What would $5 trillion be valued around the world or on the stock market?

The economy of Germany was gauged around $5 trillion in 2024.

India could be the world’s 3rd largest economy by 2026 valued at $5 trillion.

Nvidia could be a $5 trillion company in 2025, as could Amazon.

But today we report out the latest data from the Centers for Medicare and Medicaid Services (CMS) that national health spending in America reached $4.9 trillion in 2023. The full report on national health expenditures (NHE) in the U.S. was published today in Health Affairs, which came off embargo at 4 pm.

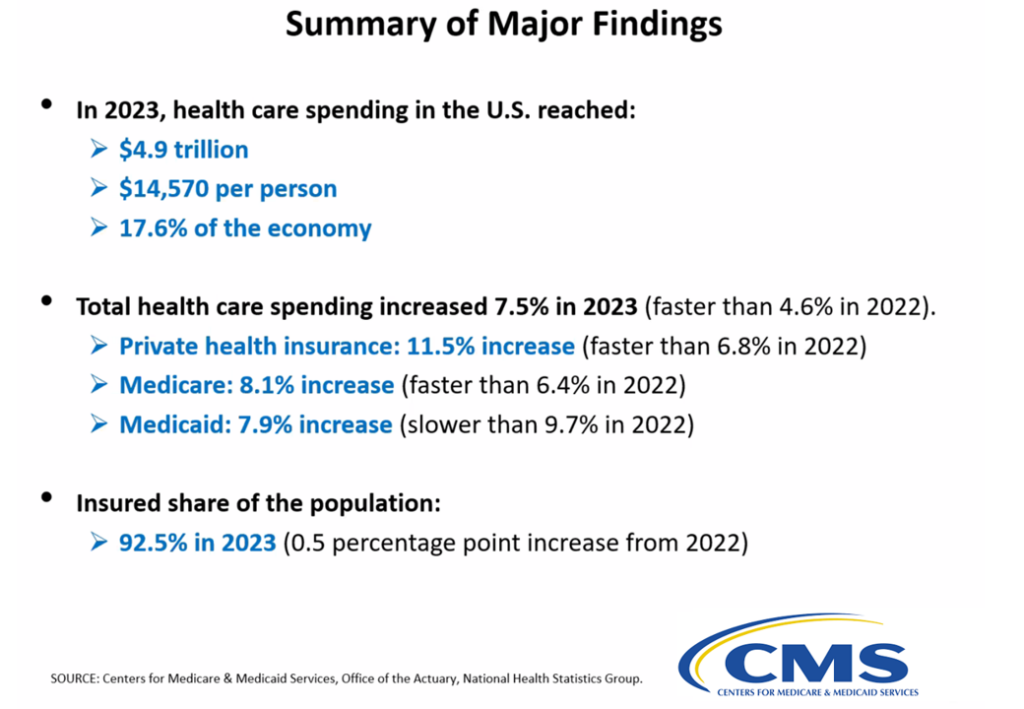

Here’s a snapshot of the key findings from the annual report on U.S. NHE:

- That health spending in the U.S. calculated to $14,570 per person in the U.S. in 2023

- Spending comprised $17,6% of the national economy, very similar to the pre-pandemic share of the total economy, and,

- Health care spending grew at a rate of 7.5% between 2022 and 2023, more than 50% faster than from 2021-2022 (which was 4.6%.

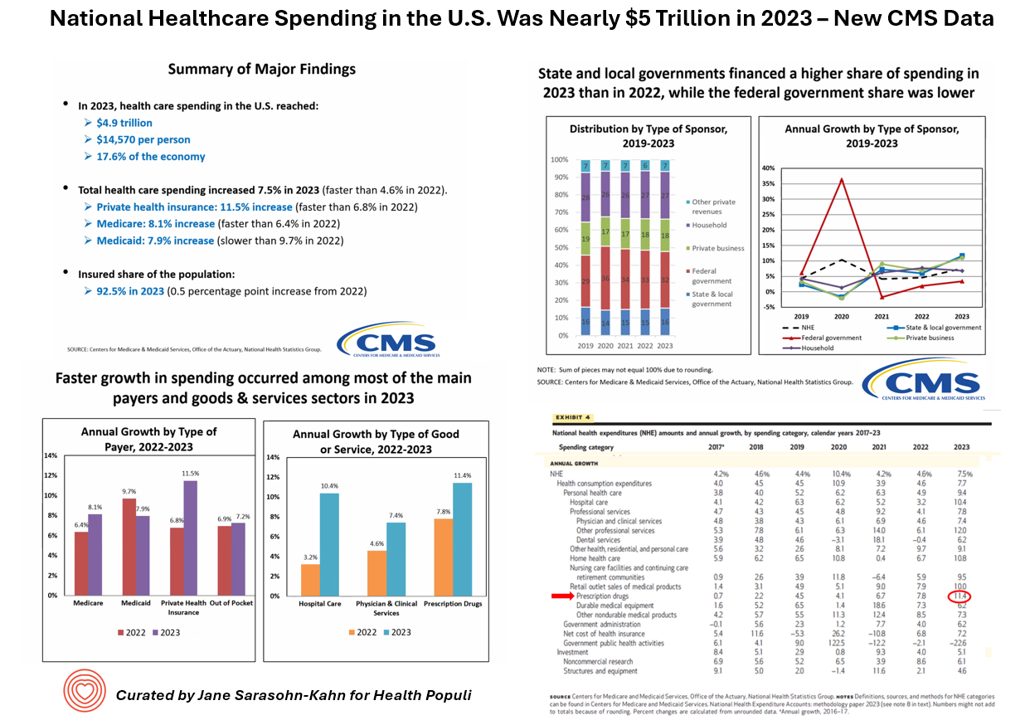

The second chart illustrates growth rates by payer type and by the type of health care good or service, between 2022-23.

The fastest-growth spending by payer was for private health insurance, increasing by 11.5% in year-over-year compared with 6.8% the previous year.

The rate of spending among the three other payer types – Medicare, Medicaid, and consumers’ out-of-pocket costs — grew more modestly, at 8.1%, 7.9%, and 7.2% respectively.

Note the differences in growth rates in spending by type of good or service, with prescription drug spending ranking first in fas5 growth at 11.4% (versus 7.8% in 2022), and then hospital spending increasing by over 3x over 2022 — from a low 3.2% growth rate in spending compared with 10.4% in 2023.

During the press conference I attended earlier today with the study researchers explaining the data findings and underlying reasons for change, there are several factors we can point to that drove costs up where they were especially faster-growing:

- See the spike in the right chart for the red line which represents the U.S. Federal government — and Coronavirus Act funding bolstering the health economy. In 2019, NHE accounted for 17,5% of the U.S. GDP, whereas in 2020, that share increased to 19.5%.

- In fact, the NHE and GDP grew at similar average annual rates between 2020 and 2023.

- Growing spending for private insurance grew post-pandemic as well as for Medicare, based on consumer-patients returning to care — with that hospital fast-growth percentage in 2023 related to that return-to-care (a reversal of “medical distancing” in and immediately after the worst of the COVID-19 pandemic).

- In addition, CMS also noted an increase in private health insurance spending as well as Medicare due to the rough flu season in 2023.

Thus, it was use and intensity, not so much price increases, driving national health spending for most categories….with prescription drugs at retail telling a different kind of story.

As the blue and orange vertical bar chart above clearly illustrates, prescription drug spending grew faster in 2022-23 than any other service or product category in the study. (Hospital spending increased 10.4%, and spending on other professional services by 12.0%, double the rate seen in 2022).

As for the retail Rx spending, several factors underpinned that double-digit growth: the fast-growing area of GLP-1s and anti-diabetic drugs contributed significantly to this number, as well as increased prices for some branded prescription drugs heavy on the Medicare Part D line item for seniors.

The GLP-1 discussion was insightful: Anne Martin, one of the lead CMS researchers in this study, called out an important statistic: that for Medicare Part D, branded anti-diabetic medicines had a 35% increase in 2023 per member/per month — which she called “significant growth.” We will be watching this space in 2025 on many fronts: in terms of supply, popular culture, impacts on other industries from food to gyms to apparel and travel, and of course impacts on household spending and health equity challenges.

We should also keep our eye on private sector spending by employers on health care, where premiums are expected to grow in double-digits — already faster-increasing in 2023. This is a key scenario planning data point I am working with for 2025 forecasts, stretching the continuum of futures from “employers say no to providing insurance” to “employers are all-in.” We should consider various futures in light of health insurance costs and current controversies which make forecasting all the more mind-bending and creativity-demanding.

I’ll leave you with the last paragraph of the Health Affairs article on this annual report, which gives us an important nugget for futures planning and forecasting:

“Although there is uncertainty about the future, expectations are that the traditional economic and demographic drivers of health spending will lead to the return of health care accounting for a larger share of the economy.”

Thank you FeedSpot for

Thank you FeedSpot for