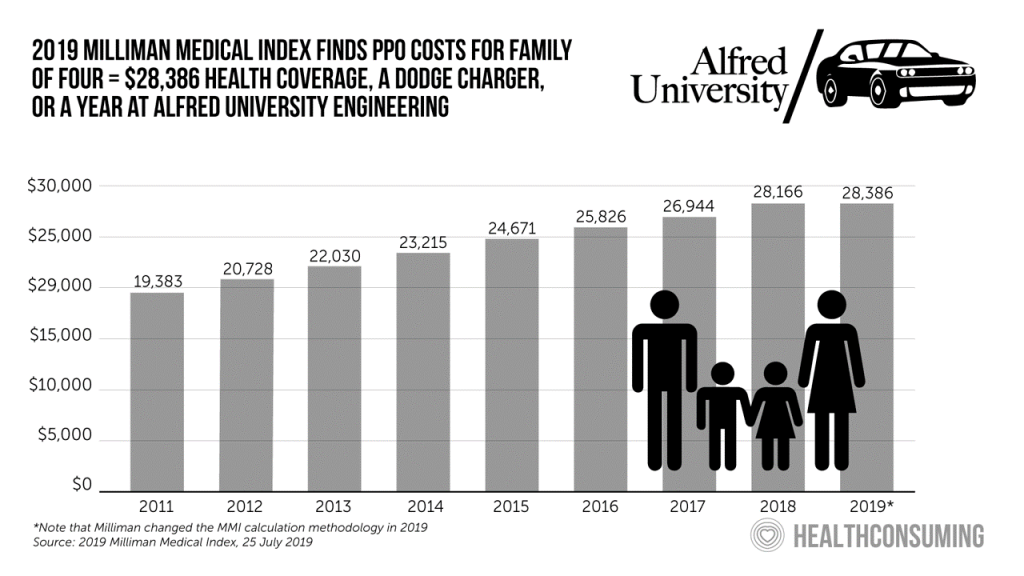

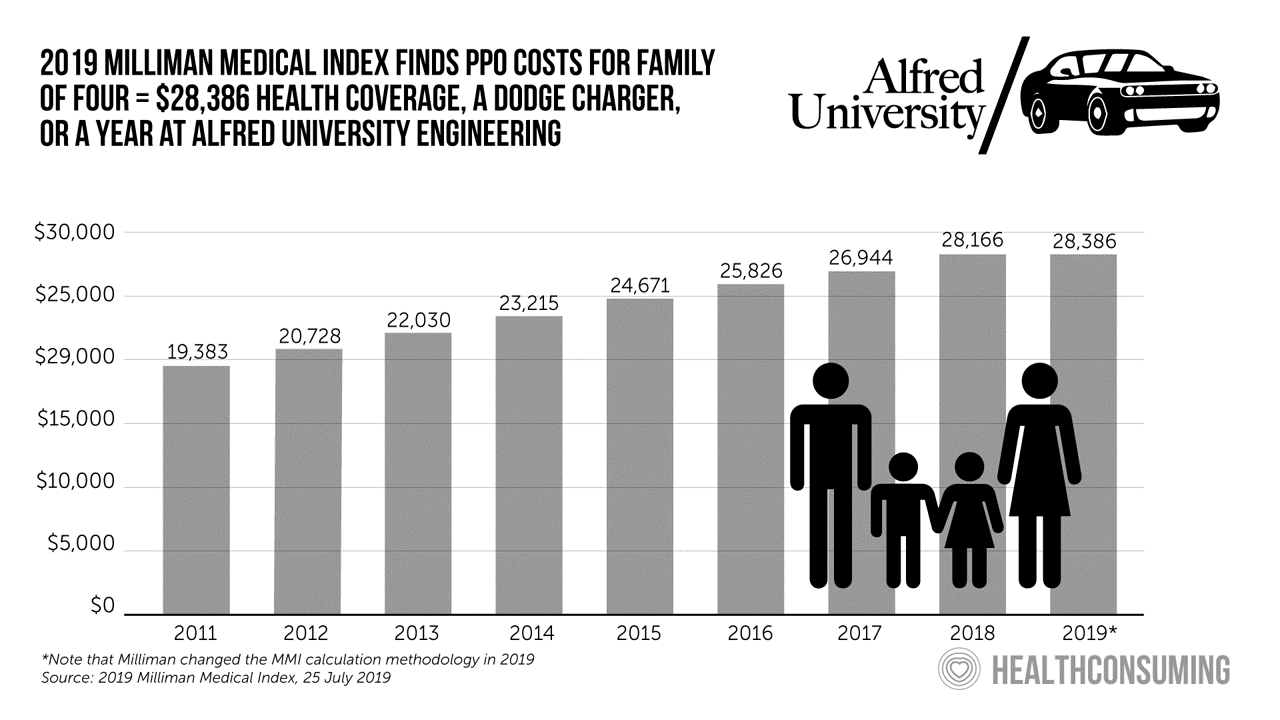

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI).

Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University.

Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University.

The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years.

The key points of the report are that:

- Health care costs are growing at a slower pace, although up-ticked from last year’s trend: in 2018-19 costs grew 3.8%, and last year 2017-18 the growth rate was 2.9%

- There was slower prescription drug cost growth this year of 2.1%, less than half the rate of last year’s 4.5%

- The employee’s share of health care costs will be relatively flat versus last year.

Milliman has changed the methodology for the 2019 MMI. Milliman explains that the composition of a “typical family of four” on which the Index is built has changed over the past decade. The actuaries are “widening the view” on the scenario, considering different stakeholders’ perspectives creating a more interactive version of the MMI. MMI has adding in additional data sources for the forecast.

The interactive tool can be found at milliman.com/mmifamilies.

The first pie chart shows the 2019 spending line items, the largest of which was physician spending amounting to $1,888, followed by outpatient of $1,846, inpatient (hospital) of $1,195, pharmacy of $1,282, and other ($137). Physician and outpatient spending each reached nearly one-third of total spending, and inpatient and pharmacy about 20% each.

Milliman found that physician spending grew 3.2%, somewhat more quickly than inpatient and outpatient expenses.

The slower growth of the pharmacy line item for prescription drugs was due to greater public scrutiny on drug prices, Milliman opines. The report includes a detailed discussion on prescription drug rebates (two full pages of the 12-page report), part of the national conversation on Rx spending with respect to the role of pharmacy benefit management companies, their profits, and lack of transparency. While rebates have “reduced sticker price of high-cost drugs” and helps consumers reduce out of pocket spending at the pharmacy, rebates increase premiums for all plan members. As to the lack of transparency, Milliman writes, “Quantifying the impact of POS (point of service) rebates is challenging because of confidentiality agreements between PBMs and manufacturers.”

Health Populi’s Hot Points: The second pie chart here in the Hot Points shows the split of medical costs shared by employers and employees. The employer contribution is the subsidy a company pays to cover a worker’s health insurance premium. The employee contribution is the share of the premium and out-of-pocket costs are those the worker pays for services up to the deductible plus copayment and coinsurance amounts.

The pie chart illustrates that the employer covers $6 in $10 of medical costs, and the employee, $4 in $10.

The good news for employees is that this level of cost sharing is relatively flat from last year’s split of medical costs for workers insured at work through a PPO.

There’s still the issue of workers covering their deductible, and that challenge will continue in 2019 into 2020 for folks and their families dealing with chronic conditions and surprise diagnoses like cancer or autoimmune diseases. The patient is still the payor in 2019 and ongoing, whether she must meet a deductible or manage health and care without insurance. Given the lower rate of U.S. consumer savings in 2019 (covered in Health Populi here in the Hot Points below the digital fold), workers dealing with medical issues will continue to be challenged to pay their bills.

Companies should look to bundle financial wellness into a culture of health in their organizations to address this continuing issue for workers dealing with medical needs.

Thank you FeedSpot for

Thank you FeedSpot for