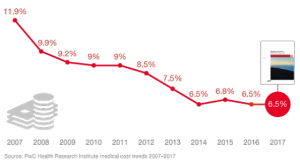

The growth of health care costs in the U.S. is expected to be a relatively moderate 6.5% in 2017, the same percentage increase as between 2015 and 2016, according to Medical Cost Trend: Behind the Numbers 2017, an annual forecast from PwC.

As the line chart illustrates, the rate of increase of health care costs has been declining since 2007, when costs were in double-digit growth mode. Since 2014, health care cost growth has hovered around the mid-six percent’s, considered “low growth” in the PwC report.

What’s driving overall cost increases is price, not use of services: in fact, health care service utilization fell since 2010, while price growth consistently exceeded Consumer Price Inflation (CPI) equal to a mere 1% in the past year (12 months ending May 2016).

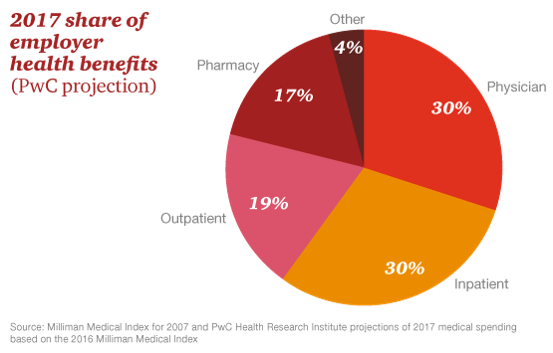

While physician and hospital inpatient services costs have been flat to declining, outpatient and pharmacy costs are growing. Note health care costs to employers by line-item: physician and inpatient care are split evenly each with 30% of the spend, shown in the pie chart. Outpatient and pharmacy consume roughly the same proportion, with outpatient costs at 19% and pharmacy, 17%.

PwC identified “inflator” growth and “deflator” (cost-reducing) factors for overall medical cost trends:

- Inflators: convenience driving costs up (e.g., growth of retail clinic use); and, growing use of behavioral health services (expected to increase in 2016 with a focus on mental health parity).

- Deflators: high performance networks (e.g., narrowing networks of providers); prescription drug benefit managers (PBMs) aggressively managing medication spending.

Health Populi’s Hot Points: PwC believes that, “specialty drugs are loosening their grip on [medical cost] growth.” Note in the pie chart that pharmacy costs now comprise 17% of overall health care costs. Gone are the days when PhRMA (the prescription drug advocacy organization or “lobby”) and manufacturers could point to the data point that medications cost “only” 10% of the total health cost bill. In fact, that proportion is expected to approach 20% in 2017. Other forecasts covered here in Health Populi have projected 20%.

While the impact of Hepatitis C therapy on drug trend is falling, as PwC notes, other new specialty drugs are coming on-stream in 2017 and beyond — addressing heart disease, cancer, diseases of inflammation and the central nervous system — collectively driving up health care trend.

This will be an area that hospitals taking on value-based care will watch, along with health plans (with a warning from AHIP, the health insurance plan lobby).

“Behind the numbers” are end-users of these expensive products — patients managing serious illnesses who can be hard-hit through high deductibles and cost-sharing coinsurance percentages. Access programs, proof of value in the eyes of the patient, price transparency, and useful tools that bring services “beyond the pill” will be important to the patient-as-consumer, bearing more financial risk for necessary therapies.

To complement these findings, in tomorrow’s Health Populi, we’ll share insights from the Society for Human Resource Management 2016 Employee Benefits survey – 20th anniversary version.

Thank you FeedSpot for

Thank you FeedSpot for