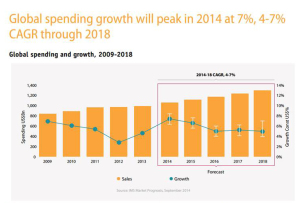

The U.S. leads in pharmaceutical drug spending. Global growth in pharmaceuticals will spike in 2014, according to the IMS Institute on Healthcare Informatics report on global pharma spending. The U.S. spends more per capita (per person) than any nation in the study, at about $1400 US dollars expected in pharmaceutical spending in 2018, owing to fewer patent expiries (the end, for now, of the patent cliff) and rising prices (think: specialty drugs like Sovaldi and oncology drugs). The next-biggest spender on Rx will be Japan, at just over $800 per person in pharmaceutical spending in 2018. The “EU5” (UK, Germany, France, Italy and Spain) will be no-growth nations for Rx – note France’s negotiation for lower Sovaldi prices here, striking the lowest cost for the drug in Europe.

The U.S. leads in pharmaceutical drug spending. Global growth in pharmaceuticals will spike in 2014, according to the IMS Institute on Healthcare Informatics report on global pharma spending. The U.S. spends more per capita (per person) than any nation in the study, at about $1400 US dollars expected in pharmaceutical spending in 2018, owing to fewer patent expiries (the end, for now, of the patent cliff) and rising prices (think: specialty drugs like Sovaldi and oncology drugs). The next-biggest spender on Rx will be Japan, at just over $800 per person in pharmaceutical spending in 2018. The “EU5” (UK, Germany, France, Italy and Spain) will be no-growth nations for Rx – note France’s negotiation for lower Sovaldi prices here, striking the lowest cost for the drug in Europe.

A $2.6 bn price tag for a new drug. A new drug brought to market costs $2.56 billion, according to the Tufts Center for the Study of Drug Development. Tufts CSDD has studied the cost of bringing a drug to market for over a decade, calculating that the cost of doing so has doubled over the past 11 years. It cost about $1 billion to product a drug back in 2003. Tufts’ estimate comes from an analysis of 106 products developed by 10 drug companies.

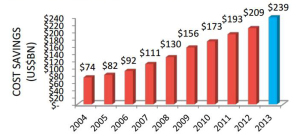

Congress asks: are generics driving health costs up? The Generics industry lobs back. Legislators in the Senate and the U.S. Department of Justice inside the DC Beltway are looking into the cost of generics, which have long been seen has a solution to lowering health care costs in the U.S. This is being done at the urging of the NCPA, the National Community Pharmacists Association, who have seen big cost increases for generics in the past year. Two generic drugmakers have been subpoenaed about collusion, and the Senate Subcommittee on Primary Health and Aging has contacted 14 companies requesting information according to Bernie Sanders (I-Vt) website. In response, the Generics Pharmaceutical Association (GPhA) expanded a communications campaign to explain the benefits of generic drugs including cost savings and safety issues with new data to support its arguments.

Congress asks: are generics driving health costs up? The Generics industry lobs back. Legislators in the Senate and the U.S. Department of Justice inside the DC Beltway are looking into the cost of generics, which have long been seen has a solution to lowering health care costs in the U.S. This is being done at the urging of the NCPA, the National Community Pharmacists Association, who have seen big cost increases for generics in the past year. Two generic drugmakers have been subpoenaed about collusion, and the Senate Subcommittee on Primary Health and Aging has contacted 14 companies requesting information according to Bernie Sanders (I-Vt) website. In response, the Generics Pharmaceutical Association (GPhA) expanded a communications campaign to explain the benefits of generic drugs including cost savings and safety issues with new data to support its arguments.

EHRs help drive generic Rx prescribing. Researchers at the University of Pennsylvania School of Medicine and the Wharton School’s Center for Health Incentives and Behavioral Economics, with the Philadelphia VA Medical Center, found that EHRs can drive generic prescribing. The study looked at four ambulatory care clinics between 2011 and 2012 examining prescribing behaviors for beta-blockers, statins, and PPIs. Where an electronic health record served up information at the point of prescribing on brand name and generic options, physicians tended to prescribe generic equivalent Rx’s more often.

Botox has a new owner. Called “the biggest (M&A) deal of 2014,” the maker of Botox, Allergan, was acquired by pharma company Actavis earlier this week. The $66 billion transaction substantially grows Actavis’s global and clinical reach. The company already has blockbuster products in CNS (central nervous system), Gastroenterology and Women’s Health, and with Allergan’s portfolio adds Dermatology/Plastic Surgery, Neurosciences, and Ophthalmology businesses.

Botox has a new owner. Called “the biggest (M&A) deal of 2014,” the maker of Botox, Allergan, was acquired by pharma company Actavis earlier this week. The $66 billion transaction substantially grows Actavis’s global and clinical reach. The company already has blockbuster products in CNS (central nervous system), Gastroenterology and Women’s Health, and with Allergan’s portfolio adds Dermatology/Plastic Surgery, Neurosciences, and Ophthalmology businesses.

Health Populi’s Hot Points: The pharmaceutical and life sciences industry cannot ignore they are part of the larger health care ecosystem, which is moving from paying for volume to paying for value. The U.S. has been the top consumer of prescription drugs, since such numbers have been measured. With per capita spending growing to the mid one-thousand dollars by 2018, the industry should be quite clear that pharma pricing will be in payors bulls-eyes. With increased transparency facing payors — employers, plan sponsors like government and unions, and increasingly, consumers themselves — the industry’s pricing kimono will be opening up. The seams of the emperors’ clothes will be on display.

These news stories taken together illustrate the growing environment for value in health care, facing both health insurance sponsors and consumers:

These news stories taken together illustrate the growing environment for value in health care, facing both health insurance sponsors and consumers:

- Growing cost scrutiny for both high-priced specialty drugs and generic drug costs, where consumers are facing increasing out-of-pocket payments

- Consolidation in the industry (where size matters for both R&D and portfolio building as well as for marketing muscle)

- The growing role of health data (getting consumer-level data via data liquidity through EHRs, and the role of Big Data and predictive analytics to get consumers more involved in their health care decisions and appropriate utilization).

The industry is trying out new business models, new technologies, and new supply chain tactics to drive more value in R&D, marketing and medication adherence. GSK went public with its piloting of sensor technologies in clinical trials. Genentech’s CEO received an “open letter” from the VHA published in major newspapers and major hospitals have asked Congress to look into the biotech company’s new distribution strategy described in this letter from Genentech to providers. The New York Times covered the story of oncologists having to close doors or throw in with hospitals to bear the high costs of drug acquisitions for patient care. Pharmacy benefit management companies (PBMs) collectively critiqued the FDA for stifling competition and innovation in health.

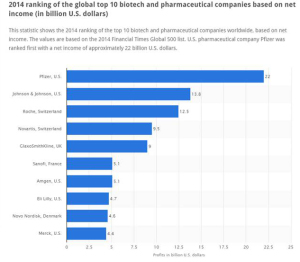

The global roster of Who’s Who in pharma, shown in the fourth graphic (based on data from the 2014 Financial Times Global 500 list), has significantly changed in the past decade. Given the value-forces challenging the industry, the pace of change will be quicker over the next few years. Expect this latest league table from to look quite different by 2020.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a