Federal healthcare program costs are the largest component of mandatory spending in the U.S. budget, according to An Update to the Budget and Economic Outlook: 2016 to 2026 from the U.S. Congressional Budget Office (CBO).

Federal healthcare program costs are the largest component of mandatory spending in the U.S. budget, according to An Update to the Budget and Economic Outlook: 2016 to 2026 from the U.S. Congressional Budget Office (CBO).

Federal spending for healthcare will increase $77 billion in 2016, about 8% over 2015, for a total of $1.1 trillion. The CBO believes that number overstates the growth in Medicare and Medicaid because of a one-time payment shift of $22 bn to Medicare (from 2017 back into 2016); adjusting for this, CBO sees Federal healthcare spending growing 6% (about $55 bn) this year.

The driver of the growth in Medicare spending is greater costs per enrollee — largely due to prescription drugs, where spending for them is increasing 15% this year.

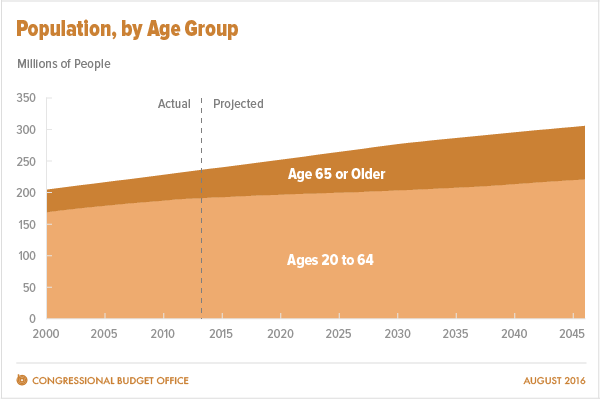

The first chart illustrates the macro underlying driver of Federal healthcare cost growth in the longer-term CBO forecast: the aging of America. “The number of people age 65 or older is now more than twice what it was 50 years ago,” the CBO report explains. “Over the next decade, as members of the baby-boom generation age and as life expectancy continues to increase, that number is expected to rise by more than one-third, boosting the number of beneficiaries in these programs.”

That will translate into projected spending for people age 65 and older in three big programs — Medicaid, Medicare and Social Security — to grow from one-third of federal noninterest spending in 2016 to 40% in 2026.

Health Populi’s Hot Points: Spending on prescription drugs in Medicare rose 17% in 2014, discussed in the Medicare Part D report published by the Center for Medicare and Medicaid Services (CMS) earlier this month. (FYI, the data represents about 70% of all Medicare beneficiaries in the CMS methodology). At the same time, claims (utilization) for prescription drugs went up only about 3%.

Health Populi’s Hot Points: Spending on prescription drugs in Medicare rose 17% in 2014, discussed in the Medicare Part D report published by the Center for Medicare and Medicaid Services (CMS) earlier this month. (FYI, the data represents about 70% of all Medicare beneficiaries in the CMS methodology). At the same time, claims (utilization) for prescription drugs went up only about 3%.

The 17% cost increase for 2014 was much higher than the 12.6% Rx price growth in 2013.

By number of claims (prescriptions written and filled), the top 10 drugs prescribed for Medicare enrollees were all generics (led by Lisinopril, and ACE inhibitor for high blood pressure), Levothyroxine sodium (for thyroid), and Amlodipine Besylate (for blood pressure and angina).

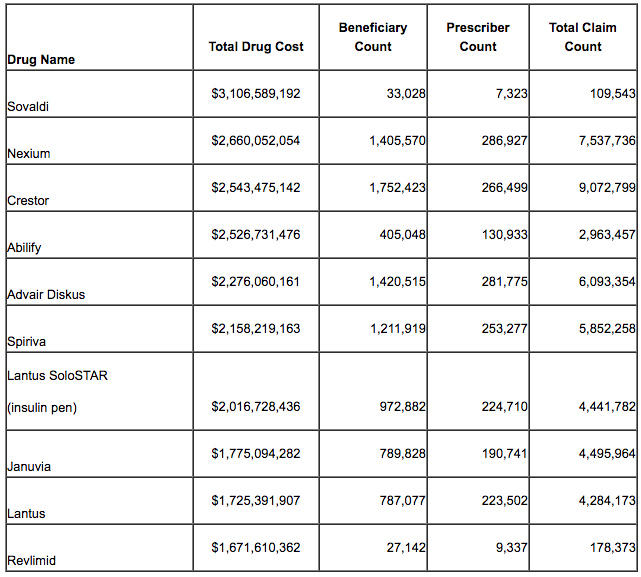

The top 10 drugs by spending were all branded medicines, led by Sovaldi (to treat Hepatitis C) with $3.1 bn in costs for 2014. The second largest spending for a prescription drug in 2014 was for Nexium (for acid reflux), closely followed by Crestor (for cholesterol management), Abilify (for mental health), and Advair (for COPD and respiratory conditions).

There is a strong economic argument for prescription drugs when they help to prolong human life and quality of life, and keep patients out of expensive hospital inpatient beds. This is certainly the case for the bulk of the top ten generic drugs by claims, which help manage heart disease, gastrointestinal issues, and respiratory conditions.

For the growing roster of high-cost specialty drugs, the return-on-investment — through health economic outcomes research — will become increasingly important to calculate for payors.

As Americans age into Medicare, they become higher utilizers/consumers of prescription drugs, so will be looking through their own lens for an ROI on their out-of-pocket spending on drugs. This is true, as well, for younger people managing chronic conditions, or facing acute diagnoses like Hep C, various cancers, among other conditions for which specialty drug portfolios are growing.

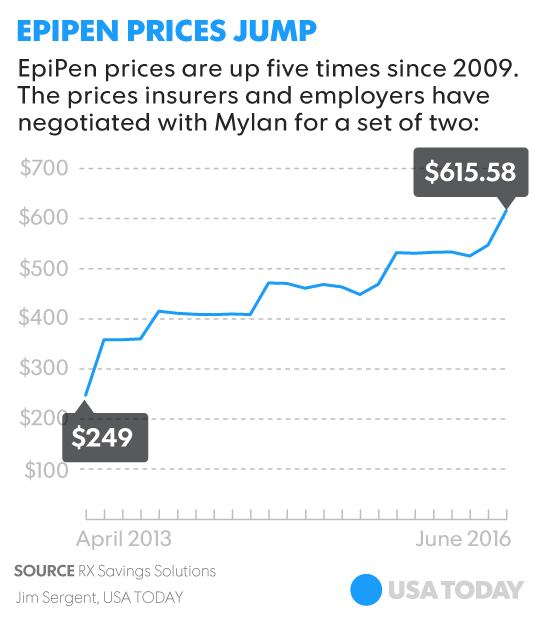

The current front-page story covered in mass media, not just trade press, involves the hockey-stick pricing of EpiPen, one of the most popular medicines on the market — especially for young people. The issue made the cover of USA Today this week, and the major broadcast networks. The five-fold price increase from 2009 to 2016 has enraged parents and patients, along with the White House. President Obama signed legislation in 2013 ensuring kids’ access to EpiPen in schools – the School Access to Emergency Epinephrine Act.

The current front-page story covered in mass media, not just trade press, involves the hockey-stick pricing of EpiPen, one of the most popular medicines on the market — especially for young people. The issue made the cover of USA Today this week, and the major broadcast networks. The five-fold price increase from 2009 to 2016 has enraged parents and patients, along with the White House. President Obama signed legislation in 2013 ensuring kids’ access to EpiPen in schools – the School Access to Emergency Epinephrine Act.

I covered the latest Fidelity retirement projections for health costs in Health Populi earlier this month. The magic number is $260,000 for a couple retiring in 2016. Much of that number will go to specialty drugs. Transparency and patient-powered research will help consumers understand the value of expensive medicines in the context of overall healthcare spending. The pharma and life science industry have their work cut out for them. In the immediate term, this issue will be one of the very few on which Presidential hopefuls Hillary Clinton and Donald Trump will converge.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,