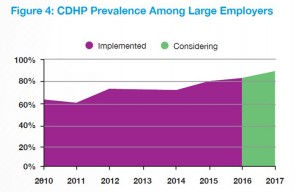

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers.

That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

The most popular tools employers will use to bolster consumer-like behavior among employees will be self-service decision-support tools, price transparency for medical services, medical decision support and second opinion services, and employer-advocacy tools (such as for claims assistance). A growing service will be high-touch health concierge services, being adopted by over one-fourth of large employers.

The most popular tools employers will use to bolster consumer-like behavior among employees will be self-service decision-support tools, price transparency for medical services, medical decision support and second opinion services, and employer-advocacy tools (such as for claims assistance). A growing service will be high-touch health concierge services, being adopted by over one-fourth of large employers.

The intention of providing these tools is to empower workers to take on that consumer hat, stretch consumer muscles so people learn to “shop” for health care — compare providers by price, quality, and other metrics available through the transparency tools (like Castlight Health and Clear Health Costs, for example), advocacy tools and concierge services (such as those served up by Accolade and Health Advocate), and self-service decision-support tools which are proliferating on health plans’ websites, as well as private-labelled sites that employers are bringing into their private employee benefit intranet portals.

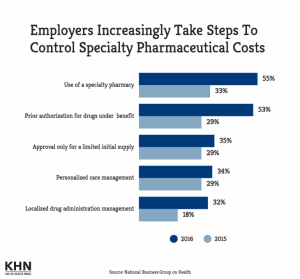

Large companies will also work to restrain costs on the supply side: 8 in 10 large employers will use Centers of Excellence to direct employees for specific services such as intricate surgical procedures such as transplants and bariatric surgery, and cardiovascular and cancer treatments. The rationale under this comes from another data point in NBGH’s survey, blaming “high cost claimants” as the #1 cost drive of rising health care costs. The second culprit among health care cost drivers is seen to be specialty drugs, named by 70% of large employers as a Top-3 cause of rising health care costs.

Large companies will also work to restrain costs on the supply side: 8 in 10 large employers will use Centers of Excellence to direct employees for specific services such as intricate surgical procedures such as transplants and bariatric surgery, and cardiovascular and cancer treatments. The rationale under this comes from another data point in NBGH’s survey, blaming “high cost claimants” as the #1 cost drive of rising health care costs. The second culprit among health care cost drivers is seen to be specialty drugs, named by 70% of large employers as a Top-3 cause of rising health care costs.

Thus, the third chart focusing on strategies employers will take to control specialty drug costs shows dramatic uptake of the use of specialty pharmacies as well as implementing prior authorization for high-cost drugs in the benefit.

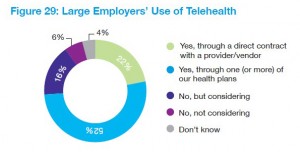

While specialty drugs are seen as cost-driving (upward trending), employers are welcoming the advent of telehealth in large numbers. NBGH finds that 74% of big companies will be providing employees and families with telehealth options, either through one or more health plans (52%) or via direct contract with a provider or vendor (22%). In 2015, 48% of employers extended telehealth options to employees living in states where the option was legal: thus, the number of large employees providing telehealth as an employee benefit grew is expected to grow over 50% from 2015 to 2016.

While specialty drugs are seen as cost-driving (upward trending), employers are welcoming the advent of telehealth in large numbers. NBGH finds that 74% of big companies will be providing employees and families with telehealth options, either through one or more health plans (52%) or via direct contract with a provider or vendor (22%). In 2015, 48% of employers extended telehealth options to employees living in states where the option was legal: thus, the number of large employees providing telehealth as an employee benefit grew is expected to grow over 50% from 2015 to 2016.

Health Populi’s Hot Points: Looking to the future, it appears that large employers plan to continue to sponsor health insurance at the workplace, as long as consumer-directed health plans can rationalize costs and spread risks to employees. The question remains whether employees and dependents will take on the habits of consumers who figure out how to shop for health care and use their health benefits effectively — the high-deductible plan, the health savings account, concierge and second opinion services, and other proliferating niche benefit areas for assisting children on the autism spectrum, couples dealing with fertility, and sleep challenges.

Health Populi’s Hot Points: Looking to the future, it appears that large employers plan to continue to sponsor health insurance at the workplace, as long as consumer-directed health plans can rationalize costs and spread risks to employees. The question remains whether employees and dependents will take on the habits of consumers who figure out how to shop for health care and use their health benefits effectively — the high-deductible plan, the health savings account, concierge and second opinion services, and other proliferating niche benefit areas for assisting children on the autism spectrum, couples dealing with fertility, and sleep challenges.

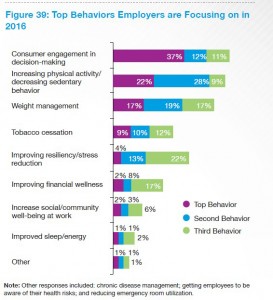

The last bar chart shows the top employer priorities for changing employee behaviors; #1 is driving consumer engagement in decision-making, closely followed by increasing physical activity and managing weight. The last two go hand-in-hand, and suggest a biometric outcome for 2016 and beyond will be the measurement of BMI going beyond smoking cessation which has been a prominent goal for wellness programs in the first half of the 2010s.

The consumer engagement in health will be the Holy Grail for employers looking to drive patient activation with the end-goal of lowering overall health care costs.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,