Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness.

The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy.

Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey.

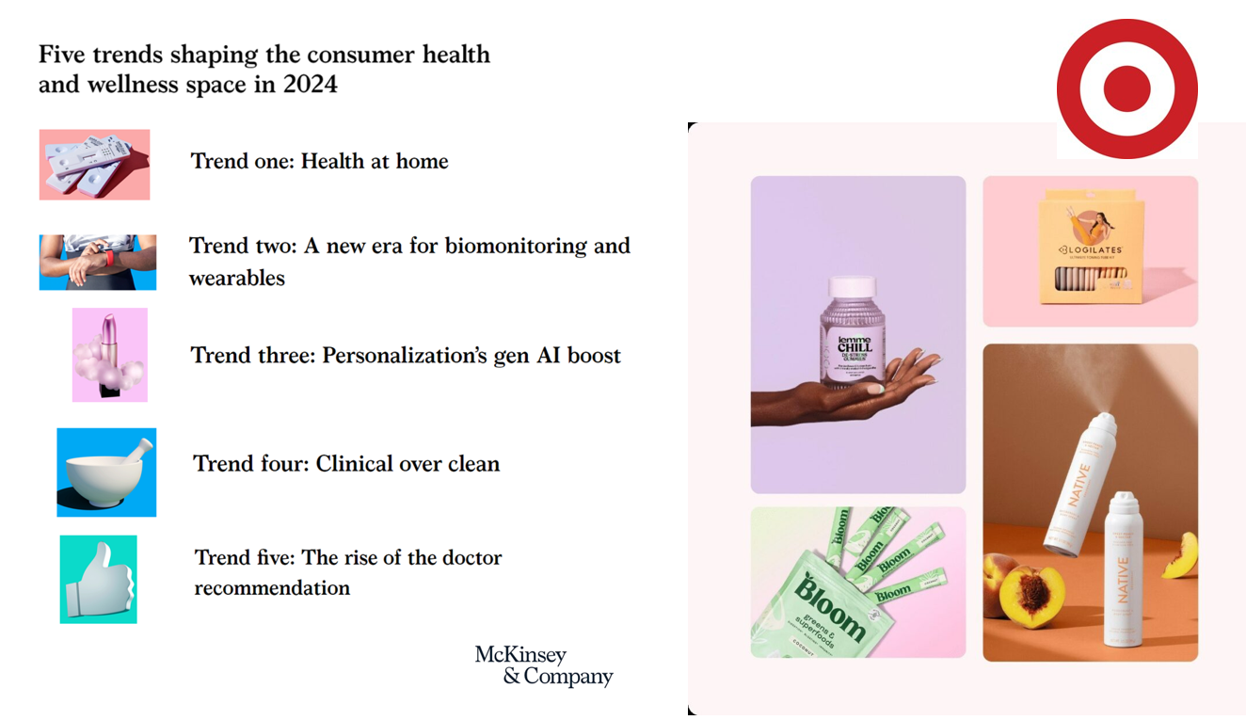

McKinsey points to five trends shaping the expanding consumer health and wellness space this year, including,

- Health at home

- A new era for biomonitoring and wearables

- Personalization’s GenAI boost

- Clinical over clean, and,

- The rise of the doctor recommendation.

Note that these five trends can be woven together painting a picture of health consumers looking for scientific-back-up, data and personalization, and the demand for “clinical over clean” — with the support of clinicians’ recommendations for what to buy to benefit body, mind, and home.

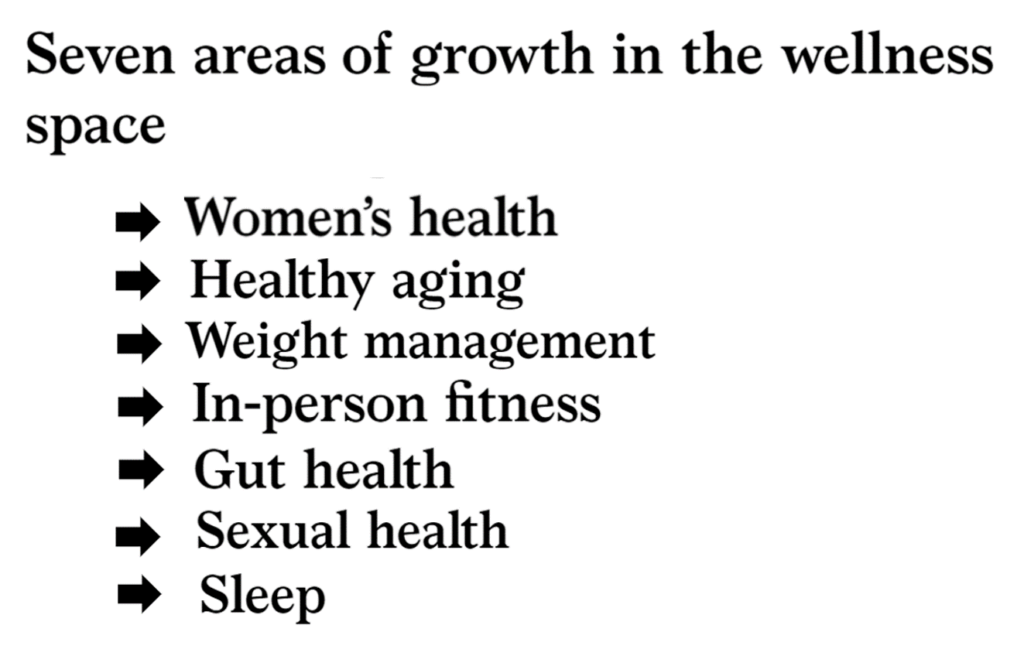

These trends are converging and driving growth across seven wellness areas, according to McKinsey, addressing women’s health, healthy aging, weight management, in-person fitness, gut health, sexual health, and sleep.

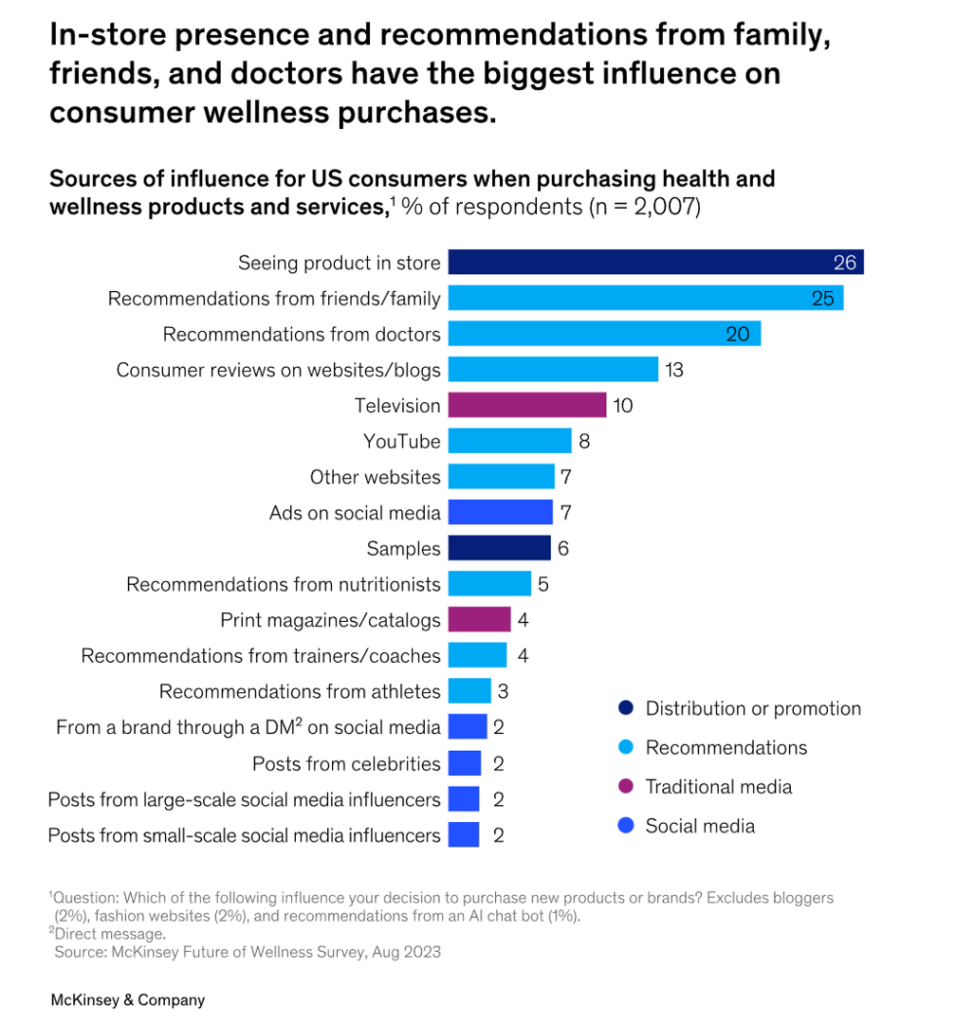

The five trends also play out in this bar chart from McKinsey’s report, arraying consumers’ favored sources of influence people turn to when purchasing health and wellness products and services.

The highest-ranking channels of influence are,

- Seeing the product in a store (for 26% of consumers)

- Recommendations from family and friends (among 25% of consumers)

- Recommendations from doctors (for 20% of consumers).

Note that social influencers, like celebrities and athletes, ranked at the bottom of the McKinsey survey (which was fielded in August 2023).

Most consumers consider clinical proof to be important across all product categories, especially for over-the-counter medicines, vitamins and supplements, and beauty products. Nearly one-half of consumers also believe clinical proof is important for consumer goods, and 41% for nutrition.

Health Populi’s Hot Points: This statement comes out of McKinsey’s report as a top-line finding — that shoppers as health consumers are seeking evidence-based products that enable empowerment and personalized solutions.

Note Target’s statement from its press release: that the company was “introducing more than 1,000 new wellness-related products starting at just $1.99 to support guests on their wellness journey without stretching their budgets. From apparel and accessories to supplements, vitamins and the latest tech, Target is the one-stop-shop where guests can feel celebrated and supported in living well.”

Target can leverage McKinsey’s finding that the #1 source for wellness product influence and information is “the store.” Furthermore, Target’s approach is omni-channel, where the store is also online and features a wellness destination for products as well as nutrition/food information through the retailer’s grocery channel meal planning site. The store’s BOPIS (buy online, pick-up in store) service grew and persisted through the pandemic, as well as same-day delivery via Shipt in many markets.

That Target is also baking in value-based pricing — value being in the eye of the beholder-consumer — speaks to peoples’ holistic views on well-being which integrates mind, body, spirit….and wallet.

Keep watching this space as Health at Home — the #1 trend of the McKinsey 5 — continues to also be embraced by patients, now medical bill payers morphing into savvier health consumers — in search of clinical value, as well.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for