The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast.

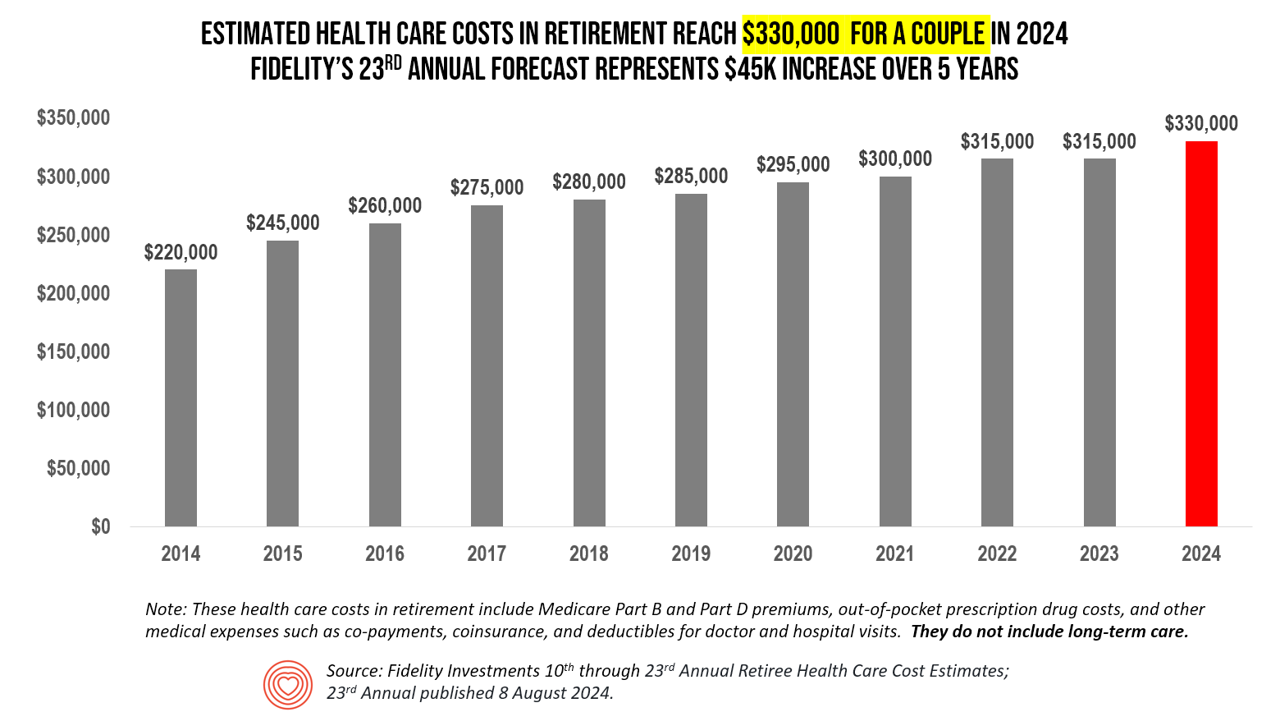

I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K.

Fidelity began to disaggregate the cost for a couple into the cost for a single average person, beginning in 2023 — when the individual’s health care costs in retirement were estimated to be $157,500.

In 2024, that’s $165,000 for an individual retiree — noting that for women over the course of this study, health care costs in retirement have been higher each year than men’s costs.

Here is Fidelity’s breakdown of health care costs in retirement by line-item their calculations cover:

- 47% of a retiree’s costs would go to other medical expenses, including co-payments, coinsurance, and deductibles for physician and hospital visits

- 43% would be spent on Medicare premiums for Part B and Part D (prescription drug plans), and,

- 10% would be spent on out-of-pocket prescription drug costs (across generic, branded, and specialty drugs).

Note a couple of key assumptions: again that there are no long-term care expenses in this $165,000 — and that this calculation assumes the retiree would enroll in Traditional Medicare (not Medicare Advantage).

Fidelity advises that, “There continues to be a disconnect for many Americans between the actual projected costs and how much they believe they will spend on health expenses in retirement…recent Fidelity research finds the average American estimates costs will be about $75,000— less than half of Fidelity’s calculation.”

Health Populi’s Hot Points: As noted, long-term care costs are not accounted for in the annual Fidelity Investments calculation of health care costs in retirement in America.

Neither are caregiving costs for people aging at home with disability, whether physical or memory, mobility challenges, vision or hearing impairments, or mental health concerns. Among people 50 and over caregiving for loved ones, the chart lays out the incidence of health issues among folks being cared for.

There is both a financial and/economic and mental health toll on caregivers not captured in economic analyses that quantify costs of aging or retirement.

That bar chart comes from a recent study from the National Poll on Healthy Aging at the University of Michigan, looking at the caregiving burden in America among people 50 years of age and older.

As we continue to educate our patients, our families, and indeed ourselves (if you live in the U.S.), we should be holistic in how we define and serve “health” and well-being — mind, body, spirit, and pocketbook — as well as being expansive in how we look at aging and finances beyond medical care, Social Security payments, and Medicare.

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., Spain and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., Spain and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future... Thank you, Max Mamoyco of Nozomi, for including the Health Populi blog as one of 20 must-follows in #digitalhealth.

Thank you, Max Mamoyco of Nozomi, for including the Health Populi blog as one of 20 must-follows in #digitalhealth. I was i

I was i