The new year will see a “looming tsunami” of high prices in healthcare, regulation trumping health reform, more business deals reshaping the health/care industry landscape, and patients growing do-it-yourself care muscles, according to Top health industry issues of 2020: Will digital start to show an ROI from the PwC Health Research Institute.

The new year will see a “looming tsunami” of high prices in healthcare, regulation trumping health reform, more business deals reshaping the health/care industry landscape, and patients growing do-it-yourself care muscles, according to Top health industry issues of 2020: Will digital start to show an ROI from the PwC Health Research Institute.

I’ve looked forward to reviewing this annual report for the past few years, and always learn something new from PwC’s team of researchers who reach out to experts spanning the industry. In this 14th year of the publication, PwC polled executives from payers, providers, and pharma/life science organizations.

Internally, health industry business leaders are prioritizing several workforce strategies in the new year, first and foremost to confront digital transformation. This will take the form of digital “upskilling” the existing workforce, as well as complementing the upskilling with deploying technology for tasks previously performed by employees.

Beyond current employees, companies in health care are also looking to hire workers with skills to support new capabilities and product offerings.

Clearly, digital transformation is top-of-mind for healthcare organizations pondering their workforce strategies for 2020.

Externally, health industry leaders realize that the end-users of their products and services are patients assuming the personae of health consumers facing not only clinical decision making, but more challenges in their role in personal financial health care management.

Externally, health industry leaders realize that the end-users of their products and services are patients assuming the personae of health consumers facing not only clinical decision making, but more challenges in their role in personal financial health care management.

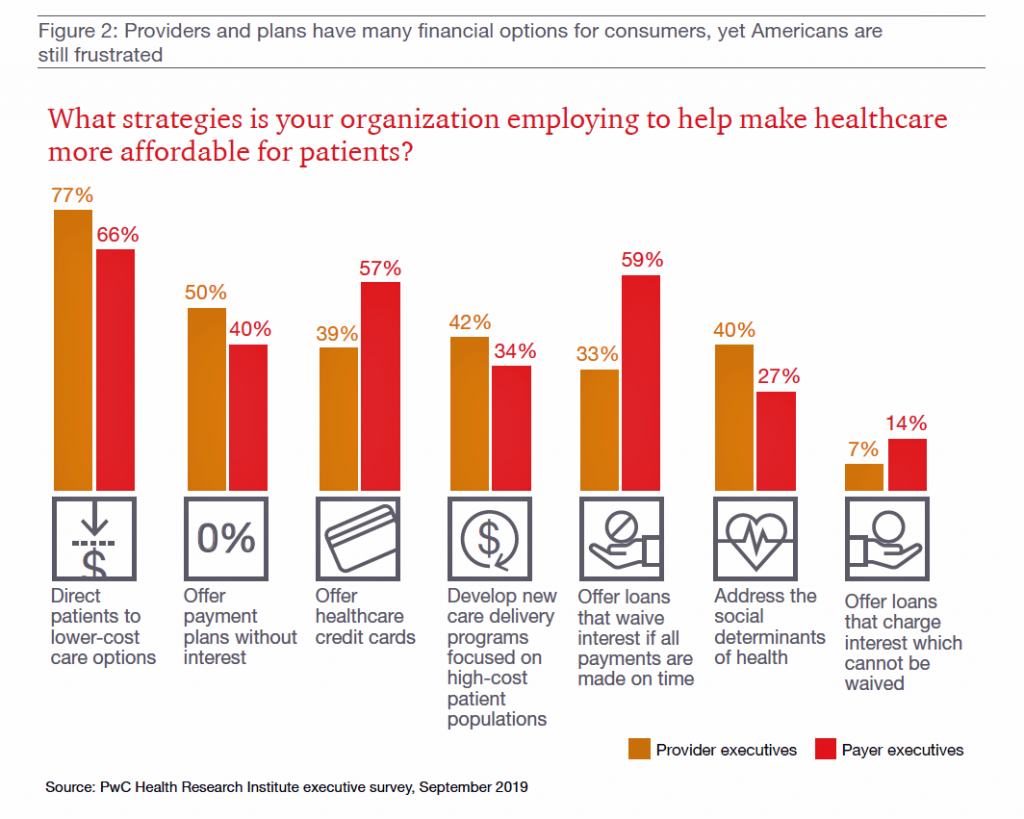

The bar chart here gauges strategies providers and payers are undertaking to help make health care more affordable for patients, the new payors.

Providers’ tactics that address health care affordability for patients include routing people to lower-cost care options (77%), offering payment plans at 0% interest, developing care delivery programs that focus on high-cost patients, and addressing social determinants of health.

For payer organizations, the order of these strategies is a bit different — first is directing patients to lower-cost sites, but offering loans that waive interest for on-time payments and offering health care credit cards rank second, followed by offering payment plans without interest.

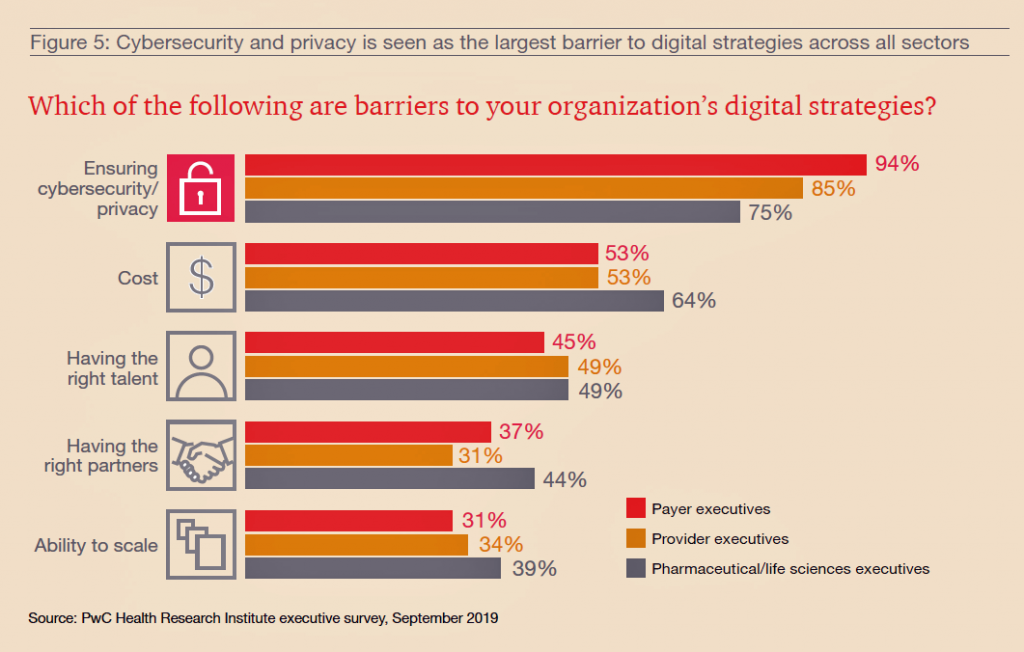

As patients continue to morph into consumers seeking retail-style service levels, digital channels and platforms will be critical to enable that vision. But on the road to digital transformation, health care organizations will encounter barriers and a bumpy journey.

Top of these obstacles to digital Nirvana is ensuring cybersecurity and privacy, the top barrier for each of the three industry segments polled. The second barrier to building out digital strategies is cost, followed by finding and retaining talent, that scarce human capital secret-in-the-digital-sauce.

Partnering, too, will be important on the road to digitization in health care across the three industry segments.

Health Populi’s Hot Points: In 2020, one certainty in our own forecast is that more patients will take on the role as medical bill payors, as enrollment in high-deductible health plans continues to grow, out-of-pocket costs increase for health care services and goods (esp. specialty medicines), and people expect greater levels of retail-enhanced service from health care providers, plans, and pharma companies.

Niall Brennan who leads the Health Care Cost Institute is quoted in the PwC paper, making the case that, “Working Americans will do anything possible to avoid interactions with the healthcare system, because it’s a sinkhole of personal time and money.”

Niall Brennan who leads the Health Care Cost Institute is quoted in the PwC paper, making the case that, “Working Americans will do anything possible to avoid interactions with the healthcare system, because it’s a sinkhole of personal time and money.”

2020 also means a Presidential election year, a theme PwC wove into their annual issue roadmap. Their poll of consumers found that 7 in 10 U.S. adults will likely vote on the basis of health care policies or paradigms.

Health care access and costs — which tend to be inter-related issues for a patient facing medical issues in the present day — are top-of-mind for Americans these days. They’re a major cause of stress and anxiety, according to the American Psychological Association’s Stress in America study. And, peoples’ financial health is bundled into their overall perceptions of personal health and wellbeing.

Niall’s quote on workers avoiding interactions with the health care system due to the “sinkhole” of medical costs threatens industry incumbents in two ways: in the immediate term, a loss of business volume, whether in terms of patients admitted to hospital or clinics, prospective health plan members not signing up for a particular insurance policy, or patients avoiding filling prescriptions due to cost or “financial toxicity.” In the longer run, the legacy health care system is at-risk of becoming less relevant a feature in peoples’ everyday lives.

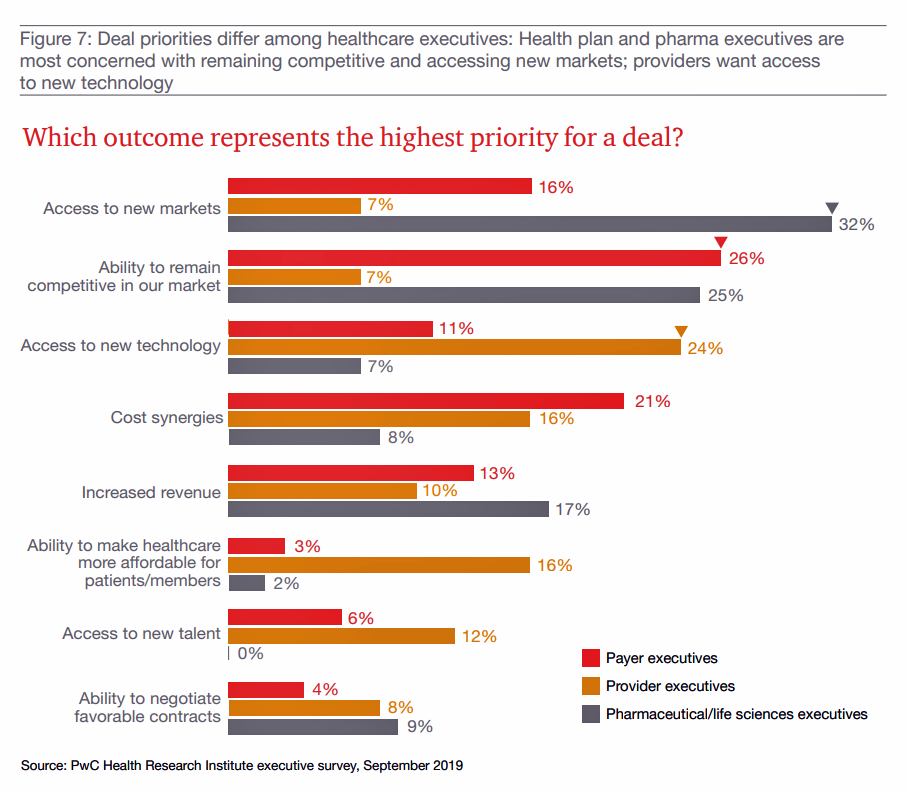

PwC mentions Walmart’s most recent retail clinic model in the context of the “tsunami of rising medical prices.” Later in the report, PwC discusses, “A whole new you: deals as makeovers,” examining the question of health care executives’ priorities for making “a deal” in the new year.

PwC mentions Walmart’s most recent retail clinic model in the context of the “tsunami of rising medical prices.” Later in the report, PwC discusses, “A whole new you: deals as makeovers,” examining the question of health care executives’ priorities for making “a deal” in the new year.

This last bar chart shows us those priorities: access to new markets top of mind for pharma; ability to remain competitive for both payers and pharma; access to new tech for providers; and, cost-synergies for payors.

Making health care more affordable for patients and members ranks fairly low here.

So much for patient/consumer centricity.

In my book, HealthConsuming: From Health Consumer to Health Citizen, we begin with the premise of the patient-as-payor seeking access to health care, avoiding negative financial side effects and a sense of justice and ownership and control in one’s personal health, health data, and the larger health care system.

U.S. voters will vote with both their political ballots and wallets for health care in 2020.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for