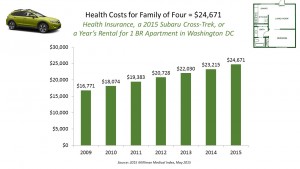

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%.

Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all healthcare costs, beyond the premium and employer’s share.

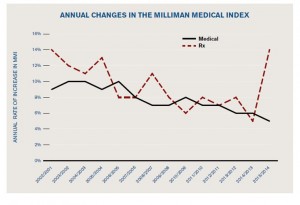

The second graph shows the changes in the MMI for medical and prescription drug costs, illustrating the spike upward in Rx costs in 2015 — equivalent to the drug cost inflation from 2001/2. For more on the topic of 2014-2015 specialty drug cost increases, see Health Populi‘s post on Supersize Rx.

The second graph shows the changes in the MMI for medical and prescription drug costs, illustrating the spike upward in Rx costs in 2015 — equivalent to the drug cost inflation from 2001/2. For more on the topic of 2014-2015 specialty drug cost increases, see Health Populi‘s post on Supersize Rx.

I searched for items that a family might purchase for $24,671 in 2015, and found a new Subaru Cross-Trek available, as well as rent for a year for a one-bedroom apartment in Washington, DC (at about $2,000 a month).

Health Populi has looked at the MMI for many years; you can explore previous MMI’s in these posts, listed by year:

2014 – A Toyota Prius or a Tonne of Tin?

2013 – A College Education, a Diamond, or a 4-Door Sedan?

2012 – Health Costs Exceed $20K for a Family of 4

2011 – Health Costs for a Family of 4 Approach $20,000

2010 – $18,074 for a Typical Family of Four

2009 – $16,771 is the Cost for Healthcare for a Family of Four

2008 – Medical Costs for a Family of Four = $15,609

Health Populi’s Hot Points: The median U.S. household income was $52,250 in 2013, the latest number reported by the U.S. Bureau of the Census. Do the math: pre-tax, health care costs for a family of four would consume about one-half of household income if families bore the entire cost.

Health Populi’s Hot Points: The median U.S. household income was $52,250 in 2013, the latest number reported by the U.S. Bureau of the Census. Do the math: pre-tax, health care costs for a family of four would consume about one-half of household income if families bore the entire cost.

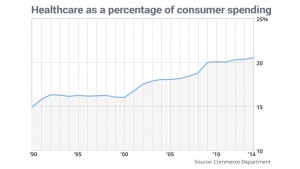

As it stands in 2015, $1 in $5 consumers spent in America went to healthcare in 2014, shown in the graph. That’s spending on health insurance premiums, out-of-pocket cost sharing, prescription drugs and the line-items captured in the National Health Accounts through health care claims.

But people in the U.S. spend another $1.5 trillion on other health-oriented products and services, like vitamins and supplements, gym memberships, nutraceuticals and health-focused foods, complementary medicine, among other line items for which people value spending post-tax dollars. That $1.5 trillion is on top of the $3.2 trillion on health”care” spending. The New Health Economy blurs healthcare and health, where consumers have begun to feel that $1 in $5 flowing out of their pocketbooks and wallets into the health ecosystem.

But at least 1 in 4 people who were insured for a full year in non-group health insurance went without medical care they needed because they could not afford to pay for it, according to FamiliesUSA special report published in May 2015, Non-Group Health Insurance: Many Insured Americans with High Out-of-Pocket Costs Forgo Needed Health Care. The Affordable Care Act has brought people access to health plans via health insurance exchanges, but having insurance is no guarantee that one can afford to access care when needed due to the growth of people with lower to middle incomes being enrolled but forgoing needed medical care due to cost.

But at least 1 in 4 people who were insured for a full year in non-group health insurance went without medical care they needed because they could not afford to pay for it, according to FamiliesUSA special report published in May 2015, Non-Group Health Insurance: Many Insured Americans with High Out-of-Pocket Costs Forgo Needed Health Care. The Affordable Care Act has brought people access to health plans via health insurance exchanges, but having insurance is no guarantee that one can afford to access care when needed due to the growth of people with lower to middle incomes being enrolled but forgoing needed medical care due to cost.

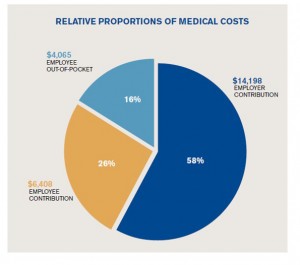

Milliman’s analysis wonders whether some consumers will be “driving” in high-cost Cadillac plans in 2015. The employee responsibility for medical cost sharing in 2015 amounts to 42.5%, shown in the pie chart which splits the proportions of costs between employer and employee contribution + out-of-pocket outlays.

That $10,073 could buy the family a 2006 used Cadillac this week.

Milliman believes the premium for the MMI will probably trigger the ACA excise tax, depending on the rate of growth of health care costs and the size of the employer. People working for smaller employers would more likely be hit by the tax, Milliman forecasts.

The bottom line: thus far, the ACA has not significantly reduced health care costs, and trends are increasing — largely driven by specialty pharmacy spending. Thus, the Cadillac tax could loom by 2018 for some workers enrolled in high-cost health plans particularly in smaller companies.

Thank you FeedSpot for

Thank you FeedSpot for