When I clipped you to my underwear for the first time in 2011, I’d no idea that you were about to change my life, health and mindfulness. You were my first digital activity tracker and since then, I’ve purchased three versions of you…as well as others. Fitbit, you really did change my life and help me become more mindful of my activity, my calorie burn, ultimately supporting me in losing weight and keeping it off.

When I clipped you to my underwear for the first time in 2011, I’d no idea that you were about to change my life, health and mindfulness. You were my first digital activity tracker and since then, I’ve purchased three versions of you…as well as others. Fitbit, you really did change my life and help me become more mindful of my activity, my calorie burn, ultimately supporting me in losing weight and keeping it off.

Since its launch in 2009, the brand name “Fitbit” has become synonymous with digital activity tracking, the most popular digital pedometer on the market — whose functions now go well beyond “pedometer.” But that’s the on-ramp for most consumers who begin tracking their steps, and when a U.S. health citizen considers laying out $50 to $100 on such a gadget, 3 in 4 buy a Fitbit (based on retail sales data from NPD).

So Fitbit is, today, the best-known brand of wearable — except, perhaps, for the Apple watch — but Fitbit’s price point is much lower.

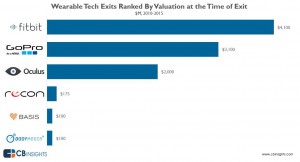

The company’s Initial Public Offering was valued around $3 bn, and came out over $4 bn. Isn’t it nice to dominate a category like consumer wearables?

There are several models of Fitbit devices available beyond the first “vanilla” step tracker, ranging from entry-level Zip (priced around $60), moving up to the One, Flex, Charge, and Surge (priced about $250) which is more akin to a smartwatch with heart rate function, GPS and text message notifications.

There are several models of Fitbit devices available beyond the first “vanilla” step tracker, ranging from entry-level Zip (priced around $60), moving up to the One, Flex, Charge, and Surge (priced about $250) which is more akin to a smartwatch with heart rate function, GPS and text message notifications.

I wrote about Fitbit and other popular fitness wearables as a Mother’s Day gift in 2013, and noted countless Sunday pre-print newspaper ads during the 2014 holiday season for wearable trackers available at Big Box, discount stores, and pharmacies. Some stores offered trade-ins of used devices for a credit (see Hot Points, below, for more on abandonment of trackers).

Fitbit has crossed the consumer chasm from health to health/care: Oscar, the newfangled health plan, offers it as a wellness tool, peer-reviewed journals feature research articles that have incorporated Fitbit devices into heart rehabilitation work, and TD Bank gifted Fitbits to customers opening new savings accounts in the 2015 New Year.

Health Populi’s Hot Points: The $4+ bn begs the question: irrational exuberance, or sober, sound long-term investment? An IPO really isn’t about that long-term if we’re honest: it’s about capitalizing on our best information at the time of the offering. And this week, it seems, investors are hot on Fitbit.

But there is much to consider over the longer term. I asked another fundamental question in The Huffington Post in January 2014 – Do people really want to tech their way to health? Since I wrote that column 18 months ago, one important consumer survey data point has emerged: that most U.S. adults would prefer for someone else to pay for their wearable devices, like an employer or health plan sponsor. Beyond the initial payment, most wearable consumers would then like to be incentivized to continue to use the device, PwC’s research learned.

On the abandonment point, the Consumer Electronics Association, which has a dedicated arm focused on fitness and health electronics, wrote in a recent research report that most consumers who buy a fitness tracker abandon it within three to six months. So much for stick-to-itiveness and long-term commitment of use.

But perhaps the value underneath the IPO isn’t in the device in and of itself, but in the data generated by millions of users and accumulating in the FItbit mine of user-generated data. Certainly, UnderArmour’s purchase of Map My Run and My Fitness Pal isn’t about the apps or selling more bike shorts and fitness bras, but about creating a health/fitness data ecosystem and gaining insights into people…that is, consumers in a world of Big Data analytics, personalization and advertising.

Thank you FeedSpot for

Thank you FeedSpot for