ABBA sang the song “Money Money Money” back in 1976.

ABBA sang the song “Money Money Money” back in 1976.

The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019.

Ain’t it sad

And still there never seems to be a single penny left for me

That’s too bad…

In the rich man’s world.”

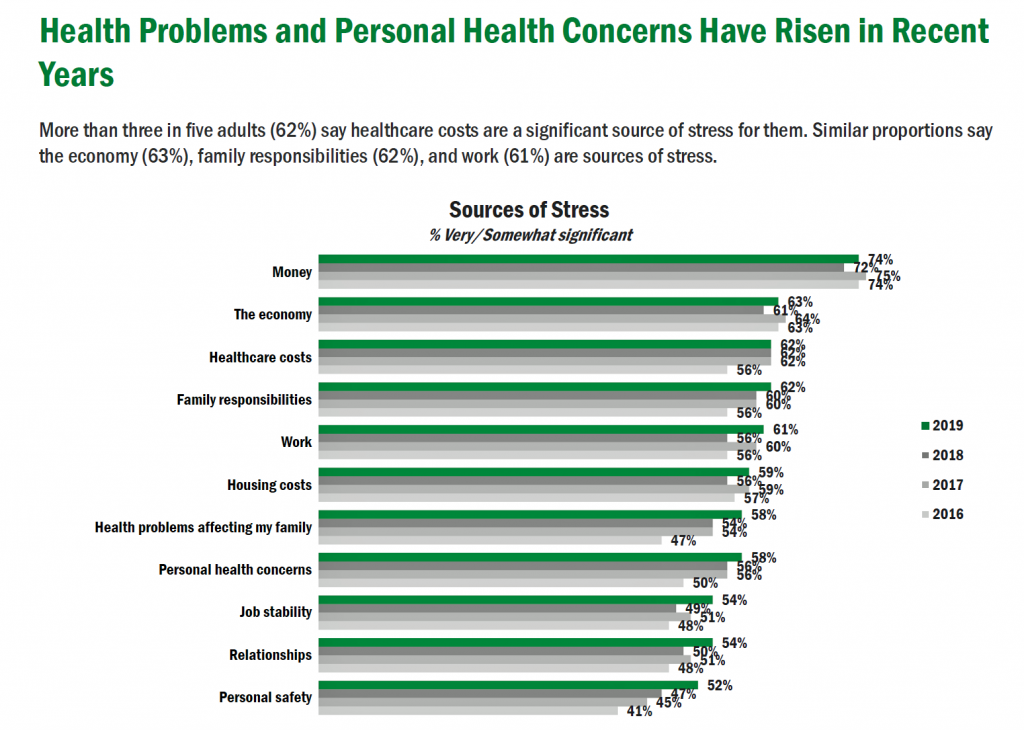

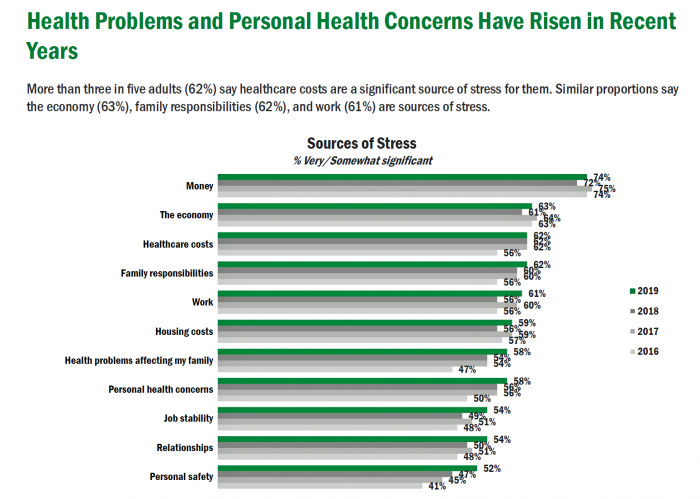

In the 2019 dictionary next to the word “stress,” we would find variations of a definition all deriving from Americans’ current worries about their money, the economy, and health care costs…then, family responsibilities and jobs.

In the 2019 dictionary next to the word “stress,” we would find variations of a definition all deriving from Americans’ current worries about their money, the economy, and health care costs…then, family responsibilities and jobs.

The 7th Annual U.S. Healthcare Consumer Survey from TransAmerica‘s Center for Health Studies underscores that Americans are “settling in” during a phase of “healthcare uncertainty.”

The first chart illustrates the top sources of stress gauged in each of the past four years of this survey since 2016.

Note that in 2019, many issues have spiked upward: healthcare costs, family, work, health problems affecting one’s family, personal health concerns, job stability, relationships, and personal safety.

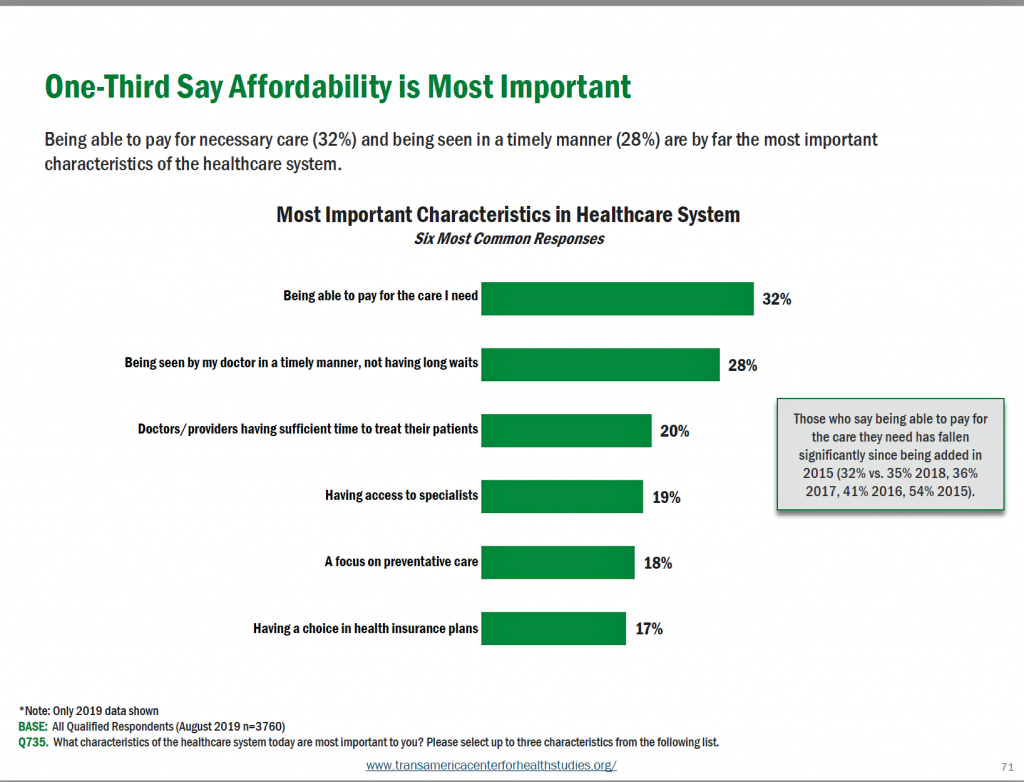

Punctuating the issue of costs, being able to pay for health care tops Americans’ list of the most important characteristic in the health care system — above being seen by a doctor in a timely matter/not long wait, sufficient time to spend with a doctor, access to specialists, prevention, and a choice of health plans.

Punctuating the issue of costs, being able to pay for health care tops Americans’ list of the most important characteristic in the health care system — above being seen by a doctor in a timely matter/not long wait, sufficient time to spend with a doctor, access to specialists, prevention, and a choice of health plans.

TransAmerica found that people can’t typically afford health insurance premiums above $300 a month — that is, $3,600 for an annual premium for a health plan.

Cost concerns create barriers for some people who don’t visit doctors or fill/take prescription drugs: 27% of Americans cancelled a medical appointment due to expected health care costs, and 22% said they did not take their prescription meds in the past year because the cost of the drugs was too high, TransAmerica’s survey found.

This latter point was emphasized in the survey noting that 71% of Americans said that drug prices were too high; 78% of people agreed that the government should be permitted to negotiate/regulate prescription drug prices.

This latter point was emphasized in the survey noting that 71% of Americans said that drug prices were too high; 78% of people agreed that the government should be permitted to negotiate/regulate prescription drug prices.

As a result of cost and health care financial concerns, one-half of employed Americans feel job-locked due to health insurance coverage at the workplace. Three in ten people had to leave a job because the company didn’t offer health insurance benefits. One-quarter of people stayed at their current job because they needed to keep their health insurance.

An historical sidebar — the uniquely American challenge and stress of job lock has been studied for years as an artifact of employer-sponsored insurance in the U.S. Here’s a study the GAO wrote back in 2011 detailing the need to overcome this labor mobility problem, which is alive and well (and not in a healthy sense) in 2019 based on the TransAmerica study.

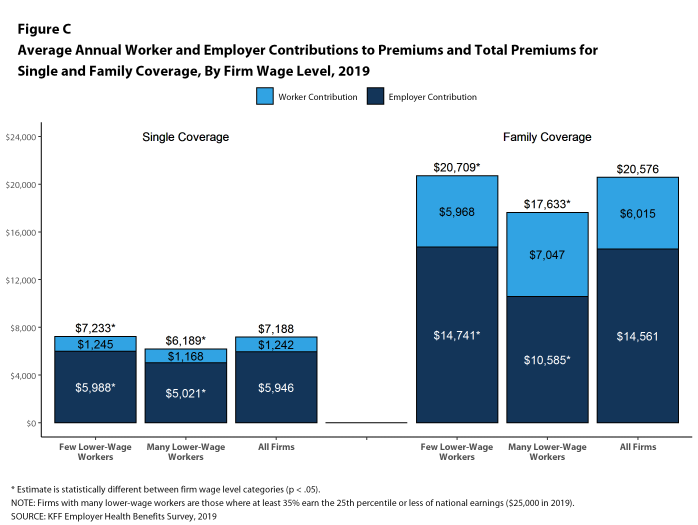

The blue bar chart comes from the recently published 2019 Employer Health Benefits Survey from Kaiser Family Foundation, which I covered here in Health Populi last month.

The blue bar chart comes from the recently published 2019 Employer Health Benefits Survey from Kaiser Family Foundation, which I covered here in Health Populi last month.

Note that workers’ contribution for family coverage across all firms was $6,015 in 2019.

Compare this $6,015 to the $3,600 affordability premium stress/pain-point found in the TransAmerica survey. That’s quite a large chasm between these two numbers, about $2,400.

That affordability data point is shown in this last line chart from the TransAmerica survey, illustrating that $300 is the total affordability median amount for a monthly premium payment.

That affordability data point is shown in this last line chart from the TransAmerica survey, illustrating that $300 is the total affordability median amount for a monthly premium payment.

Money, the economy, health care costs — these three stressors are bound up together in the American’s personal and household health economy. That was the theme that started the first Health Populi blog post in 2007.

My favorite Tom’s Shell sign, pricing petrol at the pump that year as “Arm” for regular, “Leg” for plus, and “First Born” for premium gas still resonates with the health care cost and family themes of this post, twelve years later.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,