THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today.

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today.

The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%).

Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll.

Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

While “manageable stress levels” comes in at a low 7% of respondents, it’s important to recognize the negative health and wellness impacts that financial instability and toxic relationships have on human health; these are bound up in the top two responses. For more evidence on that, turn to Christakis and Fowler’s research on being Connected — on the good and the bad aspects of our social networks.

While “manageable stress levels” comes in at a low 7% of respondents, it’s important to recognize the negative health and wellness impacts that financial instability and toxic relationships have on human health; these are bound up in the top two responses. For more evidence on that, turn to Christakis and Fowler’s research on being Connected — on the good and the bad aspects of our social networks.

For employers, the cost of stress is significant: 1 in 10 workers miss work due to stress, a study from the Faas Foundation and Mental Health America revealed this week. That cost adds up to some $500 bn a year for U.S. companies.

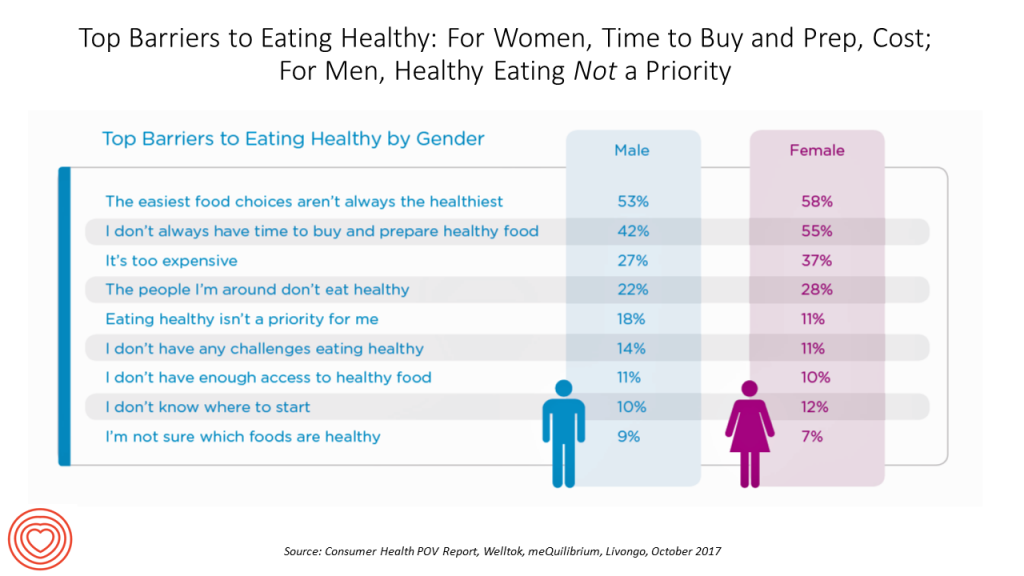

1 in 3 consumers felt the toll of stress, the report notes. Both men and women feel stress, with women more likely to feel “energy zapped” and appetites impacted (chocolate, anyone?). Connect that data point to the barriers to eating healthy by gender: women more often than men don’t have the time to buy and prepare healthy food, and also find eating healthy too expensive — a further stress related to finance.

Health Populi’s Hot Points: Financial wellness is integral to overall health and well-being. This was the theme of the first Health Populi blog post back in September 2007 – when health care was a top line-item in the national economy, taking a greater share out of peoples’ pockets. That was ten years ago, so it’s déjà vu…still. This photo from Tom’s Shell gas station illustrates what petrol-shopping drivers were perceiving at the time — that being asked to pay the price of gas in 2007 was akin to giving up your arm, leg, or first born.

Health Populi’s Hot Points: Financial wellness is integral to overall health and well-being. This was the theme of the first Health Populi blog post back in September 2007 – when health care was a top line-item in the national economy, taking a greater share out of peoples’ pockets. That was ten years ago, so it’s déjà vu…still. This photo from Tom’s Shell gas station illustrates what petrol-shopping drivers were perceiving at the time — that being asked to pay the price of gas in 2007 was akin to giving up your arm, leg, or first born.

It’s important to note that lower income Americans cared more about controlling or managing chronic health conditions versus consumers earning higher incomes, the survey found. That Welltok, meQuilibrium and Zipongo collaborated together in this study represents the kind of collaboration health consumers need industry stakeholders to forge to help people realize their holistic health goals.

Medical banking, data-collecting evidence-based beds, and health-personalized food kits: there is so much Blue Ocean to be filled based on consumer health-and-wellness wants. But through the economic lens of need vs. demand, where “demand” filters through peoples’ willingness-to-pay for products and services, which of these issues are high priorities for which consumers will pay hard dollars out-of-pocket?

This used to be the question I would ask before taking into account peoples’ now-holistic approach to personal and family health. More people, across social strata, are connecting the dots between their own determinants of health and health outcomes based on their personal values and sense of value — remember the survey finding that more lower-income people are trying to control chronic conditions compared with higher-income earners.

The grocery industry has certainly recognized this, with growing gluten-free aisles and pharmacies co-located with produce and center-store products. Pharmacies have blurred behind-the-counter with front-of-store, with more alliances being struck between food-and-pharmacy, and digital health as well. THINK: Walgreens Balance Rewards program (of which I am a beneficiary with many digital health trackers attached to the loyalty account, earning points every single day I wear them).

So the high-end bed becomes a health tool, and airlines are cutting deals with those bed companies to promote healthy sleep in the skies.

TD Bank gifted new deposit customers with Fitbit devices in sync with New Year’s Resolutions tying physical and fiscal fitness in January 2015. This is but one small tip of the iceberg of the New Retail Health. Stay tuned for more on this theme here in Health Populi, where on the advisory side of our work, we’re seeing new-new collaborations, products and services focused on this consumer-healthy sweet spot.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for