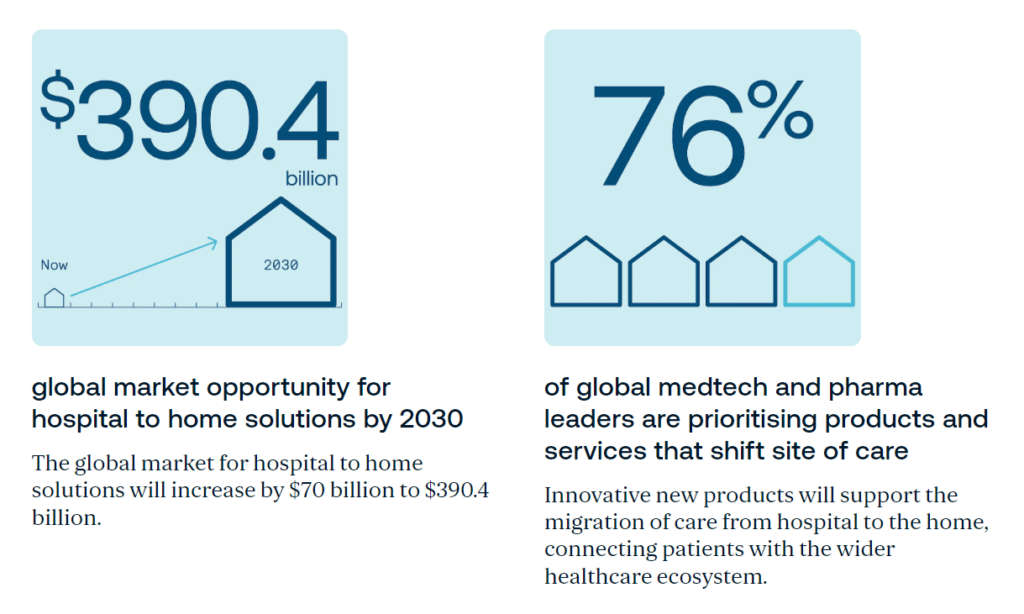

Health Populi’s Hot Points: Wearable tech and remote health monitoring are important tools in evolving toolkits for people managing healthcare at home. We learn more about this market space in Healthier at Home, a report on the new home care scenario from PA Consulting. The analysis quantifies the opportunity for moving hospital-to-home as valued at over $390 bn in 2030.

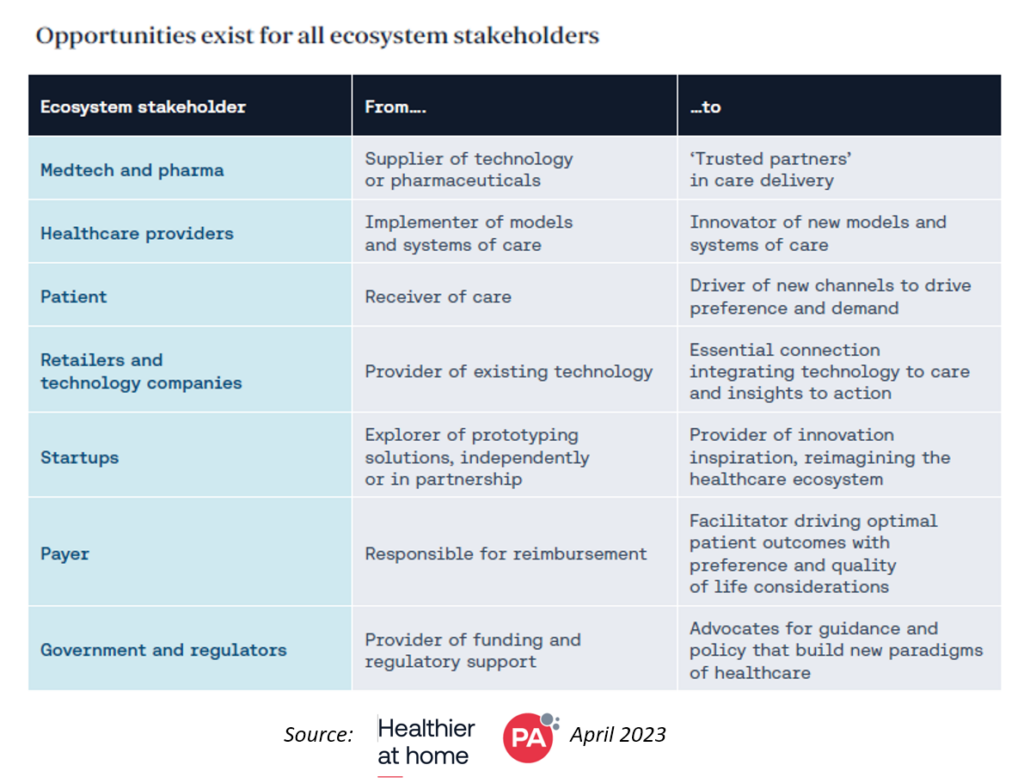

The PA Consulting team also asserts, smartly, that opportunities for participating in the hospital[-to-home migration are available for all players in the larger health/care ecosystem, including medtech and pharma, health care providers, startups and payers, government and regulators, and crucial to my context for home-as-our-personal-health-hub, retailers and technology companies and especially patients.

This table from PA Consulting’s paper identifies the shift from our current or recent state to the future….thus, for payers, a re-focus on driving optimal patient outcomes that toggle to consumers’ preferences and quality of life considerations. For pharma and medtech, to become a trusted partner in care delivery.

For patients, it’s about growing new muscles from “receiving” care to being the driver of new channels expressing personal preference and demand.

Economists define “demand” in a particular way that the general public might see as simply “need.”

Demand in the world of economics is willingness-to-pay for a particular good or service, with “need” a larger umbrella concept above that willingness-to-pay.

The CTA 2023 data tell us that in this year of 2023, millions of consumers are not persuaded to purchase connected health devices compared with previous years. What’s underneath the downturn in willingness-to-pay, especially among first-time buyers, will be a variety of factors underpinning “meh” demand for wearable tech and other connected devices for health and well-being. General price inflation and financial concerns in mainstream households ranks high on that list this year.

Beyond personal home and health economics, what is the state of health consumers’ interest in engaging for their health and medical care in 2023? We know that health consumers are at least as keen in 2023 to view and pay for food-as-medicine from other research you can search on here in Health Populi.

Innovators, developers and marketers of connected health devices in a direct-to-consumer channel would be wise to work harder in identifying health consumers’ motivations to engage with and track health, especially when asked to pay out-of-pocket for the goods and services. Working consumers have looked to employers who sponsor health insurance to cover some or all of the cost of such monitoring devices.

As more self-care and self-monitoring from home becomes adopted in PA Consulting’s vision of being Healthier at Home, it will behoove health care providers, payers, and medtech and pharma suppliers to collaborate in delivering value to patients on their terms, and based on consumers’ values in terms of PA’s note on preference and quality of life considerations.

Thank you FeedSpot for

Thank you FeedSpot for