Non-clinical goods and services can comprise $1 in $5 of net patient revenue in the U.S. health care economy, research from LogicSource gauges.

The possible tariffs proposed by the next U.S. President could drive those costs up, eroding financial margins in many parts of American health care — from hospitals to drug companies and med-tech innovators.

Simply put, “President-elect Donald Trump’s pledge to enact across-the-board tariffs isn’t going over well in the health care industry,” POLITICO reported.

Why worry about tariffs’ impacts on health care?

Ask the CFO of Reckitt, Shannon Eisenhardt, who spoke with a team from Bloomberg in one of the company’s factories operating in Taicang, China. Eisenhardt told the reporters that Reckitt was also increasing the company’s investment (at over $40 million) in Shanghai for an R&D center.

As Eisenhardt well understands, in the words of the Bloomberg coverage, “Trump’s tariffs could put the company at a disadvantage” versus other companies operating in their consumer health and home care categories.

As an undergraduate student at the University of Michigan I got a degree in (macro)economics before I went to grad school at U-M to focus on health economics and public health.

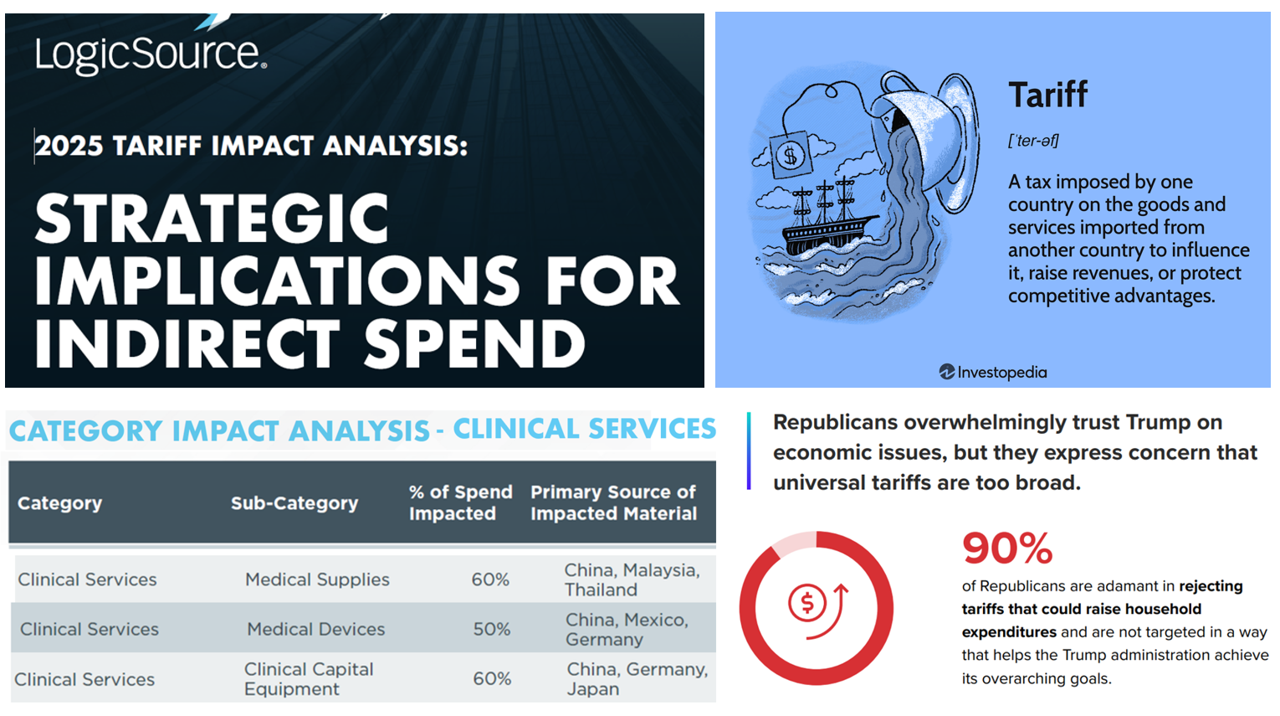

We learned in Econ 101 what tariffs are: simply put, a tariff is a tax imposed by a country on the goods and services imported from another country.

Tariffs usually have unwanted or unintended side effects — typically, raising prices on goods and services that use the tariffed products in the production or delivery of their finished goods (such as pharmaceutical products or medical devices) — or services, as would be the case for health care providers and systems.

In the landscape of health care, then, we are concerned about tariffs’ impacts on the costs and supply chains of clinical supplies and equipment, stuff we spend capital and operational dollars on which include a portfolio of things from disposable supplies to pacemakers and digital imaging equipment, along with raw ingredients for medicines.

LogicSource’s 2025 Tariff Impact Analysis report published today assesses the potential tariff implications for several U.S. industries including distribution and logistics, information technology, packaging, construction and capital, facility management, corporate services, and clinical services — the focus of this post.

FYI, LogicSource helps organizations procure the goods and services they need to transact their business. The company is active in the health care vertical, responding to the fact that non-clinical spending is an overlooked and potentially high-impact category in a hospital’s budget. LogicSource estimates that over 20% of a health systems’ net patient revenue goes to non-clinical goods and services.

And tariffs can impact that health care industry spending.

The chart above details the three categories under the clinical services umbrella: medical supplies (such as disposables — think PPE whose supply chain was dramatically disrupted from the start of the COVID-19 pandemic), medical devices (like orthopedic implants and pacemakers), and clinical capital equipment (such as digital imaging equipment and ultrasound devices).

At least 50% of these products’ spend in U.S. health care would be impacted by tariffs, LogicSource calculates in its report. The primary geographic origins of the impacted products or materials subject to tariffs would be China, Malaysia, and Thailand for medical supplies; China, Mexico, and Germany for medical devices; and, China, Germany, and Japan for clinical capital equipment.

How to manage these risks? LogicSource offers five mitigation strategies which can be useful for health care providers, research and development organizations, and other stakeholders dealing with clinical supplies, devices, and big-iron capital equipment.

Consider one of these strategies to get your mind thinking aobut implications for your own health care industry segment or stakeholder group. Take exploring alternative sourcing.

A good recent example and role model for this would be how a group of U.S. hospitals experiencing drug shortages came together to explore alternative sourcing as well as expand their supplier network. This project resulted from that first strategy, “prioritizing critical needs,” which was the lack of access to critical medicines.

The role model here is the collaborative venture of Civica Rx, bringing together many hospital systems and some government stakeholder observers. Created “by hospitals, for hospitals” in 2018, the organization currently channels nearly 80 essential (generic) medications to some 1,400 member hospitals.

Health Populi’s Hot Points: “Hospital and pharmaceutical groups have said previously that tariffs could deepen financial stress on health systems and hamper pharmaceutical innovation,” according to an article published in POLITICO in November 2024.

It wasn’t that long ago that the U.S. had to deal with the exogenous shock not of tariffs, but of supply chain shocks in the COVID-19 pandemic hitting PPE — a new acronym many of us learned in early 2020.

The exogenous shock of tariffs on clinical services and supplies would affect the broad health care ecosystem.

I show you the Civica Rx member organizations here to illustrate how mitigating risks (whether due to tariffs or other risk factors on supply chains, labor markets, and pricing) can be optimized through working together across organizations and, when possible and relevant, across industry segments or silos. See here that the Civica community includes large academic medical centers and systems, more rural organizations, faith-based institutions, et. al.

As we continue to navigate uncertainties in health care and more macro economic and trade policy, we would be wise to hang together as an ecosystem all in patient care as a health/care community — that rising or falling tide impacting all of our boats.

That includes health citizens and consumers, who appear wary of tariffs overall. A poll from the Consumer Brands Association and Morning Consult assessed Republican voters in the U.S. asking people about their perceptions of tariffs (the survey fielded in late November-early December 2024).

While 70% of Republican voters felt “very favorable” toward the president-elect Trump, 90% of Republicans were strongly against tariffs that were not focused on lowering prices for U.S. householders.

So here’s another issue that can bring health consumers and citizens together….

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for