“Tomorrow [drug makers] may not get paid for the molecule, they may only get paid for the outcome,” expects Brian Niznik of Qualcomm Life. He’s quoted in a report from PwC’s Health Research Institute, 21st Century Pharmaceutical Collaboration: The Value Convergence.

What Brian’s comment recognizes is the growing value-based environment for healthcare, which couples purchasers driving down drug costs via discounts and stringent formulary (approved drug list) contracts, and growing patient responsibility for paying for prescription drugs — especially financially costly for specialty drugs that are new-new molecules.

But as Brian points out, if the high-cost molecule doesn’t perform as expected, the drug may not get paid for or prescribed by clinicians for use in patients.

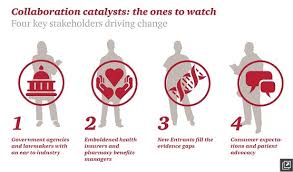

A success factor in this new world health payment world is collaboration, and there are four key stakeholders the illustration presents that will drive change: government agencies and policymakers (particularly those on Capitol Hill and in State houses); health plans, both health care insurance companies and pharmacy benefits managers (PBMs); new entrants to the health care ecosystem that are disrupting traditional business biopharma business flows, like wearables companies, Internet-enabled and consumer technology firms (like Google, Apple, and Samsung), and novel health-tech firms like 23andMe.

The fourth key stakeholder is the consumer and patient advocacy organizations who, via social media and technology platforms, are able to aggregate patients into research-ready cohorts and support systems for peer-to-peer healthcare and Citizen Science (people-powered) research networks (PPRNs). (For more on PPRNs, visit the PCORI website).

These four stakeholders, individually and often in tandem (or trios), shape patients’ access to new therapies developed by the bio/pharma industry. Insurers use data (increasingly “Big”) to consider formulary decisions based on expected utilization and a product’s impact on a patient population. Policymakers are weighing legislation to enable drug companies to communicate the cost-benefit of new products, PwC notes. New entrants work to provide price transparency, clinical trial participation opportunities, and patient social networks that enable a patient in Switzerland to communicate with her peer in Los Angeles and share their experiences with side effects caused by a particular therapy.

“Biopharmaceutical companies cannot afford to sit on the sidelines as patients and health plans negotiate access to their products,” PwC recommends. That calls for collaboration between bio/pharma firms and the four stakeholders, especially patients as partners, working well with purchasers (employers, buying groups), and piloting projects with new entrant companies using novel technologies and methods for enabling patients to self-care, to enroll and engage in research, and more effective stick with medication adherence regimens.

Health Populi’s Hot Points: I wrote about patients wanting to participate in research here on Health Populi back in 2011, when Quintiles’ survey work uncovered this consumer demand. “Collaboration is the New Black,” I wrote then, and it is even more true a statement now.

Furthermore, Accenture’s recent study found that people want to DIY with pharma, as I discussed here in this discussion of Accenture’s report. Patients/consumers really do want to get into the sandbox with pharma and collaborate to co-create health, and health products.

At the end of the day, after the pilot projects and purchaser conversations, patient collaboratives and political lobbying, bio/pharma companies must put forward the argument — via solid, transparent data — that new-new expensive products are, indeed, cost-effective and drive significant clinical benefits — seen through the lens of each stakeholder group.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a