U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points.

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points.

First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008.

Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members.

Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is higher than economists had previously forecast. Costs from hospital care were the largest component of consumer health care spending. Health care costs are expected to grow in 2014, Avalere Health expects, due to higher cost technologies and treatments.

A second pivotal U.S. consumer data point bolstering the health economy is that Americans’ spending on goods was quite weak at the beginning of 2014. Some analysts attribute this to bad weather’s impact on retail shopping in the first quarter (that is, Mother Nature’s Snowmageddon aka the Polar Vortex). However, consumers’ spending on services was very strong, growing 3.7% over one quarter. This was attributed to consumer spending on health plans approaching the deadline to enroll in health plans via the Affordable Care Act’s (ACA) Health Insurance Exchanges, according to Capitol Economics.

Health Populi’s Hot Points: While health care costs have slowed overall in the U.S. in the past year, the jury is out on whether the ACA and Obamacare are directly attributable for that slowdown. Health costs are still rising faster than general economic inflation, and consumers — enrollees in health plans, both those long-enrolled through employer benefits and newly-enrolled people — are facing more out-of-pocket costs for premiums, copayments and coinsurance. The advent of consumer-directed health plans coupled with health savings accounts (HSAs) has ushered in the era when health plan enrollees must assume the mantle of being, truly, health care consumers. Donning that hat means becoming a health care shopper and all the retail behaviors that implies: comparing choices, prices, product and service attributes.

Health Populi’s Hot Points: While health care costs have slowed overall in the U.S. in the past year, the jury is out on whether the ACA and Obamacare are directly attributable for that slowdown. Health costs are still rising faster than general economic inflation, and consumers — enrollees in health plans, both those long-enrolled through employer benefits and newly-enrolled people — are facing more out-of-pocket costs for premiums, copayments and coinsurance. The advent of consumer-directed health plans coupled with health savings accounts (HSAs) has ushered in the era when health plan enrollees must assume the mantle of being, truly, health care consumers. Donning that hat means becoming a health care shopper and all the retail behaviors that implies: comparing choices, prices, product and service attributes.

It’s a fact that consumers’ spending on health services grew in the past six months. It’s not a fact that health consumers universally behave yet in rational shopper ways the way people do for preparing to buy a car or a washing machine. The role of transparency in health care is critical, and it’s early days.

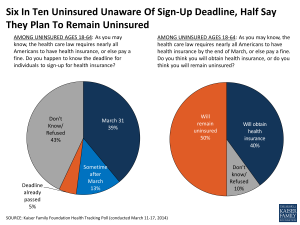

The second (pie) chart from the Kaiser Family Foundation Health Tracking Report of March 2014 illustrates that six in ten uninsured people polled in mid-March (about two weeks before the 3/31 deadline for sign-ups) said they weren’t aware of the deadline, and half of the uninsured didn’t intend to buy insurance — even when told about the penalty fine for not doing so. Over 4 in 10 uninsured people didn’t know that the Affordable Care Act provided financial help to low- and moderate-income people to help them buy health benefits. Is this rational shopping behavior? Those who are making the decision to opt out may or not be aware of the fine involved. Others may be opting out doing the math, calculating that paying the fine is worth the risk of paying for health care out-of-pocket, retail rack rates prices, over the next year. Still other uninsured people who remain uninsured may just not care or want to think about the scenario.

For people who were activated and engaged with the message that there were health benefits available on health insurance exchanges, the ACA’s health plan “metals” of bronze, silver, gold and platinum found most people – 2 in 3 health insurance shoppers – have picked the Silver plans, according to the Obama administration’s most recent monthly enrollment report. Essentially, most newly-insured plan members defaulted to “the middle” when it came to picking a health plan option. A minority picked the cheapest bronze plans, which required much higher out-of-pocket costs to meet a deductible.

My colleague Bob Laszewski who knows the in’s and out’s of health insurance inside and outside of the DC Beltway urges an Obamacare fix of allowing insurance companies to offer plans below the bronze level – allowing even lower priced plans as long as they (1) satisfy the 60% actuarial minimum in the statute, avoiding “junk” plans; and, (2) give consumers the detail to compare the standard Silver Plan to any new offerings — enabling full transparency.

This proposal would help people buy insurance at prices they’re comfortable with: certainly, one dimension of being an empowered shopper.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for