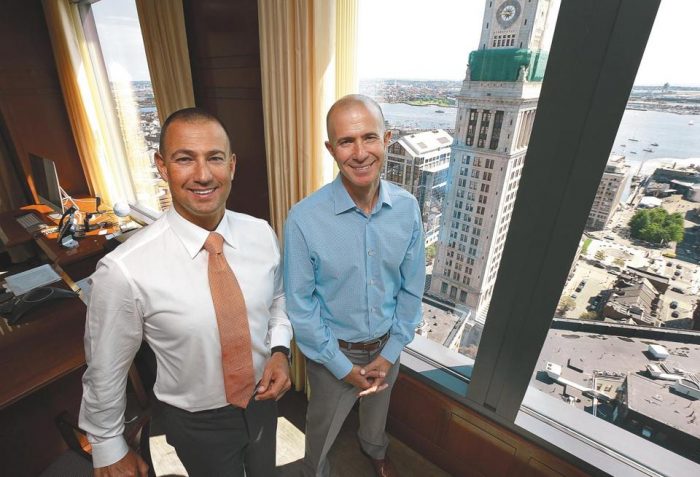

Ten years ago, two brothers, physicians both, started up a telemedicine company called American Well. They launched their service first in Hawaii, where long distances and remote island living challenged the supply and demand sides of health care providers and patients alike.

A decade later, I sat down for a “what’s new?” chat with Roy Schoenberg, American Well President and CEO. In full transparency, I enjoy and appreciate the opportunity to meet with Roy (or very occasionally Ido, the co-founding brother-other-half) every year at HIMSS and sometimes at CES. In our face-to-face brainstorm this week, we covered a wide range of topics, starting with some historical context to get to the “new and now.”

That launch of AmWell in Hawaii was with a payer, a unit of Blue Cross. The company’s early bet and first strategic choice was to work with payers. That segment is a significant business now, Roy explained. The company works with virtually every major payer-player, and 45 Blue Cross Blue Shield plans as well. This is a core business for AmWell.

The company’s second strategic choice was to “put the technology in others’ hands,” Roy described, with AmWell’s services, “baked into other businesses.” Doing so in this way can help health/care ecosystem stakeholders innovate their own business and pricing models to adapt to changing market forces. AmWell has invested in making their own technology easier to tie into other businesses’ infrastructures and architectures. Consider the plethora of EHR systems, scheduling idiosyncrasies, physician adoption and workflow considerations, and patient matching challenges, for example.

On the health system (provider) side, there is substantial pressure to reduce costs and at the same time, provide innovative services. These services are increasingly ambulatory and mobile, based on both cost and consumer preferences. AmWell’s customers cover about 150 million lives. Don’t mistake that for “reach,” Roy warned me when I quickly calculated, “So, you reach 50% of the U.S. population.” It’s a potential consumer/patient market that AmWell could serve, but not every person with access to telehealth services takes advantage of that supply side.

Remember the Field of Dreams effect? “If you build it, they will come?” In telehealth, even with employers covering the service as a workplace benefit, most employees still don’t “benefit from the benefit.” We discussed this disconnect on our panel today at HIMSS19, addressing digital traction in consumerization of health care.

Dr. Peter Rasmussen explained that there are many reasons clinicians and consumers don’t yet engage in virtual health services. In some systems, like Kaiser-Permanente, at least 50% of encounters are done via non-traditional channels: via secure email with clinicians, via video chat, and asynchronous chat, for example. Intermountain and Mercy Virtual, too, conduct lots of visits via telehealth means. However, some recent market research estimates have identified relatively low consumer market adoption.

A major limiting obstacle for providers has been licensure, where a doctor peer of Peter’s in Cleveland cannot provide a second opinion for a patient in rural Kentucky for a rare cancer due to the Ohio physician’s lack of license in the Bluegrass State. I noted that in the EU, this isn’t a problem for physicians operating in different countries, from the far north to the Mediterranean south.

On the consumer side, a Jetsons-style telehealth visit with a clinician on a screen can seem too Star Trek tricordery, whether small on a phone or on a large-screen PC monitor. But once a patient-consumer experiences that virtual visit, most people want to repeat the telehealth encounter. Here, Jane Jetson is very happy to be able to access a telehealth visit for her son, Elroy — and true enough, back here in the digital health Stone Age, Moms with young children are particularly keen on virtual visits especially on nights and weekends.

To smooth organizations’ way to offer telehealth, American Well offers an SDK, a software development kit. This package drops into the client’s technology, easing on-boarding to the AmWell service ecosystem. Samsung, for example, built an American Well app into their phone. New York Presbyterian Hospital has an app for telehealth from American Well. AmWell SDKs have also been used by Medtronic, Cerner, and Philips, among others. The Apple Heart Study used the SDK.

“American Well is like the Intel inside,” Roy agreed with my analogy.

In a new HIMSS19 announcement, Netsmart adopted the AmWell SDK for a behavioral health opioid program.

On our panel on Valentine’s Day, Greg Orr from Walgreens, Jessica Gelzer from Heal, and Dr. Rasmussen of Cleveland Clinic discussed the blurring between the traditional physician and the newer digital side. This is happening in retail, with the “A” word “Amazon” invoked at every health care meet-up over the past year and ongoing.

This omnichannel phenomenon is now retail-reality, and it’s happening in health care delivery, too.

Roy’s Amazon-analogy pointed me to the concept of “inventory.” Amazon shows us that stuff doesn’t have to live on Amazon’s warehouse shelves. “You don’t need to own it, but to route it,” Roy explained.

So for that industry disruptor, the key tactic is to develop and implement skills around inventory distribution.

Thus, the quote in the title of this post: as Roy asserted, “telehealth is the distribution channel for health care services.”

And here’s the next money quote and lightbulb moment: “We have to let go; we can’t be the product,” Roy asserted.

In sense of the health services “inventory,” that, too, has expanded since the start of offering a physician visit. Today, specialists are part of the AmWell physician network, as well as women’s health experts, nutrition counselors, weight loss coaches, lactation support, and the fast-growing area of behavioral health.

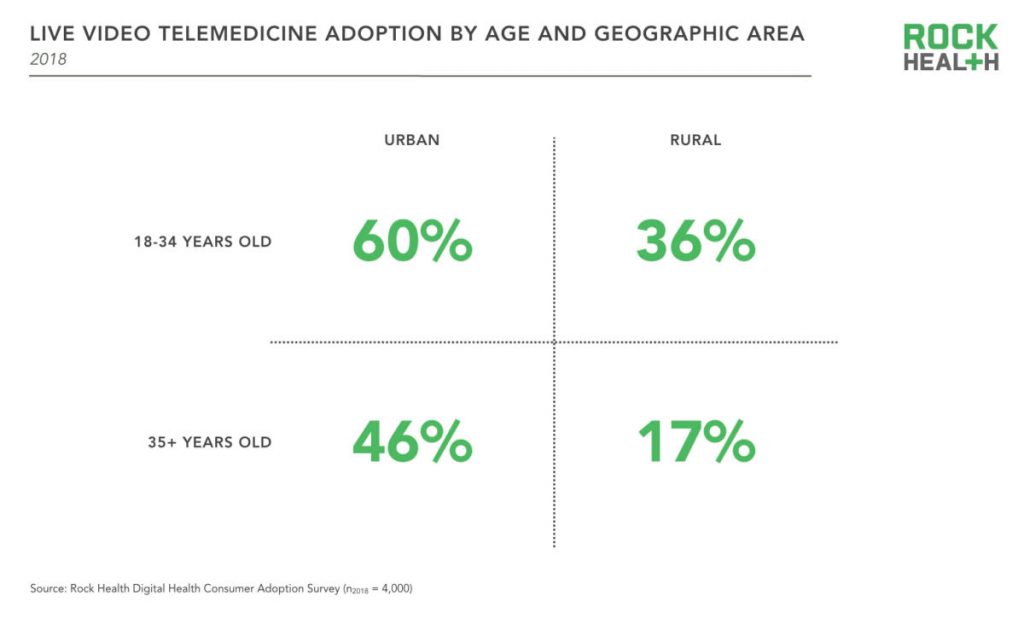

Health Populi’s Hot Points: Live telemedicine visits are more prevalent among younger urban-dwelling consumers, with lower adoption among rural, older residents, Rock Health learned in its fourth and latest digital health consumer survey.

This means that some of the very people who most need access to health care services — rural, older, frailer health citizens — aren’t tapping into virtual visits. As Dr. Rasmussen pointed out, there can be may reasons a person doesn’t engage in telehealth: cultural, financial, or trust/privacy. I would also add in the role of connectivity and broadband as a social determinant of health, clearly a barrier to adoption in rural areas that can lack connection to the last mile, and to the last person/patient.

In the growing health ecosystem landscape of retail health for patients-as-payors, attending to social determinants of health is at least as important as paying attention to health care services and specialty care access. I expect that AmWell will expand its footprint and services from the nutrition and weight loss areas to other behavioral and social factors that play so integrally into peoples’ overall health and wellness.

At HIMSS19 we see some exhibitors that will support this kind of consumer engagement and ecosystem build-out: AWS (Amazon Web Services), Google, Microsoft (with announcements for the Azure cloud collaborating with Walgreens, for example), and Salesforce bringing CRM capabilities to health and social services.

Ten years from now — even three years from now — I cannot forecast what new-new collaborations and services Roy and I will talk about. I’m certainly doing scenario planning on this for my advisory work.

Of one thing I am sure: in the coming years, the person’s home will certainly be the hub of health.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for