People have been undergoing their own human kind of digital transformations, turbocharged during the pandemic for many who never used Zoom or Amazon Prime or Uber.

That consumer-borne digital transformation has shaped people as health consumers, many having used telehealth and appointment-scheduling online. And peoples’ relationships with pharmacies are also changing, with more health consumers finding greater satisfaction with their mail order pharmacy experiences than with moat retail brick and mortar chain drug stores, the latest J.D. Power 2024 U.S. Pharmacy Study found.

It’s clear that mail order is gaining more traction-satisfaction among health consumers, but there are still some exceptional brick & mortar retail pharmacies that patients-as-consumers are keen on — in particular, Sam’s Club in the mass merchandise category, Good Neighbor Pharmacy in chain drug B&M, and Publix in the supermarket category.

But the surprise in this list might well be PillPack Amazon pharmacy, which ranks just behind the perennial B&M chain favorite, Good Neighbor Pharmacy.

The headline in this chart is in the lower four rows, with chain drug stores ranking lowest among the four pharmacy channels, far below grocery stores, mass merchandise, and mail order which is only 10 points below mass merch in this index based on 1000 points.

What’s plaguing the chain drug stores, J.D. Power calls out, are long wait times, lower levels of customer trust in pharmacists, and difficulty ordering prescriptions.

Let’s deal with the chain drug stores first in the brick & mortar (B&M) world. This is the eighth consecutive year Good Neighbor Pharmacy has ranked first in the chains category, and the 13th time the company has earned this top spot over the last 15 years.

Health Mart ranked second this year in the B&M chains, followed by Rite Aid and Walgreens, the latter of which tied in its index score with the segment average at 642. CVS Pharmacy ranked last at 626.

Interestingly, CVS Pharmacy inside Target scored a higher index stat at 682, in the B&M mass merch segment — still, last in that category compared with Sam’s Club and Costco, first and second in the group.

Consumers satisfaction with supermarkets rank several grocers quite close together: Publix first, followed by ShopRite, H-E-B, Fry’s, Wegmans, and Walmart’s Neighborhood Pharmacy (versus Walmart as a mass merchandiser pharmacy ranking just above the lowest CVS in that category).

Now, to the prescription drug channel gaining satisfaction-traction among health consumers: mail order.

“As more consumers become aware of digital pharmacies, understand how they work and determine that many accept their insurance, brick-and-mortar stores risk losing market share,” Christopher Lis, managing director of global healthcare intelligence at J.D. Power, explained in the report’s press release.

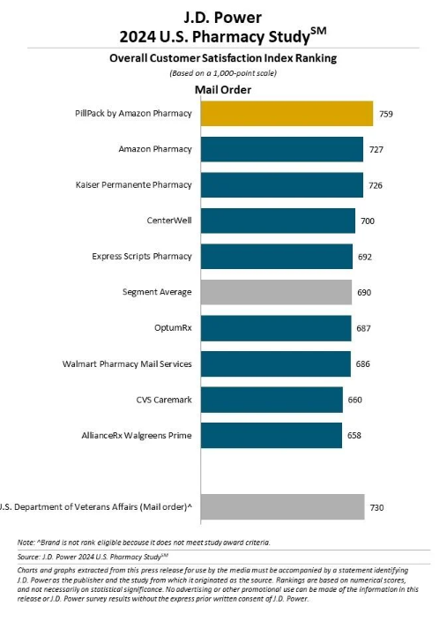

This last bar chart arrays the mail order pharmacies included in the J.D. Power study, with PillPack by Amazon Pharmacy ranking top, followed by its cousin, Amazon Pharmacy second, and Kaiser Permanente Pharmacy in the third spot in patient satisfaction.

The two big chain pharmacy mail order companies, CVS Caremark and Walgreens AllianceRx, ranked at the bottom of the mail order league table for lowest levels of satisfaction.

I’ll note that Amazon’s two pharmacy plays ranked tops with consumers in this category, notwithstanding many industry pundits/critics’ dissing of Amazon’s “failings” in health care. Clearly, consumers sourcing drugs via ecommerce are liking Amazon’s delivery flows compared with other mail order companies — with Kaiser Permanente an ongoing standout in this channel.

Health Populi’s Hot Points: Amazon held its 2nd quarter 2024 earnings call on 1st August. When asked about the company’s pharma initiatives, CEO Andy Jassy observed that,

“A lot of what you’ve seen is that the work that the team has done on the customer experience over the last 18 months has really paid off.

Customers love the customer experience of Amazon Pharmacy. And especially, by the way, when you think about the experience and the speed and ease with which you can order versus walking into a pharmacy in a physical store, if you walk into pharmacies in cities today, it’s a pretty tough experience with how much is locked behind cabinets, where you have to press a button to get somebody to come out and open the cabinets for you and a lot of shop lifting going on in the stores. So, the combination of what’s happening in the physical world and how much improved we’ve made our pharmacy experience is driving a lot of customer resonance and buying behavior. I think also you see us continuing to expand there.”

With the experience imperative in mind, now check out the table here, from Adam Fein and the Drug Channels Institute; here is the ranking of the top 15 retail pharmacies by total prescription drug revenues.

We find the top two market shares in Rx revenues were CVS Health and Walgreens — both ranked bottom in consumer satisfaction in the retail chain drug channel. Then we see two huge PBMs followed by Walmart.

If we add these top 5 of the 15 together, we get nearly $390 billion, equal to nearly two-thirds (63%) of all Rx drug revenues in 2023.

This begs the question — what is the incentive for these big players to enhance their health consumer experiences? Are they “too big to fail” in terms of assuming the patient experience is important for their business and survival?

Note that Amazon’s two pharmacy programs, nor Kaiser-Permanente’s, rank in the top 15 by revenue.

A wild card in here are some of the grocery chain pharmacies, where Publix and Albertson’s rank in experience above the supermarket industry average. And, Costco, too, a high-ranking mass merchandise retailer.

Those payers that engage with the huge PBMs on behalf of their members should make a point to include digital delight and satisfaction in contracting with the mail order vendors (like Express Scripts and OptumRx, along with CVS Caremark). The momentum is driving more people toward mail order and ecommerce convenience and cost-savings. In the growing omnichannel world that all consumers (including health consumers) expect, investing in better digital experiences will be key to gaining consumer loyalty and trust, which has begun to lag across the pharmacy segment.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a