Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned.

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned.

Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year.

One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people whose medical bills went to a collections agency, 60% were unable to pay the full amount of the bill, and 43% were confused about the amount of the bill.

Nearly all of the patients surveyed were worried about their growing health care cost responsibilities looking five years into the future.

One-half of patients in the Cedar study were frustrated about health care providers’ lack of digital administrative tools to help people pay bills online and/or access insurance information, for example.

Digital processes for peoples’ personal health care financial management are elusive: three-quarters of patients said they are notified about their medical bills and insurance via traditional postal mail. Just over one-half receive this information on a patient portal, and 34% via email. 15% receive this information in text message form.

Most patients are keen to know their out-of-pocket costs ahead of their visit or procedure, but one-half of those who asked for that information weren’t able to access it easily or accurately.

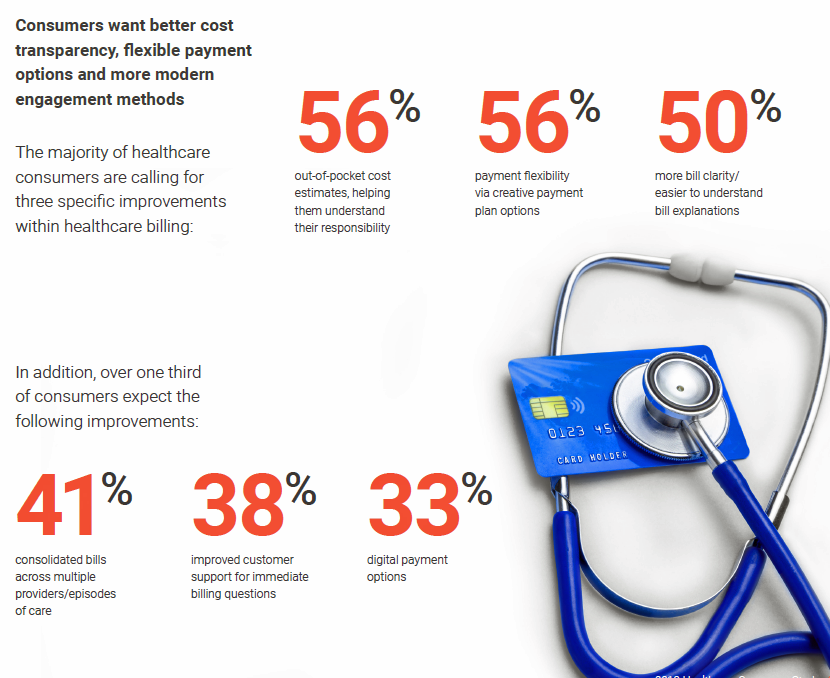

The second chart quantifies peoples’ growing demand for price transparency and “more modern” engagement methods — that is more digital, on-line, automated personal financial management workflows for health care interactions:

- 56% of people want out-of-pocket cost estimates clearly communicating their personal financial responsibility for their share of the medical bill

- 56% of people also want payment plan options

- 50% want clearer, easier-to-understand medical bills

- 41% of people would like consolidated medical bills across providers

- 33% of patients would like digital payment options.

Patients, now consumers looking for digital and “modernized” cost and payment information and options like they find in other industries like banking and travel, have begun to flex those consumer demand muscles by leaving a provider due to lack of digital engagement.

Two-thirds of patients 18-24 years of age were frustrated with doctors’ and hospitals’ lack of digital tools for pricing and payment, compared with 29% of patients 65 years of age and older. Those younger patients would be four times more likely to switch or stop going to a health care provider due to a poor digital experience compared with a patient over 65.

Note that over one-half of patients have consulted online reviews of hospitals or doctors when choosing a provider, more likely done by younger patients under 44.

Health Populi’s Hot Points: Among the five industries compared for digital experience, health care and insurance fell to #4 and #5, with online retail, banking and travel ranking in the top three positions.

Health Populi’s Hot Points: Among the five industries compared for digital experience, health care and insurance fell to #4 and #5, with online retail, banking and travel ranking in the top three positions.

When Aflac asked prospective buyers of health insurance what their shopping experience should feel like, 1 in 2 consumers said, “like Amazon.” One in five said, like a great retail experience, shown in the third pie chart.

I include this Aflac workforces study in my book, HealthConsuming, in a chapter titled, “How Amazon Has Primed Health Consumers.” Amazon has re-set consumers’ expectations on what excellent customer service (“experience” in our wonky parlance) looks like. That’s a new bar not just for retail and banking, but for health care and insurance as well.

And this is not only for providers and plans, but for pharma and life science companies, as well. Another study I cite in the book from Market Strategies found that of people already purchasing products on Amazon, over one-half would trust Amazon for health care related products or services, and 39% would be willing to use the Amazon platform for prescription drugs instead of a retail pharmacy or online PBM channel.

Do not assume that older people, and especially “younger older” Medicare members between 65 and 74 don’t increasingly feel this way. In research in which I collaborated with HealthMine, we learned that “digital immigrant” older folks were adopting digital tools in health care and were hungry for the kind of cost transparency and online access to information that younger people were. These younger-older people will continue to enroll in Medicare Advantage plans for the near-to-midterm, with new services available to be offered to people for self-care and aging well at home.

The likes of Best Buy and a growing supply of product and service companies looking to serve the “Silver Tsunami” are building services now to meet this demand. Providers, plans and pharma that don’t re-imagine their businesses in this way will not be relevant to a percent of patients. Assume these are only younger people at your strategic peril.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for