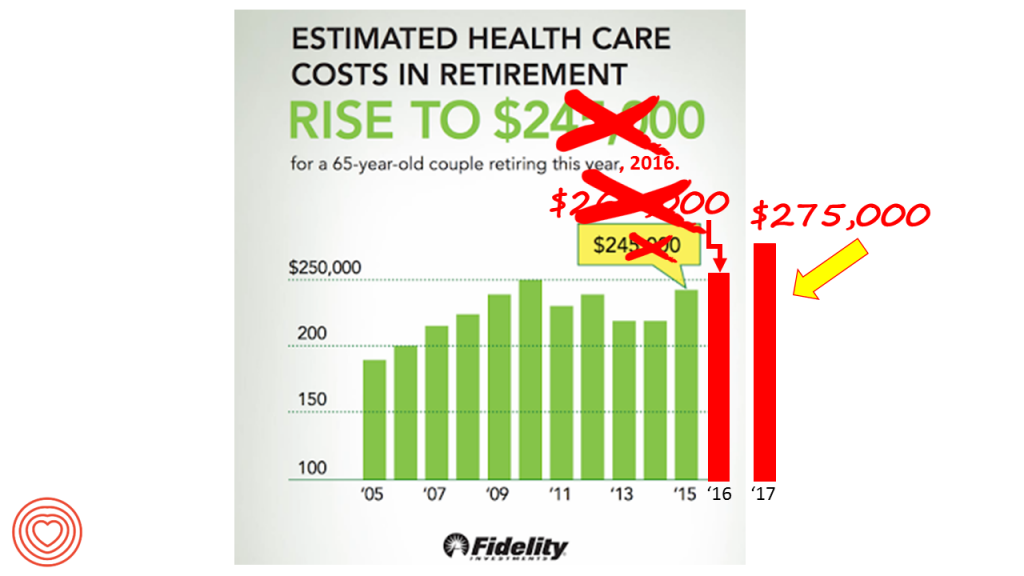

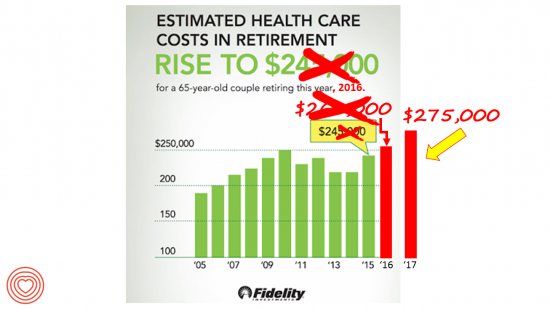

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending.

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending.

Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated for the year before in 2015. Fidelity notes that this year’s increase at nearly 6% has culminated in over 70% increase since Fidelity first began to calculate retirement health care costs in 2002.

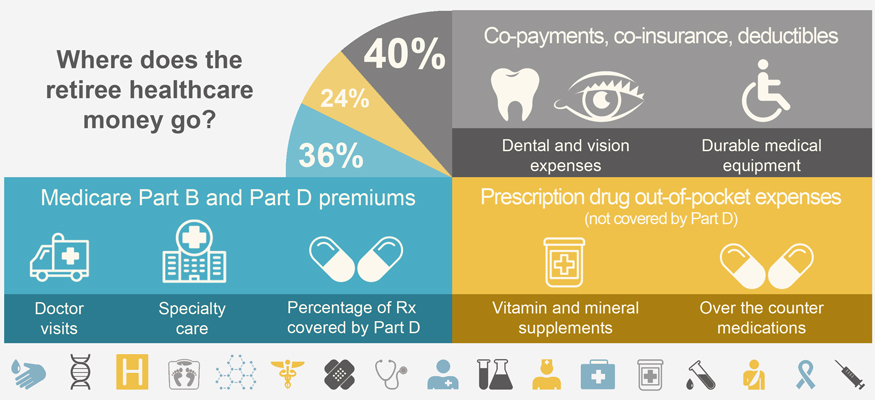

Medical and health expenses in retirement cover monthly Medicare premiums, Medicare copayments and deductibles, and prescription drug out-of-pocket spending as shown in the diagram (from Fidelity’s retirement calculator website).

Fidelity points to employers’ opportunity to bolster health-insured employees’ health financial literacy and access to tools that can help bolster workers’ financial wellness: in particular, health savings accounts (HSAs). Fidelity notes that the number of HSA clients on the company’s platform grew 38% over the year, and HSA holders increased 46%. The key financial wellness aspect of HSAs is that they have a triple-tax advantage, avoiding taxation at the initial investment, during the interest-growth period over time, and finally when taken out for use in retirement.

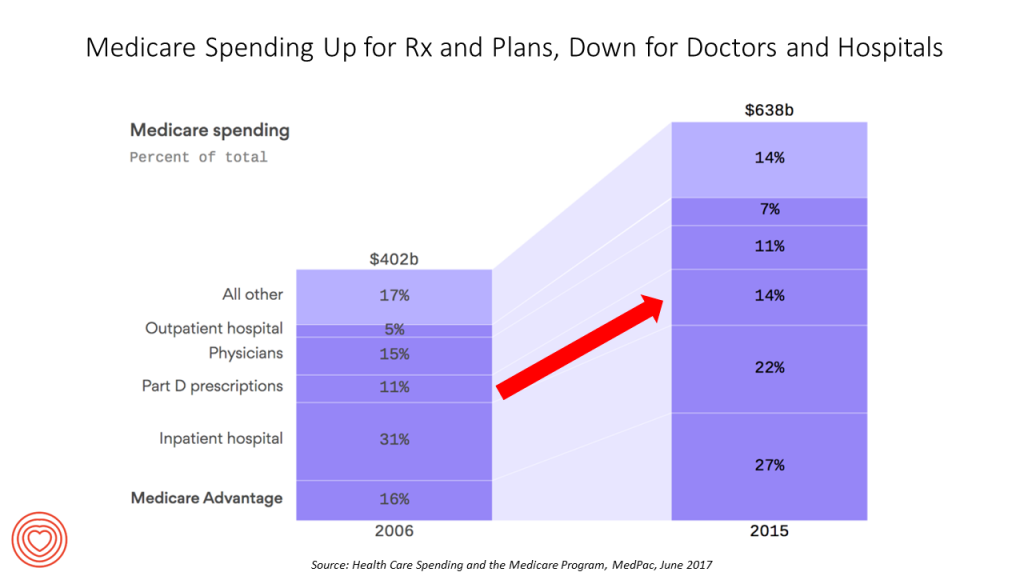

Health Populi’s Hot Points: A new report from MedPAC, the Medicare Payment Advisory Commission, segments Medicare spending by enrollee line-item, shown in the third chart. By 2015, Medicare reached $638 billion in spending, split between Medicare plan premiums, hospital, Part D prescriptions, physicians, outpatient hospital costs, and other services.

Health Populi’s Hot Points: A new report from MedPAC, the Medicare Payment Advisory Commission, segments Medicare spending by enrollee line-item, shown in the third chart. By 2015, Medicare reached $638 billion in spending, split between Medicare plan premiums, hospital, Part D prescriptions, physicians, outpatient hospital costs, and other services.

From 2006 to 2015, there was a shift in shares among these spending categories. Prescription drugs increased as a proportion of total Medicare costs from 11% to 14%; and, outpatient hospital services grew from 5% to 7% of total Medicare costs. Medicare premiums also garner more Medicare spending, from a share of 16% of spending to 27% of the total.

Payments to hospitals (inpatient) and physicians fell as a proportion of Medicare spend, from 2006-2015.

The cost of prescription drugs is on my mind this week as I learned that, per this story in USA Today, the estimated price for a new-new therapy targeting leukemia (known as CAR T-cell therapy) will cost $649,000 for a course of treatment. I’ve written about financial toxicity in the context of patients dealing with cancer therapies here in Health Populi. The magnitude of financial toxicity takes on a new scope here as this therapy is priced more than ten times the median family income in America in 2017. The clinical miracle for patients and families is that 83% of those treated with CAR T-cell therapy have gone into remission.

So it’s no surprise in this era of $500 EpiPens that more Americans are relying on “handouts” for affordable medication, as the title of an article in Britain’s Financial Times wrote in June 2017. “For Americans unable to afford prescription medicines, patient assistance programs – run by charities and drug companies to provide free or low-cost medication to poor or uninsured patients — offer a lifeline,” the column reads. But drug company execs agree that this is an unsustainable model.

Most patients in the U.S. love lower costs and “free” stuff in healthcare (and in everyday life); but as David Howard of Emory University pointed out in the New England Journal of Medicine in 2014 (at the moment of the Hep C pricing crisis and two years before the EpiPen price uproar), as patients become less sensitive to costs, companies often mark up medication costs.

It won’t be only drug companies who face scrutiny as restraining health care costs is the one aspect of U.S. reform that has bipartisan agreement (which I discussed here in Health Populi). Doctors and hospitals already garner lower shares of the Medicare bill and MedPAC learned, and the GOP’s American Health Care Act (AHCA) called for a 50% reduction in federal contributions to Medicaid would have hard-hit providers serving the program.

Retirees, be forewarned: save your cash. You’ll be spending more out-of-pocket for access to health care services. But politicians, be mindful: healthcare costs are top-of-mind for consumers as well, as 2018 looms closer.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a