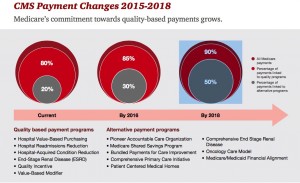

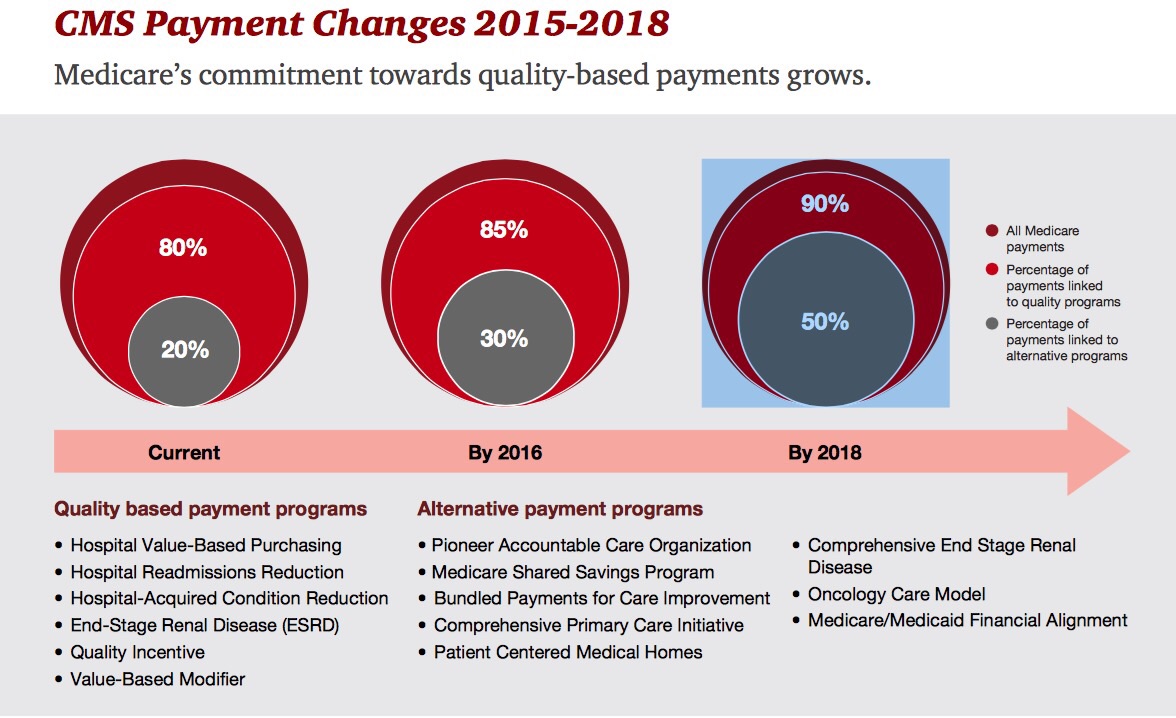

By 2018, 90% of health care delivered to people enrolled in Medicare will be paid-for on the basis of quality, not on the amount of services delivered (that is, volume). But as providers must up their game in that new value-oriented health payment world, they are bound up in work flows and organizational structures built for fee-for-service reimbursement.

By 2018, 90% of health care delivered to people enrolled in Medicare will be paid-for on the basis of quality, not on the amount of services delivered (that is, volume). But as providers must up their game in that new value-oriented health payment world, they are bound up in work flows and organizational structures built for fee-for-service reimbursement.

This changing future is discussed in Healthcare’s alternative payment landscape, PwC’s Healthcare Research Institute report on the volume-to-value shift. PwC notes that health care providers’ ability to adapt to changing payment regimes vary and fall into four categories: traditional, lagging, vanguard and emerging, based on two underlying forces: level of integration, and ability/speed to execute.

- Traditional providers can quickly execute but their fragmented system haven’t sufficiently evolved to scale at a fast rate.

- Laggards are both slow executors and fragmented in their delivery system.

- Emerging providers have integrated delivery systems but aren’t the fastest executors – their payment mix includes both fee for service and risk-based contracts, but they’re moving in the value-based direction.

- The vanguard providers both executive fast and are integrated, enabling them to sign on to risk-based contracts and collaborate with payors in local markets.

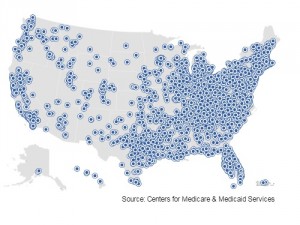

Payment for quality is already happening in 2015: Medicare will pay over 800 hospitals a bundled payment for hip and knee procedures, to include all components of the procedure from pre-op through rehabilitation. The Centers for Medicare and Medicaid Services (CMS) which administers Medicare will learn from this program and apply those lessons to other diagnoses and conditions suitable for bundled payment.

Payment for quality is already happening in 2015: Medicare will pay over 800 hospitals a bundled payment for hip and knee procedures, to include all components of the procedure from pre-op through rehabilitation. The Centers for Medicare and Medicaid Services (CMS) which administers Medicare will learn from this program and apply those lessons to other diagnoses and conditions suitable for bundled payment.

Markets where Medicare Advantage has successfully been implemented are ripe for accountable care and value-based payment, PwC notes. Health care providers in these markets have stretched new muscles, creating organizations driven by the new incentives embodied in Medicare Advantage programs.

Key success factors learned by successful implementations in the value-based world include knowing your costs, consumer engagement, a laser focus on quality, leveraging strengths and identifying and correcting weaknesses where they exist.

Health Populi’s Hot Points: The transition to value-based care has, in the words of PwC in the last sentence of the report, been “arduous.” What to do to lessen this tricky, painful journey?

This week at the Health 2.0 conference, I’ll be part of the largest ecumenical healthcare ecosystem get-together on the conference circuit. Healthcare providers, payors, pharma and biotech, IT and app developers, employers and — most central to the discussion — patients, are convening to discuss health care transformation and how technology can enable the move from volume to value, wring out inefficiencies system-wide, and enlighten and empower patients and their clinicians to share decisions and make better ones.

Those critical success factors that PwC identifies that help manage the quality-payments transition — consumer engagement, cost transparency, leaning out — are all enabled through technology, designed around patient and clinician needs.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,