In the U.S., trust in the healthcare industry declined by 9 percentage points in just one year, declining from 62% of people trusting — that’s roughly two-thirds of Americans — down to 53% — closer to one-half of the population.

I covered the launch of the 2018 Edelman Trust Barometer across all industries here in Health Populi in January 2018, when this year’s annual report was presented at the World Economic Forum in Davos as it is each year. The Edelman team shared this detailed data on the healthcare sector with me this week, for which I am grateful.

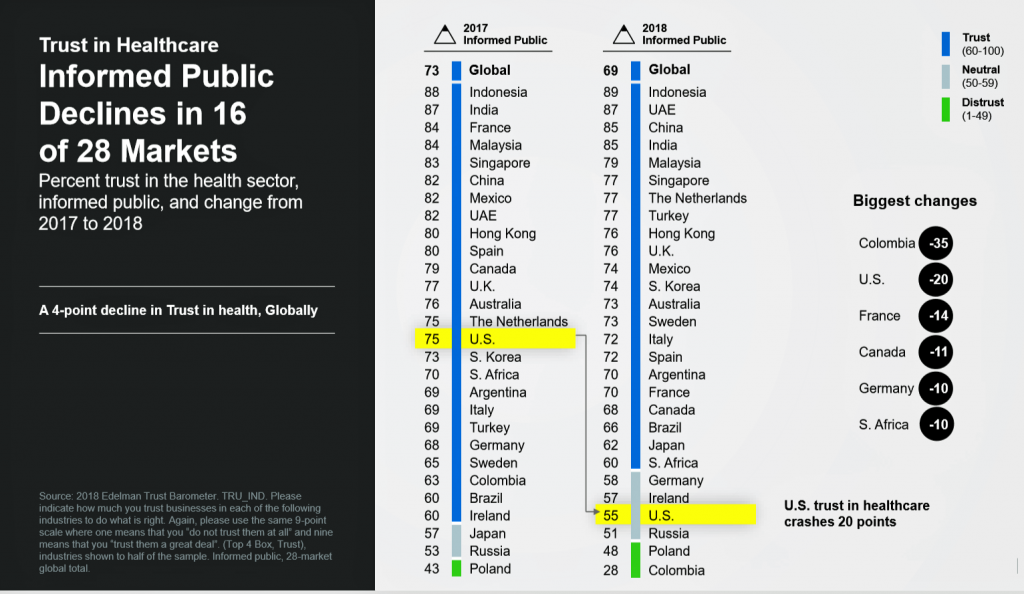

Check out what happened to healthcare trust among the “Informed Public,” a subset of the population Edelman segments in the research. The so-called Informeds are age 25-64, college educated, in the top 25% of household income, and consume more media and business news than the general population. Among these people, healthcare trust fell by 20 percentage points between 2017 and 2018, a “crash” (Edelman’s descriptor) from 75 percent to 55%. Only Colombia had a larger decline in healthcare market trust among a country’s most-informed public.

Check out what happened to healthcare trust among the “Informed Public,” a subset of the population Edelman segments in the research. The so-called Informeds are age 25-64, college educated, in the top 25% of household income, and consume more media and business news than the general population. Among these people, healthcare trust fell by 20 percentage points between 2017 and 2018, a “crash” (Edelman’s descriptor) from 75 percent to 55%. Only Colombia had a larger decline in healthcare market trust among a country’s most-informed public.

Now that you understand the macro level of distrust between Americans and their healthcare system, look at the trust levels by segment of the industry, arrayed in the third chart. The positive key finding here is that U.S. consumers rank hospitals as the top-trusted segment in the U.S., trusted by 70% of the general public, a relatively flat trust level from the previous year.

Otherwise, the news is negative across the remaining four segments: consumer health is the second most-trusted segment, by 56% of Americans, but dropped by 7 percentage points from 2017. Biotech is roughly tied for second place with consumer health, dropping also by 7 points. Health insurance ranked fourth out of five segments, with 46% of people trusting the industry dropping by 9 points, the largest drop among the five industry categories. Finally, the pharma industry ranked fifth of five segments, with only 38% of Americans trusting pharma companies, dropped by a whopping 13 percentage points over 2017.

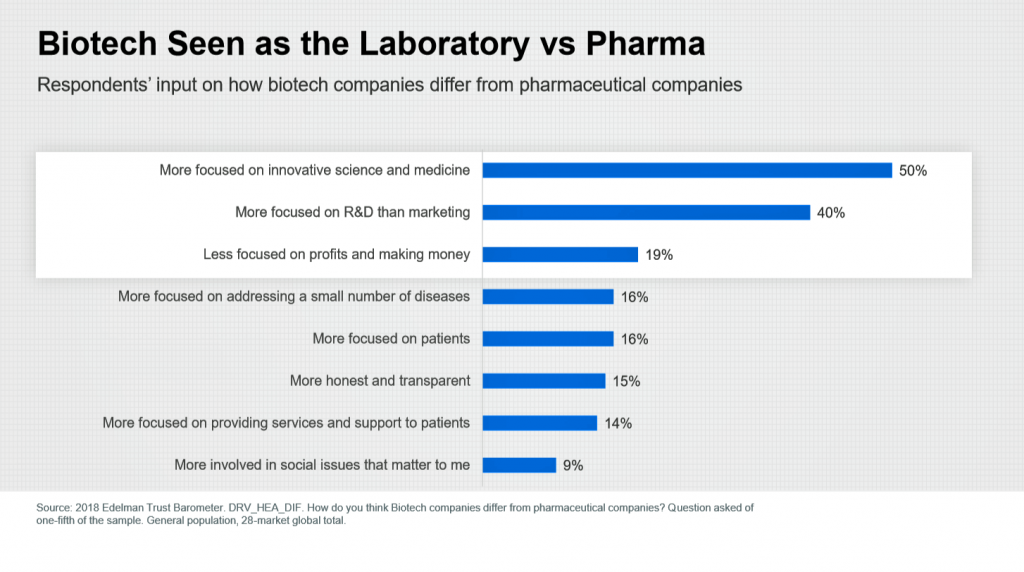

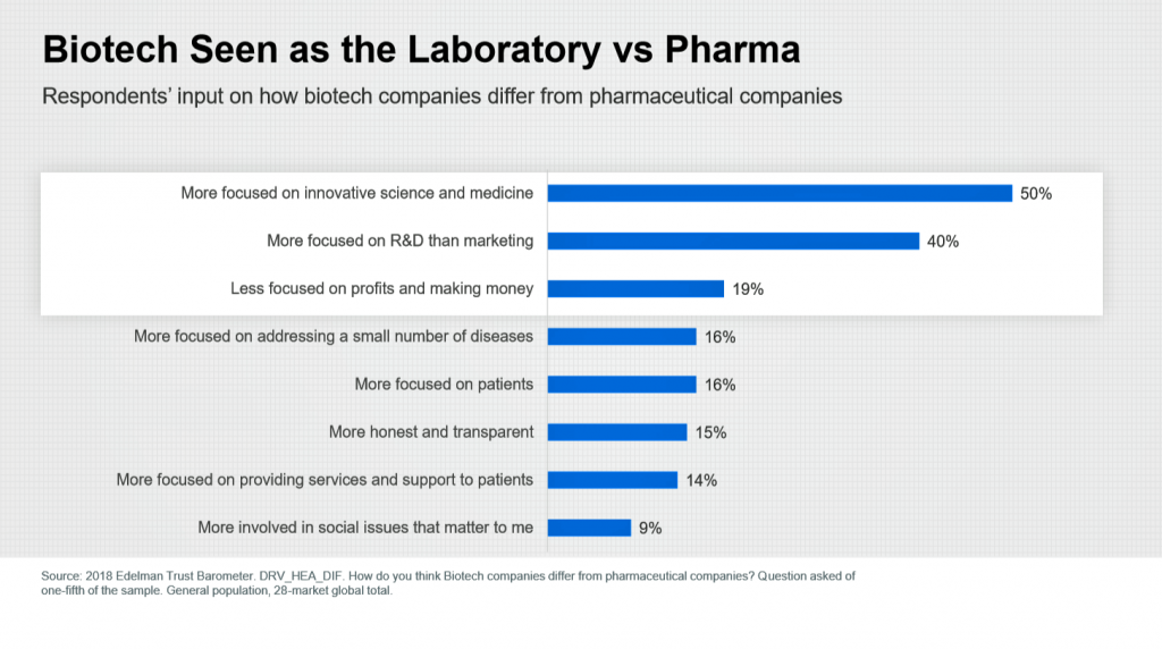

There’s another piece of math worth doing here: a chasm between biotech and pharma of 17 percentage points worth of trust — that is the difference between the 55% of American trusting biotech versus 38% trusting pharma. In that context, look at chart #4, “Biotech Seen as the Laboratory vs Pharma.” Here’s another chasm in perception on innovation: one-half of consumers say biotech is “more focused on innovative science and medicine” compared to pharma, and a plurality see biotech more focused on R&D than marketing.

Pharma is the only segment among the five healthcare businesses where U.S. consumers’ trust levels stayed even, globally, over four years. Trust in the other four segments (biotech, consumer, health insurance, and hospitals) rose from a high of 9 points for hospitals down to 3 points up for consumer health.

Pharma is the only segment among the five healthcare businesses where U.S. consumers’ trust levels stayed even, globally, over four years. Trust in the other four segments (biotech, consumer, health insurance, and hospitals) rose from a high of 9 points for hospitals down to 3 points up for consumer health.

Finally, pharma also bears the most blame among the five segments, global consumers across the 27 countries say, for the high cost of health care.

[A brief sidebar on Colombia’s fall in healthcare trust: If you live in the U.S., you are pretty familiar with what’s been happening in the nation’s healthcare industry, from the erosion of health insurance markets and merger activity between industry players to rising out-of-pocket costs for patients and EpiPen pricing. But you may be asking, “What happened in Colombia?” The brief answer is that the country experienced a huge fraud incident discovered in 2017, involving 18 networks of corruption leading to at least 42 criminal cases. The resulting monetary loss was calculated to be at least $160 mm of fraud in 2017 alone. At the same time, Colombia resolved a 50-year civil war-type conflict, La Violencia, in 2016, leaving the nation scarred physically and mentally to deal with post-traumatic stress and a public health crisis for mental health. Thus, the fraud case has been a major hit to the health economy and, understandably, to health citizens’ perceptions of trust in that system].

Health Populi’s Hot Points: Trust is a precursor for health engagement, Edelman’s Health Engagement taught us in 2010, and that lesson is crucial to dot-connect with the 2018 data for U.S. health ecosystem stakeholders.

That’s because the U.S. is the midst of migrating payment for healthcare services and products from a volume-basis — that is, piecemeal, being paid by encounter or pill/prescription — to value, for outcomes, per episode of care, for quality, among other metrics that vary from plan to plan. The bottom-line, which is becoming the top-line, is that health care providers expect to be paid less to do at least as much as they’ve always done. In this new value-based scenario, doing-more-with-less means changing workflow, developing relationships beyond the transactional, and working in a full transparency mode with both suppliers and patients.

Hospitals ranked top in trust among U.S. consumers because they are the most human-facing actor among the five in the study: hospitals are local employers, they are “my” hospital by affiliation or community brand, and we all know someone that works for the hospital-as-local-employer. They are economic engines in our cities and towns, part of our community fabric. So their trust equity has remained high in health consumers’ minds.

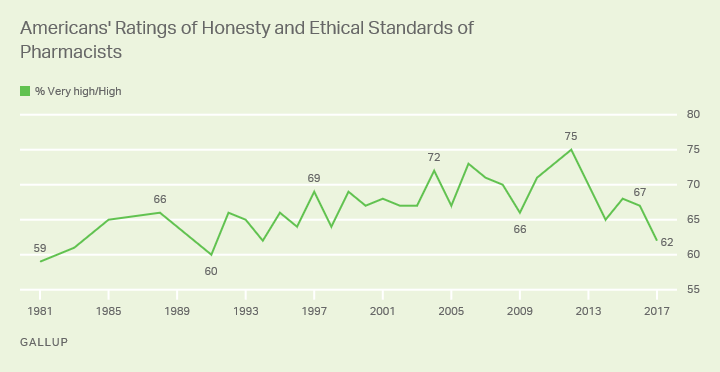

Consumer health, ranking second, is the go-to front-of-store stuff we grab for pain (like headaches and muscle strain), cold and flu, allergy and gut issues. Why the 7-point drop? In 2017, there were some issues that challenged consumers, like the safety of using cough medicines, stories about dietary supplements, and questions about pain medicines which may have stemmed as part of consumers’ concerns about the opioid crisis. Note that for the first time in a decade, the Gallup Poll on ethics and honesty in U.S. professions saw the first major drop in pharmacists’ reputations, compared with nurses and doctors remaining highly ranked. Typically, pharmacists have ranked first or second in this Gallup poll, but fell to 5th place in the professions in 2017. The green line chart draws the high of 75% ranking pharmacists honest and ethical in 2012 to the 2017 decline down to 62% — still relatively high versus members of Congress and car salespeople at the bottom of the list, but below nurses (#1) and doctors.

Consumer health, ranking second, is the go-to front-of-store stuff we grab for pain (like headaches and muscle strain), cold and flu, allergy and gut issues. Why the 7-point drop? In 2017, there were some issues that challenged consumers, like the safety of using cough medicines, stories about dietary supplements, and questions about pain medicines which may have stemmed as part of consumers’ concerns about the opioid crisis. Note that for the first time in a decade, the Gallup Poll on ethics and honesty in U.S. professions saw the first major drop in pharmacists’ reputations, compared with nurses and doctors remaining highly ranked. Typically, pharmacists have ranked first or second in this Gallup poll, but fell to 5th place in the professions in 2017. The green line chart draws the high of 75% ranking pharmacists honest and ethical in 2012 to the 2017 decline down to 62% — still relatively high versus members of Congress and car salespeople at the bottom of the list, but below nurses (#1) and doctors.

Health insurance, with less than one-half of Americans trusting the industry, fell by 9 trust points, and why not? The Affordable Care Act and health insurance exchanges were in chaos, and who to turn to? Health plans have done a very poor job at customer/user experience, as I recently explained here in Health Populi discussing the Temkin Experience Ratings, for example.

And then there’s that pharma/biotech trust chasm, with consumers drawing a stark difference between “innovative” biotech and life science companies (perceived like the white coat donned scientist-experts) vis-à-vis pharma, perceived more like marketers and sales people than research-based innovators. Those are consumers speaking: I’m just the messenger, as I well know that pharma have plenty of smart folks working in labs to develop novel products. It’s just that this research-based expert message is not getting through to the public….and nor is messaging to consumers about the value of pharma.

In fact, in consumers’ eyes, the “value” of pharma are embodied in generic drugs: stuff I can buy for $4 for a course of treatment or $30 for a 90-day supply. Now that new-new things from pharma are largely specialty drugs which can cost thousands of dollars that help people meet a high deductible in one transaction at the pharmacy or oncologist’s office, “pharma” might deserve that 13-point trust drop over the past year, consumers may feel. EpiPen pricing and Martin Shkreli in the media in 2016 and 2017 have added fuel to that fire.

Of course, biotech launches of novel products are part of that story, but somehow, that industry has done a better job in articulating a value and consumer-friendly story.

I’m not the one to solve that problem — Edelman and their communications industry peers are. My job is to connect these dots for you, and advise you that in a value-based payment mode, valuing what matters to patients (and designing for those values) would help to reverse the negative trust-trends and re-build rapport between patients/consumers and healthcare industry players.

In a year where health policy will shake, rattle, and roll in the U.S., I'm grateful to be identified as writing one of the best blogs dealing with the topic this year.

In a year where health policy will shake, rattle, and roll in the U.S., I'm grateful to be identified as writing one of the best blogs dealing with the topic this year.  I am gratified and grateful for my Health Populi blog to be named #1 by Feedspot in the category of

I am gratified and grateful for my Health Populi blog to be named #1 by Feedspot in the category of  Jane will deliver the keynote address at the upcoming

Jane will deliver the keynote address at the upcoming