My National Health Care Consumer Week, I’ll coin this, looking back on flying some 12,000 airmiles over six days, criss-crossing America from the City of Brotherly Love to Sacramento, back to Philly and then to Los Angeles. Finally, today, heading home to Philadelphia and my beloved, most necessary Tempur-Pedic bed, a loving husband and some therapeutic TV binge-watching.

My National Health Care Consumer Week, I’ll coin this, looking back on flying some 12,000 airmiles over six days, criss-crossing America from the City of Brotherly Love to Sacramento, back to Philly and then to Los Angeles. Finally, today, heading home to Philadelphia and my beloved, most necessary Tempur-Pedic bed, a loving husband and some therapeutic TV binge-watching.

It’s Friday and I’m at LAX, reflecting on a week of meeting with three groups of healthcare executives and stakeholders who all wanted to hear my take on the evolution of patients, people, caregivers, all, morphing into health care consumers. The lens on each meeting was different — from state health care interests focusing on health information, technology, safety net populations, and patient rights; on to a pharmaceutical and life science focused audience, faced with growing pressures for drug price regulation, FDA scrutiny, hospital and health insurance backlash, and consumer price sticker-shock; and third, a group of healthcare executives focused on integrating care for the benefit of patients, quality outcomes, and rationalizing cost.

While the basic premise of the talks began with how homo informaticus is DIY’ing daily life via OpenTable, online banking, the Waze GPS app, and Angie’s List, the implications of this multi-channel, multi-platform consumer on each health care industry stakeholder are different relative to the tactics each organization might undertake to respond to the empowered person’s demands.

While the basic premise of the talks began with how homo informaticus is DIY’ing daily life via OpenTable, online banking, the Waze GPS app, and Angie’s List, the implications of this multi-channel, multi-platform consumer on each health care industry stakeholder are different relative to the tactics each organization might undertake to respond to the empowered person’s demands.

Strategically, though, the unifying theory across all health industry players is value: how can spending on U.S. health care moderate to get greater ROI in terms of patient and population health and enhancing the experience while lowering costs per person?

Yesterday, I was invited to speak with the Board of the Integrated Hospital Association of California on the topic of emerging health consumers and challenges to the legacy healthcare system — in particular, those health care providers, payors, employers, and suppliers (namely, pharmaceutical companies) committed to providing an organized, integrated solution to patients.

Imagine my surprise, delight, and then nerves when sitting next to me was Professor Alain Enthoven, health economics guru at Stanford University, whose worked I have studied, appreciated, and learned from for more than two decades.

Me? Speak to an audience on health economics including Dr. E? To my delight, and not surprisingly, he couldn’t have been more supportive, welcoming, and positive, and put me at ease.

In the audience, too, was another big influencer on my work, Dr. James (Jamie) Robinson from UC-Berkeley. Since I have worked collegially with Jamie before, I was less daunted, but nonetheless felt a high bar to jump between Dr. E and Dr. R in my audience.

The bottom line: the IHA group, which includes representatives from Aetna, Blue Shield of California, CalPERS, Cedars-Sinai Hospital, Covered California, Dignity Helath, Disney Worldwide, Genentech, HealthNet, Kaiser, Martin Luther King, Jr., Community Hospital, Pfizer, Providence Health, Sharp Rees-Stealey, Sutter Health, UnitedHealthcare, among other industry leaders and innovators, collectively and earnestly took in my provocative view of this activated, somewhat angry, and decidedly frugal health care consumer.

The over-arching question: how do legacy healthcare players meet this convenience-demanding, multi-channel, dollar-stretched consumer in the growing ecosystem of new entrants — retailers like Costco, CVS/Health, Walgreens, Walmart; and digital companies like Apple, Google, Microsoft, Samsung, and new-new data players like Fitbit and UnderArmour? That was the substance of our discussion.

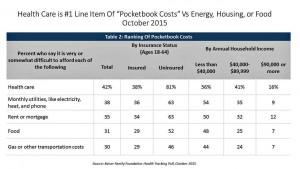

Health Populi’s Hot Points: Value is in the eye of the beholder, and for patients, people and caregivers living in an increasingly high-deductible + HSA payment world, health care costs are #1 on the mind ahead of paying for the mortgage, utilities, and food, Kaiser Family Foundation learned in their October 2015 Health Tracking Poll.

Health Populi’s Hot Points: Value is in the eye of the beholder, and for patients, people and caregivers living in an increasingly high-deductible + HSA payment world, health care costs are #1 on the mind ahead of paying for the mortgage, utilities, and food, Kaiser Family Foundation learned in their October 2015 Health Tracking Poll.

Consumers have long DIY’d their health care by using over-the-counter drugs, pharmacies and pharmacists for informal consultations, and gyms to bolster health and wellbeing. The New Retail Health includes many more touchpoints, more choices, more convenience. Old School Healthcare, delivered by hospitals, doctors, health plans and pharma, are learning to deal with this direct-to-consumer world in a real retail sense. Those who can think more like P&G and Disney, Amazon and the retail banks who get retail banking best, will keep and grow their consumer market share. Thus, it’s no surprise — and a good sign of reading the market — that Providence CEO Rod Hochman told Hospitals & Health Networks magazine in an article on health care consumerism this month about recruiting staff from Amazon, Microsoft and other consumer goods companies.

For a valuable view of 3 physicians on consumers in this evolving market environment, see the October 13, 2015 JAMA column, Value-Based Payments Require Valuing What Matters to Patients.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a