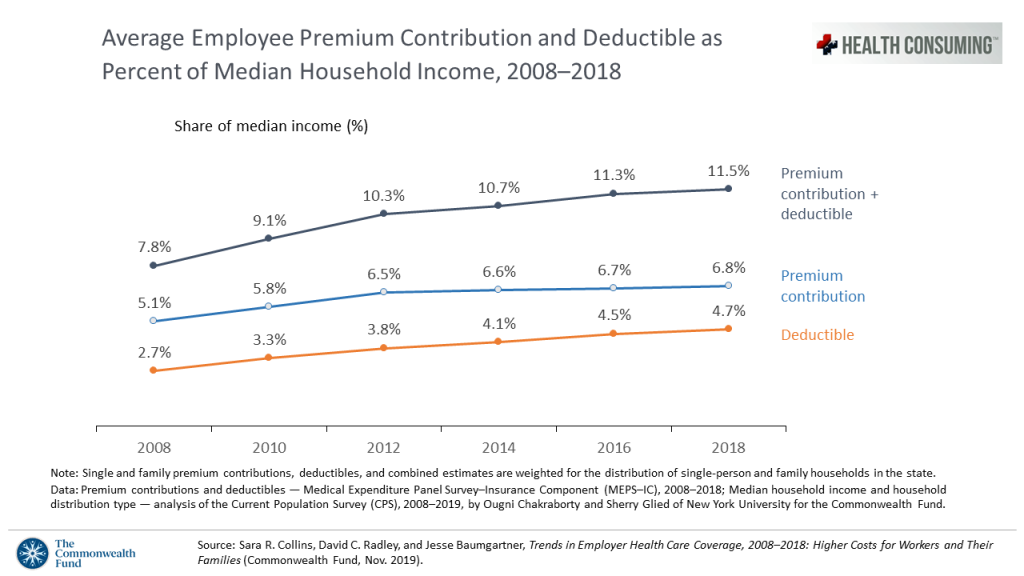

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families.

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families.

The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans.

The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced growth in median income, The Commonwealth Fund found. The first chart illustrates the continued growth of both premiums and deductibles over the past decade.

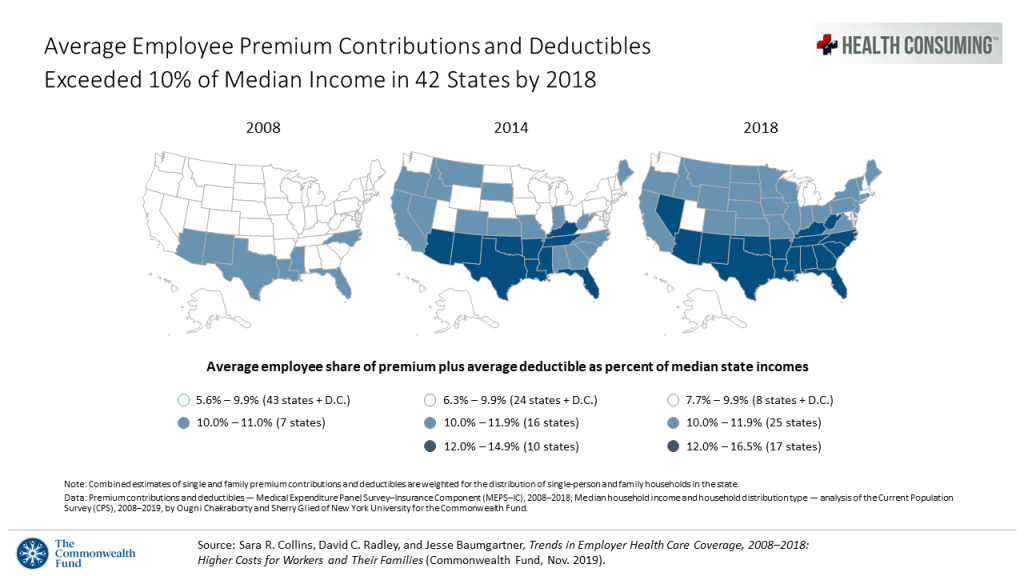

The U.S. maps break out the household burden of premium contributions and deductibles as a percent of the State’s median household income in 2018.

The U.S. maps break out the household burden of premium contributions and deductibles as a percent of the State’s median household income in 2018.

In 42 States, this percent was over 10% of media household income. For 17 states, these health care costs consumed 12 to 16.5% of household income. Those states are shown in the dark blue shade and were located largely in the southern region of the U.S. from Florida to the southeast as far west as Nevada.

Thus, even with health insurance coverage through jobs, workers are dealing with affordability issues of paying for health care as medical costs take a position crowding out other household spending like housing, utilities, and education.

Health Populi’s Hot Points: The Commonwealth Fund’s report bolsters the central premise of my book, HealthConsuming: From Health Consumer to Health Citizen, that the patient-is-the-payor as we approach the new year of 2020.

Health Populi’s Hot Points: The Commonwealth Fund’s report bolsters the central premise of my book, HealthConsuming: From Health Consumer to Health Citizen, that the patient-is-the-payor as we approach the new year of 2020.

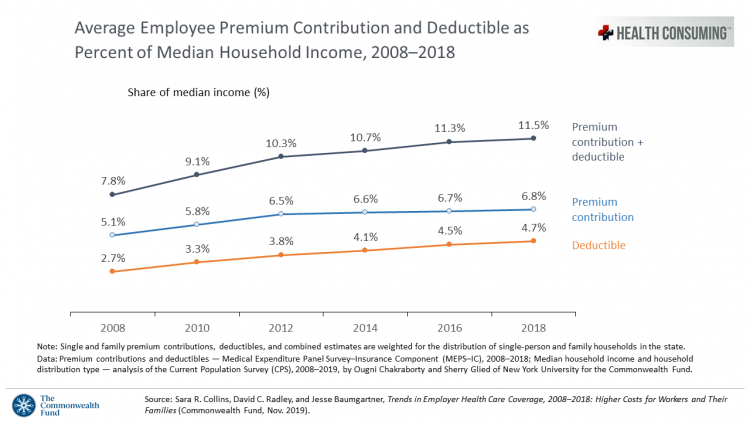

This third chart comes out of the book, built from data from the Stress in America survey annually conducted by the American Psychological Association. Note that health care stress is felt regardless of income, whether above or below the median family income in America. Health care stress is a mainstream featured in Americans’ collective psyche approaching the 2020 election.

As the graph shows, APA found that many aspects of health care in America stress most people out, from the cost of insurance to medical bills — and changes to health care policy emanating from Washington.

This new year is a U.S. Presidential election which will certainly be a health care election based on voters’ passion for health care as a top issue at the polls in 2018 and 2019. At the same time, health care providers and health plans must embrace patients’ financial health as part of the overall health care experience, which I’ll discuss at the AHIP Consumer Experience and Digital Health Forum in Chicago on 10th December 2019. Financial health for patients-as-payors is part of the overall health/care experience.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for