Large employers expect health care costs to increase by 8.9% in 2011, up from 7.0% in 2011. To stem cost increases, employers will adopt an array of tactics, most prominently offering consumer-directed health plans (CDHPs) and expanding wellness programs that encourage incentives to healthy lifestyles.

These expectations come from Large Employers’ 2011 Health Plan Design Changes, a survey report from the National Business Group on Health poll of large employers.

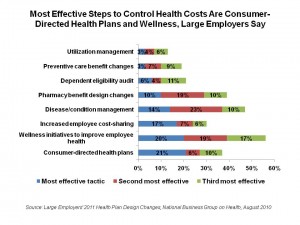

1 in 5 employers say CDHPs are the most effective approach for managing health care cost growth, as shown in the chart. 61% of employers will off CDHPs in 2011, 20% of whom will have moved to a full replacement plan — double the percent of 2011. Most of these plans will be high-deductible health plans coupled with health savings accounts.

Wellness initiatives are growing very popular among large employers who believe they can help bend their companies’ health cost curves. 1 in 5 large employers see these programs as being most effective in managing health cost increases. 76% of large employers off wellness programs for workers who are overweight. 41% of employers are offering premium discounts for enrollees who take advantage of health assessments; the total average financial incentive for employees is $386, with a wide range of responses from a minimum of $50 to a maximum of $1,200 (sample size = 49 employers who answered this question).

Other programs seen to be effective in controlling health care costs including increased employee cost-sharing, disease/condition management, and pharmacy benefit design changes.

For increased cost-sharing, 2 in 3 employers (63%) say they will increase employees’ percentage contribution to premium costs, up from 57% in 2010. 1 in 2 will set out-of-pocket maximums, and 44% will have in-network deductibles.

For pharmacy benefit changes, 1 in 4 employers will increase co-pays for retail pharmacy; 1 in 5 will increase co-pays on mail order pharmacy. Prior authorization is the #1 pharmacy benefit technique for 2011 seen to help manage the benefit cost (by 73% of employers), followed by step therapy (63%), three-tier benefit design (63%), mandatory mail order for maintenance meds (47%), mandatory generic substitution (37%), and dose optimization (37%). Four-tier designs are now in place in 16% of employers.

53% of large employers continue to monitor and tweak their plans based on their understanding of the Accountable Care Act (ACA, or health reform) especially for issues concerning limits on benefits, removing pre-existing condition exclusion clauses, and coverage of dependent children to age 26.

NBGH polled 72 members on their 2011 plans for employee health benefits in spring/summer 2010 as employers were finalizing their plans for next benefit year.

Health Populi’s Hot Points: The good news here is that large employers will continue to offer a health insurance benefit in 2011. They’re closely paying attention to ACA’s provisions and impacts on their benefit plans and, ultimately, their profitability.

To manage the expected 8.9% cost increase, which is much greater than 2010’s 7% increase, employers will transfer more costs for health coverage onto employees. This is not unexpected, but may dissuade some employees from participating given that 2 in 3 employers will increase employees’ contribution percentages to health plan premiums. With salaries in static mode over the past several years, employees are between that rock and hard place as dependents’ costs for other line items – like college education and energy costs — continue to grow as well.

It’s all about intelligent plan design: employers should look to health benefits advisors for deep-dive understanding of consumers’ elasticity for demand for health and wellness in their and their dependents’ lives. A small tweak of a few dollars can make a big difference on peoples’ adherence to health and sickness regimens.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a