The nature of retail pharmacy is changing, with both threats and opportunities re-shaping the business itself, and the pharmacy’s role in the larger health/care ecosystem. To keep sharp on the topics, I attended Rx Market Insights: Performance Trends and Outlook for 2025, a data-rich session presented on February 18 by IQVIA and sponsored by Ascend Laboratories. The webinar was hosted by DSN (Drug Store News), appropriately so because the action-packed hour went into detail providing the current state of prescription drugs and the pharmacy in America.

Doug Long, IQVIA’s VP of Industry Relations, and Scott Biggs, the company’s Director of Supplier Services, teamed in the presentation taking on the landscape of issues shaping the U.S. pharmacy marketplace (generic and branded products, generics), new product launches, drug shortages and challenges with inspections, retail pharmacy channel performance, an important cough-cold-flu update, and many lenses on GLP-1s.– on which I’m going to focus this post to make a larger point about DTC- and retail, consumer-directed health.

The topline of the story is that the U.S. pharmaceutical market grew 8.8% in 2024, to $348 bn.

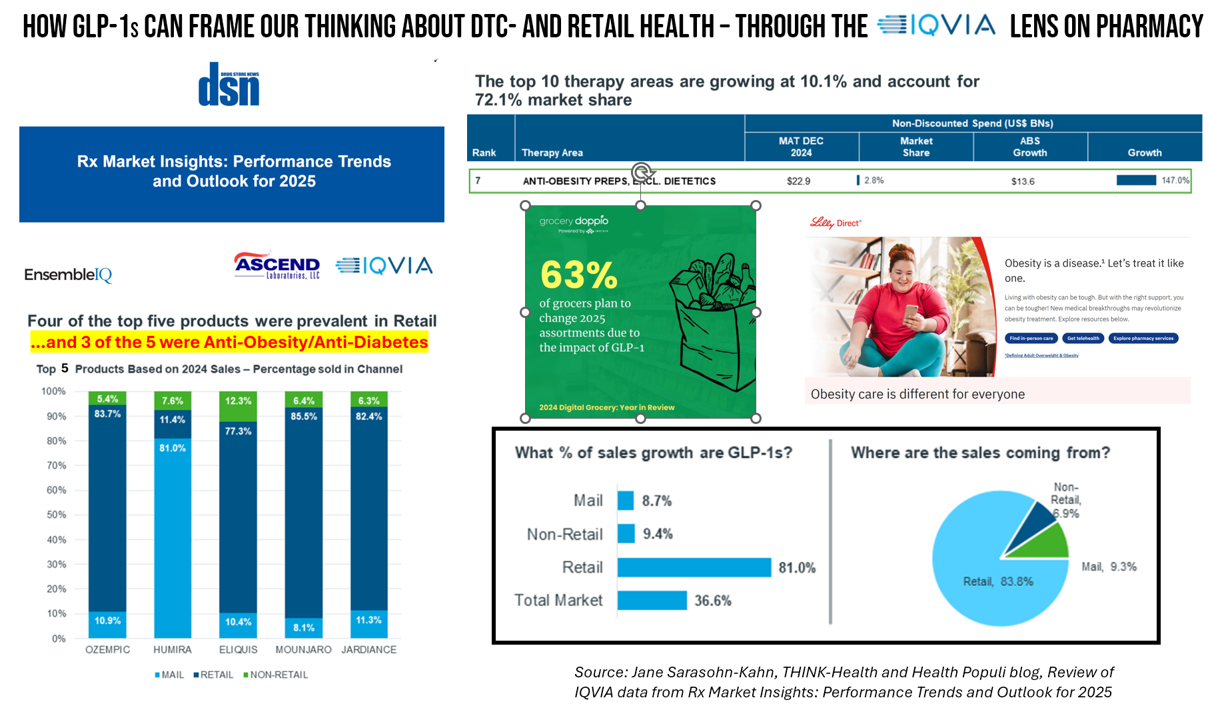

While immunology therapies ranked first in spending, the fastest-growing therapy area by far was anti-obesity (excluding dietetics) — growing by 147% in 2024.The next-fastest growing Rx category were the oncologics, increasing by 17.2% in the year.

Anti-obesity drug sales led both long- and short-term growth among the top ten retail therapies by sales in terms of 2019-2024 5 year compound annual growth.

Now, consider the top-ten Rx products for the total U.S. market — Retail, Mail, and Non-Retail — between 2023 and ’24: these were,

- Ozempic

- Humira

- Eliquis

- Mounjaro

- Jardiance

- Keytruda

- Stelara

- Skyrizi

- Dupixent, and,

- Biktarvy.

Four of the top five of these were prevalent in Retail: Ozempic, Eliquis, Mounjaro, and Jardiance.

And 3 of these fell into the anti-obesity and anti-diabetes category — Ozempic, Mounjaro, and Jardiance. Of these, Mounjaro had the fastest-growth rate over the year of 82.6%, then Ozempic with 31.7% sales growth and Jardiance at 28.9%.

Now consider the Retail Rx channel: based on IQVIA’s updated December 2024 data, the GLP-1s grew 37% during last year.

And, 81% of all Retail pharmacy sales growth came from….GLP-1s.

Health Populi’s Hot Points: Last year, I wrote here in Health Populi about a study from Grocery Doppio on the state of digital grocery, which had a discussion about the impact of GLP-1 medicines on U.S. shoppers’ grocery baskets.

As the chart here notes, the study found people curating “lower basket (spend), healthier assortments.” GLP-1-using consumers were leaning into protein, meal replacements, and healthy snacks, shunning salty snacks and sweets, baked goods, and sugary beverages.

The IQVIA discussion mentioned this study in noting that, “The GLP-1 category of drugs is affecting both sides of the pharmacy counter.”

The GLP-1 Rx therapy category index high on medicines that tend to be more consumer-driven and -demanded (in terms of personal spending) compared with other drug categories. Note the launch of LillyDirect as an example of a branded, regulated pharmaceutical company going direct-to-consumer (DTC) beyond advertising to provide a service platform focused on obesity and weight management. The platform is a digital on-ramp for consumers seeking in-person care, virtual care via telehealth, and pharmacy services.

The channeling of GLP-1 medicines via telehealth has come under criticism, most recently in the context of the Hims & Hers commercial that aired during the Superbowl LIX promoting the company’s compounded therapy. [For more on that, you can read my post serving up more of that context and controversy].

A poll conducted among 2,000 U.S. physicians for Omada Health by Sermo recently looked into doctors’ views on how GLP-1s would be best delivered to patients. [The research was fielded between December 30, 2024 and January 7, 2025].

In a discussion about the physician survey, the President of Omada Health, Wei-Li Shao, told Fierce Healthcare that, “We believe that the decision to start, stop, or continue a GLP-1 should be made in the medical home — between the patient and their primary care physician.”

The concept of the “medical home” has been defined by the American Academy of Pediatrics as,

“An approach to providing comprehensive and high quality primary care….that is accessible, family-centered, continuous, comprehensive, coordinated, compassionate, and culturally effective.”

AAP also notes that a medical home, “is not a building or place, extending beyond the walls of a clinical practice. A medical home builds partnerships with clinical specialists, families and community resources. The medical home recognizes the family as a constant in a child’s life and emphasizes partnership between health care professionals and families.”

In the eyes of patients, especially turbocharged in their pandemic experience, many people have repurposed their homes for health, medical care, and well-being. In the eyes of some patients who feel especially empowered and health-bent, the medical home might be the family home.

This is the challenge and opportunity we will be facing in a market-based reformation of health care in the U.S. in the coming months or years: will we be re-defining the “medical home” as the patient-consumer’s actual home? Or will we see greater shared decision-making and locus for care between patients and physicians which is the Holy Grail of participatory health and Medical Home 1.0?

Welcome to one of our front-of mind scenario planning exercises for 2025-2030…..and beyond…..how DTC-health care may play out in America under a Trump Administration and health care cabinet leaders, potential fragmentation of State-level health care (think: Medicaid and ACA erosion), and a greater emphasis on the patient-as-consumer for self-care and financial risk for health care shopping and spending. On that point, IQVIA reported that cash, discount cards, and Medicare Part D gained share in weight loss GLP-1s — with discount card use a patient workflow for health care shopping behavior.

The GLP-1s give us a lens on DTC and retail health given how the category has already begun to reshape sectors adjacent to and outside of health care, from apparel and consumer goods, travel and hospitality, retail, and of course, the grocery store and food manufacturers. We can expect the sales growth to continue with additional indications being proven out for the therapies for sleep apnea, kidney disease, liver disease, addiction, as well as Parkinson’s and Alzheimer’s Disease.

Postscript update 22nd February 2025: If you’re watching the GLP-1 market, you know the medicines are re-shaping the entire macro-economy. And that particularly impacts the investment community.

Here we see the sharp decline — understated adjective here — due to the FDA taking GLP-1s off the “emergency shortage” list — which then dis-allows compounding of the drug, which was Hims & Hers’ on-ramp to the category.

When it comes to monitoring this marketspace, my strong advice: “don’t blink.”

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for