At this year-end time each year, my gift to Health Populi readers is an annual “TrendCast,” weaving together key data and stories at the convergence of people, health care, and technology with a look into the next 1-3 years.

If you don’t know my work and “me,” my lens is through health economics broadly defined: I use a slash mark between “health” and “care” because of this orientation, which goes well beyond traditional measurement of how health care spending is included in a nation’s gross domestic product (GDP); I consider health across the many dimensions important to people, addressing physical, mental health, social health, appearance, and financial health.

Thus, divining the TrendCast right here, right now for U.S. patients – consumers, caregivers, health citizens all – is a tough nut to crack. While I have mature chops in forecasting, futures work, and scenario planning, the uncertainties as of late December 2024 can feel like they overwhelm and outnumber the certainties, and wild cards abound.

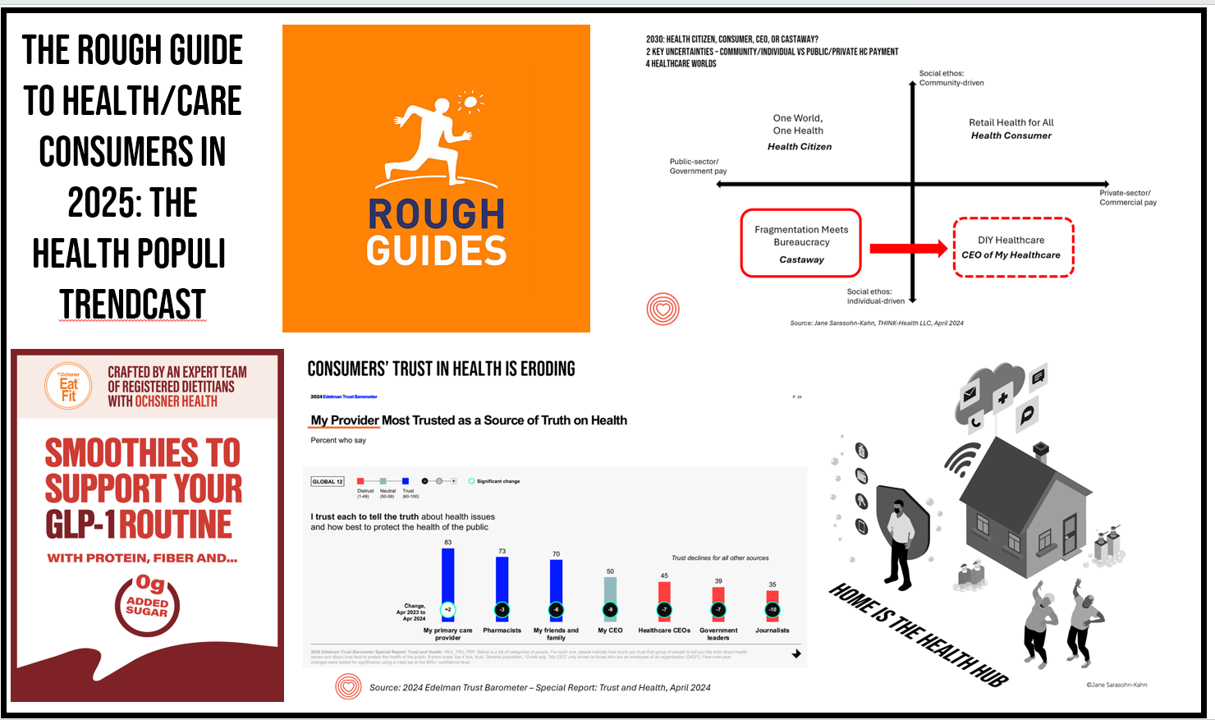

So with the intention of measuring twice and cutting once, I’ll set up our context sharing scenario planning work I did collaborating with AHIP earlier this year. I generated four scenarios on health care consumers in 2030; the four alternative futures looked like this:

As we enter 2025, my view for the next 1-3 years is that people in America feel like they live in the lower left matrix: where fragmentation meets bureaucracy, as health care “castaways.” Some folks with cash in the bank and access to care might feel like the CEOs of their healthcare if they are fortunate.

But for the next year, my lens focuses on the southern part of the graph where the social ethos tends toward the individual versus the community. This is not what I would wish for: we economists talk about the normative versus the positive – that is, what we might prefer or see as ideal versus what is based on data and observation. Here, we are in the mode of listening to the data-tea-leaves for the next year of uncertainty.

Thus, I turn to the Rough Guide as a lens on this 2025 TrendCast.

Why “The Rough Guide” reference?

This time around, I’m inspired by one of my favorite travel book series, The Rough Guides, to find the voice for this year’s TrendCast. That’s because, in the words of the title’s self-description, Rough Guides has been, “inspiring independent travelers since 1982…. synonymous with practical travel tips, quality writing and its trademark blend of honesty, humor and expertise.”

It’s with that independent voice I’ll use to describe the health/care consumer of 2025 – as an “independent traveler,” delivering the data with stories that I hope embed expertise, honesty, and engagement.

What we-know-we-know about health/care consumers in 2025 (the certainties)

Start with the patient-as-consumer and payer for health care.

Consumers are entering 2025 with value and values front-of-mind: Walmart’s fastest growth in the discounter’s customer base is among affluent people, and it was the economy (namely, inflation and prices) that ranked highest in U.S. voters’ minds in the 2024 elections.

The value+values-oriented consumer is playing out across everyday peoples’ budgeting, shopping, and spending behaviors: and that includes the broad category of health/care. Put on a health-consumer hat and how s/he might define “value-based care” in the eyes of being a consumer, a caregiver, a patient, and a health citizen. “Value” can embody a combination of convenience and time-saving, accessibility, respect in the process, outcomes realized, and to be sure, cost (specifically, a person’s out-of-pocket costs – what comes out of their own wallet).

Cost ranks highest in all U.S. consumers’ minds at the start of 2025, Gallup told us in its latest read on Americans’ most urgent health care problems – above access and quality of care. This is true not just for the uninsured who lack health insurance, but people with insurance who feel under-insured. These folks tend to be employed by companies sponsoring private/commercial health insurance; and even with a health plan, workers can feel “stuck,” The Commonwealth Foundation found, dealing with financial stress and feeling neglectful of their mental health.

Increasingly, as people pay more out-of-pocket and realize they are doing so, they grow “consumer muscles” to learn more about quality/outcomes reported by a hospital or clinic, the qualifications of doctors (say, a heart or brain surgeon), availability of appointments, and other patients’ experience ratings (reported on, say, Yelp, HealthGrades, patient social networks, along with many other social networking channels). While not every aspect of medical care is shoppable, many factors are research-able and in doing so, bolsters a person’s health literacy and empowerment.

Entering 2025, those social networks and community conversations reveal patients’ and families’ anger about claims denials – with the unthinkable event of the murder of a UnitedHealthcare executive on the streets of Manhattan.

Prior to the event occurring, we might have classified this as a “wild card” event in scenario planning exercises; now that sort of event shifts into the category of “uncertainties,” as it is now part of our real lives, not imaginary theoretical exercises.

In my book HealthConsuming, I quoted Esther Dyson, long-time investor and do-er in making health care better: she told me that, “people should own and not rent their health.”

Fast-forward to a trend identified for 2025 by the team at Mesh Digital they call the era of health ownership. They write, “Patients are more engaged in their health than ever before…with a growing awareness of the impact of lifestyle choices on overall well-being, individuals are taking proactive steps to manage their health.”

As such, my lens here frames the health/care consumer for whom medical bills and workflows feel like retail – and thus, I have expanded my use of the phrase “retail health” beyond the pharmacy and traditional use of the term to cover patients’ responses to the scenario – as someone feeling cut-off or fragmented away form a streamlined health care “system.” As my long-time friend and colleague in the field, J.D. Kleinke, titled his book from 2001 Oxymorons, we have lacked system-ness in U.S. health care for decades.

Now, mainstream patients get the concept, hitting their pocketbooks, household budgets, plans to marry and have children, ability to afford a mortgage, and a re-set of visions for The American Dream.

The concept of avoiding care, which I have termed “self-rationing” for many years, will continue to be part of peoples’ healthcare workflows in 2025. Here you have the latest data from The Commonwealth Fund detailing cost-related problems for people who were under-insured or lacked continuous coverage – resulting in not filling prescriptions, skipping recommended tests or treatments, avoiding seeing a doctor when sick, or not getting specialty care when needed.

Whether postponing, delaying, avoiding care, splitting pills or abandoning prescriptions, choosing to opt-out of getting some form of care or medical product is a mainstream consumer health behavior. We had a flavor of this in the midst of the COVID-19 pandemic as medical distancing kept patients away from their usual care, and continuing in the many months following the worst of the pandemic once vaccinations bolstered public immunity.

But the self-rationing care rationale continues to be cost, then convenience and access.

DIY health/care supplants some self-rationing and pivots then to self-care

Self-rationing or eschewing traditional medical care channels and choices are being supplanted by some consumers with other forms of self-care: through several DIY segments for care and well-being such as food (-as-medicine and for specific benefits), sleep, beauty and grooming, travel and medical tourism, among other DIY life-flows.

This year, Circana, a company that works with consumer goods companies and retailers, researched how U.S. connected consumers were taking charge of personal wellness. Increasingly, retailers and consumer products purveyors are meeting patients-as-consumers where they want to be met: at grocery stores, in retail channels (both brick-and-mortar and ecommerce), direct-to-the-home, and across the omnichannel.

Circana learned that most consumers are prioritizing mental health, social health, weight management, and lifestyle choices, with 3 in 5 people also focused on bolstering energy – a category that fast-grew in the COVID-19 era.

The category of food, for example, is a major focus for most consumers related to their health, medical conditions, and overall well-being. Among a huge amount of research I considered in 2024 for my client work was an informative study from IFIC, which perennially surveys consumers on their health goals related to food and nutrition.

We see boosting energy a top priority for consumers keen on food-as-personal-medicine, along with aging well, weight loss support, gut health, and heart health, among many other goals when going food shopping and sourcing.

The food-driven wellbeing micro-economy is really a global phenomenon, researchers at Kantar have observed. See Kantar’s “big four” growth areas consumers live out for self-care – including daily nourishment, restoring and replenishing, unwinding and relaxing, and taking time together – that all-important and increasingly recognized social health/connections driver of health.

Consumers who DIY health and self-care are leveraging technology in greater numbers. We’ve seen a strong uptake of wearable technologies, especially smartwatches with multiple sensors for health and well-being (e.g., the Apple Watch) since the start of the pandemic. Data from the Consumer Technology Association (CTA) reminded us that some digital health technologies would be popular gifts for the 2024 winter holiday season, and we’ll see more innovations in this category at #CES2025 in January 2025.

Consumers value quality and affordability for health care, and are adopting digital tools and services in their healthcare workflows. A plurality of consumers is already using patient portals to access their electronic health records at the sites of hospitals and labs, along with adopting apps for tracking fitness and exercise, and accessing telehealth and virtual care platforms for meeting up with physicians and therapists.

It’s not just younger patients and consumers who are finding value purchasing and sticking with using digital health tools. AARP has been watching the uptick of people 50 years of age and older leveraging digital health innovations. “Technology adoption continues as older adults integrate tech into daily life,” AARP notes in its discussion of the association’s 2025 Tech Trends annual report.

See that using digital tools for tracking health and fitness is a priority for older people, along with tech-driven fitness classes, medical care, telemedicine, mental health, and chronic care management, AARP discovered.

AI is part of health/care technology, as consumers overall have a concerned embrace of the concept as it is getting quickly embedded into clinical and administrative workflows in healthcare and medical settings – as well as in consumer-facing digital health tools for sleep, nutrition, fitness, and DTC mental health.

Omnichannel comes to health care, from hospital to retail to home

DTC advertising is unique to the U.S. health care landscape and plays a major role in informing patients and people about the launch of new medicines and, more generally, non-branded content that can educate people on health conditions and prevention.

DTC has come to services and products in other ways, in 2024 especially through the hockey stick-growth in adoption and use of the GLP-1 medicines and anti-diabetic products. On the prescription drug front, Eli Lilly pioneering a DTC channel for consumers to access their product, Zepbound, directly from the manufacturer – a novel approach for a pharmaceutical company to implement via their LillyDirect platform.

On the retail health DTC front, Hims & Hers launched a GLP-1 strategy going directly-to-consumers for compounded medicines during the drug shortage for GLP-1s.At the end of 2024, we see the decline of Walgreens’ primary care brick-and-mortar operation, Village Medical; Kroger’s proposed merger with Albertsons’ faltering under FTC and regulatory pressure; CVS Health struggling with areas in company’s vertical integration strategy, among other major health care strategies in the retail health category in question.

At the same time, more health systems are moving outpatient and community health care services closer to people’s homes, growing telehealth programs and omnichannel options for care, and grocery stores expanding their health/care offerings, from the pharmacy to nutritionists, food-as-medicine, check-ups and vaccinations, and medication management (e.g., Hy-Vee, the grocery chain which garnered top designation as Pharmacy Innovator of the Year in 2024 by Drug Store News for affordable, convenient care).

Another creative riff on omnichannel and retail health where people live, work, play, pray, shop, and eat was pioneered by Smoothie King – serving up a menu supporting consumers managing weight with GLP-1 medicines. Here, we see the integration of food, medicine, retail, and digital health via an app developed by a nutritionist collaborating with the smoothie company.

How to re-build trust in health/care? We enter 2025 with a more skeptical consumer, across his/her daily touchpoints – with peoples’ trust eroding for institutions with which folks regularly interact: government, media, NGOs, and indeed the health care industry.

Edelman has conducted research into global citizens’ levels of trust for over two decades, finding that peoples’ trust with the various segments of the health care industry has eroded in the past several years. By 2024, Americans’ trust in “sources of truth” on health fell to new lows among healthcare CEOs, government leaders, and journalists. The greatest health-trust equity among U.S. health citizens was first and foremost with “my” primary care provider, followed by pharmacists and then family and friends, according to the 2024 Edelman Trust Barometer.

This is what we know for sure entering the world of U.S. health/care consumers in 2025….knowing that trust is a key enabler of peoples’ engagement with stakeholders in health.

What we-know-we-don’t-know about health/care consumers in 2025 (the uncertainties)

We must keep this section brief but comprehensive, so I’m bulleting out critical uncertainties I’ve identified for my clients in 2025 scenario planning work now in process….depending on your segment in or adjacent to health/care, you can pick and choose which of these is most uncertain and most impactful, potentially, to your business, product or service. Some of these are U.S.-specific, and others apply to health care landscapes in other countries.

Pick two of the most viscerally key to your situation, array them on an x-y axis, and you create four future scenarios to consider for your 2025 planning toolkit.

Some key uncertainties for 2025 in my own 1-3 year toolkit are based on the changing leadership in the White House in 2025; on a macro health policy basis, what will President Trump’s health care cabinet, other cabinet members adjacent to health and well-being, and the Executive Branch’s overall value-set mean for patients, consumers, caregivers, and health citizens?

Specifically, consider…

• The structuring of Medicare in a Trump administration, thinking through the history and businesses of Dr. Oz, especially with respect to Medicare Advantage among other Medicare impacts on financing and care delivery .

• The structuring of Medicaid – expansion or shrinkage at the State level, work requirements, etc.

• Employers’ ongoing commitments to sponsoring health insurance – watch for the impact of tariffs on certain business sectors which may have negative impacts on profit margins, ability to invest or meet payroll and provide for health care benefits.

• Impact of immigration and foreign-born supporters for caregiving – for both childcare and eldercare, and for industries adjacent to health/care benefiting from this source of labor.

• Retail pharmacy deserts – what comes next for the retail pharmacy sector related to patient-consumer access to medicines and other retail health services.

• Privacy and cybersecurity – how will these impact health sector spending, consumer trust, and patients’ willingness to share data?

• Consumer confidence and trust in health care….will 2025 move the needle in one direction or the other? (We highly anticipate the 2025 Edelman Trust Barometer due out in January 2025 and subsequent detailed dive into the Barometer’s health findings).

The role of wild cards

Wild cards are the factors that you don’t-know-you-don’t-know, but can imagine – and if they play out in your marketplaces or in the larger world, can blow your forecast(s) to smithereens, requiring a pivot (at a minimum) or a re-imagining of the future(s). I’ll leave these up to your own imaginations, but do keep them in mind for future reference when you just might have to call on them in “thinking the unthinkable” mode.

An obvious area to put in the wild card parking lot is a medical disaster occasioned by an AI error with an algorithm or clinical mis-application. We exit 2024 with knowledge that a patient’s family is suing an insurance company as a result of an AI-‘informed’ claims denial. So keep AI tucked into both uncertainties in various ways, as well as potential wild card possibilities.

Wishes: play well and often, and love thy neighbor and thyself

Consumers, as it turns out, have a lot in common – notwithstanding the fractious behaviors portrayed in media, sometimes on the street, and in voting booths around the world.

Nielsen’s Outlook for 2025 revealed that, in their words, “even in a polarized world the world’s top values are stable and generally widespread across countries.” As we conclude this annual TrendCast as the Rough Guide to Health Consumers in 2025, we turn to Nielsen NIQ for an optimistic lens on people as global citizens, and in this instance, U.S. health citizens.

While we have the contours here of a Rough Guide on health/care consumers in the New Year, we hope for the best….always. As we consider ourselves as health citizens, we have the opportunity to embrace public and community health, inclusiveness for care and equity, and engaging in civic/civil engagement whether voting in national or local elections and being involved in health policy baked into all policies.

Wishing everyone well on your individual and collective journeys in 2025. Here’s to great love and joy in your life, time enjoyed in nature, creative flowing juices in whatever creative flows you enjoy, and time to be still…

Yours in health, joy, peace, and love….Jane S-K

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for