Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential.

Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential.

Health Affairs provides the big economic story played out by the forecasts of the Centers for Medicare and Medicaid Services (CMS) in National Health Expenditure Projections, 2014-24: Spending Growth Faster Than Recent Trends. The topline of the forecast is that health spending growth in the U.S. will annually average 5.8% between 2014 and 2024. This will grow the proportion of health spending as part of the nation’s gross domestic product to nearly 20% in 2014 — that means $1 in every $5 produced in America.

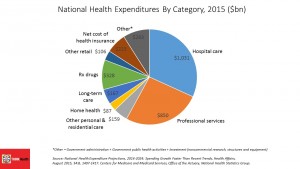

The pie chart shows the relative slices of health care spending by category, with hospitals consuming the greatest single share of spending just under 32%. Professional services, the bulk of which is physician and clinical services, comprise 26% of health spending. Prescription drugs will run about 10% of total, which has been the share of Rx in health spending for many years. However, with double-digit growth rates expected by CMS, prescription drugs will exceed that historic one-tenth of health spending share well before 2024. In 2014, prescription drug spending is projected to have risen to 12.6% in 2014, the highest growth rate since 2002 (largely owing to specialty drugs coming onto the market, and specifically new tx for Hepatitis C). The proportion of generic drug dispensing as a percent of the total Rx drug market in the U.S. has hit 82%, so there’s not much room for cost-saving-through-generic-prescribing to be wrung out of overall health cost control.

Spending growth in the forecast period to 2024 will be driven largely by growing coverage of health insureds due to the continued implementation of the Affordable Care Act, faster growth in medical care utilization as the nation’s economy continues to improve, the aging population, and growing medical prices due to wage increases (expected in this forecast).

JAMA, the second publication discussed in this post, offers many perspectives on the 50th birthday of Medicare and Medicaid in this week’s issue. The table of contents is a Who’s Who of must-read authors who know their stuff, including Dr. Donald Berwick’s perspective on the past 50 years of health care in America, Drew Altman and Bill Frist’s thoughts on health care providers and beneficiaries, and David Cutler’s over-arching take From the Affordable Care Act to Affordable Care, which speaks to the issues raised in the Health Affair’s CMS spending forecast.

JAMA, the second publication discussed in this post, offers many perspectives on the 50th birthday of Medicare and Medicaid in this week’s issue. The table of contents is a Who’s Who of must-read authors who know their stuff, including Dr. Donald Berwick’s perspective on the past 50 years of health care in America, Drew Altman and Bill Frist’s thoughts on health care providers and beneficiaries, and David Cutler’s over-arching take From the Affordable Care Act to Affordable Care, which speaks to the issues raised in the Health Affair’s CMS spending forecast.

But Dr. Harlan Krumholz and colleagues’ look into Mortality, Hospitalizations, and Expenditures for the Medicare Population Aged 65 Years or Older, 1999-2013, brings the good news out about what health spending for Medicare enrollees has accomplished in 14 years. That is, simply: better health outcomes.

But Dr. Harlan Krumholz and colleagues’ look into Mortality, Hospitalizations, and Expenditures for the Medicare Population Aged 65 Years or Older, 1999-2013, brings the good news out about what health spending for Medicare enrollees has accomplished in 14 years. That is, simply: better health outcomes.

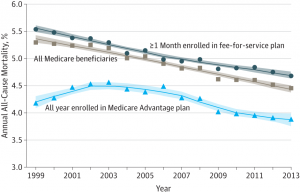

The line graph with declining lines illustrates the striking improvements in Medicare members’ health, including those enrolled in fee-for-service plans (FFS) and those in Medicare Advantage plans. Across all beneficiaries, all-cause mortality declined from 5.3% in 1999 to 4.45% in 2013. While this may seem a small percentage at a glance, the underlying numbers tell the positive story: a decline in hospitalizations per 100,000 person-years of 8,344; falling inpatient spending by $489 per Medicare FFS member; and, the percent of beneficiaries with 1 or more hospitalizations falling from 70.5 to 56.8 per 100 deaths.

As these inpatient admissions fell, folks were increasingly discharged to rehabilitation and nursing facilities, or went home supported by home care services. If these discharges left people in-hospital with greater degrees of clinical severity, then the researchers under-estimated the positive improvements beyond those calculated in the study.

Health Populi’s Hot Points: These two publications this summer week are must-reading for people involved in health care, as signs of what has been positive, and an alert to expected cost-increases that will challenge us to continue to move care out of expensive inpatient settings to peoples’ homes and workplaces. The growth of digital and telehealth platforms will enable this transition to occur.

I’m hopeful that we’ll see continued good-news results the likes of the JAMA stories in 2025, where increasingly, home will be the American’s true medical home.

Thank you FeedSpot for

Thank you FeedSpot for