The premium for employer-sponsored health plans grew by 6-7% between 2023 and 2024, according to the report on Employer Health Benefits 2024 Annual Survey from the Kaiser Family Foundation, KFF’s 26th annual study into U.S. companies’ spending on workers’ health care.

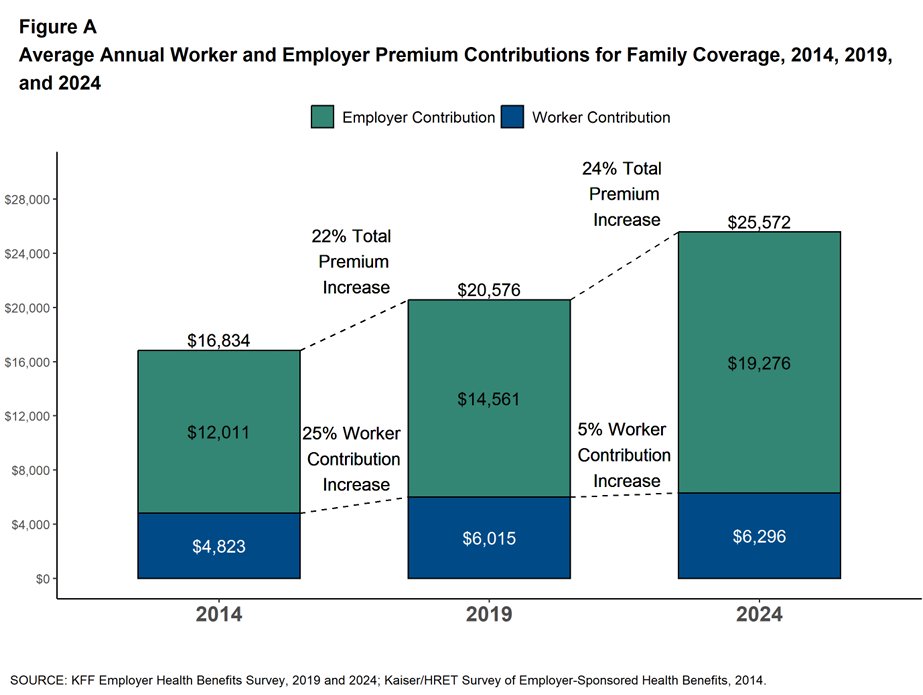

In 2024 the average annual health insurance premium for family coverage is $25,572, split by 75% covered by the employer (just over $19,000) and 25% borne by the employee ($6,296), shown in the first chart from the report.

The nearly $26K family premium is the average across all plan types in the study, which include HMOs, PPOs, point-of-service (POS) plans, and high-deductible plans with a savings option (HDHP/SO). The difference in premium cost across the four plan types is $2,482:

- PPOs have the highest family premium ($26,678) vs.

- HDHP/SOs, the lowest ($24,196).

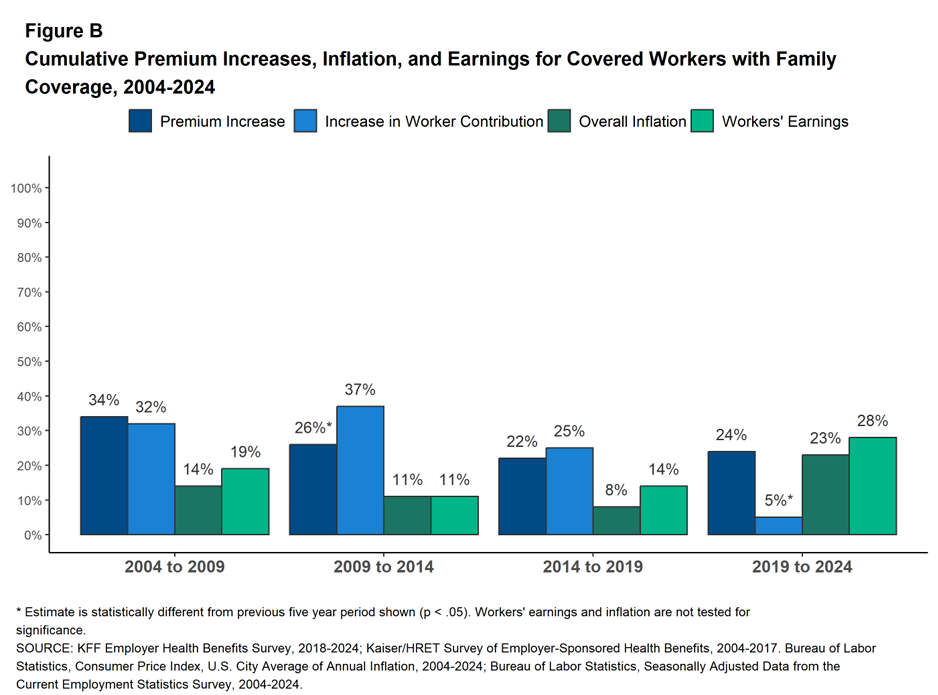

The year-after-year gr=wth in health care costs is interesting to explore in detail. Putting the microscope on increases in premiums, worker contributions, workers’ earnings (the paycheck), and overall inflation, shows variability depending on the era we’re looking at,

Figure B illustrates these trends by four time periods: 2004-2009 (the latter years of which marked the Great Recession); 2009-2014, which experienced the greatest growth in workers’ contribution to their health care premiums; 2014-2019, leading up to the pandemic period of 2019 to 2024.

In this last time period, COVID and its long-tail into 2024, workers’ earnings rose much more than in the previous three time intervals, and inflation increased dramatically at 23% roughly matching premium increases in the period.

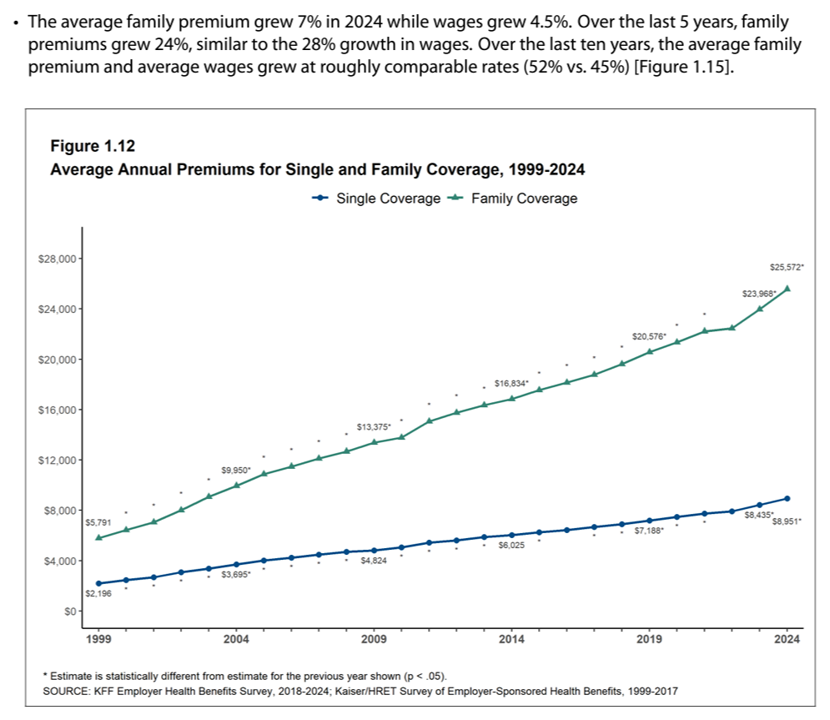

These cost-growth scenarios play out in the line drawing here, Figure 1.12, tracking average annual premiums for single and family coverage. s

About one-half of workers in plans are enrolled in PPOs, 27% in a high-deductible plan, 13% in an HMO, and 11% in a POS plan.

In 2024, 54% of all firms offered some health benefits, stable with 2023’s offer rate. Larger firms are much more likely to offer health benefits than small companies — it’s a big delta, with 98% of big companies (with 200 or more workers) versus 53% of small employers (with less than 200 workers).

There are numerous facets on employer-sponsored health care to explore in the KFF report’s 220 pages, but I’m going to focus in on a few issues with which I’m working these days: on prescription drugs, telehealth, and mental health.

Prescription drugs (and costs) are on the minds of policymakers and legislators as well as prescribers, pharma companies, and payers — employers, government plans, health insurers and, of course, patients who co-pay or c0-share the costs of medicines.

In 2024, the average patient share amounts are shown in Figure 9.6 from the KFF report, noting the tiering of drugs depending on the plan design: on average,

- For Tier 1, plans with 3 or more tiers average a $12 copayment or 22% coinsurance, or a $16 copayment for plans with the same cost sharing across all covered drugs on formulary (or 19% coinsurance)

- For Tier 2, plans with 3 or more tiers average a $36 copay, a 27% coinsurance; and, a plan with two tiers has a $39 copay.

- For Tier 3, only applicable to plans with three or more tiers, the average copay is $65 and coinsurance 35%; and,

- For Tier 4, again for plans with 3 or more tiers, the average copay is $128 and coinsurance a 33% share (generally applicable to specialty drugs).

Read more about prescription drug prices in Section 9 of the report, and especially controversial areas of copay accumulators and new research into the impact of GLP-1 drugs on health plan costs.

In Chapter 12, wellness and especially mental health continue to be a priority for large firms, with one-half of the largest companies offering incentives to workers who participate in these programs (say, to get a biometric screening then follow up on specific health tasks such as weight reduction or smoking cessation).

The wellness line item in the survey of “other specific wellness programs” garnered 95% of the largest employers: under that general category includes programs to help people stop smoking, to help workers lose weight, and other lifestyle or behavioral coaching.

There are also important insights into employers’ concerns about GLP-1 medicines costs’ and impacts, and support for women’s health issues.

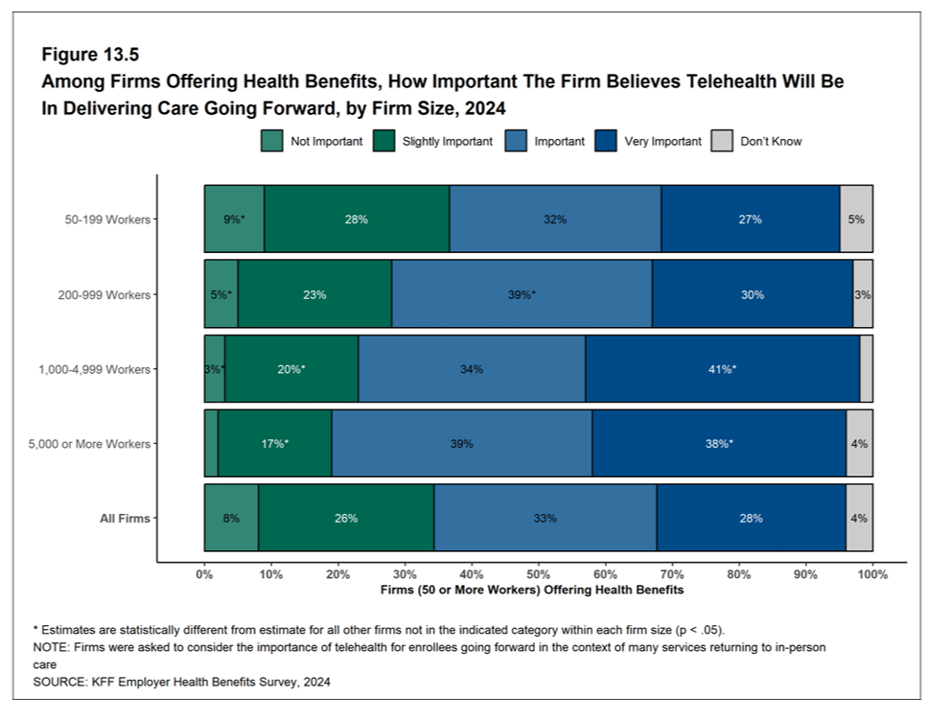

Telehealth gained traction in health care in the pandemic; in 2024, employers report support for telehealth in care going forward, with the largest companies showing somewhat greater support for telehealth for workers compared with the smallest firms. Still, 59% of firms with 50-199 workers say telehealth will have an important or very important part in delivering care going forward; with 77% of the largest firms with at least 5,000 workers saying telehealth will be important or very important going forward.

Health Populi’s Hot Points: This report, annually, always begs the question in my mind: will employer-sponsored health insurance in America continue to continue in the next year and few years to come? Based on the KFF survey and other employer health studies published in the past several months, it appears that employer-sponsored care in the U.S. will indeed keep on keepin’ on.

With health care costs to employers expected to grow in 2024, we must all continue to monitor the balance of macroeconomic growth in the U.S., the costs of health care and perceived ROI to employers (and employees bearing out-of-pocket financial skin in the game), the state of labor markets and availability of needed workers, and regulatory pressures that might shift prospects for industry in general or particular sectors in and beyond 2025.

Still, we can look to a 2023 report from The Commonwealth Fund reporting out their interviews with executives from U.S. companies, bottom-lining the following, assessing that long-standing bond between U.S. worker and employer that goes back to World War II:

“Employers often view themselves as paternalistic: they wish to make it easier for their workers to get affordable health coverage. They also do not want to relinquish control over health plans, viewing health benefits as a valuable recruitment and retention tool. Accordingly, the benefits executives we interviewed found it difficult to imagine future circumstances that would lead their companies to stop providing health coverage.”

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a