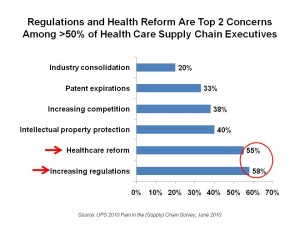

People responsible for managing the health care industry supply chain have always been concerned about regulations and compliance requirements that can negatively impact their ability to manage the materials, technologies, goods and services they need to fulfill their organizations’ medical missions and businesses. Now “health reform” joins regulation as a pain point in the supply chain.

UPS, the logistics and transport company, has surveyed executives from pharma, biotech, medical and surgical device companies, to ascertain their current perspectives on the health care supply chain. The results of this study are in the report, UPS 2010 Pain in the (Supply) Chain Survey.

There’s a lot of uncertainty among managers regarding the impacts of health reform on the supply chain. Among the 55% of health companies who rank health reform as a top business concern, there are perceived upsides and downsides. On the downside,

– 26% are worried that reform will be a barrier to research and development

– 22% don’t think they have the infrastructure in place to support changes required by reform

– 20% feel they won’t be able to afford operating in the post-health reform environment.

On the upside, 18% of executives see that health reform will expand new markets for their business and 15% believe health reform will open up new customer relationships.

1 in 2 health companies plans to expand globally, but 40% are concerned about accessing these global markets. This is a growing concern due to other-country regulations, which include country preferences for “made in-country” products, regulatory compliance, and other barriers to entry and fair competition. The top emerging global markets for the globally-minded health companies are Argentina, China, India and Brazil.

Product security is also a major worry among 40% of executives in health companies. Concerns include counterfeiting products, product theft, product diversion, and name theft in transit as top challenges in global expansion.

Health Populi’s Hot Points: So along with “green,” here comes “health” impacting the supply chain. One of the most interesting aspects of this survey is UPS’s finding that 2 in 3 health companies plans to go direct-to-patients in distributing products in the next 18 months. This will be a major disruption in the distribution aspect of the supply chain: here, wholesalers and distributors will feel the impact, as health product suppliers cut out the proverbial middle-man to go direct-to-consumer. This makes sense as the #1 supply chain concern is to manage supply chain costs.

The countervailing force which slows health manufacturers from getting up-close-and-personal with patients and consumers is regulation — and that’s where a trusted intermediary like a pharmacy, a physician and a favorite retailer can be the ‘new distributors’ for health products. Watch for health companies to grow their relationships with these kinds of middle-men as they add value — patient education, compliance programs, better health engagement — which can benefit the public’s health and improve bottom lines.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,