There’s an emer ging health-committed consumer, one of over 70% of people who believe they’re less healthy than the generations who came before them. 9 in 10 consumers overall believe that what you eat impacts how you feel. Those who are health-committed spend 70% of their grocery budgets on healthy products, read food labels, spend more and shop more frequently than low health-committed consumers, according to Healthy, Wealthy, & Wise, a survey report from Dunnhumby.

ging health-committed consumer, one of over 70% of people who believe they’re less healthy than the generations who came before them. 9 in 10 consumers overall believe that what you eat impacts how you feel. Those who are health-committed spend 70% of their grocery budgets on healthy products, read food labels, spend more and shop more frequently than low health-committed consumers, according to Healthy, Wealthy, & Wise, a survey report from Dunnhumby.

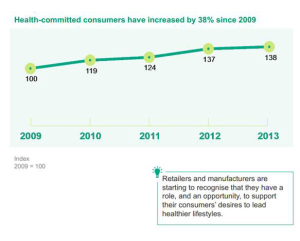

T he number of health-committed consumers globally grew by 38% since 2009. Most consumers look first to themselves to drive health, then to doctors, and third to food companies and retail grocers, shown in the second chart.

he number of health-committed consumers globally grew by 38% since 2009. Most consumers look first to themselves to drive health, then to doctors, and third to food companies and retail grocers, shown in the second chart.

The U.S. has the largest concentration of health-committed consumers across nations studied by Dunnhumby, who looked into what consumers believe can improve their health. The two top factors cited were exercising regularly and eating plenty of fresh fruit and vegetables. Lower on the priority list of what consumers believe improves health were reducing sugar consumption, controlling calories consumed, reducing saturated fat, increasing fiber in the diet, reducing processed foods, reducing salt and sodium intake, controlling the amount of meat eaten, reducing alcohol, and increasing protein.

One-third of consumers say there are “major” barriers to them leading a healthy lifestyle. Even the most health-committed consumer encounters barriers to leading a healthier lifestyle: cost is the #1 barrier, cited by 70% of consumers who say healthier foods tend to cost more. Other barriers to healthy living are difficulty in changing unhealthy eating habits (for 37% of consumers), insufficient time to cook healthy foods (34%), lack of available healthy foods where people normally shop (30%), and 30% of people also saying that healthier foods don’t taste as good as unhealthy ones.

Dunnhumby calculates that health-committed consumers are more valuable to businesses than people with lower health-commitment levels. To capture the patronage and business of health-committed people, Dunnhumby polled consumers on various promotions that people would value to help them change poor eating habits: these included coupons/discounts on healthy products, new product alternatives that were healthier choices, suggesting healthier alternatives, information on how healthy current food choices are, suggesting healthy eating plans based on consumer food preferences, information on how balanced one’s diet is, advice from nutritionists on healthy living and eating, services to help track calories, on-site pharmacies, and on-site health clinics.

Dunnhumby’s Global Trends Unit mined the company’s database covering over 660 million consumers in 18 countries in the Americas, Europe, and Asia. The report was published in October 2014.

Health Populi’s Hot Points: Food = health in the eyes of people, who are increasingly looking to themselves and their community touch-points to partner in health versus looking to the government. The most important community touch-points in this regard are the personal physician, food manufacturers, and supermarkets. Interestingly, as the second chart shows, restaurants are less relevant in the HealthcareDIY world, with more health-committed people looking to cook at home, source foods closer to home, and control quality ingredients in what’s on their and their families’ plates.

It’s important to note that big barrier of cost in the eyes of consumers: how can trusted partners in the community help people deal with the perceived cost of living well? One current example is Whole Foods, whose brand has evoked the nickname “Whole Paycheck” in certain consumer circles. Whole Foods is dropping (some) prices and strategically setting its sights on the quality-food spectrum, not boutique high-priced artisanal food segment. Whole Foods execs explained this strategic repositioning during its November 5 2014 conference call with industry analysts.

Couponing will continue to be strong in the consumer post-recession era, and especially in health care for over-the-counter products and prescription drugs and Rx access programs in the specialty drug segment. And don’t forget, we’ve entered the Walmart era where $40 becomes the new price for a consumer-driven primary care visit to a Walmart clinic. Will this drive primary care visit prices down the way the $4 generic prescription did for the Rx? That’s in one of my scenarios I’m developing with my clients for 2015-20.

The list of promotions cited by Dunnhumby is spot-on in the emerging era of retail health for whole health as Americans continue to project-manage their approach to using high-deductible health plans, managing out-of-pocket payments for health care services, and substituting self-care when they can to preserve financial wellness and total health.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,