Today is July 15, and my email in-box is flooded with all flavors of Amazon Prime’d stories in newsletters and product info from ecommerce sites — even those outside of Amazon from beauty retailers, electronics channels, and grocery stores.

So I ask on what will probably be among the top ecommerce revenue generating days of all time: “What could health care look like when Amazon Prime’d?”

So I ask on what will probably be among the top ecommerce revenue generating days of all time: “What could health care look like when Amazon Prime’d?”

I ask and answer this in my book, HealthConsuming, as chapter 3. For context, this chapter follows two that explain how patients in the U.S. have been morphing into health consumers based on how health care is financed and delivered in America. This metamorphosis has turbocharged through the growth of high-deductible health plans, coupled with health and medical savings arrangements (HSAs and MSAs). Furthermore, the ubiquity of direct-to-consumer advertisements for prescription drugs that detail to people in mass media channels market medicines in the same moments as food, automobiles, and appliances — an experience that moves Rx drugs from behind the pharmacy counter to a more retail, front-of-store and -mindset.

The patient is the payor, the second chapter characterizes. As such, motivating people to shop for the components of their health care that is shoppable — which, in a trauma or fast-paced cancer scenario isn’t a simple search, click-and-ship transaction.

And yet…as the first chart illustrates from Aflac’s Workforces Survey, half of people want shopping for health insurance to feel like an Amazon experience, and another 20% like a retail store.

This is the Amazon Prime’ing of the health care consumer, with expectations for that level of transparent, streamlined (vs. friction-filled), and choice-suggested experience.

In my work-world of forecasting and planning ahead for health care to meet that puck where it’s going in 1:3:5 years, this consumer scenario was not a surprise — it’s a rational response of people who, when faced with first-dollar payments for health care, are forced into a position to try and make rational decisions in a very complex web of payment and service delivery.

This is driving people toward greater interest and engagement in self-care which can bolster health activation that can enhance patient outcomes, shown through the research of Judith Hibbard and others.

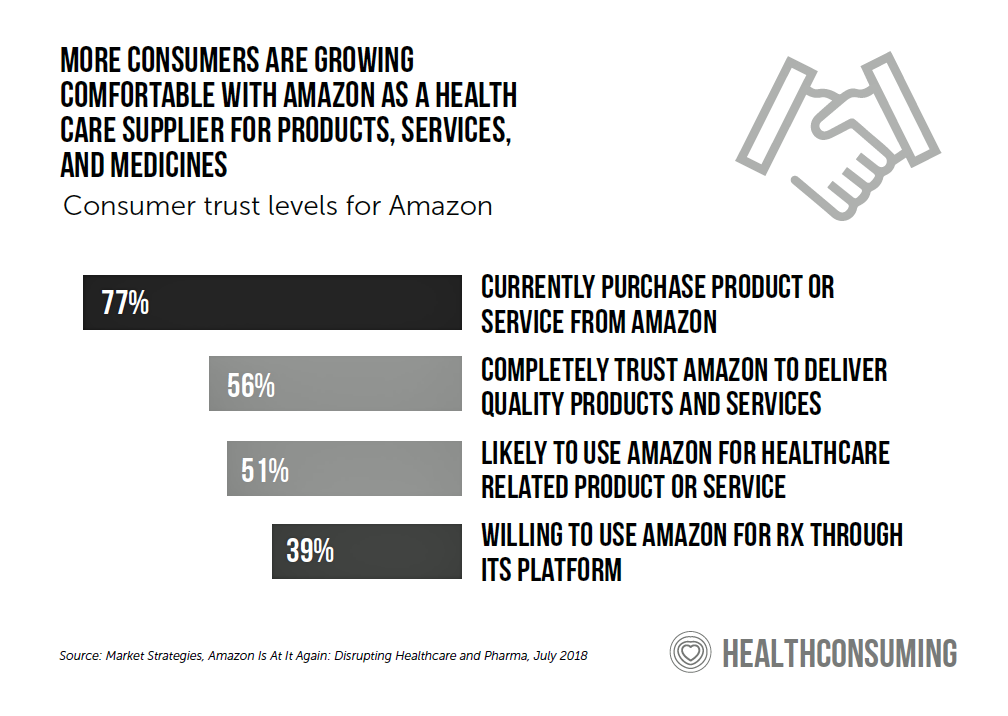

But to support that patient-consumer journey means making that self-care trip more enchanting, friction-less, empowering, and value-packed. The second chart illustrates the Amazon trust relationship with consumers — that half of the company would be likely to use Amazon for health care related products or services. Trust is a precursor for health engagement, so Amazon has that consumer goodwill in place to leverage for health care relationships.

Furthermore, two in five people would be willing to use Amazon as a prescription drug channel.

Furthermore, two in five people would be willing to use Amazon as a prescription drug channel.

The obvious dot to connect to this latter point is Amazon’s acquisition of PillPack, which enabled the ecommerce giant to become a version of a virtual national pharmacy chain serving 50 U.S. states.

But “wait! There’s more!” as Ron Popeil, iconic retail guru who on our TV sets hawked all sorts of household devices, would say. (For your trivia fun for the day, that quote was cited as one of the top ten product taglines of all time).

Amazon itself has been multi-tasking across the entire health/care ecosystem to grow platform competencies and products and services to channel across them. My most recent favorite is Xealth, which enables providers to “prescribe,” or order up, stuff for patients from one platform via streamlined Amazon-style workflow. Xealth recently received additional funding to further scale the technology. More details for this can be found here.

Another Amazon Prime effect is happening beyond consumers and patients in B2C. It’s impacting the B2B side of things. Consider that on the day of the PillPack acquisition, pharmacy chains’ stock prices took big hits on their market caps, shown in the line chart.

Health Populi’s Hot Points: The growing presence of Amazon in health/wellness and health care is also a factor driving consolidation and creative alliances between new partnerships to deliver more consumer-centric services as I envision in HealthConsuming‘s chapter foreseeing “The New Retail Health.”

As you shop for Amazon Prime deals today and tomorrow (15th and 16th July), you might ponder how your experience could (or will) translate into your own health care life-flows soon or in the future. Amazon Prime’ing has already begun to reshape consumer expectations in terms of UX/UI and service design in hospitality, financial services, and of course, retail.

Each of these industries is adjacent to health care and we’ve begun to see the green shoots of the new retail health on wellness services in hotels and real estate (think: Peloton in hotel gyms, fresh food delivery to your hotel room, and wellness embedded into sleep); and UX design thinking coming to medical payments.

We’ll see more partnerships and collaborations coming together that should bring more good design thinking into their deliverables. If these deals are meant just to lower costs for the B2B side of the transactions, they’ll be missing the important boat (opportunity) — that is, to support peoples’ self-care to help patient-consumers lower their own costs, feel better, and improve their own care and quality of life.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a