Globally, patients are growing consumer muscles leaning into trust that’s building on communications that connect with them, based on insightful research from Smart Communications. This consumer research was fielded by Toluna and Harris Interactive in February and March 2024.

In The State of Customer Conversations, the report assesses input from global consumers from the APAC region (Australia, New Zealand, China, Hong Kong, Taiwan, Japan, and Singapore), German-speaking markets (Austria, Germany, Switzerland), the United Kingdom, and the U.S.

The research revealed five key findings, shown in the first exhibit:

- Communications are increasingly important to consumers’ healthcare experiences and trust-building

- Data collection and communication practices directly impact loyalty (think: privacy, security, empathy, respect)

- Trust and data security are more critical than ever in health care

- Healthcare customers increasingly expect web and mobile interfaces (think: omnichannel), and,

- Consumers demand transparency in GenAI use for healthcare communications (and, I will add, health care interactions in general).

We learned from the first Edelman Health Engagement Barometer that 3 factors underpinned global consumers’ engagement with health care providers and other touchpoints in the ecosystem: Trust, Authenticity, and Satisfaction.

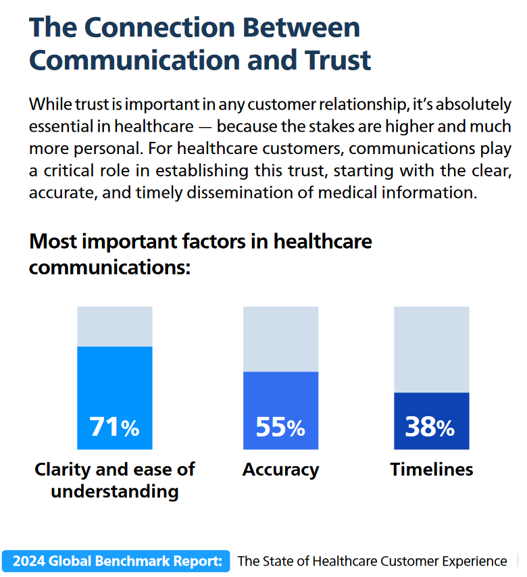

Trust is the precursor for health engagement, and the Smart Communications research revealed that effective communications underpin health consumers’ trust: specifically and first, clarity and ease of understanding the communications (for 71% of global consumers), and accuracy of the information in the comms (among 55% of people globally). Timeliness ranked third among these trust-building factors, for 4 in 10 consumers around the world.

These factors rank in this order across generations, from Gen Z to the Silent Generation, the oldest health citizens in the world for whom clarity and understand ranks key for trust among 88%.

Communications savvy and satisfaction are also important building blocks for loyalty and consumer recommendations across generations for roughly 6 in 10 people globally, from Gen Z to the oldest Silent Generation health citizens.

Health Populi’s Hot Points: Growing retailization of health care as patients around the world grow consumer muscles for shopping for health care services and products when they are “shoppable.”

Note that the Smart Communications study revealed globally that patients and members willingness to switch providers or payers due to poor communication applies to most patients-as-consumers across the world, from the APAC region to German-speaking countries, the United Kingdom and the U.S.

In my research for an upcoming client meeting exploring global health consumers, I discovered a study that I hadn’t seen when it was published in 2023 from Deloitte on Europeans’ perspectives for retail health formats. In One-Stop Shop: Where Healthcare Meets Retail, Deloitte took a page out of the U.S. growing landscape of health care delivery in communities at home and closer-to-home, finding most European health citizens keen to explore certain types of health care services and products through retail health channels — in pharmacies, in grocery stores, in gyms and spas, among other formats. Details are shown in the green heat-chart, detailing keenest interest in prescription drugs, eye tests, ear and audiology checks, sleep support, glucose measurement and nutrition advice, and birth control, among other services.

Patients are growing health-consumer muscles around the world in a growing omnichannel health care delivery environment those consumers are keen to access — with accurate, accessible information at the digital front-door.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a