In the past week, a few major events bring the nature of pharmacies and the market for retail pharmacy into sharp view:

First, news that CVS is undergoing self- and market-scrutiny about its business — specifically, the company’s vertical integration and financial punishment wrought by the organization’s insurance group, Aetna, leading to considering the break-up of the company into certain parts (whether the insurance business, the retail pharmacy, the specialty pharmacy unit, etc.).

Second, the PBM (pharmacy benefit management) business has come under harsh light from the FTC and Congress, most recently resulting in a lawsuit filed by the FTC against the three largest drug benefit managers, Caremark Rx, Express Scripts (ESI), and OptumRx, for “artificially inflating” insulin drug prices.

Third, Kroger finalized its sale of the company’s specialty pharmacy business, to Elevance Health. The grocery chain will continue to operate the stores’ retail pharmacies and Little Clinics, along with doubling down on the organization’s food-as-medicine initiatives and work in Medicare.

Which begs the question: whither the U.S. retail pharmacy, and what is a pharmacy’s changing model for business viability?

I’ve been thinking about this question for some time, and had the opportunity to consider this in real-time in a sort of back-to-the-past-to-the-future moment when I recently re-visited the glorious Farmaceutica of Santa Maria Novella (SMN) in Florence, Italy (in longhand, the “Officina Profumo-Farmaceutica di Santa Maria Novella.”

Here is a photo of the interior of the place, which looks like a church because, well, it was first established in 1221 by SMN monks who developed a portfolio of botanically-based remedies, perfumes, liqueurs, balms and foods which the likes of the Medici family and others in the City of Lilies consumed to deal with health and well-being.

In 2024, this is a thriving business, led by a recently-appointed new executive from the fashion industry, 800+ years later operating in both brick-and-mortar shops around the world as well as an ecommerce business selling remedies as well as a line of fragrance and other personal care offerings.

As I pondered what we can learn from the origins of the Farmaceutica, I was also preparing to lead a class module through my affiliation with Duke Corporate Education with a global company, listed on the Fortune 100, looking at the future of health care.

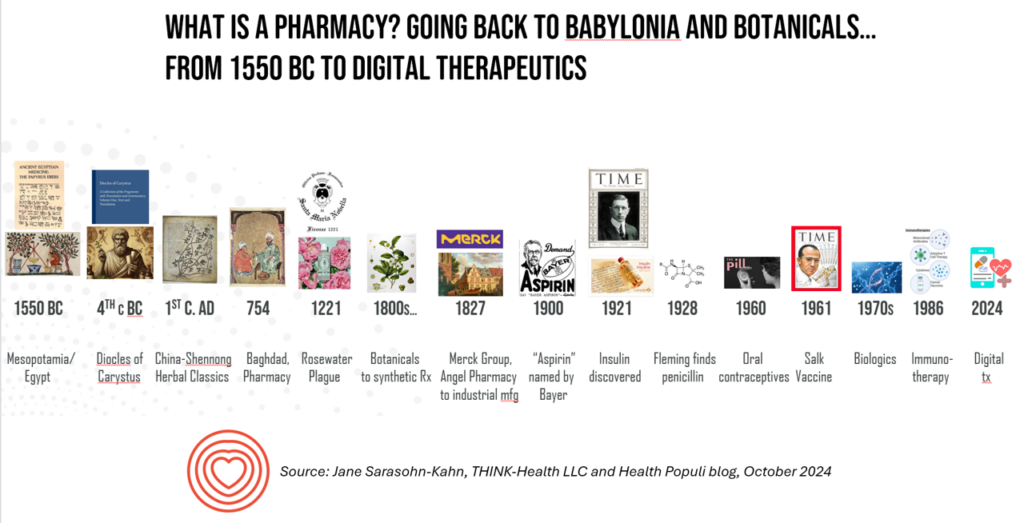

I developed a plotline for my class cohort which started with a story about the Farmaceutica SMN, followed by this slide asking, “What is a pharmacy?”

In putting this timeline together, I went even further back before the founding of the SMN pharmacy to Babylonia — arguably the first apothecary I could identify in my research into the origins of pharmacies as we’ve come to know and appreciate them.

In going back to Babylon and the botanicals used by the clinicians of the time — doctors and chemists and other knowledgeable folks back in 1550 BC — I also learned that this group of health care providers mixed into their wellbeing alchemy the power of prayer and faith.

Into my forecasting the future of health care, in addition to addressing the most common drivers of the future of health and care (e.g.,economics and financing, technology and consumer trends), I added a new pillar to my scenario planning toolkit: something I termed, the “Human OS.”

In looking to the future of health/care future state(s), the Human OS embodies several key issues we’re now facing that challenge all stakeholders in our ecosystem, globally. These factors include,

- Trust (in science, in institutions, and in health care)

- The growing virality of misinformation (esp. related to science and health)

- The stubborn state of health in-equity (including barriers of “techquity,” where many health citizens still lack connectivity and access to technology)

- The risks of social determinants of health, including access to clean air and clean, safe water, safe neighborhoods and towns, and other SDoH factors; and,

- Climate change (to which I segued from the Human OS discussion to another major pillar of the future, Sustainability).

And sustainability of the current models for pharmacies, both in-hospital and retail, is where I began this post.

The re-formation and reinvention of pharmacies (plural) will require attention to the supply and demand sides for pharmacy products and services. On the supply side, we consider the various components of the business models specific to “the business” — costs of operation, human resource costs (esp. related to the supply of pharmacies and pharmacy technicians), costs of sourcing medicines, other revenue sources, technology infrastructure, and the like.

On the demand side, I think about prescribers and patients — the latter increasingly as payers and consumers at the last mile or dollar. Those payments are based on co-pays, coinsurance shared percentages, meeting deductibles in commercial and public plans, and other out-of-pocket consumer-facing costs of medicines. This is the business model for the consumer — based on cost, perceived value, and values of the individual patient-as-payor. (For more on how consumers’ values play into value-based payment, check out this landmark essay in JAMA called, “Value-based payment requires valuing what matters to patients, presciently published in October 2015).

The patient’s view on their own Human Operating System mashes the cost of care (in this case, prescription drugs) into their overall health care experience.

And that experience was definitely part of the alchemy baked into the experience of a health citizen living in Mesopotamia in 1550 BC or the Florentine patient of Renaissance times.

Health Populi’s Hot Points: Fast-forward with me to the September 29th, 2024, issue of Forbes, in which Greg Petro asked in his titled article, “Could Amazon Become the Largest Drug Store in the USA?”

As I’ve discussed for some years, Amazon has been investing in various building blocks in and adjacent to the health care ecosystem, including finalizing its big acquisition of Pillpack in 2019 for $753 million. And consumers in general have been “Amazon-Primed” to expect convenience, timeliness, and high service levels from ecommerce which informs peoples’ demands for higher levels of service in daily life flows.

From the Forbes piece:

“Baby boomers, still a sizable cohort, are often the ones bearing the brunt of high-cost prescriptions,” Greg Zakowicz, an e-commerce expert at Omnisend, told Business Insider. As it expands its drug offerings, combined with its current subscriber base, Zakowicz said that Amazon Pharmacy ‘could become the top one or two pharmacies in the U.S.'”

As organizations choose to continue to stay in pharmacy businesses, or start-up new concepts of a “pharmacy,” innovators would be well advised to attend to various aspects of the Human OS for both providers (prescribers and pharmacists alike) and patients (as consumers, payors, caregivers alike). The cost of medicines will be part of the overall pharmacy experience in the broad umbrella of “retail health.” And those costs are on the mind of U.S. patients, whether identifying themselves as health citizens who are Democrat, Independent, or Republican, as this Kaiser Family Foundation poll recently found.

We’ll be watchful to see how consumers-as-patients and payors will look for empathy and seek trust when engaging with the health system — in this instance, the pharmacy and the pharmaceutical manufacturers supplying innovative medicines — along with the value embodied by and around “the pill,” and a holistic approach to health and well-being. Don’t underestimate the power of Human OS in working to heal health care….and people.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a