National health spending in American grew by 5.3% in 2014, hitting the $3 trillion mark. This represented an up-tick nearly twice the growth rate of 2.9% in 2013, the slowest rate of growth in 55 years, according to the latest analysis of the U.S. health economy published by Health Affairs.

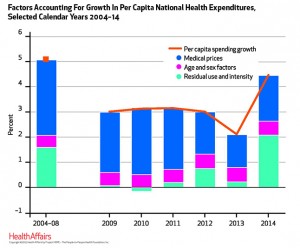

The first chart illustrates the factors that contribute to that 5.3% growth in health spending. The two largest factors were medical prices and so-called “residual use and intensity.” The medical price increase portion was 1.8% in 2014, up from 1.3% in 2013. The use and intensity component was attributable to more people covered for services using hospital care, physician and clinical services, and prescription drugs. Much of that goes to the impact of the Affordable Care Act.

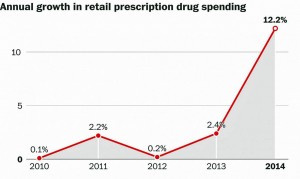

In 2014, the fastest-growing line item in the National Health Expenditures was prescription drug spending, which grew hockey-stick-like in 2014 shown in the second chart. At 12.2%, Rx drug spending increased over 15 times the rate of annual inflation for 2014, which was 0.8%.

The concluding paragraph of the Health Affairs article reads: “The expansion of insurance coverage, particularly through Medicaid and private health insurance, and rapid growth in retail prescription drug spending fueled a 5.3 percent increase in total national health care expenditures in 2014. This increase compares to historically low health spending growth from 2009 to 2013, when growth averaged only 3.7 percent. Health expenditures grew faster than the overall economy in 2014, as the GDP increased 4.1 percent. As a result, the health spending share of GDP increased from 17.3 percent in 2013 to 17.5 percent in 2014. The return to faster growth and an increased share of GDP in 2014 was largely influenced by the coverage expansions of the Affordable Care Act. But how the health sector responds to the evolving access and incentive landscape, as well as underlying economic conditions, will determine the future trajectory of health spending growth.”

Health Populi’s Hot Points: The wordle comes from the results of a survey from The Morning Consult in May 2014 asking consumers the question, “In a word or two, could you please tell me what comes to mind when you think of pharmaceutical companies?” The most frequent answers consumers (patients) gave were “greedy,” “money,” “expensive,” profit,” with many fewer people saying, “good.”

Health Populi’s Hot Points: The wordle comes from the results of a survey from The Morning Consult in May 2014 asking consumers the question, “In a word or two, could you please tell me what comes to mind when you think of pharmaceutical companies?” The most frequent answers consumers (patients) gave were “greedy,” “money,” “expensive,” profit,” with many fewer people saying, “good.”

The National Health Accounts data reveal the two biggest drivers of national spending increase in 2014 were insurance coverage expansion via Medicaid and private plans, and the ‘rapid growth in retail prescription drug spending.’ Few people will criticize health insurance expansion, as more fellow health citizens receive access to health care services.

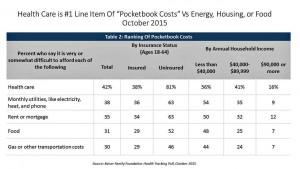

But health care costs rank #1 in Americans’ pocketbook issues, shown by Kaiser Family Foundation’s October 2015 Health Tracking Poll, as the table points out. Even for the wealthiest U.S. consumers. health costs top the list of household budget concerns.

But health care costs rank #1 in Americans’ pocketbook issues, shown by Kaiser Family Foundation’s October 2015 Health Tracking Poll, as the table points out. Even for the wealthiest U.S. consumers. health costs top the list of household budget concerns.

As the bolded final statement in the paragraph above says, “how the health sector responds to the evolving access and incentive landscape” will shape the trajectory of health spending growth. While prescription drugs are only part of health spending, they’re fast-growing and in the bulls-eye of legislators and consumers alike, with sentiment growing for some sort of price regulation. That won’t bend the macro health expenditure cost curve, but it will surely be politically palatable to a majority of voters, patients all, as we approach the 2016 Election.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a