We Are All Health Consumers Now. That’s the title of the first chapter of my new book, HealthConsuming: From Health Consumer to Health Citizen. I start this chapter quoting President Ronald Reagan in 1983, who recognized that health care costs were growing at three times the rate of inflation during the first term of his Presidency.

It’s déjà vu in health care all over again, but 35 years later, it’s the patient now facing sticker-shock with first dollar payments in high-deductible health plans, six-figure prices on specialty drugs to treat cancers, and a poor return-on-investment for personal health spending.

Thus begins my journey, with you the reader, ex plaining how patients-as-payors, now nudged into the role of consumer, could morph into health citizens: with rights to health care, bolstered privacy protections; more care in the community and at home to boost quality and safety and reduce costs, and, more opportunity and responsibility for self-care.

plaining how patients-as-payors, now nudged into the role of consumer, could morph into health citizens: with rights to health care, bolstered privacy protections; more care in the community and at home to boost quality and safety and reduce costs, and, more opportunity and responsibility for self-care.

In the Health Populi blog this week, I’ll take each weekday to explain one part of this story: the patient-as-payor, now consumer; how Amazon has primed health consumers, with informed retail service expectations; what we know about ZIP codes, food, deaths of despair and the social determinants for health; the promise of digital health and perils of privacy; and finally, whether health consumers in the U.S. can/will emerge as health citizens. All of these themes are backed up by 519 endnotes in the back of the book, as I connect the dots of the rich evidence base for telling this story.

First, let’s explore the scenario-reality of the patient-as-payor, now consumer. This is a contentious issue, debated from my admired economist-guru Paul Krugman in the New York Times in 2011 when he contended that patients weren’t consumers; to last week in Medscape, when bioethicist, and another admired thinker, Dr. Art Caplan, echoed the same.

First, let’s explore the scenario-reality of the patient-as-payor, now consumer. This is a contentious issue, debated from my admired economist-guru Paul Krugman in the New York Times in 2011 when he contended that patients weren’t consumers; to last week in Medscape, when bioethicist, and another admired thinker, Dr. Art Caplan, echoed the same.

Health Affairs covered this topic, too, last month, which I discussed here in Health Populi.

The data, though, demonstrate the growing adoption of high-deductible health plans, co-payments and coinsurance for health plan members. When people face first-dollar out-of-pocket spending, they are assigned the role of consumer in choosing to spend that money out of household budgets. The latest research from the Bureau of Labor statistics is that on a median household basis, 20% of spending goes to healthcare.

That’s the immediate situation for real people facing real diagnoses, today and tomorrow, in 2019.

“Today’s high deductibles are tomorrow’s bad debt,” a Moody’s analyst recently wrote. This starts the theme of the second chapter — The Patient is the Payor.

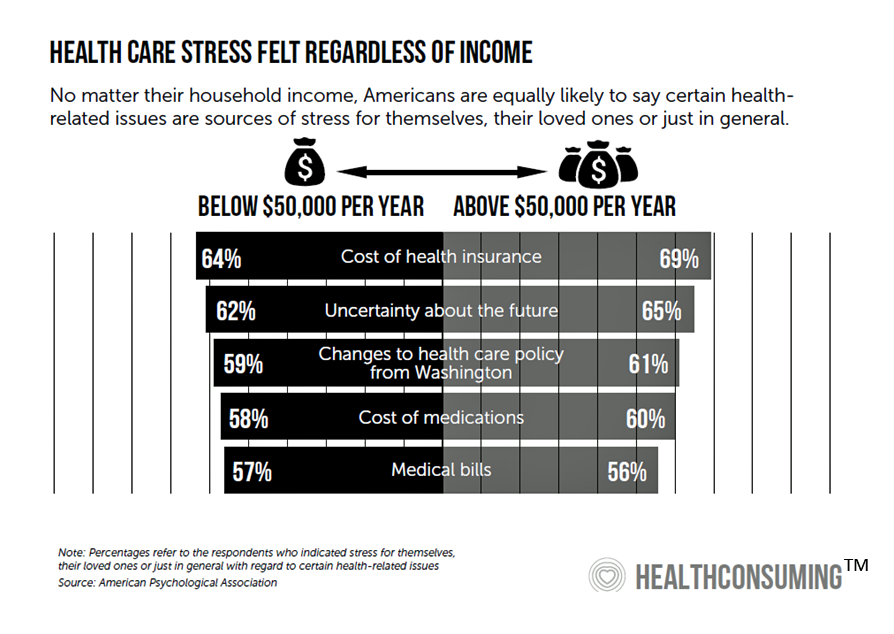

Health care costs stress out people at all income levels in the U.S., according to the American Psychological Association‘s annual study on Stress in America. And this goes, too, for people both uninsured and insured. This isn’t a new-new finding: even families earning over $90,000 a year cited health care costs as their #1 pocketbook issue, a Kaiser Family Foundation study learned in 2015.

Health care costs stress out people at all income levels in the U.S., according to the American Psychological Association‘s annual study on Stress in America. And this goes, too, for people both uninsured and insured. This isn’t a new-new finding: even families earning over $90,000 a year cited health care costs as their #1 pocketbook issue, a Kaiser Family Foundation study learned in 2015.

This sets the stage for understanding how patients, now consumers, paying more directly for health care in deductibles and OOP expenses are, justifiably, expecting greater service, experiences, value and return-on-investment from th ehealth care industry. Welcome to the next section of HealthConsuming, the Amazon-Prime-ing of health consumers, in tomorrow’s Health Populi blog,

Thank you FeedSpot for

Thank you FeedSpot for